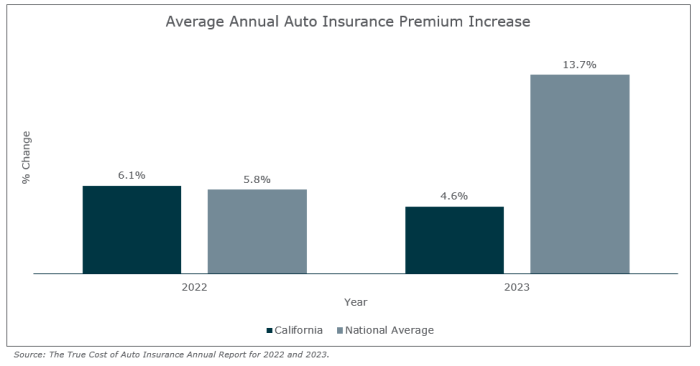

The cost of auto insurance is a significant financial burden for many, and recently, premiums have been climbing steadily. This increase isn’t a single event but a complex interplay of factors, from inflation and rising repair costs to changes in driving habits and insurance company practices. Understanding these contributing elements is crucial for drivers to manage their insurance expenses effectively.

This comprehensive guide delves into the multifaceted reasons behind auto insurance premium increases, exploring the influence of economic conditions, individual driving behaviors, and the strategies employed by insurance providers. We’ll examine how these factors interact to shape premium costs and offer practical advice on how to mitigate their impact on your budget.

Methods for Reducing Auto Insurance Premiums

Facing a higher auto insurance premium can be frustrating, but there are several proactive steps you can take to potentially lower your costs. Understanding how insurance companies assess risk and leveraging available options can significantly impact your premium. This section details effective strategies for reducing your auto insurance expenses.

Comparing Auto Insurance Quotes

Obtaining multiple quotes from different insurers is crucial for finding the best rate. A systematic approach ensures you’re making an informed decision.

- Identify Potential Insurers: Research various insurance companies operating in your area. Consider both large national providers and smaller, regional companies, as they may offer competitive rates.

- Gather Necessary Information: Before starting, collect all the necessary information, including your driving history, vehicle details (make, model, year), and desired coverage levels. Having this ready speeds up the process.

- Use Online Comparison Tools: Many websites allow you to compare quotes from multiple insurers simultaneously. Input your information once, and the site will generate a range of options.

- Contact Insurers Directly: While online tools are helpful, contacting insurers directly can provide a more personalized experience and allow you to ask specific questions about their policies and discounts.

- Compare Apples to Apples: When comparing quotes, ensure you’re comparing similar coverage levels. A lower premium with less coverage might not be the best deal in the long run.

- Review Policy Details Carefully: Before committing to a policy, thoroughly review the fine print, including deductibles, coverage limits, and exclusions.

Improving Your Driving Record

Your driving history is a major factor in determining your premium. A clean record translates to lower costs.

Maintaining a clean driving record involves defensive driving techniques, such as obeying traffic laws, avoiding speeding tickets, and practicing safe driving habits. Consider taking a defensive driving course; many insurers offer discounts for completing these courses. These courses often cover accident avoidance strategies and safe driving practices, which can directly translate to fewer accidents and, consequently, lower premiums. For example, completing a certified defensive driving course might earn you a 10-15% discount depending on your insurer and location. Furthermore, maintaining a consistent and safe driving record for several years can significantly improve your insurance rating over time.

Negotiating Lower Premiums

Don’t hesitate to negotiate your premium with your insurer. Loyalty and competition can be leveraged.

Negotiating your premium often involves highlighting your positive attributes as a driver (clean record, safe vehicle, etc.). You can also mention quotes from competitors to encourage them to match or beat the offer. Being polite but firm is key. Consider bundling your auto insurance with other types of insurance (homeowners, renters) for potential discounts. Remember, insurers want to retain customers, so they are often willing to negotiate to some extent.

Benefits of Insurance Discounts

Insurers offer various discounts to incentivize safe driving and responsible behavior.

Many discounts are available, including those for good students, safe drivers, multiple-vehicle insurance, and bundling policies. For instance, a good student discount can range from 10% to 25%, depending on the insurer and the student’s academic standing. Similarly, discounts for anti-theft devices, accident-free driving records, and completing defensive driving courses can substantially reduce your premiums. Carefully review your insurer’s website or policy documents to identify all applicable discounts.

Methods to Reduce Premiums

| Method | Effectiveness | Drawbacks |

|---|---|---|

| Comparing Quotes | High – Can save hundreds annually | Time-consuming; requires research |

| Improving Driving Record | High – Long-term impact on rates | Requires consistent safe driving; immediate impact may be limited |

| Negotiating Premiums | Moderate – Varies by insurer and situation | Requires effort and negotiation skills |

| Utilizing Discounts | Moderate to High – Depends on eligibility | May require specific qualifications or actions |

Illustrative Examples of Premium Increases

Understanding how specific events and circumstances can impact your auto insurance premiums is crucial for proactive risk management. The following examples illustrate scenarios leading to significant premium increases. Remember that these are hypothetical examples, and the actual increase may vary depending on your insurer, location, and specific policy details.

Premium Increase Due to an At-Fault Accident

In this scenario, imagine Sarah, a 28-year-old driver with a clean driving record, is involved in a car accident. She runs a red light, colliding with another vehicle. The accident is determined to be her fault. The damages include $8,000 in repairs to the other vehicle and $3,000 in medical bills for the other driver. Sarah’s own vehicle sustains $5,000 in damage. Her insurance company pays out the claims, and her premiums subsequently increase by 40%. This significant increase reflects the increased risk she now presents as an at-fault driver. The 40% increase translates to a substantial annual premium increase, impacting her budget significantly. This emphasizes the importance of safe driving practices.

Premium Increase Due to a Change in Vehicle Type

Let’s consider John, a 35-year-old driver who recently traded his reliable, fuel-efficient sedan for a high-performance sports car. His insurer assesses the new vehicle as higher risk due to its speed, power, and potential for more severe accidents. Consequently, his insurance premiums increase by 60%. This significant increase reflects the increased likelihood of accidents and the potentially higher repair costs associated with a high-performance vehicle. The cost of insurance is directly tied to the perceived risk associated with the vehicle being insured.

Premium Increase Due to a Change in Driving Location

Consider Maria, a 25-year-old driver who recently relocated from a quiet suburban area to a large, densely populated city with a high rate of accidents and theft. Her insurer re-evaluates her risk profile based on her new address. Her premiums increase by 25% to reflect the higher risk of accidents and vehicle theft in her new location. This increase demonstrates how location significantly impacts insurance costs, reflecting the statistical likelihood of incidents in a particular area. Higher crime rates and increased traffic congestion contribute to this increased risk assessment.

Final Summary

Navigating the complexities of auto insurance premium increases requires a proactive approach. By understanding the factors that contribute to rising costs, and by implementing strategies to improve driving habits and shop for competitive rates, drivers can gain greater control over their insurance expenses. Remember that careful planning and informed decision-making are key to securing affordable and adequate auto insurance coverage.

Helpful Answers

What is considered a high-risk driver?

High-risk drivers typically have a history of accidents, traffic violations, or DUI convictions. Factors like age and type of vehicle can also influence risk assessment.

How often are auto insurance premiums reviewed?

The frequency of premium reviews varies by insurer and state, but it’s common for them to be reviewed annually. Some companies may adjust rates more frequently based on driving behavior or claims data.

Can I dispute an auto insurance premium increase?

Yes, you can contact your insurance company to understand the reasons for the increase and potentially negotiate a lower rate. Providing evidence of improved driving habits or exploring alternative coverage options can be beneficial.

What is the impact of credit score on auto insurance premiums?

In many states, credit scores are used in underwriting, and a lower credit score can lead to higher premiums. Improving your credit score can positively impact your insurance rates.