Securing your family’s financial future is a paramount concern, and life insurance plays a crucial role. Understanding the average life insurance premium, however, can feel like navigating a complex maze. This guide demystifies the process, offering insights into the factors influencing costs, helping you make informed decisions about your coverage.

From the impact of age and health to the nuances of policy types and rider options, we’ll explore the key elements that shape your premium. We’ll also delve into the competitive landscape of the insurance industry, providing practical advice on obtaining and interpreting quotes to ensure you find the best fit for your needs and budget.

Factors Influencing Average Life Insurance Premiums

Several key factors interact to determine the average cost of a life insurance policy. Understanding these factors empowers individuals to make informed decisions when securing their financial future. This section will detail the most significant influences on premium calculations.

Age

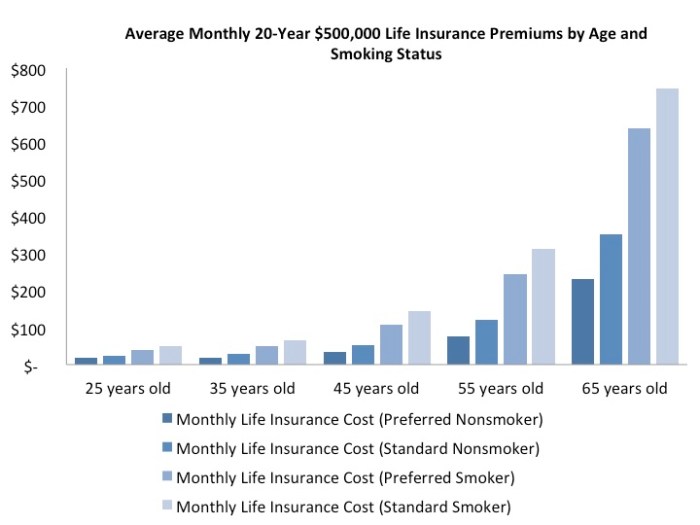

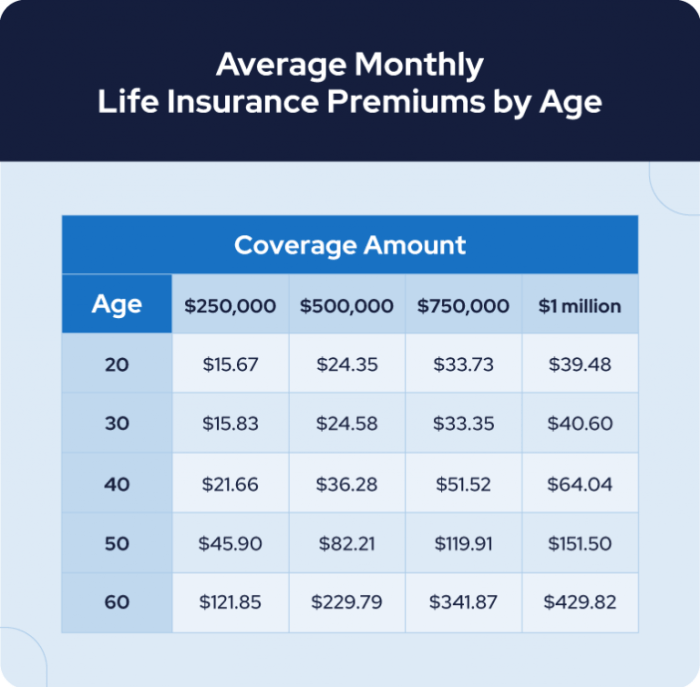

Age is a primary determinant of life insurance premiums. As individuals age, their risk of mortality increases, leading to higher premiums. Younger applicants generally receive lower rates because statistically, they have a longer life expectancy. For example, a 25-year-old might qualify for a significantly lower premium than a 50-year-old, even with identical health profiles and policy types. The difference can be substantial; a 25-year-old might pay a fraction of what a 55-year-old pays for comparable coverage. Insurance companies utilize actuarial tables reflecting mortality rates across different age groups to accurately assess risk.

Type of Policy

Term life and whole life insurance policies differ significantly in their cost structure and features. Term life insurance offers coverage for a specific period (term), while whole life insurance provides lifelong coverage.

| Policy Type | Average Premium (example range) | Term Length (if applicable) | Key Features |

|---|---|---|---|

| Term Life | $10 – $50 per month | 10, 20, or 30 years | Lower premiums, coverage for a specified period. |

| Whole Life | $50 – $200+ per month | Lifelong | Higher premiums, lifelong coverage, cash value component. |

Health Status

An applicant’s health significantly impacts premium calculations. Individuals with pre-existing conditions or unhealthy lifestyle choices generally face higher premiums due to increased risk. For instance, someone with a history of heart disease or cancer will likely pay considerably more than a healthy individual of the same age and policy type. Conversely, maintaining a healthy lifestyle, such as not smoking and exercising regularly, can lead to lower premiums. Specific conditions like diabetes, high blood pressure, or a family history of certain diseases can all result in higher premiums or even policy denial in some cases.

Amount of Coverage

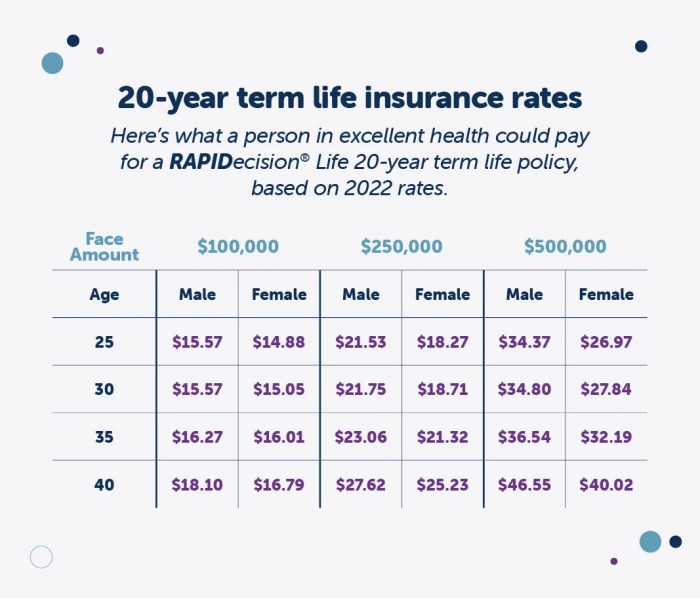

The desired death benefit amount directly influences premium costs. A larger death benefit requires a higher premium to compensate for the increased financial risk the insurance company assumes. A policy with a $500,000 death benefit will naturally cost more than a policy with a $100,000 death benefit, all other factors being equal. This relationship is generally linear; doubling the coverage amount roughly doubles the premium.

Lifestyle and Habits

Lifestyle choices, such as smoking, excessive alcohol consumption, and dangerous hobbies, can affect premium costs. Insurers consider these factors because they increase the risk of premature death. Smokers, for example, typically pay significantly higher premiums than non-smokers due to the increased risk of lung cancer and other smoking-related illnesses. Similarly, individuals engaging in high-risk activities, such as skydiving or professional racing, might face higher premiums or be ineligible for certain types of coverage.

Accessing and Interpreting Premium Information

Obtaining and understanding life insurance premium quotes is crucial for making an informed decision about your coverage. This section provides a step-by-step guide to navigating the process, clarifying common terminology, and demonstrating how to compare quotes effectively. Remember, securing the right life insurance policy requires careful consideration and analysis.

Obtaining Accurate Online Life Insurance Premium Quotes

Acquiring accurate online life insurance premium quotes involves several key steps. First, you should identify your needs, considering factors such as the desired coverage amount, policy type (term, whole, universal, etc.), and your health status. Then, use comparison websites or visit individual insurer websites. These sites typically require you to input personal information, including age, health history, smoking status, and desired coverage amount. Multiple quotes should be obtained from different insurers to ensure a comprehensive comparison. Finally, carefully review each quote, paying close attention to the details of coverage and any exclusions. Remember that online quotes are estimates; a formal application and medical examination may be required for final approval.

Common Terms and Jargon in Life Insurance Premium Quotes

Understanding the terminology used in life insurance quotes is essential for accurate comparison and informed decision-making. The following key terms frequently appear in quotes:

- Premium: The regular payment made to maintain the life insurance policy.

- Face Value/Death Benefit: The amount paid to your beneficiaries upon your death.

- Policy Term: The length of time the policy is in effect (e.g., 10-year term, whole life).

- Cash Value (for permanent policies): The accumulated savings component of some life insurance policies.

- Rider: An added benefit or feature that modifies the policy’s coverage (e.g., accidental death benefit).

- Premium Loading: Additional charges added to the base premium to cover insurer expenses and profits.

- Beneficiary: The person or people who receive the death benefit upon your death.

Interpreting and Comparing Premium Quotes from Multiple Insurers

Once you have collected several life insurance quotes, comparing them effectively is critical. Create a table to organize the information, listing each insurer, their premium amounts, policy terms, death benefits, and any key features or riders. Pay close attention to the details of coverage; a lower premium may come with limited benefits or exclusions. For example, one policy might offer a higher death benefit for a slightly higher premium, while another might have a lower death benefit but include a valuable rider, such as an accidental death benefit. Carefully weigh the benefits and costs of each policy before making a decision.

Understanding the Policy’s Fine Print Before Purchase

Before committing to a life insurance policy, meticulously review the policy’s fine print. This includes the policy’s exclusions (situations not covered), limitations on benefits, and any specific conditions that could affect your coverage. Don’t hesitate to contact the insurer directly to clarify any ambiguities or uncertainties. Understanding the policy’s terms and conditions ensures that you are fully aware of your rights and obligations under the contract, preventing potential future disputes or disappointments. Consider seeking advice from a qualified financial advisor if you have complex needs or find the details overwhelming.

Illustrative Examples of Average Premiums

Understanding average life insurance premiums requires looking at specific examples to see how various factors influence the final cost. These examples are hypothetical but reflect real-world scenarios and illustrate the range of possibilities.

Let’s consider two individuals with different profiles to highlight the impact of various factors on premium calculations.

Hypothetical Individual 1: A Healthy, Non-Smoking, 30-Year-Old Male

Imagine a 30-year-old male, a non-smoker, who maintains a healthy lifestyle and has no pre-existing health conditions. He’s applying for a $500,000 20-year term life insurance policy. Based on his profile and the current market rates, his annual premium might be approximately $500. This relatively low premium reflects his favorable risk profile. The insurer assesses his risk as low, leading to a lower premium.

Hypothetical Individual 2: A 55-Year-Old Female Smoker with Pre-existing Conditions

Now, let’s consider a 55-year-old female smoker with a history of high blood pressure. She’s also applying for a $500,000 20-year term life insurance policy. Her annual premium is likely to be significantly higher, perhaps around $2,000 or more. This higher cost reflects the increased risk associated with her age, smoking habit, and pre-existing health condition. The insurer views her as a higher-risk individual, resulting in a substantially increased premium.

Factors Contributing to Premium Variations

The significant difference in premiums between these two hypothetical individuals highlights several key factors influencing life insurance costs. These factors work in concert to determine an individual’s premium.

- Age: Older individuals generally pay higher premiums because their life expectancy is shorter, increasing the likelihood of a claim.

- Health Status: Pre-existing conditions and lifestyle choices (like smoking) significantly impact premiums. Individuals with health issues are considered higher risk.

- Policy Type: Term life insurance (covering a specific period) is typically cheaper than whole life insurance (providing lifelong coverage).

- Policy Amount: A larger death benefit naturally results in a higher premium.

- Gender: Historically, women have paid lower premiums than men, though this gap is narrowing in many regions.

- Occupation: Some high-risk occupations may lead to higher premiums due to increased chances of accidental death.

- Location: Premiums can vary geographically due to differences in healthcare costs and mortality rates.

Final Summary

Ultimately, determining the right life insurance policy hinges on a careful assessment of individual circumstances and financial goals. While the average life insurance premium provides a useful benchmark, your specific cost will depend on a multitude of personalized factors. By understanding these factors and utilizing the resources and information provided, you can confidently navigate the process of securing adequate and affordable life insurance protection.

Top FAQs

What is the difference between a term and whole life insurance policy?

Term life insurance provides coverage for a specific period (term), while whole life insurance offers lifelong coverage and builds cash value.

Can I get life insurance if I have pre-existing health conditions?

Yes, but your premiums may be higher. Insurers assess risk based on your health history.

How often are life insurance premiums paid?

Premiums can be paid annually, semi-annually, quarterly, or monthly. The frequency typically doesn’t affect the total cost.

What happens if I miss a premium payment?

Your policy may lapse, meaning your coverage ends. Most insurers offer grace periods, but it’s crucial to contact them immediately if you encounter payment difficulties.

Does my lifestyle affect my life insurance premium?

Yes, factors like smoking, excessive alcohol consumption, and dangerous hobbies can significantly increase premiums due to higher risk.