Navigating the world of auto insurance can feel like deciphering a complex code. At the heart of this lies the auto insurance premium – the price you pay for your coverage. Understanding what factors influence this cost is crucial for securing the right protection at a price that fits your budget. This guide unravels the intricacies of auto insurance premium definition, empowering you to make informed decisions.

From the fundamental components of your premium to strategies for securing discounts and reducing overall costs, we’ll explore the key elements that shape your insurance bill. We’ll examine how your driving history, vehicle type, location, and chosen coverage levels all play a significant role in determining your premium. By understanding these factors, you can gain a clearer picture of your insurance costs and potentially save money.

Defining Auto Insurance Premiums

An auto insurance premium is the amount of money you pay to an insurance company in exchange for coverage against potential financial losses related to your vehicle. This payment secures your policy and ensures you’re protected in case of accidents, theft, or other covered incidents. Understanding the components of your premium is crucial for making informed decisions about your insurance coverage.

Components of an Auto Insurance Premium

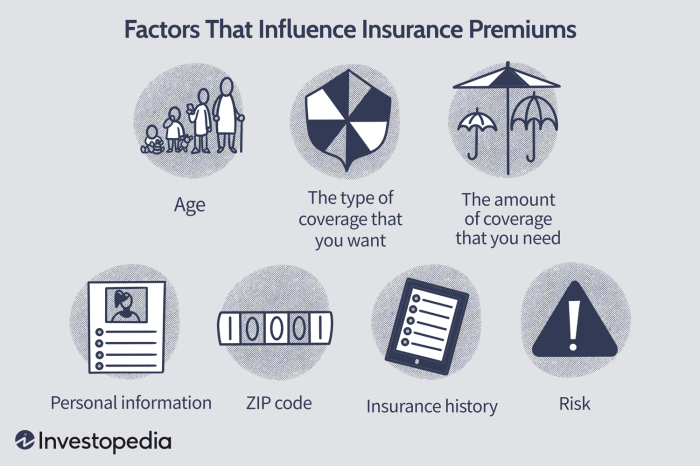

Your auto insurance premium is calculated based on a variety of factors, all contributing to the overall cost. These factors are carefully weighed by insurance companies to assess your risk profile and determine the appropriate premium. A significant portion of the premium goes towards covering claims paid out to policyholders, while the rest covers administrative costs, marketing, and profit margins for the insurance company.

Factors Influencing Premium Calculation

Several key factors influence the calculation of your auto insurance premium. These factors are analyzed individually and collectively to arrive at a final premium amount. For example, your driving history plays a significant role, with a clean record typically leading to lower premiums than a record marred by accidents or traffic violations. Your age, location (urban areas often have higher premiums due to increased accident rates), and the type of vehicle you drive also significantly impact your premium. The value of your vehicle, your credit score, and the amount of coverage you choose are additional important considerations. For instance, a newer, more expensive car will generally result in a higher premium than an older, less valuable one. Similarly, comprehensive coverage, which covers a broader range of incidents, typically costs more than liability-only coverage.

Premium vs. Deductible

It’s essential to understand the difference between your premium and your deductible. Your premium is the regular payment you make to maintain your insurance coverage. Your deductible, on the other hand, is the amount you’ll have to pay out-of-pocket before your insurance coverage kicks in after an accident or incident. For example, if you have a $500 deductible and your car repairs cost $2,000, you would pay the first $500, and your insurance company would cover the remaining $1,500. Choosing a higher deductible typically results in a lower premium, as you are assuming more of the financial risk. Conversely, a lower deductible means higher premiums because the insurance company bears a larger portion of the risk.

Impact of Coverage Options on Premiums

The type and amount of coverage you select directly influence your premium. Liability coverage, which protects you against claims from others if you cause an accident, is typically mandatory. However, adding comprehensive and collision coverage, which cover damage to your own vehicle, increases your premium. Similarly, adding optional coverages like uninsured/underinsured motorist protection or roadside assistance will also increase the overall cost of your premium. For example, opting for higher liability limits will generally lead to a higher premium, as it reflects a greater potential payout from the insurance company. Conversely, choosing only the minimum required liability coverage will likely result in a lower premium, but it also leaves you with less financial protection in the event of a significant accident.

Factors Affecting Premium Costs

Several interconnected factors influence the cost of your auto insurance premium. Understanding these factors can help you make informed decisions and potentially save money. This section will detail the key elements that insurance companies consider when calculating your premium.

Driving History

Your driving record significantly impacts your premium. A clean driving history, characterized by the absence of accidents, traffic violations, and claims, generally results in lower premiums. Conversely, a history of accidents, speeding tickets, or at-fault collisions will likely lead to higher premiums. Insurance companies view these incidents as indicators of higher risk, thus justifying increased premiums to offset potential future claims. For instance, a driver with two speeding tickets and a prior accident might face a premium increase of 20-30% compared to a driver with a spotless record. The severity of the incidents also plays a crucial role; a major accident will have a far greater impact than a minor fender bender.

Age and Gender

Statistically, age and gender correlate with accident rates. Younger drivers, particularly those in their late teens and early twenties, tend to have higher accident rates than older, more experienced drivers. This higher risk translates into higher premiums for younger drivers. Similarly, historical data often shows differences in accident rates between genders, which can be reflected in premium calculations. However, it’s crucial to note that this is a complex issue and regulations regarding gender-based pricing vary across jurisdictions. Many insurance companies are moving towards gender-neutral pricing in alignment with evolving social norms and legal requirements.

Vehicle Type and Model

The type and model of your vehicle significantly affect your insurance premium. High-performance vehicles, luxury cars, and vehicles with a history of theft or high repair costs generally command higher premiums due to their increased risk profile. Conversely, more economical and less expensive vehicles typically attract lower premiums. For example, insuring a high-performance sports car will be considerably more expensive than insuring a compact sedan, reflecting the higher repair costs and greater potential for damage in the event of an accident. Features like safety technology (e.g., anti-lock brakes, airbags) can also influence premiums, often leading to discounts for vehicles equipped with advanced safety features.

Geographic Location

Your location plays a significant role in determining your insurance premium. Areas with higher crime rates, more frequent accidents, and higher repair costs tend to have higher insurance premiums. Urban areas often have higher premiums than rural areas due to increased traffic congestion, higher risk of theft, and greater likelihood of accidents. For instance, a driver living in a densely populated city with a high crime rate will likely pay more for car insurance than a driver residing in a quiet suburban area. Insurance companies use sophisticated actuarial models to assess risk based on location-specific data.

| Factor | Description | Impact on Premium | Example |

|---|---|---|---|

| Driving History | Accidents, tickets, claims | Higher premiums for poor history, lower for clean record | Two accidents = 30% premium increase |

| Age and Gender | Statistical correlation with accident rates | Younger drivers and historically higher-risk genders may pay more | 20-year-old driver pays more than 40-year-old driver |

| Vehicle Type and Model | Vehicle cost, repair costs, safety features, theft risk | Higher premiums for expensive, high-performance vehicles | Sports car premium higher than compact car premium |

| Geographic Location | Crime rates, accident frequency, repair costs | Higher premiums in high-risk areas | City driver pays more than rural driver |

Types of Auto Insurance Coverage and Premiums

Understanding the different types of auto insurance coverage is crucial for determining your premium cost. The more comprehensive your coverage, the higher your premium will generally be, but also the greater your financial protection in the event of an accident or other incident. Conversely, choosing minimal coverage will result in lower premiums but leaves you more financially vulnerable.

The relationship between coverage type and premium cost is directly proportional: more coverage equals higher premiums. This is because the insurance company is assuming a greater financial risk by offering broader protection. For example, liability coverage, which protects you against claims from others, typically costs less than comprehensive coverage, which covers damage to your vehicle from events like theft or hail. However, the level of liability coverage also significantly impacts the premium. Higher liability limits mean higher premiums because the insurance company is taking on more responsibility for potential payouts.

Liability Coverage and Premiums

Liability coverage pays for damages or injuries you cause to others in an accident. The cost of liability coverage varies greatly depending on the liability limits you choose. Higher limits, such as $500,000/$1,000,000 (meaning $500,000 per person and $1,000,000 per accident), will result in significantly higher premiums than lower limits, such as $25,000/$50,000. The increased premium reflects the increased risk the insurance company assumes. Consider a scenario where an accident results in serious injuries requiring extensive medical treatment and rehabilitation. A low liability limit could leave you personally liable for substantial costs exceeding your coverage.

Collision and Comprehensive Coverage Premiums

Collision coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage protects against damage from non-accident events, such as theft, vandalism, fire, or hail. Both collision and comprehensive coverage significantly impact premiums. Drivers with a history of accidents or claims may find their premiums for these coverages much higher than those with clean driving records. For instance, a driver with multiple at-fault accidents might face significantly higher premiums for collision coverage compared to a driver with a perfect record. The higher premium reflects the increased likelihood of a claim. Similarly, drivers in high-risk areas, such as those with high rates of theft or vandalism, might see higher premiums for comprehensive coverage.

Premium Impact of Different Coverage Types

The following table summarizes the typical impact of different coverage types on auto insurance premiums:

| Coverage Type | Description | Typical Impact on Premiums |

|---|---|---|

| Liability | Pays for damages and injuries you cause to others. | Moderate to High (depending on limits) |

| Collision | Pays for damage to your vehicle in an accident, regardless of fault. | High (varies significantly based on driver history and vehicle value) |

| Comprehensive | Pays for damage to your vehicle from non-accident events (theft, vandalism, etc.). | Moderate (varies based on location and vehicle value) |

| Uninsured/Underinsured Motorist | Protects you if you’re injured by an uninsured or underinsured driver. | Moderate |

| Medical Payments | Covers medical expenses for you and your passengers, regardless of fault. | Low to Moderate |

Discounts and Premium Reduction Strategies

Lowering your auto insurance premiums doesn’t necessarily mean compromising on coverage. Numerous discounts and strategic approaches can significantly reduce your costs. Understanding these options and implementing effective strategies can save you a considerable amount of money over time.

Many insurance companies offer a variety of discounts to incentivize safe driving and responsible behavior. These discounts can substantially impact your overall premium, making it worthwhile to explore all available options. Furthermore, choosing the right payment method and proactively managing your driving habits can further reduce expenses.

Available Discounts

Insurance companies frequently offer a range of discounts to reward safe driving and responsible insurance practices. These discounts can significantly reduce your premium. Common examples include safe driver discounts, which reward accident-free driving records, and bundling discounts, which offer reduced rates for combining multiple insurance policies, such as home and auto, with the same provider. Other discounts may be available for things like good student status, completing a defensive driving course, or installing anti-theft devices in your vehicle. The specific discounts offered vary between insurance companies, so it’s essential to compare policies and inquire about all potential savings.

Payment Method Impact

The method you choose to pay your auto insurance premiums can influence the overall cost. While paying annually often results in a lower overall premium due to avoiding monthly processing fees, this option requires a larger upfront payment. Monthly payments, while more manageable financially, typically come with a slightly higher overall cost due to administrative fees. Carefully weigh the convenience of monthly payments against the potential savings of annual payments to determine the best option for your financial situation. For example, a hypothetical annual premium of $1200 might translate to $100 per month with added fees, resulting in a slightly higher total cost.

Strategies for Premium Reduction

Reducing your auto insurance premiums without sacrificing coverage involves a combination of proactive measures and informed decision-making. Maintaining a clean driving record is paramount, as accidents and traffic violations significantly increase premiums. Choosing a vehicle with favorable safety ratings and lower insurance risk profiles can also lead to lower premiums. Furthermore, increasing your deductible (the amount you pay out-of-pocket before insurance coverage kicks in) can reduce your monthly premiums, although this increases your personal financial risk in the event of an accident. Regularly reviewing your coverage and comparing quotes from different insurance providers can also help you find the most cost-effective plan that meets your needs.

Methods to Lower Premiums

- Maintain a clean driving record.

- Bundle home and auto insurance.

- Take a defensive driving course.

- Install anti-theft devices.

- Choose a vehicle with high safety ratings.

- Increase your deductible (within your comfort level).

- Shop around and compare quotes from multiple insurers.

- Pay annually if financially feasible.

- Maintain good credit (credit score can impact premiums in some states).

Ultimate Conclusion

Ultimately, understanding your auto insurance premium is key to responsible car ownership. By carefully considering the factors that influence your premium and exploring available discounts, you can secure the appropriate level of coverage while managing your expenses effectively. This guide provides a solid foundation for making informed decisions and finding the best auto insurance policy to meet your individual needs. Remember to regularly review your policy and shop around to ensure you’re getting the best value for your money.

Essential FAQs

What is the difference between a premium and a deductible?

Your premium is the regular payment you make to maintain your insurance coverage. Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in after an accident.

How often can I expect my premiums to change?

Premiums can change annually, or even more frequently depending on your insurer and your driving record. Significant changes in your risk profile (like a moving violation) can lead to immediate premium adjustments.

Can I pay my premium in installments?

Most insurers offer payment plans, allowing you to pay your premium monthly or quarterly. However, paying annually often results in lower overall costs due to reduced administrative fees.

What happens if I cancel my auto insurance policy?

Cancelling your policy before its term ends may result in penalties or fees depending on your insurer’s policy. It’s important to review your policy’s cancellation clause.