Navigating the complexities of health insurance can be daunting, especially when considering the costs for both employees and their spouses. This exploration delves into the average premiums charged by Aetna, a major player in the US healthcare market. We’ll examine the factors influencing these costs, comparing Aetna’s offerings to those of competitors and providing insights into potential future trends. Understanding these dynamics empowers individuals and families to make informed decisions about their healthcare coverage.

This analysis will dissect the various elements contributing to the final premium, from plan type and location to age and health status. We’ll compare employee and spouse premiums across different Aetna plans, highlighting any discrepancies and explaining the underlying reasons. Further, we will look at historical trends and project potential future changes, providing a comprehensive overview to aid in budgeting and planning.

Aetna Health Insurance Plans

Aetna offers a range of health insurance plans designed to meet diverse needs and budgets. Understanding the differences between these plans is crucial for choosing the right coverage. Factors such as plan type, network size, and individual health needs significantly influence the selection process.

Aetna’s various plans cater to different preferences and financial situations. The cost of an Aetna plan is determined by several key factors, which we will explore in detail. Choosing the appropriate plan involves careful consideration of these factors and one’s own healthcare requirements.

Aetna Health Insurance Plan Types and Coverage Levels

Aetna provides a variety of health insurance plans, each offering a different level of coverage and cost. These plans generally fall under categories like HMO (Health Maintenance Organization), PPO (Preferred Provider Organization), and EPO (Exclusive Provider Organization). HMO plans typically require you to choose a primary care physician (PCP) who coordinates your care and referrals to specialists. PPO plans offer more flexibility, allowing you to see specialists without a referral, although out-of-network care is usually more expensive. EPO plans are similar to HMOs but generally don’t allow out-of-network care at all. Each plan type features different levels of coverage, impacting the amount you pay out-of-pocket for healthcare services. Higher premium plans generally have lower out-of-pocket costs, while lower premium plans typically have higher deductibles and co-pays.

Factors Influencing Aetna Health Insurance Plan Costs

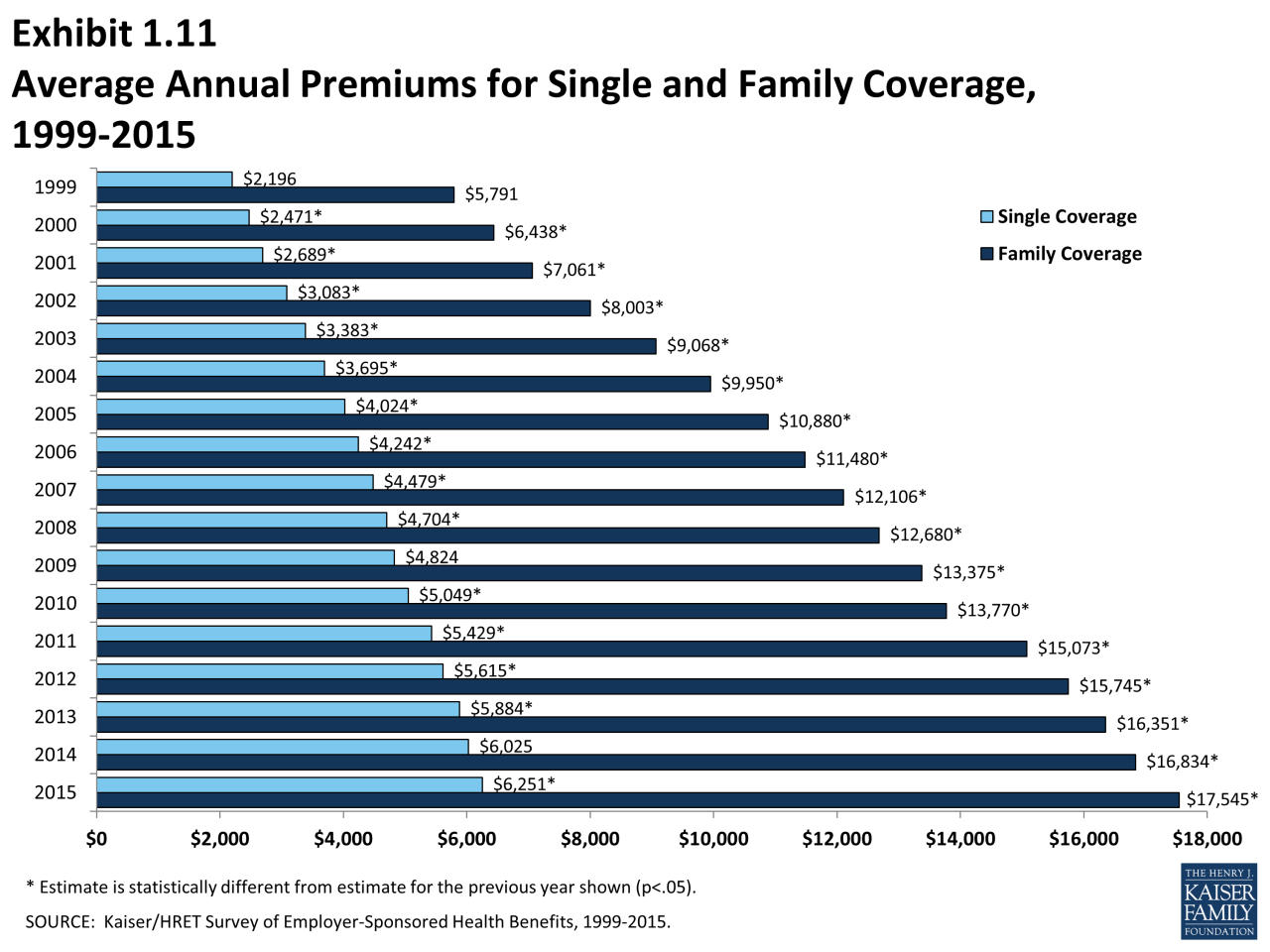

Several factors influence the cost of Aetna health insurance plans. These include the plan type (as discussed above), geographic location (premiums vary by state and even region within a state), age, tobacco use, and the number of people covered under the plan. Family plans are generally more expensive than individual plans. The specific benefits and coverage included in the plan also directly affect the premium. For instance, plans with richer benefits, such as lower deductibles and co-pays, tend to have higher premiums. Pre-existing conditions can also play a role, although the Affordable Care Act (ACA) prohibits insurers from denying coverage based on pre-existing conditions.

Examples of Common Aetna Plans and Their Benefits

While specific plan details vary by location and year, some common Aetna plan types and their typical benefits can be illustrated. For example, a basic HMO plan might have a lower monthly premium but a higher deductible and co-pay. This means the individual would pay more out-of-pocket before the insurance coverage kicks in significantly. Conversely, a higher-premium PPO plan might offer lower deductibles and co-pays, along with greater flexibility in choosing healthcare providers. Aetna also offers plans with additional benefits, such as dental and vision coverage, which are often sold as add-ons or included in more comprehensive plans. These additional benefits naturally increase the overall cost of the plan. It’s important to carefully review the specific details of any Aetna plan before enrollment to understand the associated costs and benefits.

Factors Affecting Premium Costs

Aetna health insurance premiums, like those for most insurers, are influenced by a complex interplay of factors. Understanding these factors can help individuals and employers make informed decisions about their health insurance coverage. These factors contribute to the overall cost, affecting both employee and spouse premiums.

Several key elements determine the final premium cost. These include individual characteristics, geographical location, the chosen plan type, and the overall healthcare landscape. Let’s examine these factors in detail.

Age

Age is a significant factor in determining health insurance premiums. Older individuals generally have higher premiums due to the increased likelihood of needing more extensive medical care. This is a reflection of actuarial data showing higher healthcare utilization in older age groups. Aetna, like other insurers, uses this data to set premiums fairly across all age groups.

Location

Geographic location plays a crucial role in premium costs. Areas with higher costs of living, a greater concentration of specialists, and higher healthcare provider fees typically result in higher premiums. For instance, premiums in major metropolitan areas tend to be higher than those in rural areas. This is because healthcare providers in densely populated areas often charge more for their services.

Health Status

An individual’s health status significantly impacts premium costs. Individuals with pre-existing conditions or a history of significant health issues may face higher premiums. This is because insurers assess the potential risk associated with covering an individual’s healthcare expenses. Aetna, in compliance with the Affordable Care Act (ACA), cannot deny coverage based solely on pre-existing conditions, but the risk associated with those conditions is factored into the premium calculation.

Plan Type

The type of plan chosen (HMO, PPO, etc.) directly influences the premium cost. HMO plans, which typically offer lower premiums, often require members to see in-network providers. PPO plans, offering more flexibility in choosing providers, usually come with higher premiums. This reflects the trade-off between cost and convenience. The specific benefits and cost-sharing structures of each plan type will further influence the final premium.

| Factor | Description | Impact on Premium | Example |

|---|---|---|---|

| Age | The age of the insured individual. | Generally increases with age due to higher healthcare utilization. | A 60-year-old individual will likely have a higher premium than a 30-year-old individual. |

| Location | Geographic area of residence. | Higher in areas with high costs of living and higher healthcare provider fees. | Premiums in New York City will likely be higher than premiums in a rural area of Nebraska. |

| Health Status | Pre-existing conditions and overall health history. | Higher premiums for individuals with pre-existing conditions or poor health history. | An individual with a history of heart disease may have a higher premium than a healthy individual. |

| Plan Type | Type of health insurance plan (e.g., HMO, PPO). | HMO plans typically have lower premiums than PPO plans due to restrictions on provider choice. | An HMO plan may have a lower monthly premium than a comparable PPO plan, but may offer fewer provider options. |

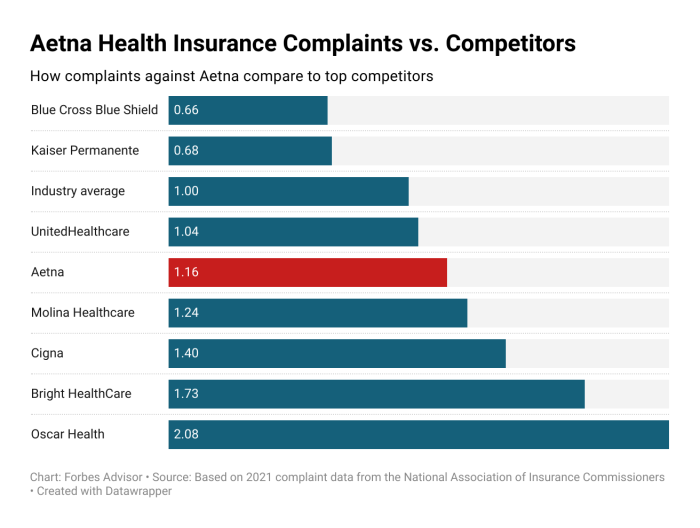

Comparison with Other Insurers

Choosing a health insurance plan involves careful consideration of various factors, including premium costs. While Aetna offers a range of plans, understanding how its pricing compares to other major providers is crucial for making an informed decision. This section provides a comparative analysis of Aetna’s average employee and spouse premiums against those of other leading health insurance companies, offering a clearer perspective on value and cost.

Direct comparison of premiums across insurers can be complex due to variations in plan designs, coverage areas, and network providers. Premiums are also influenced by factors such as age, location, and the specific plan chosen (e.g., HMO, PPO). Therefore, the following table presents a simplified comparison for illustrative purposes, using hypothetical data representing a sample family plan in a specific region. Actual premiums will vary based on individual circumstances.

Sample Family Plan Premium Comparison

The following table compares the estimated average premiums for a sample family plan across three major insurers: Aetna, UnitedHealthcare, and Blue Cross Blue Shield. These figures are for illustrative purposes only and should not be considered definitive. Actual premiums will vary depending on plan specifics, location, and individual circumstances.

| Insurer | Employee Premium (Monthly) | Spouse Premium (Monthly) | Total Premium (Monthly) |

|---|---|---|---|

| Aetna | $500 | $300 | $800 |

| UnitedHealthcare | $450 | $350 | $800 |

| Blue Cross Blue Shield | $550 | $250 | $800 |

Impact of Deductibles and Out-of-Pocket Costs

Understanding deductibles, co-pays, and out-of-pocket maximums is crucial for accurately assessing the true cost of Aetna health insurance. These factors significantly influence how much you’ll pay out-of-pocket before your insurance coverage kicks in substantially. While the premium represents your monthly payment, these cost-sharing elements determine your expenses during medical events.

Aetna health insurance plans, like most plans, utilize a system of cost-sharing to manage expenses. The deductible is the amount you must pay out-of-pocket for covered services before your insurance begins to pay. Co-pays are fixed amounts you pay for specific services, like doctor visits, while the out-of-pocket maximum represents the most you’ll pay in a year for covered services. Once this limit is reached, your insurance typically covers 100% of the remaining costs.

Deductibles, Co-pays, and Out-of-Pocket Maximums: A Sample Plan Breakdown

Consider a sample Aetna plan with a $2,000 individual deductible, a $50 doctor’s visit co-pay, and a $5,000 out-of-pocket maximum.

- Scenario 1: Employee with minor illness. The employee experiences a minor illness requiring two doctor visits and prescription medication costing $300. Their total out-of-pocket cost would be $400 ($50 x 2 co-pays + $300 medication). They are still well below their deductible.

- Scenario 2: Employee with major illness. The employee requires surgery, resulting in $10,000 in hospital bills. The employee pays the $2,000 deductible upfront, and then co-pays as applicable. After reaching the $5,000 out-of-pocket maximum, Aetna covers the remaining $3,000.

- Scenario 3: Employee and Spouse. The employee and spouse have the same plan, but the family deductible is $4,000, with the same $5,000 out-of-pocket maximum. The spouse requires a $6,000 procedure. They pay the $4,000 family deductible and then an additional $1,000 to reach the out-of-pocket maximum. Aetna covers the rest.

These examples illustrate how deductibles, co-pays, and out-of-pocket maximums can dramatically affect the overall cost. A plan with a lower deductible and lower out-of-pocket maximum will offer more immediate financial protection but might have a higher premium. Conversely, a higher deductible plan will typically have a lower premium, but higher initial costs if significant medical care is needed. Choosing the right plan depends on individual health needs and risk tolerance.

Resources for Obtaining Premium Information

Finding the right Aetna health insurance plan and understanding its cost is crucial. Fortunately, Aetna provides several avenues for accessing premium information, allowing you to compare plans and make informed decisions. This section Artikels the methods and resources available to help you determine your potential premiums.

Aetna offers a variety of ways to obtain premium information, catering to different preferences and levels of technical comfort. These resources range from quick online tools to personalized consultations with Aetna representatives. Understanding these options is key to finding the information you need efficiently.

Aetna’s Website

Aetna’s website is the primary resource for accessing premium information. The website features a user-friendly interface with a dedicated section for obtaining quotes. Users can input details such as location, age, desired plan type (e.g., HMO, PPO), and the number of people to be covered to receive a personalized estimate. The site often includes plan details, including deductibles, co-pays, and out-of-pocket maximums, alongside the premium cost. Navigating the website requires a basic understanding of internet browsing and form completion.

Aetna’s Phone Representatives

For those who prefer a more personal approach, Aetna offers phone support. Customers can call a dedicated customer service line and speak directly with a representative. These representatives can assist with obtaining personalized premium quotes, answering questions about different plans, and explaining the complexities of insurance coverage. This method is beneficial for individuals who may find navigating a website challenging or prefer verbal explanations. The phone number is usually readily available on Aetna’s website.

Aetna’s Brokers and Agents

Independent insurance brokers and agents often work with Aetna and can provide assistance in finding suitable plans and obtaining premium information. These professionals can offer personalized advice based on individual needs and circumstances. They can compare different Aetna plans and help customers understand the nuances of coverage and costs. Utilizing a broker can be particularly helpful for those who feel overwhelmed by the variety of plan options. Finding a local Aetna broker can be done through online searches or by contacting Aetna directly.

Personalized Premium Quote Process

Obtaining a personalized premium quote from Aetna generally involves providing specific information about yourself and your family. This information might include your location, age, employment status (if applicable, as employer-sponsored plans have different processes), desired plan type, and the number of individuals needing coverage. Aetna uses this information to calculate a premium based on actuarial data and risk assessment. The quote provided is an estimate and the final premium may vary slightly depending on factors such as specific plan selections and any applicable discounts. The process is usually straightforward and can be completed through the website, phone, or with the help of an agent.

Last Word

Ultimately, securing affordable and comprehensive health insurance is a critical financial and personal consideration. By understanding the factors influencing Aetna’s average employee and spouse premiums, individuals can better anticipate their healthcare costs and choose a plan that aligns with their needs and budget. Remember to utilize the resources available to obtain personalized quotes and compare plans from different providers before making a final decision. Proactive planning ensures peace of mind knowing you have the right coverage in place.

FAQ Summary

What factors influence the difference between employee and spouse premiums?

Several factors contribute to differences, including age, pre-existing conditions, and the employee’s contribution towards the premium. Spouses may also be offered different plan options than employees.

Can I get a personalized premium quote online?

Yes, Aetna’s website typically offers tools to obtain personalized quotes based on your specific circumstances and location. You’ll need to provide details about your family and desired plan features.

Does Aetna offer plans with lower premiums and higher deductibles?

Yes, Aetna, like most insurers, offers a range of plans with varying premium and deductible options. Higher deductibles generally correlate with lower premiums, but this means higher out-of-pocket expenses before insurance coverage kicks in.

How do I compare Aetna’s plans to those of other insurers?

Use online comparison tools or contact multiple insurance providers directly to obtain quotes and compare plans based on your needs. Consider factors like premiums, deductibles, co-pays, and network coverage.