Securing your home is a significant investment, and understanding the cost of that protection—the average house insurance premium—is crucial. This guide delves into the multifaceted world of homeowner’s insurance, exploring the factors that influence premiums, comparing insurer offerings, and providing strategies to potentially lower your costs. From geographic location and property features to coverage levels and risk profiles, we unravel the complexities of determining your ideal insurance policy.

We’ll examine how seemingly minor details, like the age of your roof or the presence of a security system, can significantly impact your premium. Furthermore, we’ll compare quotes from leading insurers, highlighting key differences in coverage and pricing to help you make informed decisions. Ultimately, this guide aims to empower you with the knowledge necessary to navigate the insurance landscape confidently and secure the best possible protection for your home.

Factors Influencing Average House Insurance Premiums

Understanding the factors that influence your home insurance premium is crucial for making informed decisions and potentially saving money. Several key elements contribute to the final cost, and this section will explore those in detail. The price you pay isn’t arbitrary; it’s a reflection of the insurer’s assessment of risk.

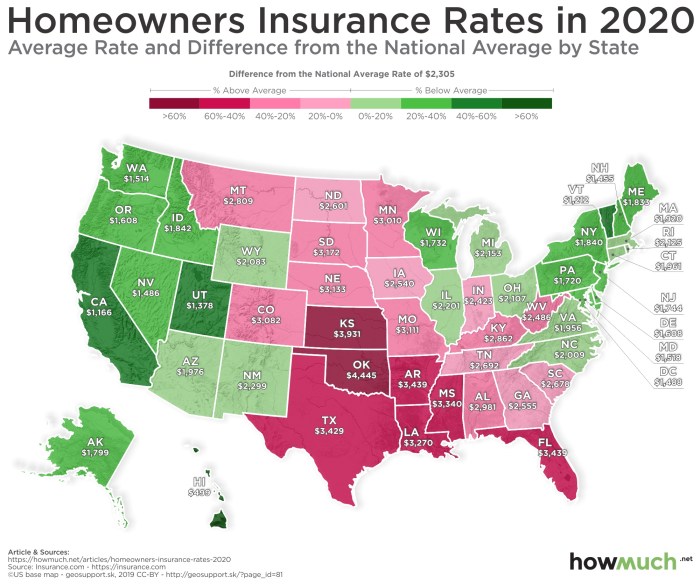

Location’s Impact on Premiums

Geographic location significantly impacts home insurance premiums. Areas prone to natural disasters, such as hurricanes, earthquakes, wildfires, or floods, command higher premiums due to the increased risk of damage. For example, coastal properties in hurricane-prone regions will generally have substantially higher premiums than those in inland, less vulnerable areas. Furthermore, crime rates within a neighborhood also play a role; higher crime rates translate to a greater risk of burglary and vandalism, leading to increased insurance costs. Even seemingly minor geographical variations, such as proximity to fire hydrants or the type of local fire department, can affect your premium.

Property Features and Insurance Costs

The characteristics of your property itself are another major determinant of your premium. Larger homes generally cost more to insure because there’s more to replace or repair in the event of damage. Older homes, particularly those lacking modern safety features, may also carry higher premiums due to increased vulnerability to wear and tear, outdated building codes, and potential issues with aging infrastructure. The construction materials used also matter; homes built with fire-resistant materials, such as brick or concrete, tend to have lower premiums compared to those built with wood. The presence of features like a swimming pool or detached garage can also impact premiums, as they present additional potential liability and damage risks.

Coverage Levels and Premium Differences

Different coverage levels directly impact the cost of your insurance. Higher coverage equates to higher premiums, but also greater financial protection in the event of a loss. The following table illustrates this relationship:

| Coverage Level | Premium Difference (Example) | Coverage Details | Deductible (Example) |

|---|---|---|---|

| Basic | Lowest | Covers only structural damage from specific perils (e.g., fire, wind). Limited liability coverage. | $1,000 |

| Standard | Moderate | Covers a broader range of perils, including theft, vandalism, and some water damage. Increased liability coverage. | $500 |

| Premium | Highest | Comprehensive coverage for a wide range of perils, including higher liability limits, additional living expenses, and potentially valuable personal possessions. | $0 |

*Note: Premium differences and coverage details are illustrative examples and will vary significantly based on individual circumstances and insurer policies.

Homeowner Risk Profiles and Premiums

Your personal risk profile significantly influences your insurance premiums. A history of insurance claims, especially multiple claims within a short period, will almost certainly lead to higher premiums. Insurers view this as an indicator of higher risk. Conversely, a clean claims history demonstrates responsible homeownership and can result in lower premiums. Installing security systems, such as alarms and security cameras, can also reduce your premiums. These systems deter theft and vandalism, thus reducing the insurer’s risk exposure. Furthermore, factors like your credit score might be considered by some insurers, although this practice varies by location and insurer.

Comparing Premiums Across Different Insurers

Choosing the right home insurance policy often involves comparing offers from several insurers. This comparison helps identify the best balance between coverage and cost, ensuring adequate protection without unnecessary expenditure. Understanding the factors influencing these price variations is crucial for making an informed decision.

Several major insurers offer home insurance, each with varying coverage options and pricing structures. A direct comparison reveals significant differences that can impact the final premium.

Premium Comparison Across Three Major Insurers

Let’s compare hypothetical quotes from three major insurers – Insurer A, Insurer B, and Insurer C – for a standardized home: a 2,000 sq ft, single-family home in a low-risk area with no prior claims.

- Insurer A: Offers comprehensive coverage with a focus on personalized options. Their premium might be slightly higher, reflecting broader coverage, but they may include additional benefits like emergency services or extended coverage for specific perils. They might also offer discounts for specific home security features.

- Insurer B: Provides standard coverage at a competitive price. Their policy may be less customizable than Insurer A’s, focusing on essential protections. They often emphasize simplicity and ease of use in their policy documents and claims process.

- Insurer C: May offer the lowest premium initially, but their coverage might be more limited. They might have higher deductibles or exclude certain perils from their basic policy. While initially cheaper, additional coverage options could increase the final cost, potentially exceeding the premiums offered by Insurers A and B.

Factors Contributing to Price Variations

Several factors contribute to the observed price differences between insurers. These factors are often intertwined and influence the overall premium calculation.

- Risk Assessment: Insurers use different models to assess risk. Factors like location, home age, construction materials, and security features significantly impact the perceived risk and, consequently, the premium.

- Claims History: Insurers consider the claims history of both the individual and the neighborhood. A higher frequency of claims in a specific area or by an individual can lead to higher premiums.

- Profit Margins and Operational Costs: Each insurer has different operational costs and profit margins. These variations can affect the overall pricing strategy, resulting in differing premiums even for similar risk profiles.

- Reinsurance Costs: The cost of reinsurance, which protects the insurer against significant losses, also plays a role. Higher reinsurance costs can translate to higher premiums for the policyholder.

Role of Discounts in Reducing Premium Costs

Several discounts can significantly reduce home insurance premiums. These discounts incentivize responsible homeownership and risk mitigation.

- Bundling Discounts: Combining home and auto insurance with the same insurer often results in substantial discounts.

- Loyalty Discounts: Insurers often reward long-term customers with reduced premiums for their continued business.

- Safety Feature Discounts: Installing security systems, smoke detectors, and other safety features can qualify for discounts, as these measures reduce the likelihood of claims.

Average Premiums for a Standardized House

The following table illustrates hypothetical average annual premiums for a standardized 2,000 sq ft home in a low-risk area, demonstrating the variation among insurers.

| Insurer | Basic Coverage | Comprehensive Coverage | Premium with Bundling Discount |

|---|---|---|---|

| Insurer A | $1200 | $1500 | $1350 |

| Insurer B | $1000 | $1300 | $900 |

| Insurer C | $900 | $1200 | $810 |

Understanding Policy Components and Their Costs

Homeowner’s insurance policies are multifaceted, covering various aspects of your property and liability. Understanding the different components and how they influence your premium is crucial for securing adequate protection at a manageable cost. This section will detail the key elements of a typical policy, exploring how deductibles, coverage limits, and additional options impact the overall premium.

A standard homeowner’s insurance policy typically comprises three main components: dwelling coverage, personal property coverage, and liability coverage. Dwelling coverage protects the physical structure of your house, while personal property coverage insures your belongings within the house. Liability coverage protects you financially if someone is injured on your property or if your actions cause damage to someone else’s property.

Deductible Amounts and Premium Calculations

The deductible is the amount you agree to pay out-of-pocket before your insurance coverage kicks in. A higher deductible generally results in a lower premium, as the insurer’s risk is reduced. Conversely, a lower deductible leads to a higher premium. For example, choosing a $1,000 deductible instead of a $500 deductible might lower your annual premium by $100-$200, depending on your insurer and location. This is because you are accepting more financial responsibility in the event of a claim. The relationship between deductible and premium is typically inverse; higher deductibles mean lower premiums and vice versa.

Additional Coverage Options and Costs

Many additional coverage options can enhance your policy’s protection, but they will increase your premium. It’s important to weigh the potential risks against the added cost.

The following are common add-on coverages and their typical premium impact. These figures are estimates and can vary significantly based on location, insurer, and the specific details of your policy.

- Flood Insurance: This covers damage from flooding, a peril typically excluded from standard homeowner’s insurance. The cost varies greatly depending on your location’s flood risk, but it can add several hundred dollars annually to your premium. For example, a home in a high-risk flood zone might see an increase of $500-$1000 or more per year.

- Earthquake Insurance: Similar to flood insurance, earthquake coverage is often sold separately. The cost depends heavily on your location’s seismic activity and the construction of your home. Premiums can range from a few hundred to over a thousand dollars per year, potentially even more in high-risk areas.

- Personal Liability Umbrella Policy: This extends your liability coverage beyond the limits of your standard policy, offering greater protection against significant lawsuits. The added cost is relatively low compared to the increased protection, often ranging from $150-$300 annually for substantial additional coverage.

- Scheduled Personal Property Coverage: This provides higher coverage limits for specific valuable items like jewelry or artwork, protecting you against significant losses. The cost depends on the value of the items insured, but it can range from a few tens of dollars to several hundred dollars per year.

Coverage Limits and Premium Impact

Coverage limits define the maximum amount your insurer will pay for a covered loss. Higher coverage limits generally lead to higher premiums. For instance, increasing your dwelling coverage from $250,000 to $350,000 will likely increase your premium, reflecting the increased risk the insurer is assuming. Similarly, increasing personal property coverage limits will also affect the premium. It is essential to select coverage limits that adequately protect your assets while remaining financially feasible.

Strategies for Lowering House Insurance Premiums

Reducing your home insurance premiums doesn’t have to be a complex undertaking. Several straightforward strategies can significantly lower your annual costs, often resulting in substantial savings over time. By implementing a combination of these methods, tailored to your specific circumstances, you can effectively manage your insurance expenses without compromising the level of coverage you need.

Home Improvements for Reduced Premiums

Many home improvements not only enhance your living space but also reduce your insurance risk, leading to lower premiums. Insurance companies recognize that homes with enhanced safety features and improved construction are less likely to experience damage or loss. Therefore, investing in these improvements can translate into tangible financial benefits.

- Security Systems: Installing a monitored security system, including burglar alarms and fire detectors, often qualifies for significant discounts. The reduced risk of theft and fire damage directly impacts your premium calculation. For example, some insurers offer up to 20% discounts for professionally monitored systems.

- Fire-Resistant Materials: Using fire-resistant roofing materials, such as Class A asphalt shingles, or installing fire-resistant drywall in key areas can significantly lower your risk of fire damage. This demonstrably reduces the insurer’s potential payout, leading to lower premiums. The cost savings often outweigh the initial investment in these materials over the long term.

- Impact-Resistant Windows and Doors: Upgrading to impact-resistant windows and doors offers protection against severe weather events, such as hurricanes and hailstorms. This reduction in vulnerability to damage translates to lower insurance premiums, particularly in areas prone to such weather conditions. The added security benefit is an additional advantage.

Maintaining a Good Claims History

Your claims history is a crucial factor influencing your insurance premiums. A history of filing few or no claims demonstrates responsible homeownership and a lower risk profile. Insurance companies reward this responsible behavior with lower premiums. Conversely, frequent claims can lead to higher premiums or even policy cancellation.

- Minimize Unnecessary Claims: Only file claims for significant damage. Minor repairs are often more cost-effective to handle yourself, avoiding potential premium increases associated with claim filings.

- Address Maintenance Issues Promptly: Regular maintenance prevents small problems from escalating into larger, more costly issues that require insurance claims. Proactive maintenance demonstrates responsible homeownership and contributes to a positive claims history.

- Shop Around for Insurers: Different insurers weigh claims history differently. Comparing quotes from multiple insurers can reveal opportunities for lower premiums based on your specific claims history.

Additional Strategies to Lower Premiums

Beyond home improvements and claims history, several other strategies can contribute to lower premiums. These often require less significant investment but still yield considerable savings.

- Increase Your Deductible: A higher deductible means a lower premium. Carefully weigh the increased out-of-pocket expense in case of a claim against the potential premium savings. This is a simple, effective way to reduce your costs.

- Bundle Policies: Combining your home insurance with other policies, such as auto insurance, from the same insurer often results in discounts. This bundling strategy leverages your loyalty and reduces administrative costs for the insurance company.

- Pay Annually: Many insurers offer discounts for paying your premiums annually instead of monthly. This simplifies their billing processes and often translates into cost savings for you.

Final Summary

Understanding your average house insurance premium is not merely about finding the cheapest policy; it’s about securing comprehensive coverage that aligns with your individual needs and risk profile. By carefully considering the factors discussed—location, property characteristics, coverage levels, and insurer offerings—you can make informed choices that protect your most valuable asset. Remember, proactive strategies, such as home improvements and maintaining a good claims history, can significantly impact your premiums over time, offering long-term cost savings. This comprehensive understanding empowers you to secure peace of mind knowing your home is adequately protected.

FAQ Insights

What is a deductible, and how does it affect my premium?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums, as you’re assuming more of the risk.

Can I get insurance if I have a history of claims?

Yes, but your premiums may be higher. Insurers consider claims history when assessing risk. However, maintaining a clean record for several years can positively impact future premiums.

What factors influence the cost of flood or earthquake insurance?

Flood and earthquake insurance costs are significantly influenced by location (flood zones, seismic activity), the value of your property, and the level of coverage you choose. These are often purchased separately from standard homeowner’s insurance.

How often should I review my homeowner’s insurance policy?

It’s advisable to review your policy annually, or whenever there are significant changes to your property (renovations, additions) or your risk profile.