Navigating the world of auto insurance can feel like deciphering a complex code. Premiums vary wildly, leaving many drivers wondering what constitutes a “fair” price. This guide delves into the intricacies of average auto insurance premiums, exploring the factors that influence costs and providing insights to help you understand your own insurance bill.

From geographical location and driving history to vehicle type and coverage choices, numerous variables contribute to the final premium. We’ll break down these factors, offering a clear picture of how they interact to determine your individual cost. Understanding these dynamics empowers you to make informed decisions and potentially save money on your auto insurance.

Defining “Average Auto Insurance Premium”

The average auto insurance premium represents the typical cost consumers pay for car insurance within a specific timeframe and geographical area. It’s a crucial metric for understanding the overall cost of car insurance and comparing rates across different regions and demographics. Calculating this average involves considering numerous factors, resulting in a figure that provides a general picture but doesn’t represent the exact cost for any individual.

Factors Influencing the Calculation of an Average Auto Insurance Premium

Several key factors contribute to the calculation of an average auto insurance premium. These factors are weighted differently depending on the insurer and the specific risk assessment models used. The more risk an individual poses, the higher their premium will be. This is a fundamental principle of actuarial science, which underpins the insurance industry.

Components of a Typical Auto Insurance Premium

A typical auto insurance premium is composed of several key components. These components reflect the various risks the insurance company assumes when providing coverage. Understanding these components helps consumers better understand their premium and how it is structured.

The primary components typically include:

* Liability Coverage: This covers bodily injury and property damage to others caused by an accident for which the insured is at fault. This is often a significant portion of the premium.

* Collision Coverage: This covers damage to the insured vehicle in an accident, regardless of fault.

* Comprehensive Coverage: This covers damage to the insured vehicle from events other than collisions, such as theft, vandalism, or weather-related damage.

* Uninsured/Underinsured Motorist Coverage: This protects the insured in the event of an accident caused by a driver without adequate insurance.

* Medical Payments Coverage (Med-Pay): This covers medical expenses for the insured and passengers in their vehicle, regardless of fault.

* Administrative Costs and Profit Margins: These costs associated with running the insurance company, including salaries, marketing, and the desired profit margin, are factored into the premium.

Geographical Variations in Average Premiums

Average auto insurance premiums vary significantly across different geographical locations due to a number of factors. These factors include the frequency and severity of accidents, the cost of vehicle repairs, the prevalence of theft, and the legal environment surrounding insurance claims. Urban areas, for example, tend to have higher premiums due to increased accident rates and higher repair costs compared to rural areas.

Average Premium Variations Across Different States

The following table illustrates the variation in average auto insurance premiums across selected states. It’s important to note that these figures are averages and individual premiums will vary based on individual factors. The data presented is for illustrative purposes only and should not be considered exhaustive or definitive. Actual premiums can vary significantly based on insurer, coverage levels, and individual risk profiles.

| State | Average Annual Premium | State | Average Annual Premium |

|---|---|---|---|

| California | $1500 (Example) | Texas | $1200 (Example) |

| Florida | $1800 (Example) | New York | $1600 (Example) |

| Illinois | $1400 (Example) | Pennsylvania | $1300 (Example) |

Factors Affecting Auto Insurance Premiums

Several interconnected factors influence the final cost of your auto insurance premium. Understanding these factors can empower you to make informed decisions and potentially lower your expenses. This section will detail the key elements that insurance companies consider when calculating your premium.

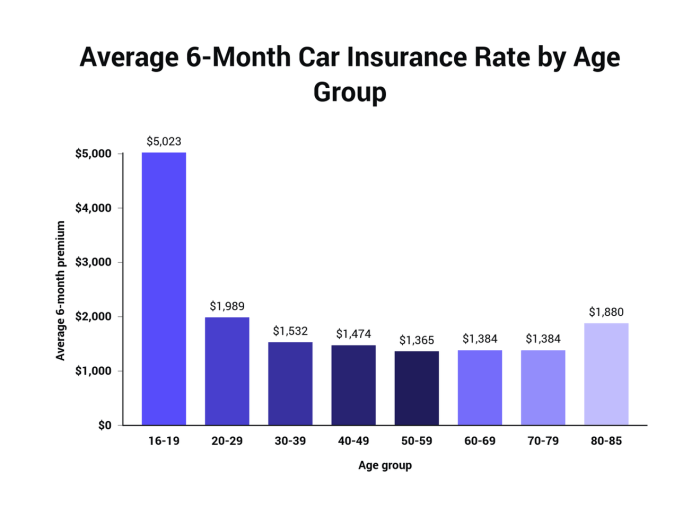

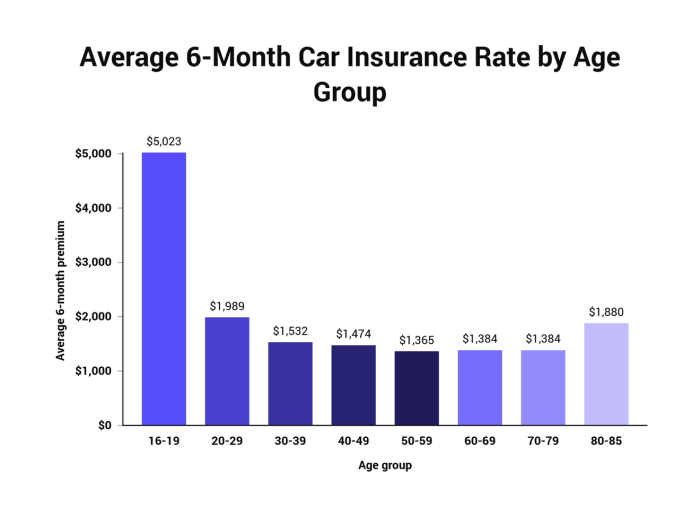

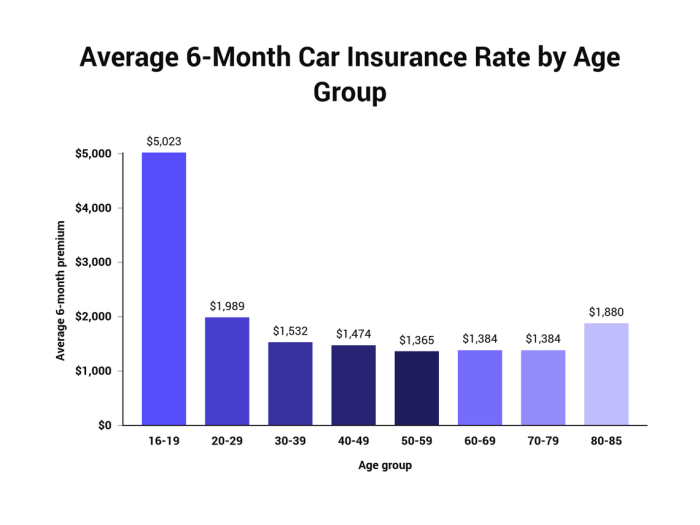

Age and Driving History

Age significantly impacts insurance premiums. Younger drivers, particularly those under 25, generally pay higher rates due to statistically higher accident involvement. Insurance companies perceive them as higher risk. Conversely, drivers in their mid-thirties and beyond often qualify for lower premiums, reflecting a decreased likelihood of accidents based on actuarial data. A clean driving record, free of accidents, tickets, or DUI convictions, substantially reduces premiums. Conversely, a history of accidents or violations leads to higher premiums, reflecting the increased risk associated with a less experienced or less cautious driver. The severity of incidents also plays a role; a minor fender bender will impact premiums less than a serious accident involving injuries or significant property damage.

Vehicle Type and Model

The type and model of your vehicle directly affect your insurance costs. Luxury cars, sports cars, and high-performance vehicles typically command higher premiums due to their higher repair costs and increased risk of theft. These vehicles are often more expensive to repair and replace, resulting in higher insurance payouts for the insurance company. Conversely, smaller, less expensive vehicles often have lower premiums. Furthermore, safety features play a role. Vehicles equipped with advanced safety technologies, such as anti-lock brakes, airbags, and electronic stability control, may receive discounts because these features reduce the likelihood and severity of accidents. The vehicle’s safety rating, as determined by organizations like the IIHS (Insurance Institute for Highway Safety) and NHTSA (National Highway Traffic Safety Administration), also influences premium calculations.

Credit Score

In many states, your credit score is a factor in determining your auto insurance premium. Insurers use credit scores as an indicator of risk. Studies suggest a correlation between credit score and insurance claims; individuals with lower credit scores tend to file more claims. Therefore, a higher credit score can lead to lower premiums, while a lower score can result in higher premiums. It is important to note that this practice is subject to state regulations and is not universally applied.

Coverage Levels

The level of coverage you choose significantly impacts your premium. Liability coverage, which protects others in case you cause an accident, is typically mandatory. However, the amount of liability coverage you select affects your premium; higher liability limits mean higher premiums, offering greater financial protection. Collision coverage pays for damage to your vehicle in an accident, regardless of fault. Comprehensive coverage protects against damage from non-collision events, such as theft, vandalism, or weather-related damage. Both collision and comprehensive coverage are optional and adding them increases premiums.

Coverage Option Cost Comparison

The following table illustrates the potential cost differences between various coverage options. These are illustrative examples and actual costs will vary based on numerous factors.

| Coverage Level | Liability (per accident) | Collision Deductible | Comprehensive Deductible | Approximate Monthly Premium Increase |

|---|---|---|---|---|

| Minimum State Requirements | $25,000/$50,000 | N/A | N/A | $0 (Base Premium) |

| Increased Liability | $100,000/$300,000 | N/A | N/A | +$20 |

| Added Collision ($500 Deductible) | $100,000/$300,000 | $500 | N/A | +$40 |

| Added Comprehensive ($500 Deductible) | $100,000/$300,000 | $500 | $500 | +$25 |

Note: These figures are for illustrative purposes only and do not reflect actual premiums. Actual costs will vary significantly based on location, insurer, driving record, vehicle type, and other factors.

Data Sources and Research Methods for Premium Information

Accurately determining the average auto insurance premium requires access to reliable data and the application of sound research methodologies. The process involves identifying trustworthy sources of premium information, selecting appropriate analytical techniques, and understanding the inherent limitations of each approach. This section will detail the key data sources and methodologies used in this type of research.

Several reputable sources provide data on auto insurance premiums. These sources vary in the scope of their data, the frequency of updates, and the level of detail provided. Understanding the strengths and weaknesses of each source is crucial for conducting a robust analysis.

Reputable Data Sources for Auto Insurance Premiums

Several organizations and publications compile data on auto insurance premiums. The reliability of these sources depends on their data collection methods, sample size, and transparency. Accessing these data sets often requires subscriptions or purchases, but the investment is worthwhile for accurate analysis.

- Insurance Information Institutes (IIIs): Many countries have independent insurance information institutes that collect and analyze data on insurance premiums. These organizations often publish reports and summaries on average premiums, broken down by various factors such as location, age, and vehicle type. Their data is usually considered highly reliable due to their extensive research and industry connections.

- State Insurance Departments: Each state typically maintains a department of insurance that regulates the insurance industry within its borders. These departments often collect data on premiums charged by insurers operating within the state. This data can be useful for understanding regional variations in premiums. However, access to this data may vary depending on the state.

- Industry Publications and Research Firms: Specialized publications and research firms focusing on the insurance industry often publish reports and analyses on auto insurance premiums. These sources usually conduct their own surveys and analyses, offering insights into market trends and average premiums. Examples include publications that specialize in financial news and insurance-specific journals.

- Government Statistical Agencies: National statistical agencies may collect data on various aspects of the insurance market, including premiums. This data may be part of broader economic surveys and may not always focus specifically on auto insurance. Nonetheless, it can provide valuable contextual information.

Methodologies for Calculating Average Premiums

Calculating average auto insurance premiums involves several statistical methods. The choice of method depends on the available data and the research objectives. The most common approaches involve simple averages, weighted averages, and more sophisticated statistical models.

- Simple Average: This is the most straightforward method, calculating the mean of all premiums collected in the dataset. While simple, it is susceptible to outliers and may not accurately represent the overall average if the data isn’t normally distributed.

- Weighted Average: This method assigns weights to different premiums based on factors like policy volume or market share. This approach addresses the limitations of simple averages by giving more influence to larger segments of the market. For instance, a weighted average might give more weight to premiums from insurers with a larger number of policyholders.

- Regression Analysis: This statistical technique can model the relationship between premiums and various factors (age, driving history, vehicle type, etc.). It allows researchers to isolate the effect of specific factors on premiums and to predict average premiums under different scenarios. This provides a more nuanced understanding of the factors influencing premiums.

Comparison of Data Collection Methods: Strengths and Weaknesses

Different data collection methods have varying strengths and weaknesses. The optimal method depends on the resources available, the research question, and the desired level of accuracy. A comparative analysis highlights these trade-offs.

| Data Collection Method | Strengths | Weaknesses |

|---|---|---|

| Surveys | Direct data collection, control over sample selection | Potential for bias, high cost, low response rates |

| Publicly available datasets (IIIs, State Insurance Departments) | Large sample size, readily available data | Data may not be completely up-to-date, limited control over variables |

| Regression analysis using publicly available data | Leverages large datasets, allows for control of confounding variables | Requires statistical expertise, assumptions of the model may not always hold |

Illustrative Examples of Premium Variations

Auto insurance premiums are not a one-size-fits-all proposition. Numerous factors contribute to the final cost, resulting in significant variations between individuals. The following examples illustrate how different driver profiles and coverage choices impact premium costs.

Consider two drivers in the same location, driving identical vehicles. The first is a 20-year-old with a history of speeding tickets and an at-fault accident. The second is a 55-year-old with a clean driving record spanning over 30 years. The younger driver’s higher risk profile translates to a significantly more expensive premium. While the exact difference varies depending on the insurer and specific details, the younger driver could easily pay double, or even triple, the premium of the older driver. This disparity reflects the increased likelihood of accidents and claims associated with younger, less experienced drivers.

Premium Differences Based on Driver Profile and Driving History

Let’s assume both drivers are insured by the same company and have chosen the same vehicle, a 2018 Honda Civic. The 20-year-old driver, with their poor driving record, might face a premium of $2500 annually for basic liability coverage. In contrast, the 55-year-old driver, with their spotless record, might only pay $800 annually for the same coverage. This illustrates how a clean driving record can lead to substantial savings over the long term. This significant difference highlights the importance of safe driving and maintaining a good driving record.

Impact of Different Coverage Options on Premium Cost

Now, let’s examine how different coverage options affect the premium for a single driver profile. Consider a 35-year-old driver with a clean driving record insuring a 2022 Toyota Camry. The base premium for liability-only coverage might be $1200 per year. Adding collision and comprehensive coverage, which protects against damage to the driver’s vehicle regardless of fault, significantly increases the premium. Including these additional coverages might raise the annual cost to $1800, a 50% increase. Further adding uninsured/underinsured motorist coverage, which protects against accidents involving drivers without sufficient insurance, could push the annual premium to $2000. The decision of which coverages to include should be based on individual risk tolerance and financial capabilities. While comprehensive coverage offers greater protection, it comes at a higher cost.

Impact of External Factors on Premiums

Auto insurance premiums are not static; they are influenced by a variety of external factors that impact the cost of providing insurance coverage. These factors often interact in complex ways, making it challenging to isolate the effect of any single variable. Understanding these influences is crucial for both consumers seeking to manage their insurance costs and insurers striving to price their products accurately.

Inflation, fuel prices, accident rates, and the level of competition within the insurance market all play significant roles in shaping average auto insurance premiums.

Inflation’s Influence on Auto Insurance Premiums

Inflation directly affects the cost of repairing vehicles and replacing parts. As the prices of materials, labor, and other inputs rise, so too does the cost of settling claims. This increased cost is passed on to consumers in the form of higher premiums. For example, a significant rise in the cost of steel, a key component in vehicle manufacturing, would directly impact repair costs following an accident, subsequently leading to higher insurance premiums. Similarly, increases in the cost of medical care contribute to higher premiums, as medical expenses constitute a substantial portion of many auto insurance claims.

The Impact of Fuel Prices and Accident Rates on Premiums

Changes in fuel prices have an indirect but noticeable effect on premiums. Higher fuel prices can lead to less driving, potentially resulting in fewer accidents and lower claim payouts. Conversely, lower fuel prices might encourage more driving, potentially increasing accident frequency and severity, thus driving premiums upward. Accident rates themselves are a primary driver of premium costs. A region experiencing a surge in accidents, perhaps due to increased traffic congestion or adverse weather conditions, will likely see a rise in premiums as insurers adjust their pricing to reflect the heightened risk. For instance, a city implementing a new highway system that significantly increases traffic volume might experience a rise in accidents, subsequently leading insurers to increase premiums in that area.

The Effect of Insurance Company Competition on Average Premium Costs

The level of competition within the auto insurance market significantly impacts average premium costs. A highly competitive market, with numerous insurers vying for customers, typically results in lower premiums as companies strive to attract policyholders with competitive pricing. Conversely, a less competitive market, perhaps due to mergers or stricter regulatory barriers to entry, can lead to higher premiums as insurers have less incentive to lower their prices. For example, the entry of a new, large insurer into a previously saturated market often results in a period of intense competition, leading to lower premiums for consumers before a new market equilibrium is established. Conversely, if a major insurer exits a market, the remaining companies might have less pressure to compete on price, leading to potential premium increases.

Last Word

Ultimately, understanding your average auto insurance premium is key to responsible financial planning. By considering the various factors influencing your rate – from your driving record and vehicle choice to your coverage options and location – you can gain a clearer picture of your insurance costs and make more informed decisions. Remember, comparing quotes and understanding the nuances of your policy can lead to significant savings over time.

Question Bank

What is the average auto insurance premium in the US?

There’s no single “average” as premiums vary significantly by state, driver profile, and coverage. However, national averages are often reported, though they should be considered general estimates only.

How often do auto insurance premiums change?

Premiums can change periodically, often annually, due to factors like claims experience, inflation, and changes in risk assessment models by insurance companies.

Can I lower my auto insurance premium?

Yes, several factors can influence your premium. Safe driving, bundling policies, increasing your deductible, and choosing a less expensive vehicle are examples of ways to potentially reduce costs.

What happens if I make a claim?

Filing a claim will typically impact your premium, usually leading to an increase, reflecting the increased risk associated with your driving record.