Navigating the complexities of health insurance can feel like deciphering a foreign language. One of the most crucial aspects to understand is the average premium – the monthly cost you’ll pay for coverage. This cost, however, is far from uniform, influenced by a multitude of factors ranging from your age and location to the type of plan you choose and the level of coverage desired. This guide delves into the intricacies of average health insurance premiums, providing you with the knowledge to make informed decisions about your healthcare.

We will explore the key elements that determine your premium, comparing different plan types, examining the impact of government subsidies, and analyzing the role of deductibles, co-pays, and out-of-pocket maximums. Furthermore, we will offer insights into current trends and future projections, empowering you to anticipate potential changes in your healthcare costs.

Factors Influencing Health Insurance Premiums

Several key factors interact to determine the average cost of health insurance premiums. Understanding these factors can help individuals make informed decisions about their health coverage. These factors are not independent; they often influence each other to create a complex pricing model.

Age and Health Insurance Premiums

Age significantly impacts health insurance premiums. Generally, older individuals pay more than younger individuals. This is because the risk of developing health problems increases with age, leading to higher healthcare utilization and costs. Insurance companies base premiums on actuarial data, which reflects the statistically higher probability of needing more extensive medical care as one ages. For example, a 60-year-old will likely pay considerably more than a 25-year-old for the same level of coverage due to the increased likelihood of needing expensive treatments like surgeries or long-term care.

Health Status and Premium Costs

An individual’s health status is another crucial determinant of premium costs. People with pre-existing conditions or a history of significant health issues typically pay higher premiums. This is because they represent a higher risk to the insurance company, indicating a greater likelihood of requiring expensive medical treatments. Conversely, individuals with excellent health and a history of minimal healthcare utilization may qualify for lower premiums, reflecting the lower risk they present. For instance, someone with a history of heart disease will likely pay more than someone with no such history.

Geographic Location and Premium Variation

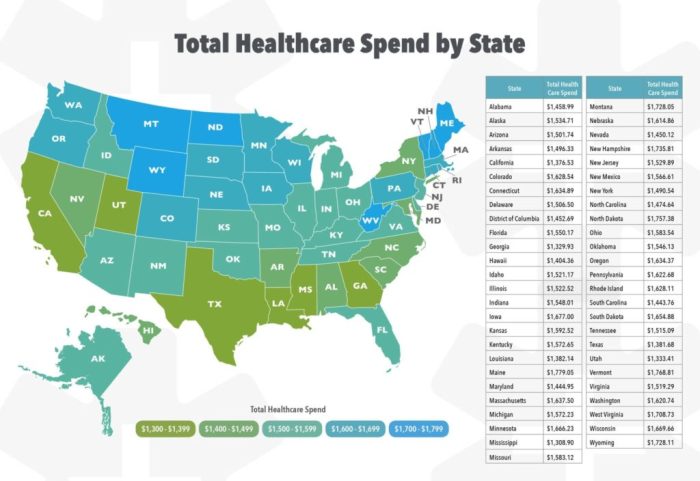

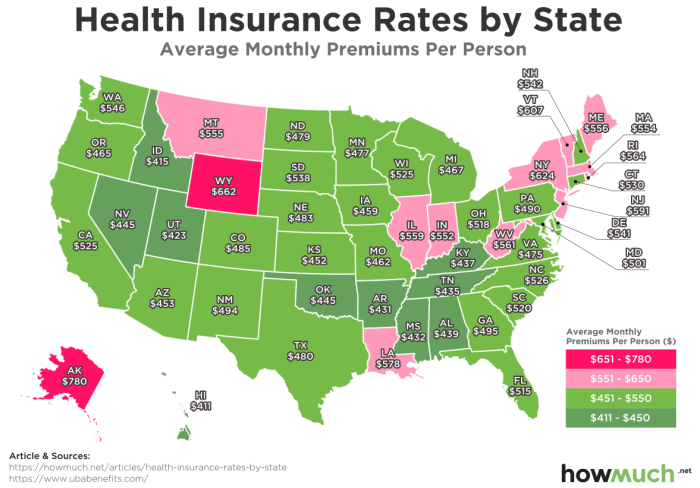

The location where an individual resides substantially influences health insurance premiums. Premiums vary widely across states and even within regions of the same state due to differences in healthcare costs, provider availability, and state regulations. Areas with a higher concentration of specialists, expensive medical procedures, or a higher cost of living tend to have higher premiums. For example, premiums in major metropolitan areas with high healthcare costs will often be higher than in rural areas with fewer medical facilities.

Family Size and Health Insurance Costs

The size of a family also plays a role in determining health insurance premiums. Adding family members to a health insurance plan generally increases the overall cost of the premiums. This is because more individuals are covered under the same plan, increasing the potential for healthcare utilization and associated expenses. For example, a family of four will typically pay more than an individual covered under a single plan, reflecting the increased risk and potential costs associated with covering multiple individuals.

Average Premiums for Different Coverage Levels

| Coverage Level | Average Monthly Premium (Example) | Deductible (Example) | Out-of-Pocket Maximum (Example) |

|---|---|---|---|

| Bronze | $300 | $7,000 | $8,000 |

| Silver | $450 | $4,000 | $6,000 |

| Gold | $600 | $2,000 | $4,000 |

| Platinum | $750 | $1,000 | $2,000 |

Note: These are example figures and actual premiums will vary significantly based on the factors discussed above and specific plan details. Always check with your insurer for accurate pricing.

Types of Health Insurance Plans and Their Average Premiums

Understanding the different types of health insurance plans and their associated costs is crucial for making informed decisions about your healthcare coverage. Premiums, the monthly payments you make for insurance, vary significantly based on plan type, individual circumstances, and location. This section will delve into the average premium differences between common plan types and highlight factors influencing these variations.

Average Premiums for HMO, PPO, and EPO Plans

Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs) represent the most common types of health insurance plans. They differ primarily in network restrictions and cost-sharing mechanisms, which directly impact premiums. Generally, HMOs tend to have the lowest average premiums because they emphasize preventative care and require in-network care. PPOs offer more flexibility with out-of-network options but usually come with higher premiums to reflect this increased choice. EPOs fall somewhere in between, offering a broader network than HMOs but less flexibility than PPOs, resulting in premiums that are typically lower than PPOs but higher than HMOs. Exact premium amounts, however, vary significantly based on location, age, and the specific plan offered.

Average Premium Differences Between Individual and Family Plans

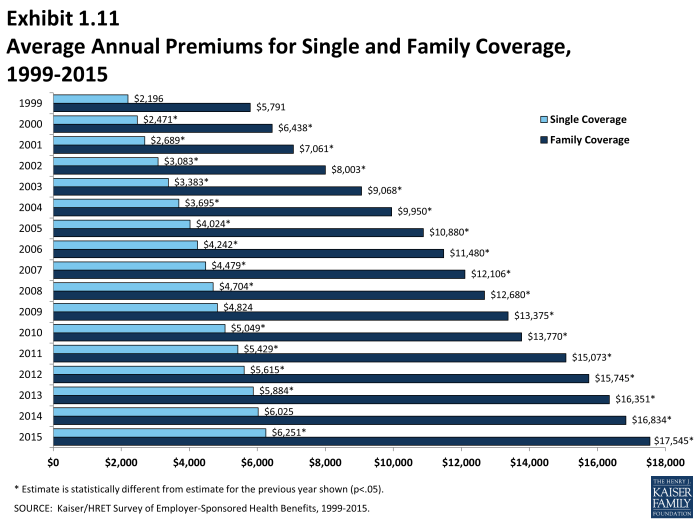

The cost of health insurance for a family is considerably higher than for an individual. This is because family plans cover multiple individuals, increasing the potential for healthcare utilization and claims. While an individual plan covers only one person, a family plan typically covers a spouse and dependents. The added coverage naturally increases the risk for the insurance provider, leading to higher premiums. The exact difference varies depending on the number of family members covered and the specific plan chosen. For example, a family plan might cost two to three times more than an equivalent individual plan.

Factors Contributing to Premium Variations Within the Same Plan Type

Several factors contribute to variations in premiums even within the same plan type. These include geographical location (premiums are generally higher in areas with higher healthcare costs), age (older individuals typically pay more due to increased healthcare needs), tobacco use (smokers usually pay significantly more), and health status (individuals with pre-existing conditions may face higher premiums). The specific benefits package also plays a crucial role; richer benefit packages naturally translate to higher premiums. Finally, the insurer itself can influence premiums, as different companies have varying risk assessments and administrative costs.

Examples of Situations Where Premium Costs Might Significantly Differ

Consider two individuals, both choosing the same PPO plan. Individual A is a 30-year-old non-smoker in a rural area with no pre-existing conditions, while Individual B is a 60-year-old smoker in a major metropolitan area with diabetes. Individual B’s premium will be substantially higher due to their age, smoking status, location, and pre-existing condition. Similarly, a family of four choosing a family HMO plan will pay significantly more than a single individual choosing the same HMO plan.

Average Premiums by Plan Type and Age Group

The following table illustrates hypothetical average monthly premiums for different plan types across various age groups. These figures are for illustrative purposes only and do not represent actual premiums, which vary significantly by location, insurer, and specific plan details.

| Plan Type | Age 25-34 | Age 35-44 | Age 45-54 | Age 55-64 |

|---|---|---|---|---|

| HMO | $300 | $400 | $550 | $700 |

| PPO | $450 | $600 | $800 | $1000 |

| EPO | $375 | $500 | $675 | $850 |

The Role of Deductibles, Co-pays, and Out-of-Pocket Maximums

Understanding deductibles, co-pays, and out-of-pocket maximums is crucial for navigating the complexities of health insurance costs. These cost-sharing mechanisms significantly impact your actual healthcare expenses, influencing your choice of plan and your financial responsibility for medical services. While lower premiums might seem attractive, the cost-sharing components can dramatically alter the overall cost of care.

Understanding how these elements interact is key to selecting a plan that aligns with your budget and healthcare needs. A higher premium might be offset by lower out-of-pocket costs in the long run, depending on your anticipated healthcare utilization.

Deductibles, Co-pays, and Out-of-Pocket Maximums: Their Relationship to Overall Cost

Deductibles, co-pays, and out-of-pocket maximums are interconnected elements that define your financial responsibility for healthcare services. The deductible is the amount you must pay out-of-pocket before your insurance coverage kicks in. Co-pays are fixed fees you pay for specific services, such as doctor visits. The out-of-pocket maximum is the most you’ll pay for covered services in a plan year; once this limit is reached, your insurance covers 100% of covered expenses. For example, a plan with a $5,000 deductible, $50 co-pay for doctor visits, and a $10,000 out-of-pocket maximum means you’ll pay $5,000 before your insurance begins to cover most costs. After that, you’ll pay $50 per doctor visit until your total out-of-pocket expenses reach $10,000.

Average Premium Costs for Plans with Varying Deductibles

The relationship between premiums and deductibles is generally inverse: higher deductibles often correspond to lower premiums, and vice versa. For instance, a bronze plan (the lowest cost-sharing plan) might have a premium of $300 per month and a $7,000 deductible, while a gold plan (higher cost-sharing) might have a premium of $600 per month and a $2,000 deductible. These are illustrative figures and actual costs vary significantly by location, insurer, and plan specifics. A family’s premiums would be considerably higher than those for an individual. It’s important to compare the total cost—premium plus potential out-of-pocket expenses—to determine the most cost-effective plan.

Cost-Sharing Components’ Influence on Actual Healthcare Costs

Cost-sharing components directly influence the actual cost of healthcare. A high deductible plan may seem cheaper initially due to lower premiums, but if you require significant medical care during the year, the high deductible could lead to substantial out-of-pocket expenses. Conversely, a low-deductible plan with higher premiums might be more cost-effective if you anticipate frequent medical visits or potential for expensive treatments. Consider a scenario where one individual has a high-deductible plan and requires emergency surgery costing $20,000. They may face significant out-of-pocket expenses before their insurance covers the remainder, whereas someone with a low-deductible plan would bear a smaller share of the costs.

Financial Implications of High-Deductible versus Low-Deductible Plans

Choosing between a high-deductible and a low-deductible plan involves a careful assessment of your financial situation and healthcare needs. High-deductible plans are suitable for individuals who are healthy, have a healthy emergency fund, and are comfortable with the risk of higher out-of-pocket expenses in case of unexpected medical events. Low-deductible plans offer more financial protection against unexpected medical costs but come with higher premiums. The choice depends on individual risk tolerance and financial stability. For example, a young, healthy individual might prefer a high-deductible plan to save on premiums, while a family with chronic health conditions might find a low-deductible plan more financially manageable.

Key Differences and Potential Savings Between Various Cost-Sharing Structures

Before outlining the key differences, it is important to note that the specific values for deductibles, co-pays, and out-of-pocket maximums vary widely depending on the insurer, plan type, and location. The following examples are for illustrative purposes only.

- High-Deductible Health Plan (HDHP): Lower monthly premiums, higher deductible (e.g., $5,000 or more), potentially lower out-of-pocket maximum. Suitable for healthy individuals with financial resources to cover a high deductible. Potential savings: lower monthly premiums.

- Low-Deductible Health Plan (LDHP): Higher monthly premiums, lower deductible (e.g., $1,000 or less), potentially higher out-of-pocket maximum. Suitable for individuals with frequent healthcare needs or higher risk of expensive medical events. Potential savings: lower out-of-pocket costs for routine care and unexpected medical events.

- Mid-Range Plans: Offer a balance between premium costs and out-of-pocket expenses. Deductibles and out-of-pocket maximums fall between those of HDHPs and LDHPs. Potential savings: a compromise between premium and out-of-pocket costs.

Final Review

Ultimately, understanding the average premium for health insurance is paramount to securing affordable and adequate healthcare coverage. By considering the various factors influencing premiums – age, location, plan type, and government subsidies – and by carefully evaluating the cost-sharing components of your chosen plan, you can make a well-informed decision that aligns with your individual needs and financial capabilities. Remember to regularly review your options as premiums and market conditions evolve over time.

Commonly Asked Questions

What is a deductible?

A deductible is the amount you pay out-of-pocket for covered healthcare services before your insurance plan begins to pay.

How do I qualify for government subsidies?

Eligibility for subsidies is typically based on income, household size, and citizenship status. Specific criteria vary by location and program.

What is the difference between an HMO and a PPO?

HMOs typically require you to choose a primary care physician (PCP) within their network, while PPOs offer more flexibility with provider choice, though often at a higher cost.

Can my premium change throughout the year?

Premiums are generally set annually, but may change if you make significant changes to your plan or coverage.

What factors affect out-of-pocket maximums?

Out-of-pocket maximums are influenced by your plan type, deductible, and the cost of your healthcare services. Once you reach your out-of-pocket maximum, your insurance generally covers 100% of covered services for the remainder of the year.