The cost of car insurance is a significant expense for most drivers, and understanding the factors that influence your premium is crucial for budgeting and financial planning. This guide delves into the complexities of average car insurance premiums, exploring the various elements that contribute to the final cost. From geographical variations and individual risk profiles to the pricing strategies of insurance companies, we’ll unravel the mysteries surrounding this often-confusing topic, empowering you to make informed decisions about your auto insurance coverage.

We will examine how demographic factors, driving history, and even your credit score can impact your premium. We’ll also explore how different insurance companies approach pricing and provide practical strategies for securing the best possible rate. By the end, you’ll have a clearer understanding of what constitutes an average premium and how you can potentially lower your own.

Defining “Average Car Insurance Premium”

The average car insurance premium represents the typical cost individuals pay for car insurance coverage within a specific geographic area or demographic group. It’s a statistical average, calculated from a large dataset of insurance policies, and provides a general benchmark for understanding the cost of car insurance. However, it’s crucial to remember that this average doesn’t reflect the individual cost for any specific person, as premiums are highly personalized.

Factors Influencing the Calculation of an Average Car Insurance Premium

Several factors contribute to the calculation of an average car insurance premium. These factors are analyzed by insurance companies using complex algorithms to assess risk and determine the appropriate premium for each individual policyholder. The greater the perceived risk, the higher the premium.

Components of a Typical Car Insurance Premium

A typical car insurance premium is comprised of several key components. These components reflect the various aspects of risk assessment and the costs associated with providing insurance coverage. Understanding these components can help consumers better understand their premium.

| Component | Description |

|---|---|

| Liability Coverage | Covers bodily injury and property damage caused to others in an accident. |

| Collision Coverage | Covers damage to your vehicle in an accident, regardless of fault. |

| Comprehensive Coverage | Covers damage to your vehicle from non-collision events (e.g., theft, vandalism, weather). |

| Uninsured/Underinsured Motorist Coverage | Protects you if you’re involved in an accident with an uninsured or underinsured driver. |

| Medical Payments Coverage | Covers medical expenses for you and your passengers, regardless of fault. |

| Administrative Fees and Profit Margin | Covers the insurer’s operational costs and profit. |

Variations in Average Premiums Across Demographics

Average car insurance premiums vary significantly based on several demographic factors. These variations reflect the differing risk profiles associated with different groups of drivers.

| Demographic Factor | Impact on Premium |

|---|---|

| Age | Younger drivers generally pay higher premiums due to higher accident rates. Premiums typically decrease with age and experience. |

| Location | Premiums vary by location due to differences in accident rates, crime rates, and repair costs. Urban areas often have higher premiums than rural areas. |

| Driving History | A clean driving record with no accidents or violations leads to lower premiums. Accidents and violations increase premiums significantly. |

Average Premiums for Different Vehicle Types

The type of vehicle you drive also significantly impacts your insurance premium. Factors such as the vehicle’s value, repair costs, and safety features influence the premium.

| Vehicle Type | Average Premium (Example) | Premium Range (Example) |

|---|---|---|

| Compact Car | $1,000 | $800 – $1,200 |

| Sedan | $1,200 | $1,000 – $1,400 |

| SUV | $1,500 | $1,200 – $1,800 |

| Sports Car | $2,000 | $1,500 – $2,500 |

Impact of Driving History and Risk Factors

Your driving history and various personal factors significantly influence the cost of your car insurance premium. Insurance companies assess risk to determine how likely you are to file a claim, and this assessment directly impacts the price you pay. Understanding these factors can help you make informed decisions and potentially lower your premiums.

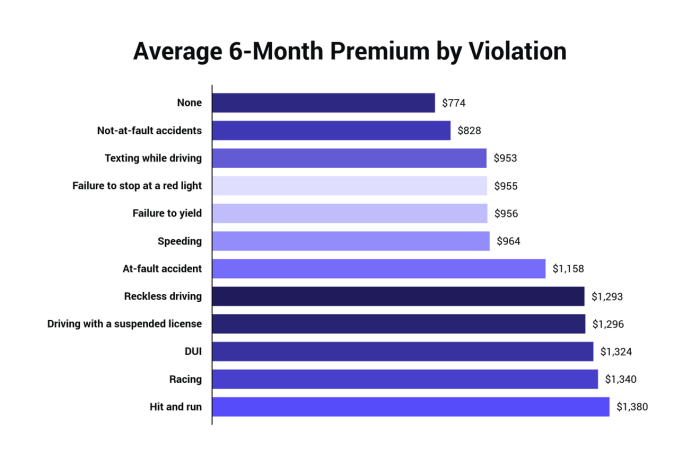

Insurance companies meticulously analyze your driving record to gauge your risk. This involves examining both the frequency and severity of past incidents. A clean driving record generally translates to lower premiums, reflecting a lower perceived risk to the insurer. Conversely, a history of accidents or traffic violations will likely result in higher premiums. The more severe the incident, the greater the premium increase. For example, a DUI conviction will typically result in a much larger premium increase than a minor speeding ticket.

Driving History’s Influence on Premiums

A clean driving record is highly valued by insurance companies. The absence of accidents and violations demonstrates responsible driving habits and reduces the likelihood of future claims. Conversely, each accident or violation adds to your risk profile, increasing your premium. The severity of the incident also matters; a serious accident involving significant damage or injury will result in a more substantial premium increase than a minor fender bender. Similarly, multiple violations within a short period will likely lead to a more significant premium adjustment than isolated incidents. The impact of a driving record can vary based on the specific insurance company and their risk assessment models, but the general trend remains consistent: a better driving record translates to lower premiums.

Other Risk Factors Affecting Premiums

Beyond driving history, several other factors contribute to premium calculations. These factors, while not directly related to driving skill, still provide valuable insights into your risk profile for the insurance company. Age, gender, and credit score are among the most significant.

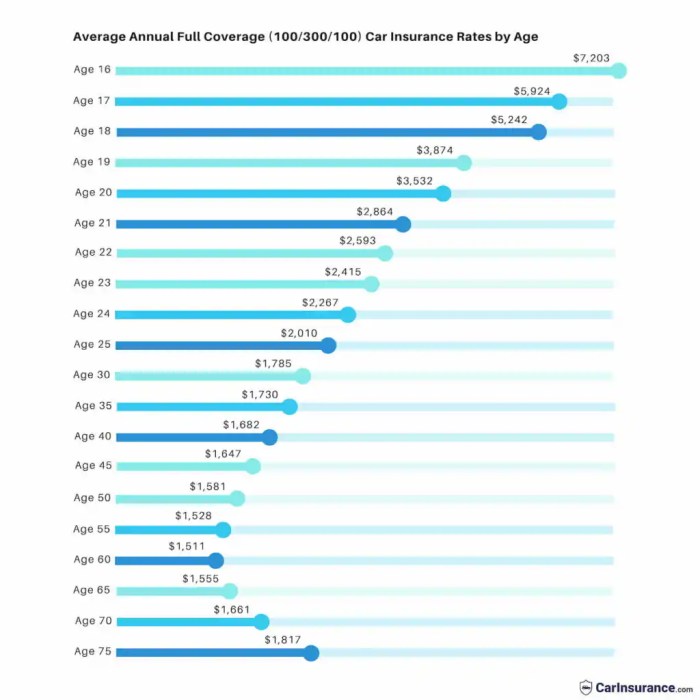

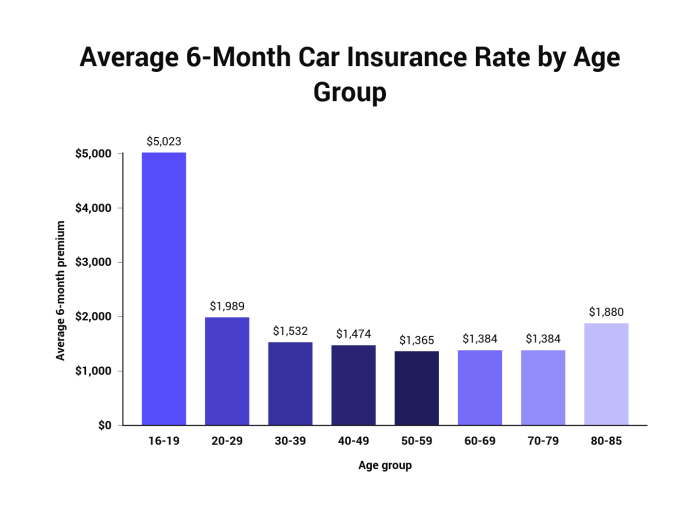

- Age: Younger drivers, particularly those under 25, generally pay higher premiums due to statistically higher accident rates in this age group. As drivers age and gain experience, their premiums typically decrease.

- Gender: Historically, statistical data has shown differences in accident rates between genders, influencing premium calculations. However, it’s important to note that this factor is becoming increasingly less prominent due to legislative changes and evolving societal norms.

- Credit Score: Surprisingly, your credit score can influence your car insurance premium. Insurers often view a lower credit score as an indicator of higher risk, potentially leading to higher premiums. This is based on the correlation between credit history and claim behavior, though the exact relationship is debated.

Premium Adjustments for Different Risk Profiles

The adjustments applied to premiums vary significantly based on the combination of risk factors. A young driver with a poor driving record and a low credit score will likely face substantially higher premiums than an older driver with a clean record and a good credit score. Insurance companies use complex algorithms to weigh these factors, resulting in individualized premium calculations. For instance, a single speeding ticket might result in a modest increase for a driver with an otherwise clean record, but the same ticket could lead to a more substantial increase for a driver already facing higher premiums due to age or credit score. The overall effect is a customized premium reflecting the insurer’s assessment of individual risk.

Epilogue

Navigating the world of car insurance can feel overwhelming, but understanding the factors that influence average premiums empowers you to make informed choices. By comparing quotes, understanding your risk profile, and employing the strategies discussed, you can secure a policy that meets your needs without breaking the bank. Remember, proactive planning and a thorough understanding of the market are your best allies in securing affordable and comprehensive car insurance.

Expert Answers

What is a “good” average car insurance premium?

There’s no single “good” average. A good premium is one that provides adequate coverage at a price you can comfortably afford. The average varies widely based on location, coverage, and individual risk factors.

How often are car insurance premiums recalculated?

Premiums are typically recalculated annually at your policy renewal. However, significant life events (like moving, getting a speeding ticket, or adding a driver) may trigger a mid-term adjustment.

Can I lower my premium by bundling insurance policies?

Yes, many insurers offer discounts for bundling car insurance with other policies, such as homeowners or renters insurance. This is a common strategy to reduce overall costs.

What is the impact of using a dashcam on my insurance premium?

Some insurers offer discounts for drivers who install and use dashcams, as they can provide evidence in case of accidents and potentially reduce fraudulent claims.