Navigating the world of automobile insurance can feel like deciphering a complex code. The seemingly arbitrary fluctuations in your automobile insurance premium can leave you scratching your head. This guide unravels the mysteries behind those premium costs, exploring the numerous factors that influence the final price you pay, from your driving history to the type of car you drive, and even your location. Understanding these factors empowers you to make informed decisions and potentially save money.

We’ll delve into the intricacies of how insurance companies assess risk, the various discounts available, and strategies for managing and reducing your premiums. We’ll also look ahead to the future of automobile insurance, considering the impact of emerging technologies and evolving societal trends on the cost of coverage. Prepare to become a more savvy consumer of automobile insurance.

Factors Influencing Automobile Insurance Premiums

Understanding the factors that determine your car insurance premium is crucial for securing the best possible rate. Several key elements contribute to the final cost, and this section will detail their influence. Knowing these factors can empower you to make informed decisions about your coverage and potentially save money.

Driver Age and Insurance Premiums

Younger drivers typically pay significantly higher premiums than older drivers. This is because statistically, younger drivers are involved in more accidents. Insurance companies assess risk based on historical data, and the higher accident rate for younger drivers translates to higher premiums. Generally, premiums decrease as drivers age and gain more experience, reaching a lower point in their mid-thirties to fifties, before potentially increasing slightly again in later years. For example, a 16-year-old might pay double or even triple the premium of a 35-year-old with a similar driving record and vehicle. The age brackets most significantly impacting premiums are typically 16-25 and those over 70.

Driving History and Insurance Costs

Your driving history is a major determinant of your insurance premium. Accidents and traffic violations significantly increase your risk profile in the eyes of insurance companies. A single at-fault accident can lead to a substantial premium increase, often lasting several years. Similarly, traffic violations such as speeding tickets, reckless driving citations, and DUI convictions can drastically raise your premiums. For example, a speeding ticket might increase your premium by 10-20%, while a DUI could result in a premium increase of 50% or more. The severity and frequency of incidents directly correlate to the impact on your premiums.

Vehicle Type and Insurance Premiums

The type of vehicle you drive plays a crucial role in determining your insurance costs. Factors such as make, model, year, and safety features all contribute to the overall premium. Generally, newer cars with advanced safety features tend to have lower premiums than older models with fewer safety features. Luxury vehicles and high-performance cars often command higher premiums due to their higher repair costs and increased risk of theft. Sports cars, for example, are frequently targeted by thieves and have higher repair bills, leading to higher insurance premiums.

| Vehicle Type | Average Premium | Safety Rating | Theft Rate |

|---|---|---|---|

| Compact Sedan (e.g., Honda Civic) | $1200 | Good | Low |

| Mid-size SUV (e.g., Toyota RAV4) | $1500 | Good | Medium |

| Luxury Sedan (e.g., BMW 3 Series) | $2000 | Excellent | High |

| Sports Car (e.g., Porsche 911) | $2500 | Good | Very High |

Geographic Location and Insurance Rates

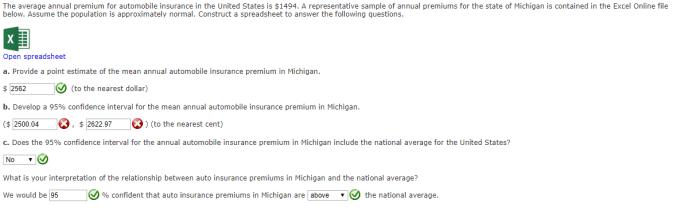

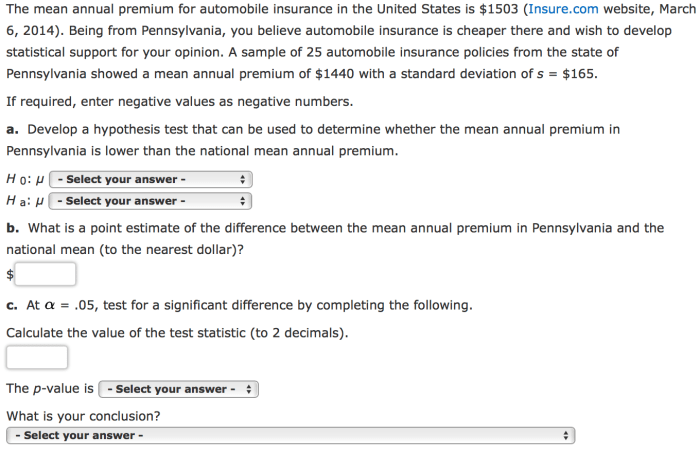

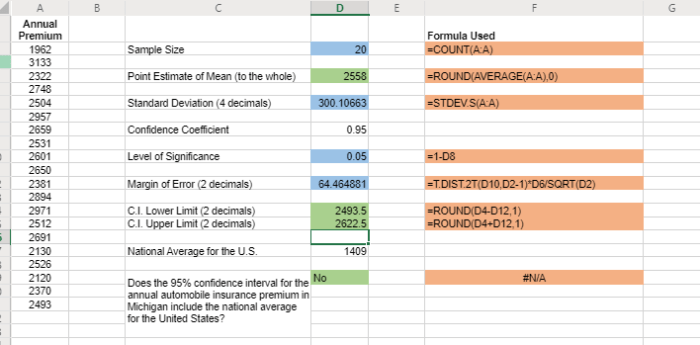

Your location significantly influences your car insurance premium. Factors such as population density, accident rates, crime rates, and the cost of repairs in your area all play a role. Urban areas with high traffic congestion and higher crime rates tend to have higher premiums than rural areas. State regulations also influence rates; some states have stricter laws or higher average claim costs, leading to higher premiums. For example, insurance in a densely populated city with a high accident rate might be considerably more expensive than insurance in a rural area with low accident rates.

Coverage Levels and Premium Costs

The level of coverage you choose directly impacts your premium. Liability coverage, which protects you against claims from others, is typically required by law. Collision coverage, which pays for damage to your car in an accident regardless of fault, and comprehensive coverage, which covers damage from non-accident events (e.g., theft, vandalism, weather), are optional but significantly increase your premium. Higher liability limits result in higher premiums, as does the addition of collision and comprehensive coverage. Choosing a higher deductible, however, can help lower your premium, but it means you pay more out-of-pocket in the event of a claim.

Understanding Discounts and Savings on Automobile Insurance

Securing affordable auto insurance is a priority for many drivers. Fortunately, numerous opportunities exist to reduce premiums through discounts and strategic planning. Understanding these options and how to leverage them can significantly impact your overall insurance costs.

Common Automobile Insurance Discounts

Insurance companies offer a variety of discounts to incentivize safe driving habits and responsible policyholder behavior. These discounts can substantially lower your premium. Some of the most common include good student discounts (for students maintaining a certain GPA), safe driver discounts (for those with a clean driving record and no accidents or violations), and multiple vehicle discounts (for insuring more than one car with the same company). Discounts for features like anti-theft devices or advanced safety technologies in your vehicle are also frequently available. Bundling home and auto insurance with the same provider often results in further savings.

Bundling Insurance Policies for Savings

Bundling your home and auto insurance policies with a single provider is a popular strategy for saving money. The process typically involves contacting your current insurer or obtaining quotes from companies offering bundled packages. When requesting a quote, clearly indicate your interest in bundling your policies. The insurer will then calculate a combined premium, usually lower than the sum of separate home and auto insurance premiums. The exact savings will depend on the insurer, your coverage levels, and your risk profile. For example, a homeowner with a clean driving record and a newer, well-maintained vehicle might see a more substantial discount than someone with a history of claims.

Comparing Insurance Quotes from Different Providers

Comparing quotes from multiple insurance providers is crucial to securing the best possible rate. This involves obtaining quotes from a variety of companies, ensuring you’re comparing apples to apples (meaning similar coverage levels). A systematic approach, such as using online comparison tools, simplifies this process.

- Many websites specialize in comparing auto insurance quotes. These include sites like The Zebra, NerdWallet, and Insurify. These platforms allow you to input your information once and receive quotes from multiple insurers simultaneously.

- Directly contacting insurance companies is another effective method. This allows you to ask specific questions about coverage and discounts and to potentially negotiate rates.

- Using a local independent insurance agent can also be beneficial. These agents often work with multiple insurance companies and can help you find the best fit for your needs and budget.

Telematics Programs and Their Impact on Premiums

Telematics programs utilize devices or smartphone apps to track your driving behavior. Data collected, such as speed, braking habits, and mileage, influences your premium. Safe driving habits, as reflected in the data, often lead to lower premiums. Conversely, risky driving behaviors can result in higher premiums.

For example, imagine two drivers with identical vehicles and coverage. Driver A consistently drives under the speed limit, accelerates and brakes smoothly, and maintains a low mileage. Driver B frequently speeds, brakes hard, and drives a high number of miles. Driver A’s telematics data will likely result in a lower premium compared to Driver B’s, reflecting their safer driving habits.

Impact of Payment Methods on Total Insurance Cost

Choosing an annual payment plan typically results in a lower overall cost compared to monthly payments. Most insurers offer a discount for paying the entire premium upfront. This discount compensates for the administrative costs associated with processing monthly payments. However, paying annually requires having a larger sum of money available at once. Monthly payments offer greater flexibility but usually come with a higher total cost over the year. For example, a $1200 annual premium might be offered at $100 per month, but the total cost over the year becomes $1200 plus any additional fees associated with monthly payments.

The Role of Insurance Companies in Setting Premiums

Insurance companies play a crucial role in determining automobile insurance premiums. This process is complex, involving a careful assessment of risk, the use of sophisticated statistical models, and consideration of external factors like competition and regulation. The goal is to balance the need for profitability with the responsibility of providing fair and affordable coverage to consumers.

Insurance companies utilize a multifaceted process to assess the risk associated with insuring individual drivers. This involves collecting a wide range of data points, analyzing them using actuarial models, and applying this analysis to determine the likelihood of a claim and the potential cost of that claim.

Risk Assessment and Actuarial Data

The foundation of premium setting lies in the meticulous assessment of risk. Insurance companies gather extensive data on drivers, including their driving history (accidents, violations), age, gender, location, vehicle type, and even credit history. This data is then fed into actuarial models – sophisticated statistical tools that predict the likelihood of accidents and the associated costs. Actuarial data, essentially historical claims data combined with predictive modeling, is the cornerstone of the entire process. For example, a driver with multiple speeding tickets and a history of accidents will be assigned a higher risk profile than a driver with a clean driving record. This higher risk profile translates into a higher premium, reflecting the increased likelihood of a claim. The more data an insurance company has, the more refined its risk assessment becomes, leading to more accurate premium calculations.

Insurance Company Rating Systems

Various rating systems are employed by different insurance companies to translate risk assessments into premiums. These systems are often proprietary and complex, but generally involve assigning points based on various risk factors. A common approach is a point system, where each risk factor (e.g., age, driving history, location) is assigned a numerical value. These points are then aggregated to produce a risk score. This score determines the driver’s placement within a rating class, which dictates the premium. Some companies might use a more nuanced approach, incorporating factors like credit scores or even telematics data (information collected from devices installed in the vehicle). For instance, a company might offer discounts to drivers who use telematics devices and demonstrate safe driving habits, reflecting a lower risk profile. Conversely, a driver living in a high-crime area might face higher premiums due to the increased risk of theft or vandalism.

Competition and Regulatory Environment

The competitive landscape significantly influences premium costs. In markets with many insurers, competition often drives premiums down as companies strive to attract customers with lower rates. Conversely, markets with limited competition might see higher premiums. The regulatory environment also plays a critical role. State insurance departments set regulations that govern various aspects of insurance, including minimum coverage requirements, rate filings, and consumer protection laws. These regulations aim to ensure fair pricing practices and prevent insurers from exploiting consumers. For example, regulations might restrict the use of certain factors in setting premiums, or require insurers to justify their rate increases. These regulatory oversight mechanisms are designed to promote market stability and protect consumers from unfair pricing.

Managing and Reducing Automobile Insurance Premiums

High automobile insurance premiums can strain your budget. Fortunately, several strategies can help you manage and reduce these costs. By understanding the factors influencing your premiums and taking proactive steps, you can significantly lower your expenses and maintain adequate coverage. This section Artikels practical steps to achieve this.

Step-by-Step Guide to Lowering Insurance Premiums

Lowering your car insurance premiums involves a multi-faceted approach. It requires careful consideration of your driving habits, vehicle choices, and insurance policy options. The following steps provide a structured approach to achieving lower rates.

- Review your driving record: A clean driving record is the cornerstone of lower premiums. Avoid speeding tickets, accidents, and DUI convictions. These incidents significantly impact your insurance score.

- Shop around for insurance: Different insurance companies offer varying rates. Compare quotes from multiple providers to find the best deal for your needs and risk profile. Use online comparison tools or contact insurers directly.

- Consider increasing your deductible: A higher deductible means you pay more out-of-pocket in case of an accident, but it can significantly reduce your premium. Carefully weigh the financial implications of a higher deductible against the potential savings.

- Bundle your insurance policies: Many insurers offer discounts for bundling your auto insurance with other types of insurance, such as homeowners or renters insurance. This can lead to substantial savings.

- Maintain a good credit score: Your credit score is often a factor in determining your insurance premiums. A good credit score can lead to lower rates. Pay your bills on time and manage your credit responsibly.

- Choose a safe vehicle: The type of car you drive affects your insurance premium. Cars with good safety ratings and lower theft rates typically have lower insurance costs. Consider the insurance implications when choosing a vehicle.

- Take a defensive driving course: Completing a defensive driving course can demonstrate your commitment to safe driving and may qualify you for discounts from your insurer.

- Install anti-theft devices: Installing anti-theft devices in your car can reduce your risk of theft and potentially lower your premiums. Some insurers offer discounts for vehicles equipped with these devices.

- Review your coverage regularly: Your insurance needs may change over time. Review your coverage annually to ensure you have the right amount of protection without paying for unnecessary coverage.

- Consider usage-based insurance: Some insurers offer usage-based insurance programs that track your driving habits. If you’re a safe driver, you may qualify for lower premiums based on your driving data.

Checklist of Actions to Reduce Risk and Premiums

Proactive risk reduction measures can significantly impact your insurance premiums. This checklist highlights key actions to minimize risk and potentially lower your costs.

- Maintain your vehicle regularly to prevent breakdowns and accidents.

- Avoid driving in hazardous weather conditions whenever possible.

- Always wear your seatbelt and ensure passengers do the same.

- Drive defensively and avoid aggressive driving behaviors.

- Obey all traffic laws and speed limits.

- Park your vehicle in well-lit and secure areas.

- Keep your car insurance information up-to-date.

- Report any accidents or incidents promptly to your insurer.

Negotiating Lower Rates with Insurance Providers

Negotiating lower insurance rates is a viable strategy. Preparing in advance and presenting a strong case can improve your chances of success.

Before contacting your insurer, gather information on your driving record, vehicle details, and quotes from competing insurers. Clearly explain your reasons for seeking a lower rate, highlighting your good driving record, safety measures, and any relevant discounts you qualify for. Be polite and professional throughout the negotiation process. Don’t be afraid to threaten to switch providers if they are unwilling to negotiate fairly.

Appealing a Premium Increase

If your insurance premiums increase unexpectedly, you have the right to appeal the decision. Carefully review the justification for the increase provided by your insurer. If you believe the increase is unjustified, gather supporting evidence, such as a clean driving record or evidence of safety improvements to your vehicle. Contact your insurer and formally request a review of your premium. If the appeal is unsuccessful, consider switching to a different insurer.

Examples of How Lifestyle Choices Affect Insurance Costs

Lifestyle choices significantly influence insurance premiums. For instance, driving a high-performance sports car generally leads to higher premiums compared to driving a fuel-efficient sedan. Similarly, frequent long-distance driving increases the risk of accidents and consequently, higher premiums. Individuals with a history of speeding tickets or accidents will likely face higher premiums than those with clean driving records. Living in high-crime areas may also result in higher premiums due to the increased risk of theft or vandalism.

The Future of Automobile Insurance Premiums

Predicting the future of automobile insurance premiums requires considering several converging technological, environmental, and societal shifts. The industry is on the cusp of significant transformation, driven by advancements in vehicle technology, data analytics, and a growing awareness of climate change’s impact. These factors will collectively reshape how risk is assessed and premiums are calculated.

Autonomous Vehicles and Insurance Premiums

The widespread adoption of autonomous vehicles (AVs) is poised to dramatically alter the landscape of automobile insurance. The reduction in human error, a primary cause of accidents, is expected to lead to significantly fewer accidents. This decrease in accident frequency will, in turn, translate into lower insurance claims and potentially lower premiums for AV owners. However, the initial cost of AV technology and the complexities of liability in the event of an accident involving an AV (e.g., determining fault between the AV’s software and external factors) will initially present challenges for insurers in accurately pricing premiums. Furthermore, the potential for large-scale, coordinated AV failures or cyberattacks introduces new risks that insurers will need to account for in their pricing models. Insurers are actively developing new actuarial models to accurately reflect the evolving risk profiles of AVs. For example, some insurers are exploring usage-based insurance models that reward safe driving behavior and monitor the performance of AV systems.

The Influence of Emerging Technologies

Telematics, AI, and other emerging technologies are fundamentally changing how the insurance industry operates. Telematics devices, which track driving behavior such as speed, braking, and acceleration, allow insurers to personalize premiums based on individual risk profiles. Drivers exhibiting safer driving habits receive lower premiums, creating a powerful incentive for better driving. AI plays a crucial role in analyzing vast amounts of telematics data, identifying patterns, and predicting risk more accurately. This enhanced risk assessment leads to more precise pricing, ultimately benefiting both insurers and policyholders. Furthermore, AI can automate many aspects of the insurance process, streamlining claims handling and reducing administrative costs. For example, AI-powered systems can assess damage from accident photos, speeding up the claims process and reducing processing times.

Climate Change and Insurance Costs

Climate change significantly impacts automobile insurance costs through increased frequency and severity of weather-related events. More frequent and intense storms, floods, and wildfires lead to a higher number of vehicle damages and total losses. These increased claims costs are inevitably passed on to consumers in the form of higher premiums. Insurers are increasingly incorporating climate risk into their models, considering factors like geographical location, vulnerability to extreme weather, and historical claims data related to climate events. For example, insurers might increase premiums in areas prone to flooding or wildfires. The rising costs of repairing or replacing vehicles due to extreme weather events also contribute to escalating premiums.

Predictions for Future Trends in Automobile Insurance Pricing

The future of automobile insurance pricing is characterized by increased personalization, dynamic pricing, and a shift towards usage-based models. We anticipate a continued decline in premiums for safer drivers, as technology allows for more granular risk assessment. Simultaneously, premiums are likely to rise for drivers in high-risk areas or those exhibiting riskier driving behaviors. The rise of autonomous vehicles will eventually lead to a significant reduction in accident-related claims, although the initial period may see volatility as the technology matures and liability issues are resolved. Insurers will continue to refine their predictive models using advanced analytics and AI, leading to more accurate and fair pricing.

| Technology/Trend | Impact on Risk | Impact on Premiums | Timeframe |

|---|---|---|---|

| Autonomous Vehicles | Reduced human error; potential for new system failures | Initially uncertain, potentially lower in the long term | Next 10-20 years |

| Telematics | More accurate assessment of individual driver risk | Personalized premiums based on driving behavior | Next 5-10 years |

| AI and Machine Learning | Improved risk prediction and fraud detection | More accurate and efficient pricing | Next 5-10 years |

| Climate Change | Increased frequency and severity of weather-related events | Higher premiums in high-risk areas | Ongoing |

Concluding Remarks

Ultimately, understanding your automobile insurance premium isn’t just about the numbers; it’s about understanding your risk profile and making choices that reflect your individual circumstances. By actively engaging with the factors influencing your premium, you can gain control over your insurance costs and secure the most appropriate coverage for your needs. Remember, informed choices lead to better outcomes, and this guide provides the knowledge to navigate the often-confusing landscape of automobile insurance with confidence.

FAQ Section

What is the difference between liability, collision, and comprehensive coverage?

Liability coverage pays for damages you cause to others. Collision covers damage to your vehicle in an accident, regardless of fault. Comprehensive covers damage from events not involving a collision, like theft or hail.

Can I get my insurance premium lowered if I have a clean driving record for several years?

Yes, many insurers offer discounts for accident-free driving periods. The length of time and the specific discount vary by company.

How often can I expect my insurance rates to change?

Rates can change annually, or even more frequently, depending on your insurer and any changes in your risk profile (e.g., moving, adding a driver, getting a ticket).

What if I disagree with the amount of my insurance premium increase?

Contact your insurer to discuss the reasons for the increase. You may be able to negotiate a lower rate or shop around for a better deal with a different company.