Navigating the complex world of health insurance can feel like deciphering a secret code. At the heart of this puzzle lies the average health insurance premium – a seemingly simple figure that actually reflects a multitude of interwoven factors. This guide unravels the mysteries behind this key number, exploring its calculation, the forces that shape its cost, and its far-reaching impact on individuals, businesses, and the economy as a whole. We’ll delve into the trends, the challenges, and ultimately, strategies for managing these crucial costs.

From the influence of age and location to the role of government regulations and the impact of chronic diseases, we’ll examine the diverse elements that contribute to the final premium amount. Understanding these factors is crucial for making informed decisions about your health coverage and advocating for more affordable and accessible healthcare.

Defining “Average Health Insurance Premium”

Understanding the average health insurance premium requires careful consideration of its multifaceted nature. It’s not a single, fixed number, but rather a statistical representation that varies significantly depending on numerous factors. This makes comparing premiums across different groups challenging but crucial for policy analysis and individual planning.

Average health insurance premium refers to the mean cost of health insurance plans within a specific population or market segment. This average is calculated using various methodologies, each with its own limitations and strengths, and the resulting figure represents a broad trend rather than a precise indicator for any individual.

Methods for Calculating Average Premiums

Several approaches exist for calculating average premiums. The most common involves summing the premiums of all plans within a defined group (e.g., all individual plans in a state) and dividing by the total number of plans. This simple arithmetic mean, while straightforward, can be skewed by outliers—extremely high or low premiums—which may not accurately reflect the typical cost. Another method uses a weighted average, assigning greater importance to plans with a larger number of enrollees. This approach offers a more representative picture of the average cost borne by the population but requires detailed enrollment data. A third method might focus on a specific plan type, such as a bronze-level plan, providing a more targeted average. Each method has its limitations; the choice depends on the specific analytical goal. For example, a simple average might be suitable for a broad overview, while a weighted average is better for understanding the typical cost for the insured population.

Average Premiums Across Demographics

Average premiums show significant variations across different demographic groups. Age is a major factor; older individuals generally pay higher premiums due to increased healthcare utilization. Location also plays a crucial role, with premiums varying substantially across states and even within regions of a single state, reflecting differences in healthcare costs and provider networks. Family size impacts premiums as well, with family plans typically costing more than individual plans. Income, while not directly used in premium calculations for subsidized plans, indirectly influences affordability as higher income individuals may qualify for less or no government assistance. For example, a 60-year-old in New York City will likely pay a significantly higher premium than a 25-year-old in rural Iowa, even if both have similar health statuses and plan types. Similarly, a family plan covering four people will generally be more expensive than an individual plan.

Influence of Government Subsidies and Regulations

Government subsidies and regulations profoundly impact average premium calculations. Subsidies, such as those provided under the Affordable Care Act (ACA) in the United States, lower the cost for eligible individuals and families, effectively reducing the average premium for the subsidized population. Regulations, such as those mandating minimum essential health benefits or limiting insurer profit margins, also influence the overall cost structure and, consequently, the calculated average premiums. The ACA subsidies, for instance, directly impact the average premium calculations by reducing the out-of-pocket costs for a significant portion of the population. Without considering these subsidies, the average premium would be artificially inflated. Similarly, regulations impacting provider reimbursement rates or prescription drug pricing influence the underlying cost of healthcare, indirectly affecting average premiums.

Factors Influencing Premium Costs

Several interconnected factors significantly influence the cost of health insurance premiums. Understanding these factors is crucial for individuals and employers alike to make informed decisions about health insurance coverage. These factors can be broadly categorized into those related to healthcare utilization, individual characteristics, and the structure of the insurance market itself.

Healthcare Utilization Rates

Healthcare utilization rates directly impact premium costs. Higher utilization, meaning more frequent doctor visits, hospital stays, and prescription drug usage, leads to higher claims payouts by insurance companies. This necessitates increased premiums to cover these costs. For instance, a population with high rates of preventable illnesses requiring expensive treatment will drive up premiums for everyone in the pool. Conversely, a population that actively engages in preventive care and maintains healthy lifestyles may see lower premiums due to reduced healthcare needs. This demonstrates a strong correlation between individual health choices and the overall cost of insurance.

Prevalence of Chronic Diseases

The prevalence of chronic diseases like diabetes, heart disease, and cancer significantly influences premium costs. These conditions often require extensive and ongoing medical care, leading to substantial claims payouts. The higher the incidence of these conditions within an insured population, the higher the average premium needs to be to cover the increased risk. For example, a region with a high prevalence of diabetes will likely experience higher health insurance premiums compared to a region with lower rates, reflecting the substantial costs associated with managing this chronic condition.

Administrative Costs and Profit Margins

Administrative costs, encompassing expenses related to processing claims, marketing, customer service, and managing the insurance company’s operations, contribute to premium expenses. Profit margins, the amount of money the insurance company earns after covering its costs, also factor into premium calculations. These costs are passed on to consumers in the form of higher premiums. For instance, a company with high administrative overhead due to inefficient processes may need to charge higher premiums to maintain profitability. Similarly, a company aiming for a higher profit margin will naturally incorporate this into its premium calculations.

Comparative Influence of Factors on Premium Costs

The following table compares the influence of various factors on premium costs across different insurance plans. Note that the degree of influence can vary based on specific plan designs and the characteristics of the insured population.

| Factor | PPO | HMO | EPO | High Deductible Plan |

|---|---|---|---|---|

| Healthcare Utilization | High Influence | Moderate Influence | Moderate Influence | Low Influence (until deductible is met) |

| Chronic Disease Prevalence | High Influence | High Influence | High Influence | High Influence (potential for catastrophic costs) |

| Administrative Costs | Moderate Influence | Moderate Influence | Moderate Influence | Low Influence (generally simpler administration) |

| Profit Margins | Moderate Influence | Moderate Influence | Moderate Influence | Moderate Influence (though potentially lower due to lower premiums) |

Trends in Average Health Insurance Premiums

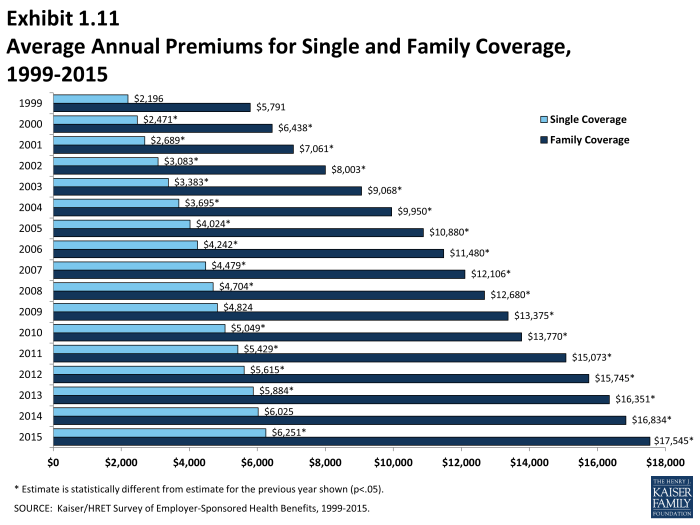

Average health insurance premiums have experienced significant fluctuations over the past decade, influenced by a complex interplay of factors including healthcare utilization, technological advancements, and regulatory changes. Understanding these trends is crucial for individuals, employers, and policymakers alike to make informed decisions about healthcare coverage and affordability.

Historical Trends in Average Health Insurance Premiums (2014-2023)

Over the past decade (2014-2023), average health insurance premiums have generally shown an upward trend, though the rate of increase has varied from year to year. Several factors contributed to this increase, including rising healthcare costs, the expansion of coverage under the Affordable Care Act (ACA), and increased utilization of healthcare services. For example, the average annual premium for a family plan on the ACA marketplace increased by approximately 50% between 2014 and 2023, though this varied widely by state and plan type. Specific data for individual years would need to be sourced from organizations like the Kaiser Family Foundation or the Centers for Medicare & Medicaid Services for precise figures.

Projected Trends in Average Premiums (2024-2028)

Projecting average health insurance premiums for the next five years involves considerable uncertainty. However, based on current trends and anticipated factors, a continued upward trend is likely, albeit potentially at a slower pace than in previous years. Several factors could influence this projection, including inflation, changes in healthcare utilization patterns (potentially affected by advancements in telehealth and preventative care), and ongoing legislative and regulatory changes. For example, some analysts predict a 3-5% annual increase in premiums over the next five years, but this is a broad estimate, and actual increases will vary considerably based on factors such as location, plan type, and individual health circumstances. The increasing adoption of value-based care models could potentially mitigate premium increases in the long term.

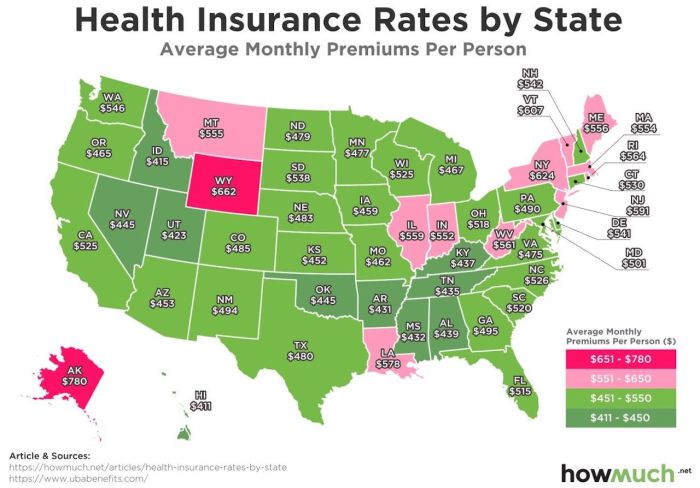

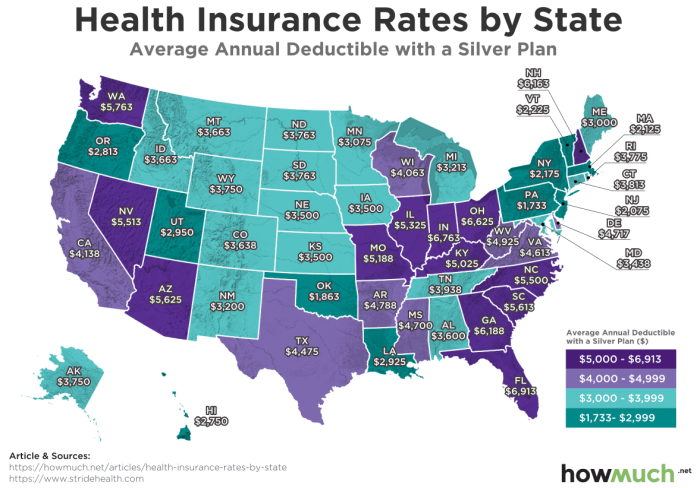

Comparison of Premium Trends Across States/Regions

Average health insurance premiums exhibit significant variation across different states and regions of the United States. Factors contributing to this disparity include differences in healthcare costs (such as hospital prices and physician fees), the prevalence of chronic diseases, the demographics of the population, and the regulatory environment. States with higher healthcare costs and a greater proportion of individuals with chronic conditions tend to experience higher average premiums. For instance, states in the Northeast and West Coast generally have higher average premiums compared to states in the South and Midwest. This disparity underscores the importance of considering location when evaluating health insurance options.

Graphical Representation of Historical and Projected Trends

The following text represents a line graph illustrating the historical and projected trends in average health insurance premiums. The horizontal axis represents the year (2014-2028), and the vertical axis represents the average annual premium (in arbitrary units for illustrative purposes).

The line starts at a relatively low point in 2014, gradually increasing each year until 2023, showing a steeper incline in some years than others. From 2024 onwards, the line continues to rise, but the slope is less steep than in the preceding years. The graph visually demonstrates the upward trend in premiums over the past decade and the projected, albeit slower, continued increase in the coming years. This representation is a simplification, as actual premium increases vary considerably based on numerous factors.

Impact of Average Premiums on Individuals and the Economy

The average cost of health insurance significantly impacts individuals, families, and the broader economy. High premiums create a substantial financial burden, influencing healthcare access, employer-sponsored plans, and macroeconomic stability. Understanding these effects is crucial for developing effective healthcare policies.

Rising health insurance premiums place a considerable economic strain on individuals and families. Many households face difficult choices between paying for healthcare and meeting other essential needs like housing, food, and transportation. This financial pressure can lead to delayed or forgone medical care, potentially worsening health outcomes and increasing long-term healthcare costs. For example, a family struggling to afford a $1,500 monthly premium might postpone necessary checkups or treatments, resulting in more serious and expensive health issues later. This situation disproportionately affects low- and middle-income families, who may allocate a larger percentage of their income to healthcare expenses.

Effect of Rising Premiums on Healthcare Access and Affordability

The increase in health insurance premiums directly impacts healthcare access and affordability. Higher premiums often lead to reduced enrollment in health insurance plans, leaving a significant portion of the population uninsured or underinsured. This lack of coverage can result in delayed or forgone care, contributing to poorer health outcomes and increased healthcare costs in the long run. For instance, individuals who cannot afford premiums might avoid preventative care, leading to the development of more serious, and more expensive, health problems down the line. This decreased access to preventative care also contributes to higher overall healthcare expenditures.

Impact of Average Premium Changes on Employer-Sponsored Health Insurance Plans

Changes in average health insurance premiums significantly affect employer-sponsored health insurance plans. Rising premiums force employers to either increase employee contributions, reduce benefits, or absorb the increased costs themselves. Increased employee contributions can reduce employee morale and productivity, while benefit reductions can lead to dissatisfaction and potential loss of employees. Employers absorbing the increased costs might reduce hiring, investment, or wage increases, impacting economic growth. For example, a small business might decide against offering health insurance to its employees due to escalating premium costs, shifting the burden of healthcare expenses to the employees.

Macroeconomic Consequences of Fluctuating Health Insurance Premiums

Fluctuations in health insurance premiums have broader macroeconomic consequences. High premiums can reduce consumer spending and investment, slowing economic growth. The healthcare sector’s significant share of the national economy means that changes in health insurance costs directly influence overall economic activity. Furthermore, uncertainty surrounding future premium increases can discourage businesses from expanding and individuals from making major purchases, impacting overall economic confidence. For example, a sudden spike in premiums could lead to a decrease in consumer spending, negatively affecting various sectors of the economy, from retail to tourism. Conversely, stable and predictable premiums can foster economic stability and growth.

Strategies for Managing Health Insurance Costs

Managing the ever-increasing costs of health insurance requires a multifaceted approach involving individuals, employers, and government policies. Effective strategies can significantly mitigate the financial burden associated with healthcare and ensure access to quality care. This section Artikels practical steps for each stakeholder group to control costs and promote affordability.

Strategies for Individuals to Reduce Health Insurance Premiums

Choosing the right health insurance plan is a crucial step in managing costs. Several strategies can help individuals reduce their premiums without compromising necessary coverage.

- Enroll in a High-Deductible Health Plan (HDHP) with a Health Savings Account (HSA): HDHPs typically have lower premiums than traditional plans, but they require higher out-of-pocket expenses before insurance coverage begins. An HSA allows pre-tax contributions to be used for qualified medical expenses, offering tax advantages and potential savings over time. For example, a family might save hundreds of dollars annually on premiums by opting for an HDHP and strategically utilizing their HSA.

- Compare Plans Carefully: Before enrolling, individuals should compare plans offered through their employer or the marketplace. Consider factors like deductibles, co-pays, and out-of-pocket maximums to find a plan that balances affordability with adequate coverage. Online comparison tools can simplify this process.

- Maintain a Healthy Lifestyle: Preventative care, such as regular check-ups and screenings, can help avoid costly health issues down the line. A healthy lifestyle can also reduce the likelihood of needing expensive treatments. For instance, regular exercise and a balanced diet can contribute to lower healthcare utilization.

- Negotiate with Providers: Individuals can negotiate prices with healthcare providers, particularly for non-emergency services. Asking for price estimates upfront and exploring options like telehealth can help manage out-of-pocket expenses.

- Utilize Generic Medications: Generic medications are often significantly cheaper than brand-name drugs while offering the same therapeutic effect. Consulting a pharmacist about generic alternatives can lead to substantial savings on prescription costs.

Strategies for Employers to Manage Health Insurance Costs

Employers play a significant role in managing healthcare costs for their employees. Effective strategies can benefit both the employer and the employee by controlling expenses and enhancing employee well-being.

- Offer a Variety of Plan Options: Providing employees with a choice of health insurance plans, including HDHPs with HSAs and traditional plans, allows them to select a plan that best fits their individual needs and budget. This can reduce the overall cost burden for the employer while catering to diverse employee preferences.

- Implement Wellness Programs: Investing in employee wellness programs can promote healthy lifestyles and reduce healthcare utilization. These programs might include gym memberships, health screenings, and health education initiatives. A healthier workforce translates to lower healthcare costs for both the employer and the employees.

- Negotiate with Insurance Providers: Employers can leverage their bargaining power to negotiate favorable rates with insurance providers. This involves comparing bids from multiple insurers and negotiating terms such as premium discounts and plan features.

- Utilize Data Analytics: Analyzing employee healthcare utilization data can help identify areas for cost savings. For example, identifying high-cost medical conditions can inform targeted interventions and preventative care programs.

- Consider Self-Funded Plans: For larger employers, self-funded health plans can offer more control over costs and benefits design. However, this requires careful risk management and financial planning.

Policy Recommendations for Governments to Control Rising Health Insurance Premiums

Government intervention is crucial in controlling the rising costs of health insurance and ensuring equitable access to healthcare. Effective policies can help moderate premiums and improve affordability for individuals and families.

- Increase Competition among Insurers: Promoting competition among insurance providers can drive down premiums. This can involve reducing regulatory barriers to entry and encouraging innovation in the insurance market. Increased competition forces insurers to offer more competitive plans to attract customers.

- Negotiate Drug Prices: Governments can negotiate lower prices for prescription drugs, a significant driver of healthcare costs. This can involve leveraging bulk purchasing power or implementing price controls. Lower drug prices directly impact insurance premiums and out-of-pocket costs for individuals.

- Invest in Preventative Care: Investing in preventative care programs can reduce the need for costly treatments in the long run. This includes funding public health initiatives, promoting healthy lifestyles, and improving access to preventative services. Preventative care leads to better health outcomes and reduces the overall demand for expensive healthcare services.

- Expand Access to Affordable Care: Expanding access to affordable healthcare, such as through subsidies and tax credits, can help individuals afford health insurance. This ensures that a larger portion of the population has access to necessary healthcare services, mitigating the impact of rising premiums on vulnerable populations.

- Promote Transparency in Healthcare Pricing: Greater transparency in healthcare pricing allows consumers to make informed decisions about their care and encourages providers to be more competitive. This can include requiring hospitals and other providers to publicly disclose their prices for common procedures and services.

Last Recap

The average health insurance premium is far more than just a number; it’s a reflection of our healthcare system’s complexities and a key indicator of its accessibility. While the fluctuating costs present significant challenges for individuals, families, and employers alike, understanding the contributing factors and available strategies empowers us to navigate this landscape more effectively. By advocating for policy changes and employing informed personal strategies, we can work towards a future where healthcare is both affordable and accessible to all.

Helpful Answers

What does “average” mean in the context of health insurance premiums?

The “average” premium represents a calculated mean across a specific population, often weighted by factors like age, location, and plan type. It’s a statistical representation, not necessarily reflective of any individual’s actual cost.

How are family plans factored into average premium calculations?

Family plans typically include a higher premium than individual plans, reflecting the increased coverage for multiple individuals. The average often accounts for the prevalence of different family sizes within the population studied.

Can I negotiate my health insurance premium?

While direct negotiation isn’t always possible, exploring different plan options, considering preventative care, and understanding your health needs can help you find a more affordable plan. Some employers may also offer subsidies or flexible options.

What are the implications of rising average premiums on the national debt?

Rising health insurance premiums contribute to increased healthcare spending, impacting national budgets and potentially leading to higher national debt. This can strain government resources allocated to other crucial areas.