Navigating the world of auto insurance can feel like driving through a dense fog, especially when considering the nuances of six-month premiums. While annual policies are the norm, opting for a shorter-term plan can offer surprising advantages or drawbacks depending on your individual circumstances. This guide unravels the complexities of six-month auto insurance premiums, providing a clear understanding of cost factors, provider comparisons, and ultimately, helping you make an informed decision that best suits your needs.

We’ll explore the key factors influencing premium costs, including driving history, vehicle type, location, and coverage choices. We’ll then delve into a comparison of pricing strategies from leading insurance providers, equipping you with the tools to find the most competitive rates. By the end, you’ll be confident in your ability to choose the right six-month policy and potentially save money in the process.

Factors Affecting 6-Month Premium Costs

Understanding the factors that influence your six-month auto insurance premium is crucial for budgeting and making informed decisions. Several key elements contribute to the final cost, and this section will explore those in detail. By understanding these factors, you can better predict your premium and potentially find ways to lower it.

Driver Rating Factors

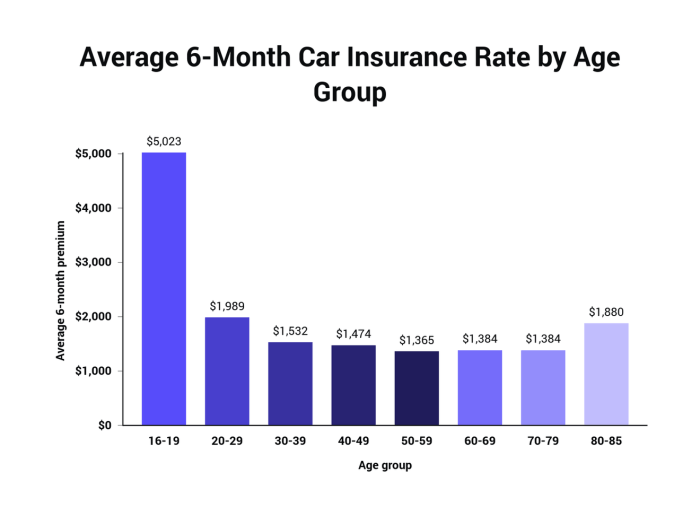

Your driving record is a primary determinant of your insurance premium. Insurers assess risk based on your history, and a clean record typically translates to lower premiums. Factors such as age, years of driving experience, and your driving record are considered. Younger drivers, particularly those with limited experience, generally face higher premiums due to statistically higher accident rates. Conversely, experienced drivers with a history of safe driving often qualify for discounts. The insurer uses a complex algorithm considering all these factors to generate a driver rating score that significantly impacts the final premium.

Driving History’s Influence

Accidents and traffic violations significantly impact your 6-month premium. Each incident adds to your risk profile, leading to higher premiums. The severity of the accident (e.g., a fender bender versus a major collision) and the number of at-fault accidents play a substantial role. Similarly, speeding tickets, reckless driving citations, and DUI convictions substantially increase your premium. For example, a single at-fault accident could result in a 20-40% increase in your premium for the following six months, while multiple violations can lead to even higher increases or policy cancellations.

Vehicle Type, Location, and Coverage Options

The type of vehicle you insure directly affects your premium. Sports cars and high-performance vehicles generally command higher premiums due to their higher repair costs and increased risk of theft. Conversely, smaller, less expensive vehicles usually result in lower premiums. Your location also plays a significant role. Areas with high crime rates or a high frequency of accidents will generally have higher insurance premiums due to the increased risk of claims. Finally, the level of coverage you choose directly impacts your premium. Comprehensive and collision coverage, while providing greater protection, are more expensive than liability-only coverage.

Coverage Level Impact on 6-Month Premium

The different levels of coverage you select significantly affect your six-month premium. Here’s a breakdown:

- Liability-Only: This covers damages to other people and their property in an accident where you are at fault. It’s the most basic and least expensive coverage.

- Liability + Collision: This adds coverage for damage to your vehicle, regardless of fault. It increases the premium compared to liability-only.

- Liability + Collision + Comprehensive: This includes collision coverage and adds protection against damage caused by events other than collisions (e.g., theft, vandalism, hail damage). This is the most comprehensive and expensive option.

For instance, a liability-only policy for a standard sedan in a low-risk area might cost $500 for six months. Adding collision coverage might increase that to $800, while adding comprehensive coverage could bring the total to $1000 or more. These figures are illustrative and vary greatly depending on all the factors discussed above.

Comparison of Insurance Providers for 6-Month Policies

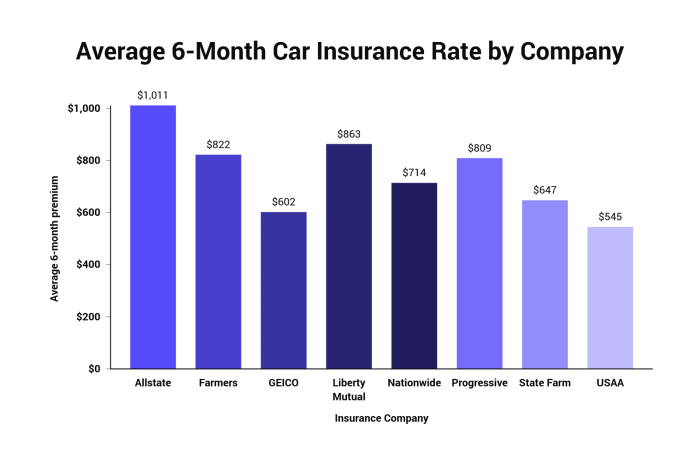

Choosing a six-month auto insurance policy often requires comparing different providers to find the best fit for your needs and budget. This comparison focuses on pricing strategies, features, and the calculation of total costs for three major providers – Geico, State Farm, and Progressive – to illustrate the process. Note that prices and features can vary significantly based on individual factors like driving history, location, and the type of vehicle.

Pricing Strategies of Three Major Providers

Each provider employs distinct pricing strategies, influenced by their risk assessment models and market positioning. Geico often emphasizes competitive pricing, aiming to attract customers with lower premiums. State Farm, known for its extensive network and long history, may offer slightly higher premiums but often includes additional benefits and customer service features. Progressive, with its focus on personalized pricing through its “Name Your Price® Tool,” allows customers to see options within a specified budget, making it attractive to those seeking more control over their premiums. These strategies are not static and can change based on market conditions and internal adjustments.

Features and Benefits Offered by Each Provider

The features included in a six-month policy vary among providers. While basic liability coverage is standard, additional benefits like roadside assistance, rental car reimbursement, and accident forgiveness may differ in availability and cost. Geico might offer competitive pricing on add-ons, while State Farm might bundle several features into a package. Progressive’s focus on customization allows for a greater degree of flexibility in choosing the features most important to the individual.

Comparison Table of 6-Month Auto Insurance Policies

The following table provides a hypothetical comparison, illustrating potential differences in pricing and features. Remember that actual quotes will vary based on individual circumstances.

| Provider | Base Premium (6 months) | Roadside Assistance | Rental Car Reimbursement | Accident Forgiveness | Estimated Total Cost (with taxes and fees) |

|---|---|---|---|---|---|

| Geico | $600 | Included | Optional ($50/6 months) | Optional ($25/6 months) | $675 (assuming 12.5% for taxes and fees) |

| State Farm | $650 | Included | Included | Included | $731.25 (assuming 12.5% for taxes and fees) |

| Progressive | $575 | Optional ($40/6 months) | Optional ($60/6 months) | Optional ($30/6 months) | $688.75 (assuming 12.5% for taxes and fees, with Roadside Assistance and Accident Forgiveness) |

Calculating Total Cost for a 6-Month Policy

Calculating the total cost involves adding any applicable fees and taxes to the base premium. The example above assumes a 12.5% additional cost for taxes and fees, a common range, but this percentage can vary significantly by state and provider. The formula used is:

Total Cost = Base Premium + (Base Premium * Tax Rate) + Additional Feature Costs

For example, with Geico, if you add rental car reimbursement and accident forgiveness, the calculation would be: $600 + ($600 * 0.125) + $50 + $25 = $735. It is crucial to obtain a detailed quote from each provider to determine the precise total cost based on your specific situation and chosen features.

Finding and Choosing the Right 6-Month Policy

Securing the best six-month auto insurance policy involves a strategic approach. By comparing quotes, negotiating effectively, and carefully reviewing policy terms, you can find a plan that offers comprehensive coverage at a price that fits your budget. This section Artikels the steps involved in this process.

Obtaining Quotes from Multiple Insurance Providers

Gathering quotes from several insurers is crucial for finding the most competitive price. Begin by compiling a list of reputable insurance companies operating in your area. You can find this information online through comparison websites or by directly visiting the websites of major insurance providers. Next, use each company’s online quoting tool, providing accurate information about your vehicle, driving history, and desired coverage. Remember to specify that you require a six-month policy. Compare the quotes carefully, paying attention to not only the premium but also the coverage details. Note that some companies may offer discounts for bundling policies or for safe driving records.

Negotiating a Lower Premium

Once you’ve received several quotes, you can leverage this information to negotiate a lower premium. Contact the insurance companies with the most appealing quotes and politely inquire about potential discounts or adjustments. Highlight any factors that might make you a low-risk driver, such as a clean driving record, accident-free history, or safety features in your vehicle. Some insurers may be willing to negotiate if you can demonstrate your commitment to safe driving practices. Consider mentioning quotes you’ve received from competitors; this can sometimes incentivize them to offer a more competitive rate.

Understanding the Policy’s Terms and Conditions

Before committing to a six-month policy, thoroughly review the terms and conditions. Pay close attention to the coverage details, deductibles, and exclusions. Understand what situations are covered by the policy and what situations are not. Clarify any aspects that are unclear by contacting the insurance company directly. Failing to understand the policy terms could lead to unexpected costs or insufficient coverage in case of an accident. Ensure the policy accurately reflects your needs and expectations.

Making Changes or Canceling a 6-Month Auto Insurance Policy

Most insurance companies allow for policy changes or cancellations, but there may be associated fees or penalties. If you need to make changes to your policy, such as updating your address or adding a driver, contact your insurer immediately. Similarly, if you need to cancel your policy before the six-month term expires, contact them to understand the cancellation process and any applicable fees. The specific procedures and fees will vary depending on the insurance company and the reason for cancellation. Always obtain written confirmation of any changes or cancellations.

Concluding Remarks

Ultimately, the decision between a six-month and an annual auto insurance policy hinges on individual circumstances and financial priorities. By carefully weighing the advantages and disadvantages discussed here, considering your specific risk profile, and comparing quotes from multiple providers, you can make a well-informed choice that provides the necessary coverage at the most reasonable cost. Remember to thoroughly review the policy terms and conditions before committing to any plan. Driving safely and maintaining a clean driving record will always be the most effective way to keep your premiums low, regardless of the policy length.

Questions and Answers

What are the potential downsides of a 6-month auto insurance policy?

Six-month policies often come with slightly higher overall costs compared to annual policies due to administrative fees. You also might miss out on potential discounts offered for annual payments.

Can I switch from a 6-month policy to an annual policy mid-term?

Generally, yes, but you’ll need to contact your insurer to discuss the process and any potential fees or adjustments to your premium.

Does my credit score affect my 6-month auto insurance premium?

In many states, yes. Insurers often consider credit history as a factor in determining risk and setting premiums. A better credit score could lead to lower premiums.

How do I cancel a 6-month auto insurance policy?

Contact your insurance provider to initiate the cancellation process. Be aware that there may be cancellation fees depending on your policy terms and state regulations.