Navigating the complex world of health insurance can feel overwhelming, especially when confronted with the often-opaque issue of average premiums. This guide aims to demystify the factors that contribute to the cost of health insurance, providing a clear understanding of how various elements – from age and location to plan type and government regulations – influence the final price you pay. By examining current trends and exploring different plan options, we hope to empower you with the knowledge needed to make informed decisions about your healthcare coverage.

The cost of healthcare is a significant concern for many individuals and families. Understanding the dynamics of average health insurance premiums is crucial for budgeting and planning. This exploration will delve into the intricacies of premium calculation, offering insights into how various factors interact to determine the final cost. We will also explore the historical trends in premiums, offering context for current pricing structures and potential future changes.

Factors Influencing Average Premiums

Several key factors interact to determine the average cost of health insurance premiums. Understanding these influences is crucial for individuals and families navigating the healthcare market. This section will explore the primary drivers of premium variations.

Age and Health Insurance Premiums

Age significantly impacts health insurance premiums. Older individuals generally pay more due to a statistically higher likelihood of needing more extensive medical care. This is reflected in actuarial tables used by insurance companies to assess risk and set premiums. For example, a 60-year-old might pay considerably more than a 30-year-old, even with identical health conditions, because the probability of developing age-related health issues increases with age. This is a fundamental principle of insurance – spreading risk across a diverse pool of individuals.

Individual Health Status and Premium Costs

An individual’s health status is another major factor influencing premium costs. Pre-existing conditions, current health issues, and lifestyle choices all play a role. Individuals with pre-existing conditions like diabetes or heart disease often face higher premiums because they represent a greater risk to insurers. Similarly, smokers and individuals with unhealthy lifestyles may see increased premiums due to the higher probability of future health problems. Conversely, individuals in excellent health may qualify for lower premiums, reflecting their lower risk profile.

Geographic Location and Premium Variation

The cost of healthcare varies significantly across geographic locations. Premiums tend to be higher in areas with a high cost of living, a higher concentration of specialists, and a greater demand for medical services. Urban areas often have higher premiums than rural areas. For instance, premiums in major metropolitan areas like New York City or Los Angeles are typically higher than those in smaller towns or rural communities due to factors such as higher physician salaries and facility costs.

Family Size and Average Premiums

The size of a family unit also affects average premiums. Larger families typically pay more for coverage than individuals or smaller families because they represent a larger pool of potential healthcare expenses. The cost of covering multiple individuals within a single plan naturally leads to higher overall premiums. For example, a family plan covering four individuals will generally be more expensive than an individual plan.

Employer-Sponsored Plans and Premium Averages

Employer-sponsored health insurance plans significantly influence average premiums. The participation of employers in providing health insurance helps to lower the overall average cost for employees. Employer contributions, often a substantial portion of the total premium, reduce the financial burden on employees. However, the average premium for employer-sponsored plans can still vary based on factors like the size and industry of the employer, the type of plan offered, and employee contributions.

Average Premiums Across Coverage Levels

The level of coverage chosen (bronze, silver, gold, platinum) directly impacts premium costs. Lower-level plans (bronze) have lower premiums but higher out-of-pocket costs, while higher-level plans (platinum) have higher premiums but lower out-of-pocket costs. This reflects the trade-off between upfront costs and cost-sharing responsibilities.

| Coverage Level | Average Monthly Premium (Example) | Deductible (Example) | Out-of-Pocket Maximum (Example) |

|---|---|---|---|

| Bronze | $300 | $7,000 | $8,000 |

| Silver | $450 | $4,000 | $6,000 |

| Gold | $600 | $2,000 | $4,000 |

| Platinum | $750 | $1,000 | $3,000 |

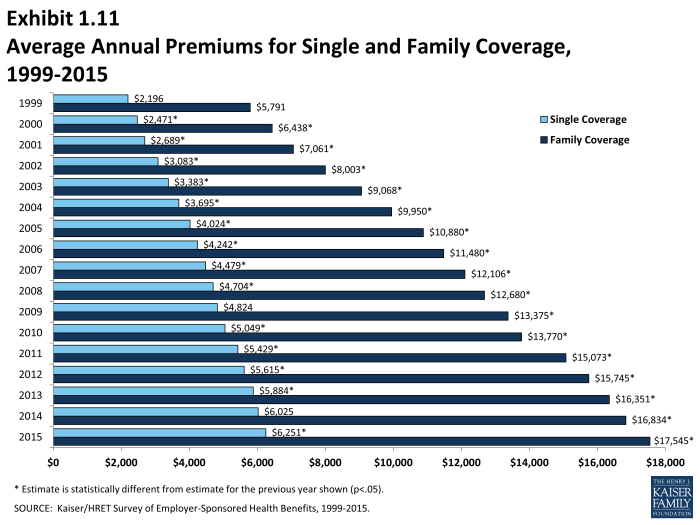

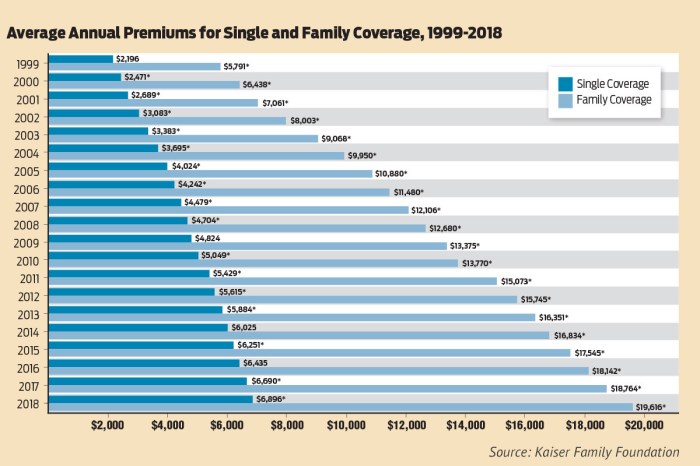

Premium Trends Over Time

Average health insurance premiums have experienced significant fluctuations over the past decade, reflecting a complex interplay of factors impacting the healthcare industry and the insurance market. Understanding these trends is crucial for individuals, employers, and policymakers alike to make informed decisions about healthcare coverage and affordability.

Analyzing premium data reveals a generally upward trend, though the rate of increase has varied across different years and insurance plans. Several key factors contribute to this pattern.

Average Premium Increases from 2013 to 2023

The following data illustrates the approximate average annual increase in health insurance premiums over the past decade. These figures are generalized and may vary depending on the specific type of plan (e.g., employer-sponsored, individual market), location, and other factors. Precise figures require referencing specific insurance market data from reliable sources such as the Kaiser Family Foundation or the Centers for Medicare & Medicaid Services.

| Year | Average Annual Premium Increase (Approximate) |

|---|---|

| 2013 | 4% |

| 2014 | 5% |

| 2015 | 6% |

| 2016 | 3% |

| 2017 | 4% |

| 2018 | 7% |

| 2019 | 5% |

| 2020 | 3% |

| 2021 | 8% |

| 2022 | 6% |

| 2023 | 4% |

Factors Contributing to Premium Increases

Several interconnected factors have driven the increase in average health insurance premiums. These include rising healthcare costs (hospital care, prescription drugs, physician services), increased utilization of healthcare services, and administrative expenses associated with insurance plan management and processing claims. Furthermore, changes in government regulations and the overall economic climate have also played a significant role.

Graphical Representation of Premium Trends

The following description details a line graph illustrating the trend of average health insurance premiums from 2013 to 2023.

The graph’s horizontal axis (x-axis) represents the year, ranging from 2013 to 2023. The vertical axis (y-axis) represents the average annual premium, measured in dollars (or a suitable index adjusted for inflation). A single line connects data points, each representing the average premium for a given year. The line’s upward slope indicates a general increase in premiums over time. The legend simply states “Average Annual Health Insurance Premium.” The graph would clearly show periods of steeper increases and gentler slopes, reflecting the variations in annual premium growth.

Correlation Between Inflation and Premium Changes

Inflation, a general increase in the prices of goods and services in an economy, is strongly correlated with health insurance premium increases. As the cost of healthcare services and other inputs rises due to inflation, insurance companies must increase premiums to maintain profitability and cover their expenses. For example, if inflation rises by 3%, healthcare providers may increase their prices accordingly. Insurance companies, then, need to adjust premiums to cover these increased costs, leading to a parallel increase in premiums. Analyzing the data from the table above alongside corresponding inflation rates would reveal a positive correlation, meaning that as inflation increases, so do health insurance premiums.

Types of Health Insurance Plans and Their Costs

Choosing a health insurance plan can feel overwhelming due to the variety of options and associated costs. Understanding the different types of plans and their cost structures is crucial for making an informed decision that aligns with your individual healthcare needs and budget. This section will Artikel the key plan types, compare their average premiums, and explore factors influencing cost differences.

Health Insurance Plan Types

Several common types of health insurance plans exist, each with its own network of doctors and hospitals, cost-sharing mechanisms, and premium structure. The most prevalent types include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). Understanding the distinctions between these plans is essential for selecting the best option for your circumstances.

Premium Comparisons Across Plan Types

Average premiums vary significantly depending on the plan type, location, age, and the insurer. While precise figures fluctuate constantly, general trends indicate that HMOs often have the lowest average premiums, followed by EPOs, with PPOs typically carrying the highest premiums. This is because PPOs offer greater flexibility in choosing providers, leading to potentially higher costs for the insurer. However, it’s crucial to remember that these are broad generalizations; actual premiums will vary greatly depending on individual circumstances and the specific plan chosen.

Factors Influencing Cost Differences Between Plan Types

Several factors contribute to the cost differences between various health insurance plan types. These include:

- Network Restrictions: HMOs have the strictest networks, limiting choices to in-network providers. This tighter network control helps keep costs lower. PPOs offer broader networks, allowing access to out-of-network providers at a higher cost. EPOs fall somewhere in between, generally allowing access to specialists only within the network.

- Cost-Sharing Mechanisms: The way cost-sharing is structured (deductibles, co-pays, coinsurance) significantly impacts the overall cost. HMOs often require higher co-pays for visits but may have lower deductibles. PPOs may have higher deductibles but lower co-pays for in-network care. EPOs typically share characteristics with both HMOs and PPOs.

- Administrative Costs: The administrative costs associated with managing a broader network (as in PPOs) can be higher than for plans with more restricted networks (like HMOs).

- Negotiated Rates: Insurers negotiate different rates with healthcare providers based on the size and reach of their networks. HMOs, with their smaller networks, may negotiate lower rates.

Examples of Deductibles, Co-pays, and Out-of-Pocket Maximums

The following examples illustrate the potential differences in cost-sharing mechanisms across different plan types. Remember, these are illustrative examples only, and actual values will vary significantly based on the specific plan and insurer.

- HMO Example: $500 deductible, $25 co-pay for doctor visits, $5000 out-of-pocket maximum.

- PPO Example: $2000 deductible, $50 co-pay for doctor visits, $7500 out-of-pocket maximum.

- EPO Example: $1000 deductible, $40 co-pay for doctor visits, $6000 out-of-pocket maximum.

Government Regulations and Their Effect

Government regulations significantly impact the cost and availability of health insurance. These regulations, at both the federal and state levels, aim to balance the interests of consumers, insurers, and healthcare providers, often resulting in complex and sometimes contradictory effects on average premiums.

The Affordable Care Act’s Impact on Average Premiums

The Affordable Care Act (ACA), enacted in 2010, has profoundly reshaped the health insurance landscape. Key provisions, such as the individual mandate (since repealed), guaranteed issue and community rating requirements, and the expansion of Medicaid eligibility, have influenced premium levels. While the individual mandate aimed to broaden the risk pool, thereby lowering premiums, its repeal contributed to increased premiums for some. The guaranteed issue and community rating provisions, designed to protect individuals with pre-existing conditions, have led to higher premiums for healthier individuals to offset the costs of insuring those with higher healthcare needs. The Medicaid expansion, while increasing access to coverage, has also placed additional financial burdens on some states, potentially affecting their overall healthcare spending and indirectly influencing premium costs in the private market. The net effect of the ACA on average premiums is complex and varies by state and individual circumstances, but generally, studies show a significant increase in coverage rates, even if premium costs were impacted.

Government Subsidies and Health Insurance Affordability

Government subsidies, primarily through the ACA’s premium tax credits, play a crucial role in making health insurance more affordable for low- and moderate-income individuals and families. These tax credits reduce the monthly premium payments, making coverage attainable for those who might otherwise be unable to afford it. The amount of the subsidy is based on income and the cost of insurance in a given area. For example, a family earning $50,000 annually might receive a substantial subsidy, reducing their monthly premium significantly. The availability and generosity of these subsidies directly impact the affordability of insurance, reducing the average cost for eligible individuals and impacting the overall average premium statistics because those individuals are now able to purchase plans that might otherwise be too expensive.

State-Level Regulations and Their Influence on Premiums

States also have significant regulatory power over health insurance markets. State-level regulations can impact average premiums through various mechanisms, including essential health benefits mandates, rate review processes, and regulations governing provider networks. For instance, states with stricter requirements regarding essential health benefits may see higher premiums as insurers must cover a broader range of services. Similarly, states with robust rate review processes may limit premium increases, but this could potentially restrict insurers’ profitability and limit the availability of plans. The variation in state-level regulations creates a diverse landscape, with some states experiencing significantly higher or lower average premiums than others. For example, states that have not expanded Medicaid tend to have higher uninsured rates and potentially higher premiums in the individual market compared to states that have expanded Medicaid coverage.

Potential Future Changes in Regulations and Their Projected Impact on Premiums

Future changes in federal and state regulations could significantly affect average health insurance premiums. For example, potential modifications to the ACA’s essential health benefits package or further changes to the individual mandate could alter the risk pool and consequently impact premium costs. Similarly, changes in federal funding for Medicaid or other healthcare programs could affect state-level regulations and the affordability of insurance. Predicting the precise impact of future regulatory changes is challenging, but it’s likely that any significant alterations will have a ripple effect throughout the health insurance market, influencing average premiums and the overall availability of affordable coverage. For example, a hypothetical scenario of a significant increase in the cost of prescription drugs could lead to insurers increasing premiums to offset these rising costs, which would impact average premium calculations.

Ending Remarks

In conclusion, average health insurance premiums are a multifaceted issue shaped by a complex interplay of individual circumstances, market forces, and governmental policies. While the cost of healthcare continues to rise, understanding the factors that influence premiums allows for better planning and informed decision-making. By carefully considering your individual needs and exploring the various plan options available, you can find a balance between affordability and comprehensive coverage. Staying informed about regulatory changes and market trends is essential to maintaining control over your healthcare costs.

User Queries

What is a deductible?

A deductible is the amount you pay out-of-pocket for covered healthcare services before your insurance plan begins to pay.

What is a copay?

A copay is a fixed amount you pay for a covered healthcare service, such as a doctor’s visit, at the time of service.

What is an out-of-pocket maximum?

The out-of-pocket maximum is the most you will pay during a policy period (usually a year) for covered healthcare services. Once you reach this limit, your insurance plan typically covers 100% of covered expenses.

How do I qualify for a government subsidy?

Eligibility for government subsidies, such as those offered through the Affordable Care Act (ACA), is based on income level and family size. Check the Healthcare.gov website or your state’s marketplace for specific requirements.

Can I change my health insurance plan during the year?

Generally, you can only change your health insurance plan during the annual open enrollment period, unless you qualify for a special enrollment period due to a qualifying life event (e.g., marriage, job loss).