Navigating the complexities of health insurance can feel like deciphering a foreign language. One of the most crucial aspects to understand is the average monthly premium, a figure that significantly impacts your budget and access to healthcare. This guide delves into the various factors that influence these costs, providing a clear and concise overview to empower you with the knowledge needed to make informed decisions about your health coverage.

From the impact of age and location to the differences between plan types and the role of government subsidies, we’ll explore the key elements that shape your monthly health insurance bill. We’ll also examine the interplay between deductibles, copays, and out-of-pocket maximums, helping you understand the true cost of your chosen plan. By the end, you’ll have a much clearer picture of how to find affordable and appropriate health insurance.

Factors Influencing Average Monthly Premiums

Several key factors interact to determine the average monthly premium for health insurance. Understanding these factors can help individuals make informed decisions about their coverage choices. These factors are complex and often intertwined, leading to significant variations in costs from person to person.

Age and Health Insurance Costs

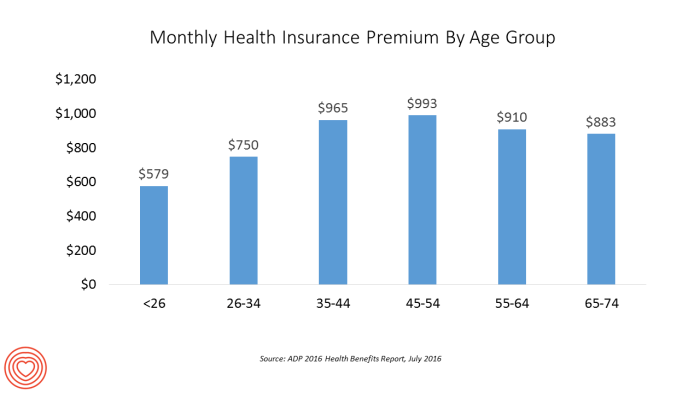

Age is a significant factor influencing health insurance premiums. Older individuals generally have higher premiums than younger individuals because they tend to have more health issues and require more frequent medical care. Insurers consider the statistically higher likelihood of needing expensive treatments as age increases when setting premiums. This is not a reflection of individual health, but rather a reflection of actuarial data. For example, a 60-year-old might pay significantly more than a 30-year-old, even if both are in excellent health.

Geographic Location and Premium Rates

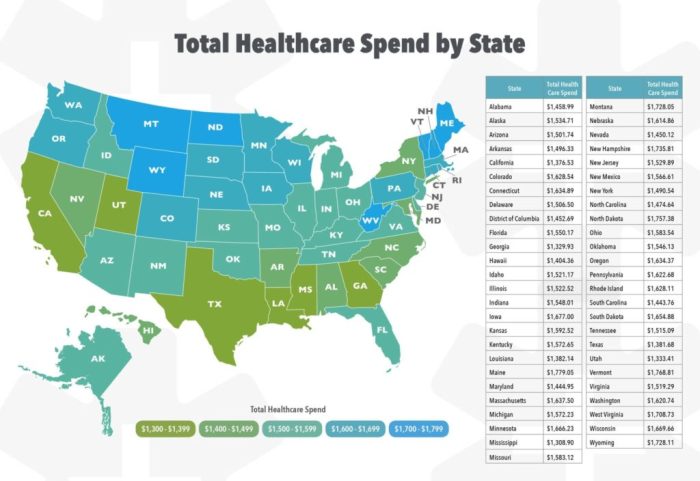

Geographic location plays a crucial role in determining health insurance premiums. The cost of healthcare varies significantly across different regions. Areas with a higher concentration of specialists, advanced medical facilities, and a higher cost of living generally have higher premiums. For instance, premiums in major metropolitan areas on the coasts tend to be higher than those in rural areas of the Midwest. This is due to the higher demand and costs associated with providing healthcare services in these densely populated and resource-intensive locations.

Individual vs. Family Coverage

The type of coverage significantly impacts premiums. Family plans, covering multiple individuals, typically cost more than individual plans. This is because family plans cover a larger pool of individuals, increasing the potential for healthcare utilization and claims. While the premium per person might be lower in a family plan compared to multiple individual plans, the overall cost will be considerably higher. A family of four will invariably pay more than four individuals each on an individual plan, but the cost per person within the family plan will be less than the cost for each person on a separate individual plan.

Pre-existing Health Conditions and Premiums

Pre-existing health conditions can significantly impact health insurance premiums. Individuals with chronic conditions like diabetes, heart disease, or cancer are likely to have higher premiums than those without such conditions. This is because insurers anticipate higher healthcare costs associated with managing these conditions. The severity and management of these conditions also play a role. For example, a person with well-managed type 2 diabetes might have a less significant premium increase compared to someone with poorly controlled type 1 diabetes requiring intensive care.

Average Premium Differences Across Age Groups

| Age Group | Average Monthly Premium (Example) |

|---|---|

| 18-25 | $300 |

| 26-35 | $400 |

| 36-45 | $550 |

| 46-55 | $750 |

*Note: These are example figures only and will vary significantly based on other factors such as location, plan type, and health status. Actual premiums will depend on the specific insurance provider and plan chosen.*

Types of Health Insurance Plans and Their Costs

Understanding the different types of health insurance plans and their associated costs is crucial for making informed decisions about your healthcare coverage. The variations in premiums reflect differences in the level of coverage, the extent of your out-of-pocket expenses, and the flexibility offered in choosing healthcare providers. This section will delve into the cost comparisons of various plans, highlighting key features and influencing factors.

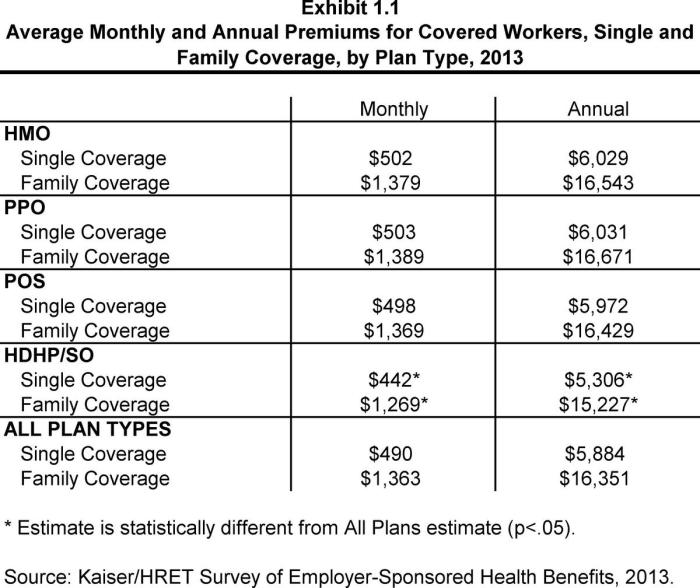

Comparison of HMO, PPO, and POS Plans

HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and POS (Point of Service) plans represent three common types of managed care plans, each with a distinct structure and cost profile. Generally, HMO plans tend to have the lowest monthly premiums, but offer less flexibility in choosing doctors and specialists. PPOs typically have higher premiums but provide greater flexibility, allowing you to see out-of-network providers, although at a higher cost. POS plans offer a middle ground, combining elements of both HMOs and PPOs. The exact premium differences vary widely depending on location, age, health status, and the specific plan details offered by the insurer.

- HMO: Lower premiums, restricted provider network, typically requires referrals to specialists.

- PPO: Higher premiums, broader provider network, allows out-of-network access (at higher cost), typically does not require referrals.

- POS: Moderate premiums, offers a combination of HMO and PPO features, may require referrals depending on the plan.

Cost Differences Between Bronze, Silver, Gold, and Platinum Plans

These plan categories, often referred to as “metal tiers,” represent different levels of cost-sharing between the insurance company and the insured. Bronze plans have the lowest monthly premiums but the highest out-of-pocket maximums and deductibles. As you move up the tiers to Silver, Gold, and Platinum, the monthly premiums increase, but the cost-sharing decreases, resulting in lower out-of-pocket expenses. The ideal plan depends on individual risk tolerance and financial capabilities. For instance, a healthy young adult might opt for a Bronze plan to save on premiums, while someone with pre-existing conditions might prefer a Gold or Platinum plan to minimize out-of-pocket costs.

- Bronze: Lowest monthly premiums, highest out-of-pocket costs.

- Silver: Moderate monthly premiums, moderate out-of-pocket costs.

- Gold: Higher monthly premiums, lower out-of-pocket costs.

- Platinum: Highest monthly premiums, lowest out-of-pocket costs.

Factors Contributing to Premium Variability

Several factors influence the variability in premiums within each plan type. These include geographic location (cost of living and healthcare services vary regionally), age (older individuals generally pay more), health status (individuals with pre-existing conditions may face higher premiums), tobacco use (smokers often pay significantly more), and the specific benefits included in the plan. For example, a plan with comprehensive dental and vision coverage will likely have a higher premium than a plan with more limited coverage. Additionally, the insurer’s administrative costs and profit margins also contribute to premium differences.

Employer-Sponsored Health Insurance vs. Individual Plans

Choosing between employer-sponsored health insurance and an individually purchased plan is a significant decision, impacting both your finances and healthcare access. Understanding the key differences in cost, coverage, and benefits is crucial for making an informed choice. This section will compare these two options, highlighting factors influencing their respective costs and outlining the advantages and disadvantages of each.

Employer-sponsored plans and individually purchased plans often exhibit considerable differences in average monthly premiums. Generally, employer-sponsored plans tend to have lower premiums for employees than comparable individual plans. This disparity arises from several contributing factors.

Factors Contributing to Cost Differences

Several key factors contribute to the cost discrepancies between employer-sponsored and individual health insurance plans. These differences stem from economies of scale, risk pooling, and regulatory considerations.

Employer-sponsored plans benefit from economies of scale. Larger groups of insured individuals, as found in many workplaces, allow insurers to negotiate lower rates. The larger pool of individuals also helps to balance out risk, mitigating the impact of high-cost claims on premiums. Conversely, individual plans lack this benefit; insurers must account for the higher risk associated with insuring a smaller, less diverse group of individuals. Furthermore, regulations often mandate greater coverage and benefits in individual plans, pushing up premiums. Finally, administrative costs can be higher for individual plans due to the need for more extensive individual enrollment and billing processes.

Employer Contributions and Net Employee Cost

Employer contributions significantly reduce the net cost of insurance for employees. Employers often pay a substantial portion of the monthly premium, leaving the employee responsible for only a fraction of the total cost. This contribution varies widely depending on the employer, the type of plan offered, and the employee’s income level. For example, an employer might cover 80% of the premium, meaning an employee only pays 20%. If the total monthly premium is $500, the employee’s share would be $100. This demonstrates how employer contributions substantially lower the financial burden on employees. This contrasts sharply with individual plans, where the entire premium is the individual’s responsibility.

Benefits and Drawbacks of Each Plan Type

Employer-sponsored plans typically offer lower premiums due to employer contributions and the economies of scale described above. However, plan choices may be limited to those offered by the employer, potentially lacking ideal coverage for specific individual needs. Coverage may also cease upon job loss, requiring a transition to a potentially more expensive individual plan.

Individual plans offer greater flexibility in choosing a plan that best meets individual needs and preferences. However, the premiums are generally higher, and individuals bear the entire cost without employer contributions. Coverage options are broader, but the increased choice can also lead to more confusion in selecting the most appropriate plan. Furthermore, obtaining coverage with pre-existing conditions might be more challenging and costly.

Illustrative Examples of Premium Costs

Understanding the factors influencing health insurance premiums is crucial for making informed decisions. However, seeing these factors in action through real-world examples can provide a clearer picture. The following examples illustrate how age, location, health status, and plan choices impact monthly premiums. Remember that these are hypothetical examples and actual premiums will vary based on many individual factors and the specific insurance provider.

Hypothetical Individuals and Their Premium Costs

The following table details the estimated average monthly premiums for three different individuals, highlighting the impact of varying factors.

| Individual | Age | Location | Health Status | Plan Type | Deductible | Monthly Premium (Estimate) | Other Relevant Factors |

|---|---|---|---|---|---|---|---|

| Sarah | 28 | Austin, Texas | Generally healthy, no pre-existing conditions | Silver Plan | $3,000 | $450 | Lives in a moderately priced area, chooses a plan with a higher deductible to lower her monthly premium. |

| David | 55 | New York City, New York | Manages high blood pressure, requires regular medication | Gold Plan | $5,000 | $800 | Lives in a high-cost area, needs a plan with comprehensive coverage due to his pre-existing condition. Higher premium reflects both location and health needs. |

| Maria | 67 | Tampa, Florida | Recently diagnosed with type 2 diabetes | Medicare Advantage Plan | $1,500 | $200 (plus Part B premium) | Eligible for Medicare, chooses a Medicare Advantage plan which often has lower premiums than traditional Medicare but may have other cost-sharing components. Part B premium is an additional monthly cost. |

Summary

Securing affordable and comprehensive health insurance is a critical aspect of financial well-being. Understanding the average monthly premium and its contributing factors empowers you to make informed choices that align with your individual needs and budget. By considering the various plan types, cost-sharing mechanisms, and potential subsidies, you can navigate the insurance landscape effectively and find a plan that provides the necessary coverage without undue financial strain. Remember to carefully review your options and compare plans to ensure you’re making the best decision for your health and financial future.

FAQ Compilation

What is a deductible?

A deductible is the amount you pay out-of-pocket for covered healthcare services before your health insurance plan begins to pay.

How do pre-existing conditions affect premiums?

Under the Affordable Care Act (ACA), insurers cannot deny coverage or charge higher premiums based solely on pre-existing conditions. However, the specific condition may still influence the overall cost of your plan.

Can I change my health insurance plan during the year?

Generally, you can only change your health insurance plan during the annual open enrollment period, unless you qualify for a special enrollment period due to a qualifying life event (e.g., marriage, job loss).

What is a Health Savings Account (HSA)?

An HSA is a tax-advantaged savings account that allows you to set aside pre-tax money to pay for eligible medical expenses. It’s typically used in conjunction with high-deductible health plans.