Securing your family’s financial future through whole life insurance is a significant decision, and understanding the associated costs is paramount. This guide delves into the complexities of average whole life insurance premiums, exploring the factors that influence them and providing insights to help you make an informed choice. We’ll examine how age, health, policy features, and insurer practices all contribute to the final premium amount, empowering you to navigate this crucial aspect of financial planning.

From analyzing the impact of various policy riders and add-ons to comparing premium structures across leading insurance providers, we aim to demystify the process of determining the average premium for whole life insurance. We’ll also explore the invaluable role a financial advisor can play in helping you select a policy that aligns with your individual needs and budget.

Factors Influencing Whole Life Insurance Premiums

Several key factors interact to determine the cost of whole life insurance premiums. Understanding these factors allows individuals to make informed decisions when selecting a policy that aligns with their needs and budget. These factors are not independent; they often influence each other to produce a final premium.

Age’s Impact on Whole Life Insurance Premiums

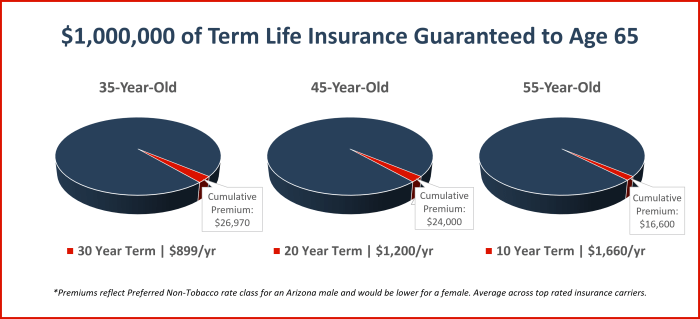

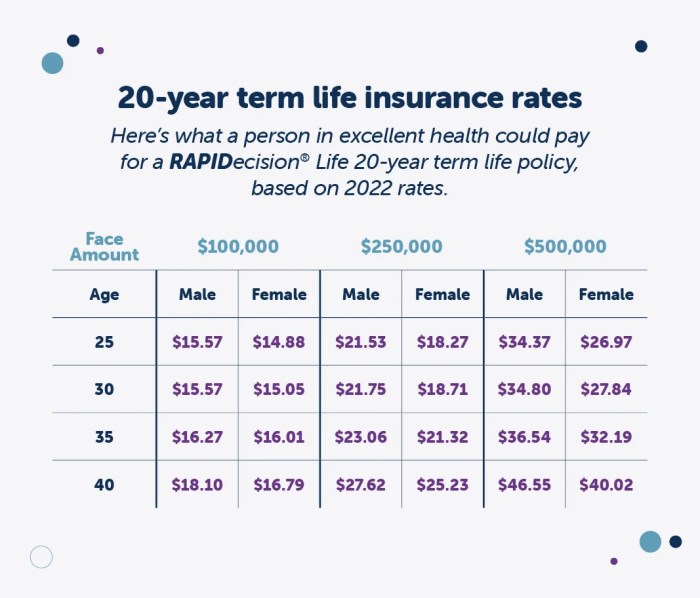

Age is a significant determinant of whole life insurance premiums. Younger applicants generally receive lower premiums than older applicants. This is because statistically, younger individuals have a longer life expectancy, reducing the insurer’s risk of having to pay out a death benefit sooner. The longer the insurer expects to hold your premiums, the lower the risk for them. As age increases, so does the likelihood of needing a payout, leading to higher premiums to offset this increased risk. For example, a 25-year-old might receive a significantly lower premium than a 55-year-old, even with identical health and policy details.

Health Status and Whole Life Insurance Premiums

An applicant’s health status plays a crucial role in determining premium costs. Individuals with pre-existing health conditions or a family history of certain diseases will typically face higher premiums. Insurers assess risk based on medical history, current health conditions, and lifestyle factors. Those deemed to be higher risk because of health issues will pay more to compensate for the increased probability of an early claim. A thorough medical examination and questionnaire are often part of the underwriting process to assess risk accurately. Someone with a history of heart disease, for instance, would likely pay a higher premium than a person with a clean bill of health.

Death Benefit Amount and Premium Costs

The death benefit amount, or the payout to beneficiaries upon the insured’s death, directly correlates with the premium amount. A larger death benefit necessitates a higher premium, as the insurer is obligated to pay a larger sum. Conversely, a smaller death benefit results in a lower premium. This relationship is relatively straightforward: the greater the financial commitment from the insurance company, the greater the cost to the policyholder. For example, a $500,000 death benefit policy will have a significantly higher premium than a $100,000 policy, all other factors being equal.

Premiums for Different Whole Life Insurance Policy Types

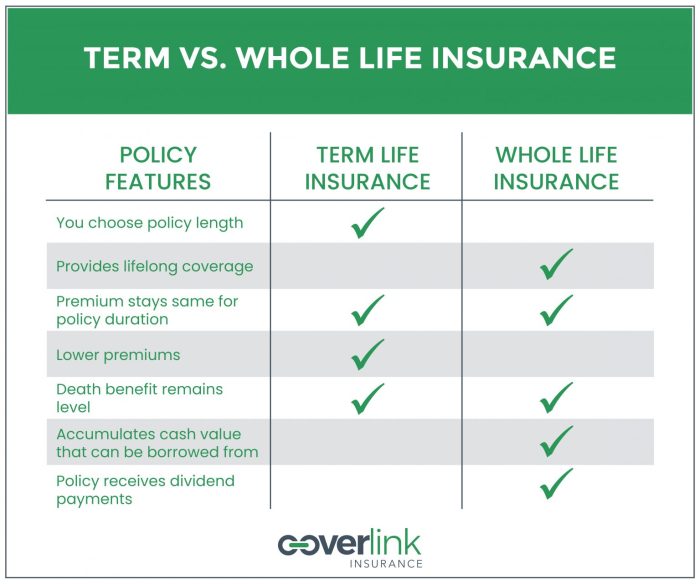

Different types of whole life insurance policies carry varying premium structures. Level term life insurance premiums remain consistent throughout the policy’s duration. Variable whole life insurance premiums can fluctuate based on the performance of the underlying investment accounts. Universal life insurance premiums offer more flexibility, but this flexibility can sometimes lead to higher premiums in the long run depending on the performance of the policy’s cash value. The specific premium structure depends heavily on the policy type and its associated features.

Smoking and Lifestyle Choices’ Influence on Premiums

Smoking and other unhealthy lifestyle choices significantly impact premium costs. Insurers consider these factors because they increase the risk of premature death. Smokers typically face considerably higher premiums compared to non-smokers. Similarly, individuals with unhealthy habits, such as excessive alcohol consumption or lack of physical activity, may also see their premiums increase. This is because these factors are statistically linked to a higher risk of health problems and mortality.

Average Premiums for Different Age Groups and Health Classifications

The following table provides illustrative examples of average annual premiums. These are simplified examples and actual premiums will vary based on many other factors not included in this simplified model. Note that these figures are for illustrative purposes only and should not be considered actual quotes.

| Age Group | Excellent Health | Good Health | Fair Health |

|---|---|---|---|

| 30-35 | $500 | $700 | $1000 |

| 40-45 | $750 | $1000 | $1500 |

| 50-55 | $1200 | $1600 | $2200 |

Understanding Policy Features and Premium Costs

Whole life insurance premiums are not a one-size-fits-all proposition. Several interconnected factors determine the final cost, making it crucial to understand how policy features influence the premium you pay. This section will break down the key components and illustrate how different choices affect your overall cost.

Key Features Affecting Whole Life Insurance Premiums

The premium you pay for whole life insurance is significantly impacted by several core policy features. These features interact to create a personalized cost structure. Understanding these elements is essential for making informed decisions.

- Death Benefit Amount: A larger death benefit necessitates a higher premium, as the insurance company assumes a greater financial obligation.

- Age at Issue: Premiums are generally lower for younger applicants, reflecting a longer life expectancy and lower risk for the insurer.

- Health Status: Individuals with pre-existing health conditions or a higher risk profile will typically pay higher premiums to compensate for the increased likelihood of a claim.

- Policy Type: Variations within whole life policies, such as participating (paying dividends) versus non-participating policies, can influence premium costs. Participating policies may have slightly higher premiums but offer the potential for dividend payouts.

Components of Whole Life Insurance Premiums

Your whole life insurance premium is composed of several key components, each contributing to the overall cost.

- Mortality Cost: This is the largest portion of your premium, representing the insurer’s assessment of the risk of paying out the death benefit. It’s calculated based on actuarial tables and your individual risk profile.

- Expense Charges: These cover the insurer’s administrative costs, including salaries, marketing, and overhead. They can vary depending on the company and the complexity of the policy.

- Cash Value Accumulation Costs: A portion of your premium contributes to the policy’s cash value, which grows tax-deferred over time. The rate of growth influences the overall premium, with higher projected growth potentially leading to higher premiums.

Impact of Riders and Add-ons on Premiums

Riders and add-ons, which enhance the basic policy, typically increase the premium.

- Waiver of Premium Rider: This rider waives future premiums if you become disabled. It adds to the cost but provides valuable protection.

- Accelerated Death Benefit Rider: This allows you to access a portion of the death benefit while still alive if you have a terminal illness. This rider also increases premiums.

- Long-Term Care Rider: This rider covers long-term care expenses, adding a significant cost to the premium but offering crucial financial protection for potential long-term care needs.

Impact of Cash Value Accumulation on Premiums

The cash value component of a whole life policy is a key factor influencing the premium. While a portion of the premium contributes to this cash value, it also influences the overall cost structure. Higher cash value accumulation often correlates with higher premiums, as the insurer allocates more of your premium towards the cash value growth.

Hypothetical Scenario: Premium Cost Variations

Let’s consider two hypothetical individuals, both applying for a $500,000 whole life policy at age 35.

| Feature | Individual A | Individual B |

|---|---|---|

| Age | 35 | 35 |

| Death Benefit | $500,000 | $500,000 |

| Health Status | Excellent | Good (minor health condition) |

| Riders | None | Waiver of Premium Rider |

| Approximate Annual Premium | $2,500 | $3,000 |

Individual B, with a minor health condition and a Waiver of Premium rider, pays a higher premium than Individual A, highlighting the impact of health status and riders on the overall cost. This is a simplified example, and actual premiums will vary based on many factors and specific insurer policies.

Comparing Premiums Across Different Insurers

Whole life insurance premiums vary significantly between insurers. Several factors contribute to these differences, making it crucial for consumers to compare offerings before purchasing a policy. Understanding these variations can lead to substantial savings over the life of the policy.

The following table illustrates average premium variations among four major insurance providers for a $250,000 whole life policy for a 35-year-old male in excellent health. Remember that these are sample figures and actual premiums will depend on individual circumstances and policy specifics. Always obtain a personalized quote from each insurer.

Premium Variations Among Major Insurers

| Insurer | Annual Premium | Premium Structure | Financial Strength Rating (Example) |

|---|---|---|---|

| Insurer A | $1,500 | Level premium throughout the policy’s life | A+ (Excellent) |

| Insurer B | $1,700 | Level premium with a slightly higher initial rate | A (Excellent) |

| Insurer C | $1,300 | Level premium with options for paid-up additions | A- (Excellent) |

| Insurer D | $1,600 | Modified whole life with lower initial premiums, increasing over time | B+ (Good) |

Insurer Premium Structures

Different insurers offer varying premium structures. Some offer strictly level premiums, meaning the annual cost remains consistent throughout the policy’s duration. Others may offer modified whole life, where premiums are lower initially but increase over time. Still others might provide options for paid-up additions, allowing policyholders to allocate extra funds to accelerate cash value growth. Understanding these differences is vital for choosing a policy that aligns with your financial goals and long-term budget.

Impact of Insurer Financial Strength on Premiums

An insurer’s financial strength significantly influences its premium pricing. Companies with strong financial ratings, often denoted by agencies like A.M. Best, tend to offer more competitive premiums. This is because they demonstrate a greater capacity to pay out claims reliably. Conversely, insurers with weaker ratings might charge higher premiums to offset their increased risk. For example, an insurer with a lower rating might charge a higher premium to compensate for the increased risk of insolvency.

Negotiating Premium Rates

While not always guaranteed, it’s possible to negotiate premium rates with some insurers. This is often more successful when purchasing a larger policy or demonstrating a strong financial profile. Clearly articulating your needs and comparing offers from multiple insurers can strengthen your negotiating position. For instance, presenting quotes from competitors that offer lower rates can incentivize an insurer to become more competitive.

Illustrating Premium Trends and Projections

Understanding historical trends and projecting future changes in whole life insurance premiums is crucial for informed decision-making. Several factors, both economic and demographic, significantly influence premium costs over time. Analyzing these trends allows individuals and financial planners to better anticipate future expenses and adjust their financial strategies accordingly.

Premium changes are rarely uniform across all insurers and policy types. However, general trends can be observed.

Historical Trends in Whole Life Insurance Premiums

Historically, whole life insurance premiums have generally increased over time, though the rate of increase has varied considerably depending on economic conditions and the specific insurer. For example, periods of high inflation often correlate with steeper premium increases, while periods of low inflation and high interest rates may see more moderate increases or even slight decreases in some cases. The impact of significant economic events, such as recessions or financial crises, can also be observed in the historical data, often leading to temporary adjustments in pricing strategies by insurance companies. Detailed analysis of industry reports and actuarial data would reveal specific year-on-year changes and patterns.

Projected Future Premium Changes

Projecting future premium changes involves considering several key factors. Inflation is a primary driver, as increased costs for the insurer (claims payouts, administrative expenses) directly translate to higher premiums. Interest rate fluctuations play a significant role; lower interest rates generally lead to higher premiums because insurers earn less on their investments, requiring higher premiums to maintain solvency. Changes in mortality rates also influence premiums; if people are living longer, insurers face increased payout obligations, impacting pricing. Finally, regulatory changes and increased competition within the insurance market can also contribute to premium adjustments.

Projected Premium Growth Illustration

Imagine a graph charting average whole life insurance premiums over the next 10 years. The y-axis represents the average premium amount, and the x-axis represents the year. Assuming a moderate inflation rate of 2-3% annually and relatively stable interest rates, the graph would show a gradual upward trend. The line would not be perfectly linear; it might show slight fluctuations year to year, reflecting variations in economic conditions. For example, a year with unexpectedly high mortality rates might show a steeper increase than in other years. However, the overall direction would be a consistent, though not necessarily dramatic, rise in premiums. A scenario with higher inflation or lower interest rates would result in a steeper upward slope, while a more optimistic scenario with lower inflation and higher interest rates could lead to a flatter, less pronounced increase.

Factors Influencing Future Premium Increases or Decreases

Several factors could influence the trajectory of future premium changes. Significant inflationary pressures, for example, could cause substantial premium hikes. Conversely, periods of unexpectedly low inflation or high interest rates could moderate premium increases or even lead to temporary decreases in certain situations. Changes in government regulations, such as new mandates or tax policies impacting insurance companies, could also significantly alter the premium landscape. Finally, increased competition among insurers could lead to price wars, resulting in lower premiums for consumers. However, this scenario is usually short-lived as the market tends to reach an equilibrium.

The Role of Financial Advisors in Premium Selection

Navigating the complexities of whole life insurance and selecting a policy with appropriate premiums can be challenging. A financial advisor plays a crucial role in simplifying this process, ensuring clients choose a policy that aligns with their financial goals and risk tolerance. Their expertise extends beyond simply comparing premiums; they offer comprehensive guidance tailored to individual circumstances.

Financial advisors provide several key benefits when it comes to choosing whole life insurance. They act as an objective third party, helping clients understand the intricacies of different policy features and their impact on premiums. Their knowledge base enables them to identify potential cost savings and strategies for optimizing premium payments over the long term. Moreover, they can provide valuable insights into the long-term financial implications of various policy choices, ensuring the decision supports broader financial planning goals.

Advisor Assistance in Policy Selection

Financial advisors use a multifaceted approach to help clients select a suitable whole life insurance policy. This involves a thorough assessment of the client’s financial situation, including income, assets, debts, and existing insurance coverage. They then analyze the client’s insurance needs, considering factors such as age, health, family responsibilities, and long-term financial objectives. Based on this analysis, the advisor recommends appropriate coverage levels and policy types, explaining the associated premium costs and potential benefits. They also explore various policy riders and options, highlighting their impact on the overall premium. For instance, a client aiming for a higher death benefit might opt for a policy with a higher premium, while someone prioritizing affordability might choose a lower death benefit with a correspondingly lower premium.

Strategies for Premium Cost Optimization

Several strategies can be employed by financial advisors to help clients optimize their whole life insurance premium costs. One common strategy is to explore policies with different premium payment options. Some policies offer the flexibility to pay premiums annually, semi-annually, quarterly, or even monthly. Choosing a longer payment period, such as annual payments, can often result in lower overall costs due to reduced administrative fees. Another strategy involves leveraging the client’s existing financial resources. For instance, if a client has a significant amount of cash on hand, they might consider paying a higher premium upfront to reduce the overall cost over the life of the policy. Advisors might also suggest strategies to improve insurability, such as lifestyle changes that could lead to lower premiums, although this is not always possible.

Understanding Complex Premium Structures

Whole life insurance premiums are influenced by numerous factors, resulting in complex structures that can be difficult for individuals to understand. Financial advisors play a crucial role in deciphering these complexities. For example, they can explain the impact of factors like age, health status, smoking habits, and the chosen death benefit on premium calculations. They can also explain the difference between level premiums (fixed throughout the policy term) and adjustable premiums (subject to change based on factors like interest rates and the insurer’s financial performance). Furthermore, they can clarify the implications of various policy riders, such as accidental death benefits or long-term care riders, and how these riders affect the overall premium cost. For instance, an advisor can illustrate how adding a long-term care rider, while increasing premiums, can offer valuable protection against potential future healthcare expenses. They can present this information in a clear, understandable manner, using charts, graphs, and real-world examples to illustrate the financial implications of different policy choices.

Final Wrap-Up

Choosing a whole life insurance policy requires careful consideration of numerous factors, with the average premium being a central element. By understanding the key influences on premium costs, comparing offerings from different insurers, and leveraging the expertise of a financial advisor, you can make a well-informed decision that provides adequate coverage without unnecessary financial strain. Remember, proactive planning and a thorough understanding of your options are essential for securing your family’s long-term financial well-being.

Detailed FAQs

What is the difference between guaranteed and non-guaranteed premiums?

Guaranteed premiums remain fixed throughout the policy’s life, while non-guaranteed premiums can adjust based on factors like the insurer’s investment performance.

Can I change my whole life insurance policy after purchase?

Some policy changes are possible, but it often depends on the specific policy and insurer. Consult your policy documents or your insurer for details.

How often are premiums paid?

Premiums are typically paid annually, semi-annually, quarterly, or monthly, depending on the policy and insurer.

What happens if I miss a premium payment?

Missing payments can lead to policy lapse or suspension. Most insurers offer grace periods, but it’s crucial to contact them immediately if you anticipate difficulties.