Navigating the world of auto insurance can feel like deciphering a complex code. Premiums vary wildly, leaving drivers wondering how to secure the best coverage at the most affordable price. This guide cuts through the confusion, offering a clear and concise path to understanding and comparing auto insurance premiums, empowering you to make informed decisions and save money.

From understanding the factors influencing your premiums to mastering the art of comparing quotes, we’ll equip you with the knowledge and strategies to confidently navigate the insurance landscape. We’ll explore various coverage options, highlight the importance of careful policy analysis, and provide practical examples to illustrate key concepts. By the end, you’ll be well-prepared to choose the auto insurance policy that perfectly aligns with your needs and budget.

Understanding Auto Insurance Premiums

Auto insurance premiums can seem complex, but understanding the factors that influence them empowers you to make informed choices and potentially save money. This section will break down the key components of your premium, the different types of coverage available, and how various factors impact your overall cost.

Factors Influencing Auto Insurance Costs

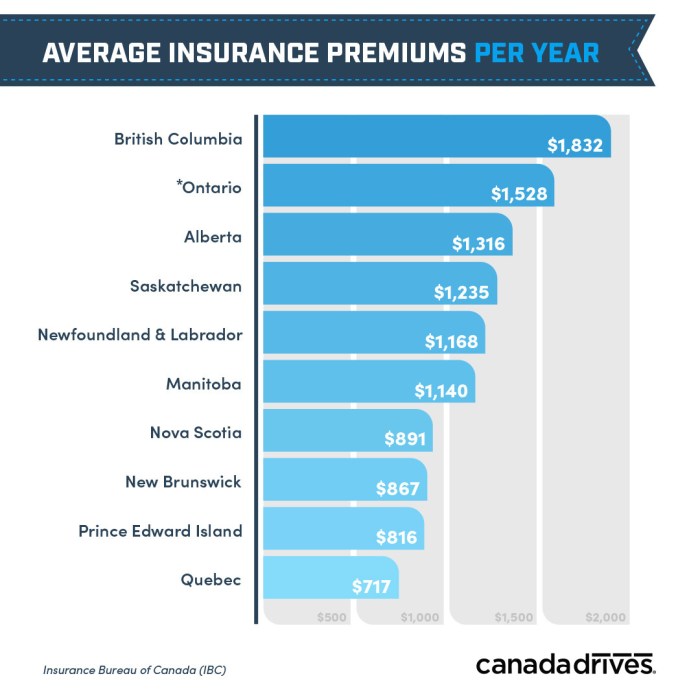

Several factors contribute to the price of your auto insurance. These factors are considered by insurance companies to assess your risk profile. A higher-risk profile typically results in a higher premium. Key factors include your driving history (accidents, tickets), age and driving experience, the type of vehicle you drive (make, model, year), your location (crime rates, accident frequency), and your credit history (in some states). Your chosen coverage levels also significantly impact the premium.

Types of Auto Insurance Coverage

Auto insurance policies typically offer various coverage options, each designed to protect you and your vehicle in different situations. Liability coverage protects others if you cause an accident. Collision coverage pays for repairs to your vehicle after an accident, regardless of fault. Comprehensive coverage protects your vehicle from non-collision damage, such as theft or weather-related incidents. Uninsured/Underinsured motorist coverage protects you if you are involved in an accident with a driver who lacks adequate insurance. Personal Injury Protection (PIP) covers medical expenses and lost wages for you and your passengers, regardless of fault.

Common Premium Components

Your auto insurance premium is comprised of several key components. The base rate reflects the average cost of insurance for a similar driver and vehicle in your area. This is then adjusted based on your individual risk factors, as described above. The cost of your chosen coverage levels directly impacts the final premium; higher coverage limits generally mean higher premiums. Administrative fees and other charges are added to the base rate and coverage costs to arrive at your final premium.

Comparison of Coverage Levels

The following table illustrates how the cost of different coverage levels might vary. These are sample figures and will vary greatly depending on the factors mentioned previously. Always obtain quotes from multiple insurers for a personalized comparison.

| Coverage Level | Liability | Collision | Comprehensive |

|---|---|---|---|

| Minimum State Requirements | $300 | $200 | $150 |

| Higher Liability Limits | $500 | $200 | $150 |

| Full Coverage (High Limits) | $700 | $350 | $250 |

| Additional Coverage (e.g., Uninsured Motorist) | $800 | $350 | $250 |

Methods for Comparing Auto Insurance Premiums

Finding the best auto insurance rates requires a strategic approach. This involves leveraging various resources and carefully analyzing the information provided by different insurance companies. Understanding the different methods available, and their respective advantages and disadvantages, is crucial for making an informed decision that best suits your needs and budget.

Strategies for Finding the Best Auto Insurance Rates

Several effective strategies can help you secure the most competitive auto insurance rates. These methods involve utilizing online resources, contacting insurers directly, and carefully comparing policy details.

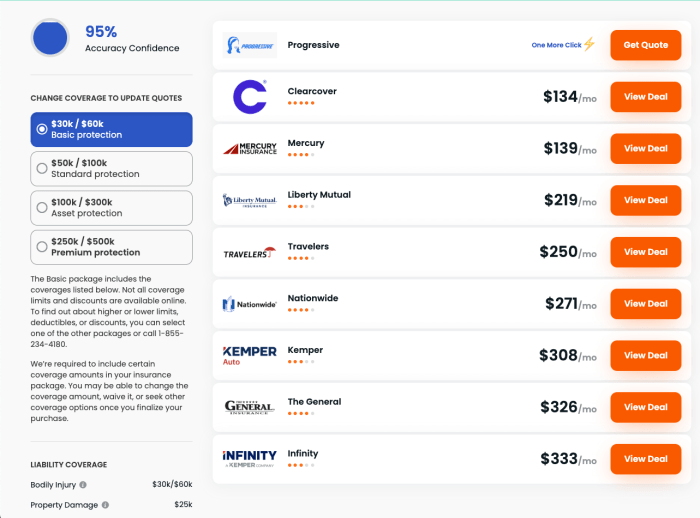

- Utilize Online Comparison Tools: Many websites allow you to input your information and receive quotes from multiple insurers simultaneously. This saves time and effort in the initial stages of your search.

- Contact Insurers Directly: While online tools are convenient, contacting insurers directly can provide a more personalized experience and allow you to ask specific questions about policy details.

- Leverage Insurance Brokers: Independent insurance brokers can compare quotes from a wide range of insurers on your behalf, potentially saving you time and identifying options you might have missed.

- Bundle Insurance Policies: Many insurers offer discounts for bundling multiple insurance policies, such as home and auto insurance, under a single provider.

Advantages and Disadvantages of Using Online Comparison Tools

Online comparison tools offer significant benefits, but also have limitations. A balanced understanding of both is essential for effective use.

- Advantages: Convenience, time-saving, access to a wide range of insurers, quick quote comparisons.

- Disadvantages: Limited customization options, potential for incomplete information, difficulty in comparing nuanced policy details, reliance on algorithm-driven results which may not always perfectly reflect individual needs.

Importance of Reading Policy Details Carefully

Simply focusing on the premium amount is insufficient. A thorough review of the policy documents is crucial to ensure the coverage adequately protects your needs. Overlooking crucial details can lead to inadequate protection in the event of an accident or other covered incident.

For example, comparing policies solely on price might lead you to choose a policy with a high deductible, leaving you with significant out-of-pocket expenses in the event of a claim. Similarly, overlooking specific coverage limitations could leave you unprotected in certain scenarios.

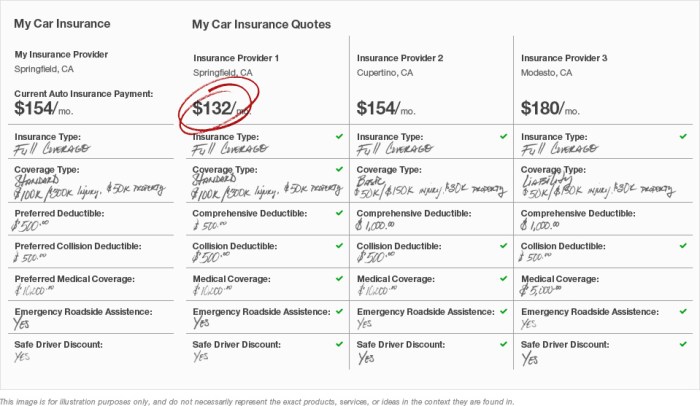

Step-by-Step Guide to Comparing Quotes from Multiple Insurers

A systematic approach ensures a thorough comparison. This method minimizes the risk of overlooking critical information and facilitates a more informed decision.

- Gather Necessary Information: Collect all relevant information, such as your driving history, vehicle details, and desired coverage levels.

- Obtain Quotes from Multiple Insurers: Utilize online comparison tools and contact insurers directly to obtain at least three to five quotes.

- Compare Coverage Details: Carefully review each policy’s coverage limits, deductibles, exclusions, and other relevant terms and conditions. Pay close attention to details like liability limits, collision and comprehensive coverage, and uninsured/underinsured motorist protection.

- Analyze Pricing and Value: Consider the total cost of the policy, including any discounts or additional fees, in relation to the level of coverage provided. Don’t just focus on the premium; evaluate the value you receive for your money.

- Read Reviews and Ratings: Research the insurers’ financial stability and customer service ratings from independent sources to gauge their reliability and responsiveness.

- Make an Informed Decision: Based on your thorough comparison, select the policy that best balances cost, coverage, and insurer reputation.

Illustrative Examples

Understanding the factors influencing auto insurance premiums is best done through concrete examples. The following scenarios demonstrate how various aspects of your driving history and vehicle choice affect your costs.

Speeding Ticket Impact on Premiums

A speeding ticket significantly impacts your insurance premium. Let’s consider Sarah, a 28-year-old with a clean driving record. Her annual premium for comprehensive coverage is $1200. After receiving a speeding ticket, her insurance company increases her premium by 20%, raising her annual cost to $1440. This increase reflects the higher risk associated with speeding. The severity of the ticket and the driver’s history influence the percentage increase; multiple speeding tickets will result in even higher premiums. This example highlights the financial consequences of traffic violations.

Safe Driving Record Premium Reduction

Conversely, maintaining a clean driving record leads to substantial savings. John, a 35-year-old driver, has held a spotless record for ten years. His insurer rewards his safe driving by offering a 15% discount on his premium. If his initial premium was $1500, the discount reduces his annual cost to $1275. Many insurance companies offer loyalty discounts and safe driver bonuses, further incentivizing safe driving practices. This case shows the financial benefits of responsible driving.

Premium Comparison: Sedan vs. SUV

Vehicle type significantly influences insurance costs. Comparing a mid-size sedan and a mid-size SUV, both driven by a 30-year-old with a clean driving record, reveals a price difference. The sedan might have an annual premium of $1100, while the SUV, due to its higher repair costs and potential for greater damage in an accident, could cost $1400 annually. This difference illustrates how the inherent risk associated with different vehicle types impacts insurance premiums. Factors like safety ratings and theft rates also contribute to this variation.

Age and Driving Experience Impact on Premiums

A bar graph visually depicts the relationship between age, driving experience, and premiums. The horizontal axis represents age (18-65), while the vertical axis shows the premium cost. The graph displays several lines, each representing a different level of driving experience (e.g., 0-2 years, 3-5 years, 5+ years). Younger drivers with less experience have significantly higher premiums, represented by a tall bar at the left of the graph. As age and experience increase, the premium gradually decreases, illustrated by a descending line towards the right of the graph, showing lower premiums for older, more experienced drivers. The graph clearly shows that premiums are highest for young, inexperienced drivers and progressively decline with age and experience.

Choosing the Right Policy

Selecting the most suitable auto insurance policy involves careful consideration of several key factors to ensure you receive adequate coverage at a price you can afford. This decision shouldn’t be taken lightly, as the wrong choice could leave you financially vulnerable in the event of an accident.

Coverage Limits and Deductibles

Understanding coverage limits and deductibles is crucial for determining the right policy. Coverage limits define the maximum amount your insurer will pay for covered losses, such as bodily injury or property damage. Higher limits offer greater protection but typically result in higher premiums. Conversely, the deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible lowers your premium but increases your financial responsibility in the event of a claim. For example, a policy with a $500 deductible will cost less than one with a $1000 deductible, but you’ll pay $500 more out of pocket if you file a claim. The optimal balance between coverage limits and deductible depends on your individual risk tolerance and financial situation.

Policy Terms and Conditions

A thorough review of the policy’s terms and conditions is essential before purchasing. This includes understanding the specific coverages provided, exclusions (situations where coverage doesn’t apply), and the claims process. Pay close attention to details such as roadside assistance, rental car reimbursement, and uninsured/underinsured motorist coverage. Comparing policies side-by-side, using a comparison tool or carefully reading policy documents, allows you to identify key differences and choose the policy that best fits your needs. For instance, one policy might offer better roadside assistance than another, even if their premiums are similar.

Essential Considerations Checklist

Before finalizing your auto insurance purchase, consider the following:

- Your driving history: Accidents and traffic violations significantly impact premiums.

- Your vehicle’s make, model, and year: These factors influence the cost of repairs and replacement.

- Your location: Insurance rates vary by geographic location due to factors like accident frequency and crime rates.

- Your driving habits: Mileage, commuting distance, and driving style can all influence premiums.

- Your coverage needs: Assess your risk tolerance and financial situation to determine appropriate coverage limits and deductibles.

- The insurer’s financial stability and customer service ratings: Choose a reputable insurer with a proven track record.

- Policy discounts: Explore available discounts, such as those for safe driving, bundling policies, or paying in full.

Final Summary

Ultimately, comparing auto insurance premiums is not just about finding the cheapest option; it’s about finding the best value. By carefully considering your individual needs, understanding the factors influencing premiums, and utilizing the comparison strategies Artikeld in this guide, you can confidently secure a policy that offers comprehensive coverage at a price you can afford. Remember, proactive research and informed decision-making are your best allies in the world of auto insurance.

Query Resolution

What is a deductible?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally lead to lower premiums.

How often should I compare auto insurance quotes?

It’s recommended to compare quotes annually, or even more frequently if your circumstances change significantly (e.g., new car, moving, changes in driving record).

Can my credit score affect my auto insurance premium?

In many states, your credit score is a factor in determining your insurance premium. A higher credit score generally leads to lower premiums.

What is liability coverage?

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It covers their medical bills and property damage.