Securing your home is a fundamental aspect of financial responsibility, and understanding the cost of that security—the average household insurance premium—is crucial. This comprehensive guide delves into the multifaceted world of home insurance premiums, exploring the factors that influence their calculation, the data behind the averages, and the trends shaping their future. We’ll unravel the complexities of premiums, offering insights into how location, coverage, and individual circumstances impact the final cost.

From analyzing reliable data sources and statistical methodologies to examining the effects of inflation, government regulations, and technological advancements, we aim to provide a clear and informative overview. We’ll also consider the challenges in accurately representing the average premium due to the inherent variability in coverage and risk profiles across households.

Defining “Average Household Insurance Premium”

Understanding the average household insurance premium requires examining its multifaceted nature. It’s not a single, fixed number, but rather a range reflecting numerous contributing factors. This average represents a statistical midpoint derived from a large pool of insurance policies, offering a general idea of typical costs but not necessarily reflecting individual experiences.

The components of a household insurance premium are diverse and interconnected. Primarily, they cover the insurer’s costs for claims payouts, administrative expenses, and profit margins. The insurer assesses risk based on various factors (discussed below) and sets premiums accordingly. A significant portion of the premium goes towards building a reserve fund to cover potential future claims, ensuring the insurer’s financial stability.

Components of Household Insurance Premiums

Several key factors determine the specific components of your household insurance premium. These include the cost of claims expected for similar properties and the insurer’s operational costs, which encompass salaries, technology, and marketing. A significant factor is also the insurer’s desired profit margin. The more claims expected, the higher the premium will be to ensure profitability.

Variations in Premium Calculations Across Providers

Insurance providers employ different actuarial models and risk assessment methodologies. This leads to variations in premium calculations, even for similar properties and coverage levels. Some insurers may prioritize specific risk factors more heavily than others, resulting in differing premiums. For example, one insurer might heavily weigh the proximity to fire hydrants, while another may prioritize the age of the roof. This difference in assessment and pricing strategy leads to a diverse market where consumers can compare and select the best fit for their needs.

Factors Influencing the Average Premium

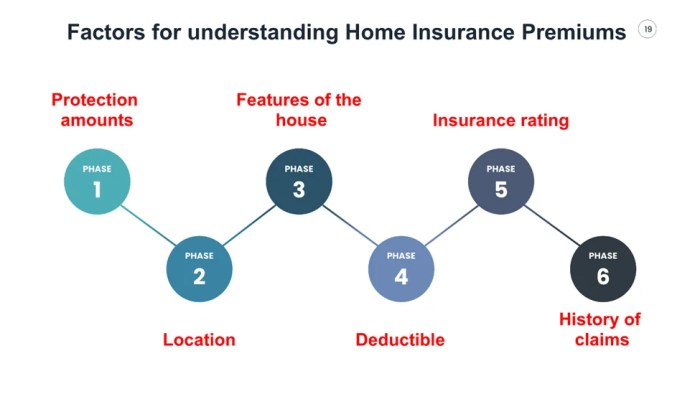

Numerous factors influence the average household insurance premium. Understanding these factors helps consumers make informed decisions about their coverage and budgeting. Location, coverage type, and deductible are three key elements that significantly impact premium costs.

Location: Premiums are often higher in areas with higher risks of natural disasters (hurricanes, earthquakes, wildfires), higher crime rates, or higher instances of property damage claims. For example, coastal areas frequently have higher premiums due to hurricane risk compared to inland locations.

Coverage Type: The extent of coverage significantly impacts the premium. Comprehensive coverage offering protection against a wider range of risks naturally commands a higher premium than a basic policy. Choosing higher coverage limits for liability or personal property will also increase the premium.

Deductible: The deductible represents the amount the policyholder pays out-of-pocket before the insurance coverage kicks in. Opting for a higher deductible typically results in a lower premium, as the insurer assumes less immediate financial responsibility. Conversely, a lower deductible means a higher premium.

Premium Comparison Table

The following table illustrates a hypothetical comparison of premiums for different household sizes and dwelling types. These figures are for illustrative purposes only and should not be considered actual quotes. Actual premiums vary significantly based on the factors discussed above.

| Household Size | Dwelling Type | Annual Premium (Example) | Notes |

|---|---|---|---|

| 1 Person | Apartment | $500 | Lower risk profile |

| 2 People | Townhouse | $750 | Moderate risk profile |

| Family of 4 | Single-Family Home | $1200 | Higher risk profile, more potential claims |

| Family of 6 | Large Single-Family Home | $1500 | Highest risk profile, potential for higher claims |

Data Sources and Methodology for Determining the Average

Accurately determining the average household insurance premium requires a robust methodology and access to reliable data. This involves identifying appropriate data sources, employing suitable statistical techniques, and acknowledging inherent limitations in data availability and coverage variations. The process is complex and the resulting average should be interpreted with caution, considering the inherent variability in insurance premiums.

Calculating a truly representative average household insurance premium presents several challenges. The sheer volume of policies, the diversity of coverage options, and the regional variations in pricing all contribute to the complexity. Furthermore, data access limitations often restrict the scope of analysis, leading to potential biases in the final average.

Data Sources for Household Insurance Premiums

Reliable data on household insurance premiums is crucial for calculating a meaningful average. Several sources can provide this information, each with its own strengths and weaknesses. Careful consideration of these factors is necessary to select the most appropriate data for analysis.

- Government Regulatory Agencies: Many countries have regulatory bodies that oversee the insurance industry. These agencies often collect and publish aggregate data on insurance premiums, providing a broad overview of the market. Strengths: Data tends to be comprehensive and reliable, covering a large portion of the market. Weaknesses: Data may be aggregated at a high level, lacking detail on specific household types or coverage variations. Data release frequency might be limited.

- Insurance Industry Associations: Industry groups often compile and analyze data from their member companies. This data can offer valuable insights into specific market segments and trends. Strengths: Data may be more granular than government data, offering insights into specific product types and demographics. Weaknesses: Data might not be publicly available, and its representativeness can be questioned, as it may not include data from smaller, non-member companies.

- Private Data Providers: Several companies specialize in collecting and analyzing insurance market data. These providers often offer detailed datasets for sale, allowing for more in-depth analysis. Strengths: Data can be highly granular and tailored to specific research needs. Weaknesses: Access requires purchasing data, which can be expensive. Data quality and methodology may vary between providers.

Statistical Methods and Bias Mitigation

Once data is gathered, appropriate statistical methods are needed to calculate the average premium. A simple arithmetic mean might be used initially, but this can be heavily skewed by outliers – extremely high or low premiums. Therefore, more robust methods are typically preferred.

To address potential biases and outliers, methods like the median (the middle value when data is ordered) or trimmed mean (removing a percentage of the highest and lowest values before calculating the average) might be more suitable. Weighted averages can also be used if certain types of policies are more prevalent. For example, a weighted average might give more importance to homeowners insurance premiums if they represent a significantly larger portion of the overall market than renters insurance premiums.

Challenges in Representing the Average Premium

Despite using robust statistical methods, accurately representing the average household insurance premium remains challenging. Data limitations, variations in coverage, and the dynamic nature of the insurance market all contribute to this difficulty.

For instance, data might not be available for all types of insurance policies or all geographical regions. Furthermore, the definition of a “household” itself can vary, impacting the accuracy of the average. Finally, insurance premiums are constantly changing due to factors like inflation, claims frequency, and regulatory changes. This makes it challenging to maintain a consistently accurate average over time.

Factors Affecting the Average Household Insurance Premium

Several interconnected factors influence the average cost of household insurance premiums. Understanding these factors provides valuable insight into the dynamics of the insurance market and allows for better prediction of future premium trends. These factors operate both individually and in concert, creating a complex interplay that shapes the final premium amount.

Inflation’s Impact on Insurance Premiums

Inflation significantly impacts insurance premiums over time. Rising costs for repairs, replacement materials, and medical care directly translate into higher claim payouts for insurance companies. To maintain profitability and solvency, insurers adjust premiums upward to offset these increased expenses. For example, a 5% annual inflation rate in construction costs could necessitate a similar percentage increase in premiums for homeowners insurance to cover potential damage repairs. This effect is often compounded by increases in labor costs, further driving premium growth. Therefore, consistent monitoring of inflation rates across relevant sectors is crucial for predicting future premium adjustments.

Geographical Variations in Average Premiums

Average household insurance premiums vary considerably across different geographical regions. This disparity stems from a multitude of factors, including the prevalence of natural disasters, crime rates, and the cost of living. Coastal areas, for instance, often face higher premiums for homeowners insurance due to the increased risk of hurricanes and flooding. Similarly, regions with high crime rates tend to have higher premiums for property and liability insurance. Areas with a higher cost of living generally experience higher premiums due to the increased cost of repairs and replacements. For example, homeowners insurance in a high-value coastal property market like Malibu, California, will likely be substantially higher than in a rural area of the Midwest.

Claims Frequency and Severity’s Influence on Premiums

The frequency and severity of insurance claims significantly influence premium adjustments. A higher frequency of claims, even if they are relatively small, indicates a greater risk for the insurer. Conversely, a lower frequency of claims, even with some large claims, may result in lower premiums. However, the severity of claims carries even more weight. A few large, catastrophic claims can significantly impact an insurer’s profitability, leading to substantial premium increases for all policyholders, regardless of their individual claims history. For instance, a region experiencing a spate of high-value burglaries might see a sharp increase in homeowners insurance premiums, while a region with many minor car accidents might only see a moderate increase.

Hypothetical Scenario: Risk Factor Changes and Premium Adjustments

Consider a hypothetical scenario: A previously low-risk region experiences a significant increase in wildfire risk due to prolonged drought and changes in land management practices. This increased risk, represented by a higher probability of severe wildfires, will lead insurance companies to reassess the risk profile of the region. Consequently, they would likely implement premium increases for homeowners insurance, potentially by a substantial margin. This increase aims to reflect the elevated likelihood and potential severity of future claims related to wildfire damage. Conversely, if crime rates decrease significantly in a particular area, insurers might respond by reducing premiums to reflect the lowered risk. This demonstrates the dynamic relationship between risk factors and premium adjustments.

Trends and Projections of Average Household Insurance Premiums

Understanding the historical trends and future projections of average household insurance premiums is crucial for both consumers and the insurance industry. This section will explore the historical movement of premiums, predict future trends based on various factors, and analyze the potential impact of technological advancements.

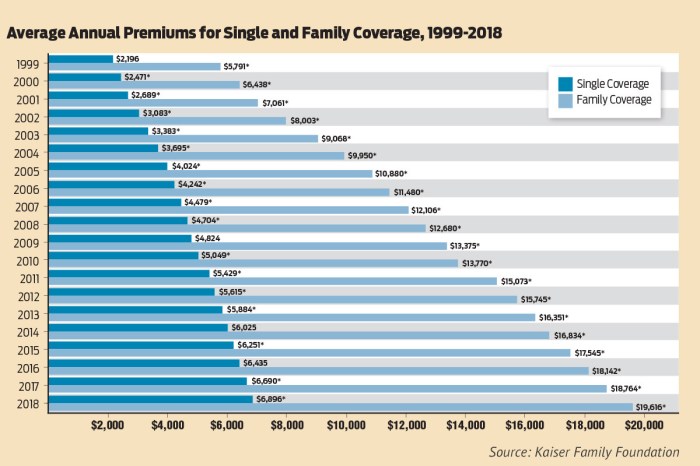

Historical Overview of Average Household Insurance Premium Trends

Over the past two decades, average household insurance premiums have generally shown an upward trend, though the rate of increase has fluctuated significantly depending on economic conditions, catastrophic events, and regulatory changes. For example, periods of high inflation often correlate with increased premium costs, as do years with a high frequency of severe weather events leading to increased payouts by insurance companies. Conversely, periods of economic stability and technological improvements in risk assessment have sometimes led to slower premium growth or even temporary decreases in certain sectors. Specific data on this trend would require referencing publicly available data from sources like the Insurance Information Institute or government regulatory bodies, which would show year-over-year changes and variations across different types of insurance.

Future Trends in Average Premiums

Based on current market conditions and projected risk factors, several factors suggest continued, albeit potentially fluctuating, growth in average household insurance premiums over the next five years. Rising inflation, climate change leading to more frequent and severe weather events (hurricanes, wildfires, floods), and increasing healthcare costs (particularly impacting health insurance premiums) are all expected to contribute to this upward pressure. However, the extent of this increase will depend on factors like the effectiveness of risk mitigation strategies employed by insurance companies, government regulations, and the overall economic climate. For instance, a recession might temporarily dampen premium growth due to reduced consumer spending and demand.

Impact of Technological Advancements on Future Premiums

Technological advancements, particularly in the field of telematics for auto insurance and predictive modeling for other lines of insurance, have the potential to significantly impact future premiums. Telematics devices, for example, can track driving behavior, providing insurers with more accurate risk assessments. This allows for more personalized pricing, potentially rewarding safer drivers with lower premiums while charging higher premiums to riskier drivers. Similarly, advanced analytics and machine learning can improve the accuracy of risk prediction for various insurance products, leading to more efficient pricing and potentially lower premiums for some individuals. However, the full impact of these technologies remains to be seen and will depend on consumer adoption rates, data privacy concerns, and the regulatory landscape.

Projected Changes in Average Premiums Over the Next Five Years

[Imagine a line graph here. The x-axis represents the years (Year 0, Year 1, Year 2, Year 3, Year 4, Year 5), and the y-axis represents the average household insurance premium (in dollars). The line starts at a baseline premium amount (e.g., $1500) in Year 0. The line shows a gradual upward trend, with a slightly steeper increase in Years 3 and 4, reflecting the impact of increased risk factors and potentially slower technological adoption in the early years. Year 5 shows a less steep increase, reflecting the potential mitigating effect of advanced technologies becoming more widespread. The graph should clearly illustrate a positive correlation between time and average premium, but with variations in the rate of increase reflecting the interplay of various factors.] The graph illustrates a projected increase in average household insurance premiums over the next five years. While the overall trend is upward, reflecting the influence of factors like inflation and increased risk, the rate of increase is not uniform. The initial years show a relatively moderate increase, reflecting a balance between rising risks and the early stages of technological implementation. The steeper increase in years 3 and 4 reflects the impact of more pronounced risk factors, while the slowing of the increase in year 5 represents the potential for technological advancements to mitigate some of the upward pressure on premiums. The specific numbers used in this projection are illustrative and would need to be based on detailed market analysis and predictive modeling.

Impact of Government Regulations and Policies

Government regulations significantly influence the affordability and accessibility of household insurance. These policies, ranging from tax incentives to mandated coverage, directly impact both the average premium paid by consumers and the overall health of the insurance market. Understanding the interplay between government intervention and insurance pricing is crucial for both consumers and policymakers.

Government regulations affect household insurance affordability and availability through several mechanisms. Directly, regulations can mandate specific coverages, increasing the overall cost of insurance policies. Indirectly, regulations impacting the insurance industry’s operational costs, such as licensing requirements or solvency standards, can also lead to higher premiums. Conversely, some regulations aim to promote competition and transparency, potentially lowering premiums.

Tax Credits and Subsidies

Tax credits and subsidies are common government interventions designed to make insurance more affordable for specific demographics or in response to specific events, like natural disasters. For example, the Affordable Care Act in the United States includes tax credits to help individuals and families purchase health insurance. Similarly, some states offer subsidies for flood insurance in high-risk areas. These financial incentives directly reduce the out-of-pocket cost for consumers, effectively lowering the average premium they pay. The impact varies based on the design of the credit or subsidy; targeted programs offering significant financial assistance will result in a larger decrease in average premiums compared to less generous programs. The effect on the average premium across the entire population, however, depends on the percentage of the population eligible for and utilizing these benefits.

State and Country Level Regulatory Differences

The regulatory landscape for household insurance varies considerably across different states and countries. Some states have stricter regulations regarding coverage requirements or rate setting, potentially leading to higher average premiums compared to states with more lenient regulations. For instance, states with stringent building codes and stricter regulations for insurers might see higher premiums because of increased costs associated with compliance. Internationally, the differences are even more pronounced. Countries with robust social safety nets and extensive government-provided insurance may have lower average premiums for certain types of coverage because of the reduced risk borne by private insurers. Conversely, countries with less developed regulatory frameworks might experience higher premiums due to increased uncertainty and risk. For example, a comparison of average home insurance premiums between the United States and certain European countries with more centralized social security systems often reveals significant differences.

Government Initiatives to Reduce Insurance Costs

Various government initiatives aim to reduce the cost of household insurance. These initiatives often focus on risk mitigation, improving market efficiency, or directly subsidizing insurance costs. Examples include government-sponsored programs promoting home safety improvements (e.g., retrofitting homes to withstand earthquakes or hurricanes), which can lead to lower insurance premiums for participating homeowners by reducing the likelihood of claims. Another example is the development of sophisticated risk assessment models that allow insurers to better price policies based on individual risk profiles, leading to fairer premiums and increased access to insurance. These initiatives aim to create a more efficient and equitable insurance market, ultimately benefiting consumers through lower average premiums and increased access to insurance coverage.

Closing Notes

In conclusion, the average household insurance premium is not a static figure; it’s a dynamic reflection of numerous interconnected factors. By understanding these influences—from geographical location and coverage type to government policies and technological innovation—homeowners can make informed decisions about their insurance needs and budget accordingly. This guide serves as a starting point for a deeper exploration of this vital aspect of homeownership, empowering individuals to navigate the complexities of insurance with greater confidence.

Helpful Answers

What is the difference between liability and property coverage in home insurance?

Liability coverage protects you financially if someone is injured on your property or you damage someone else’s property. Property coverage protects your home and belongings from damage due to covered perils (e.g., fire, windstorm).

How often are home insurance premiums reviewed and adjusted?

Premiums are typically reviewed annually, and adjustments are made based on factors such as claims history, changes in risk assessment, and market conditions.

Can I lower my home insurance premium?

Yes, several actions can lower premiums, including increasing your deductible, improving home security, bundling policies, and maintaining a good claims history.

What factors are considered when determining my eligibility for home insurance?

Insurers consider your credit score, claims history, the age and condition of your home, its location, and the type of coverage you request.