Navigating the complexities of health insurance can feel like deciphering a foreign language. One crucial aspect often shrouded in confusion is the deductibility of health insurance premiums. Understanding whether your premiums are tax-deductible can significantly impact your overall healthcare costs. This guide will unravel the intricacies of premium deductibility at both the federal and state levels, exploring the various factors influencing eligibility and offering practical examples to clarify the process.

We’ll delve into the different types of health insurance plans, the impact of Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs), and the specific circumstances under which deductions are permitted. By the end, you’ll possess a clearer understanding of how to potentially reduce your tax burden through deductible health insurance premiums.

Defining Health Insurance Premiums

Health insurance premiums are the recurring payments you make to maintain your health insurance coverage. Think of it as the price you pay for the peace of mind knowing you have financial protection against unexpected medical expenses. Understanding the components and factors influencing these premiums is crucial for making informed decisions about your health insurance plan.

Components of Health Insurance Premiums

Several factors contribute to the final cost of your health insurance premium. These components are often bundled together, making it difficult to isolate each individual cost. However, understanding the general categories helps in evaluating the overall value of a plan. These components typically include administrative costs (covering the insurer’s operational expenses), claims payments (covering the costs of medical services for policyholders), profit margins (the insurer’s earnings), and reserves (funds set aside for unexpected claims). The relative weight of each component varies based on the insurance company, the type of plan, and the overall health of the insured population.

Factors Influencing Premium Costs

Numerous factors influence how much you pay for your health insurance. Your age is a significant factor, with older individuals generally paying more due to a higher likelihood of needing medical care. Your geographic location also plays a role; premiums tend to be higher in areas with high healthcare costs. Your health status, including pre-existing conditions, is another key determinant. People with pre-existing conditions often face higher premiums, reflecting the increased risk to the insurer. The type of plan you choose (e.g., HMO, PPO) significantly impacts the premium. Higher coverage plans with lower out-of-pocket costs typically come with higher premiums. Finally, the number of people covered under the plan (individual vs. family) significantly affects the premium. Family plans naturally cost more than individual plans.

Types of Health Insurance Premiums

Health insurance premiums vary widely depending on the context. Individual premiums are paid by individuals for their own coverage. Family premiums cover multiple individuals, typically a family unit. Employer-sponsored premiums are a common arrangement where the employer contributes a portion or the entire premium cost. The employer’s contribution can significantly reduce the employee’s out-of-pocket expense, but the plan design and employer contribution levels vary greatly depending on the employer and the employee’s benefit package. Government-subsidized premiums, such as those offered through the Affordable Care Act (ACA) marketplaces in the United States, are designed to make health insurance more affordable for lower-income individuals and families.

Premium Cost Comparison

| Premium Type | Factors Affecting Cost | Average Cost (range) | Deductibility Status |

|---|---|---|---|

| Individual | Age, location, health status, plan type | $400 – $1000+ per month | Generally not deductible, except as part of self-employment expenses |

| Family | Age, location, health status of all covered members, plan type, number of dependents | $1000 – $3000+ per month | Generally not deductible, except as part of self-employment expenses |

| Employer-Sponsored | Employer’s contribution, employee’s contribution, plan type, employee’s age, location | Varies widely based on employer contribution | Employee contributions are generally not deductible, employer contributions are deductible as a business expense. |

Federal Tax Deductibility of Premiums

Understanding the federal tax deductibility of health insurance premiums can significantly impact your tax liability. This section Artikels the circumstances under which these premiums may be deducted, focusing specifically on the self-employed. Careful consideration of these rules is crucial for accurate tax filing.

The deductibility of health insurance premiums for federal income tax purposes depends largely on your employment status. For those employed by a company, premiums are typically paid through payroll deductions, and the employer often covers a portion. In these cases, the premiums themselves aren’t directly deductible by the employee. However, for the self-employed, the rules differ significantly, offering a valuable tax break.

Self-Employed Health Insurance Deduction

Self-employed individuals can deduct the amount they paid for health insurance premiums. This deduction is available even if they don’t itemize deductions on their tax return. This deduction helps offset the cost of health insurance, a significant expense for many independent contractors and small business owners. It’s important to note that this deduction is for health insurance premiums only, not other medical expenses.

Requirements for Claiming the Deduction

To claim the self-employed health insurance deduction, several requirements must be met. First, you must be self-employed or a freelancer. Second, the insurance must be for you, your spouse, and your dependents. Third, you must not be eligible to participate in an employer-sponsored health plan. Finally, you must have reported your business income and expenses on Schedule C or Schedule F of Form 1040.

The deduction is taken above the line, meaning it’s deducted from your gross income before calculating your adjusted gross income (AGI). This results in a larger reduction in your taxable income compared to itemized deductions, which are deducted after AGI calculation. The amount you can deduct is limited to the actual amount you paid in premiums during the tax year. You’ll need Form 1040, Schedule 1 (Additional Income and Adjustments to Income), and Form 8889 (Health Savings Accounts (HSAs)) if applicable, to claim this deduction.

Claiming the Premium Deduction: A Flowchart

The following flowchart visually Artikels the process of claiming the self-employed health insurance deduction:

[Imagine a flowchart here. The flowchart would start with a box: “Are you self-employed and not eligible for employer-sponsored health insurance?”. A “Yes” branch would lead to a box: “Did you pay health insurance premiums for yourself, spouse, and/or dependents?”. A “Yes” branch leads to a box: “Report premiums on Schedule C or F and Schedule 1 (Form 1040)”. A “No” branch from both initial questions would lead to a box: “Deduction not applicable”. A final box would read: “File your tax return.”]

State Tax Deductibility of Health Insurance Premiums

While the federal government offers limited tax benefits for health insurance premiums, several states provide additional deductions or credits, significantly impacting the overall cost for residents. The availability and specifics of these state-level deductions vary considerably, making it crucial to understand your state’s regulations. This section Artikels the complexities of state tax deductibility for health insurance premiums, offering a comparative analysis against federal provisions and providing examples.

State tax deductions for health insurance premiums differ significantly from federal deductions. Federally, the deduction is largely tied to self-employment or specific health savings account (HSA) contributions, whereas many states offer broader deductions, often encompassing premiums paid for both self-employed individuals and those covered under employer-sponsored plans. This divergence highlights the significant role state governments play in supporting healthcare affordability. The specific criteria for eligibility and the amount of the deduction vary widely across states.

State-Specific Deduction Rules

Understanding state-level deductibility requires examining individual state tax codes. Many states allow deductions for self-employed individuals, while others extend this to those with employer-sponsored plans, but with varying limitations and conditions. Some states offer a flat deduction amount, while others base the deduction on a percentage of premiums paid. This lack of uniformity necessitates a careful review of each state’s specific regulations.

Categorization of States Based on Deduction Rules

States can be categorized based on their approach to health insurance premium deductions. One category includes states offering deductions only for self-employed individuals, often with income limitations. Another category encompasses states that allow deductions for both self-employed individuals and those with employer-sponsored plans, possibly with limitations based on income or the type of plan. A third category includes states that offer no deduction for health insurance premiums. The specific rules and eligibility criteria within each category can be quite complex.

Examples of State Tax Forms

The specific forms vary greatly by state. For instance, California’s tax form (Form 540, California Individual Income Tax Return) may include a specific line item or schedule for health insurance premium deductions, while New York’s IT-201 (New York State Resident Income Tax Return) might require a different approach, potentially utilizing a separate schedule or form to claim the deduction. These forms usually provide instructions outlining the necessary documentation and eligibility requirements. Always consult the relevant state’s tax department website for the most up-to-date information and the correct forms.

Impact of Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) are valuable tools that can significantly reduce the out-of-pocket costs associated with healthcare. Understanding how they interact with health insurance premiums and offer tax advantages is crucial for maximizing their benefits. Both HSAs and FSAs allow pre-tax contributions, reducing your taxable income and therefore your tax liability. However, they differ significantly in their eligibility requirements and how funds can be used.

Contributions to HSAs and FSAs do not directly affect the deductibility of health insurance premiums. The deductibility of premiums is determined by federal and state laws, as discussed previously, and is independent of contributions made to these accounts. However, using HSA and FSA funds to pay for healthcare expenses reduces your overall healthcare costs, potentially freeing up more money for other expenses or allowing you to contribute more to other tax-advantaged accounts.

Tax Advantages of HSAs and FSAs

HSAs and FSAs offer substantial tax advantages. Contributions are made pre-tax, meaning they reduce your taxable income, resulting in lower income tax liability. Furthermore, the earnings in an HSA grow tax-deferred, and withdrawals for qualified medical expenses are tax-free. FSAs, while not offering the same investment growth potential, also provide pre-tax contributions and tax-free withdrawals for qualified medical expenses. The key difference lies in the “use it or lose it” nature of most FSAs, whereas HSA funds can roll over year after year.

Calculating Tax Savings with HSAs and FSAs

Calculating tax savings involves determining the reduction in your taxable income due to pre-tax contributions and the resulting decrease in your tax liability. For example, assume a taxpayer is in the 22% tax bracket and contributes $3,000 to an HSA. This $3,000 reduction in taxable income results in a tax savings of $3,000 * 0.22 = $660. Similarly, a $2,000 contribution to an FSA would yield a tax savings of $2,000 * 0.22 = $440 (assuming the same tax bracket). The actual savings will vary depending on the individual’s tax bracket and contribution amount. It’s crucial to note that these calculations only reflect income tax savings; any applicable state taxes would need to be factored in separately.

Comparison of HSAs and FSAs Regarding Tax Deductibility

While neither HSA nor FSA contributions directly impact health insurance premium deductibility, understanding their tax advantages is key to optimizing healthcare savings. The following points highlight key differences:

| Feature | HSA | FSA |

|---|---|---|

| Contribution Limit | Annual limit set by the IRS (indexed annually) | Annual limit set by the employer (varies) |

| Eligibility | Must have a high-deductible health plan (HDHP) | Offered by many employers, regardless of health plan type |

| Rollover | Funds roll over year to year | Funds typically forfeit at year-end (exceptions may apply) |

| Tax Treatment of Contributions | Pre-tax | Pre-tax |

| Tax Treatment of Withdrawals (qualified medical expenses) | Tax-free | Tax-free |

| Investment Growth | Tax-deferred | No investment growth |

Deductibility and Different Insurance Plans

Understanding how different health insurance plan types affect the deductibility of your premiums is crucial for maximizing tax benefits and minimizing your overall healthcare costs. The deductibility of premiums themselves remains largely consistent across plan types, but the interplay between premiums, deductibles, co-pays, and out-of-pocket maximums significantly alters the net cost after tax considerations.

The deductibility of health insurance premiums is primarily determined by your income and whether you itemize deductions on your tax return. The type of plan (HMO, PPO, EPO, etc.) doesn’t directly influence the eligibility for premium deductions, but it profoundly impacts your overall healthcare spending, which in turn affects your tax situation indirectly.

Premium Deductibility Across Plan Types

While the IRS doesn’t differentiate between HMO, PPO, or EPO plans regarding premium deductibility, the choice of plan significantly impacts your out-of-pocket expenses. A higher premium for a plan with lower out-of-pocket costs might result in lower overall costs after tax deductions compared to a lower-premium plan with higher out-of-pocket costs. This is because the tax deduction applies only to the premiums, not to other healthcare expenses.

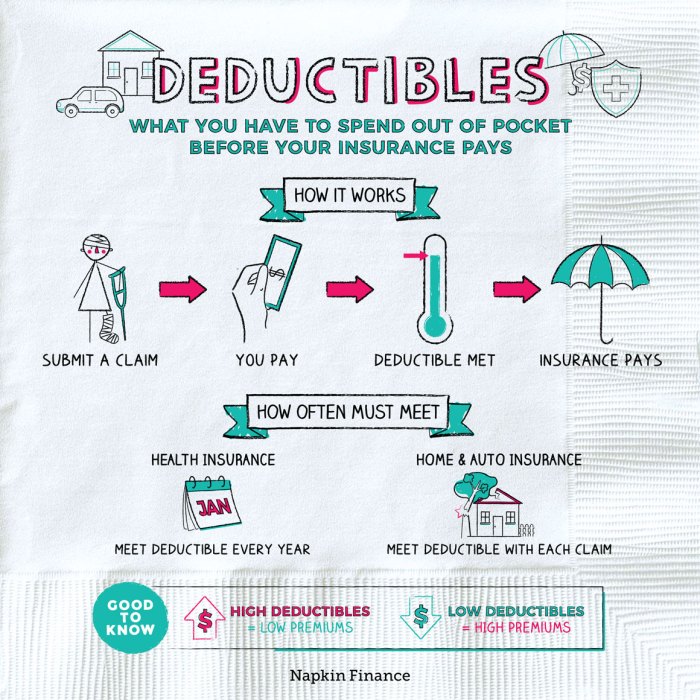

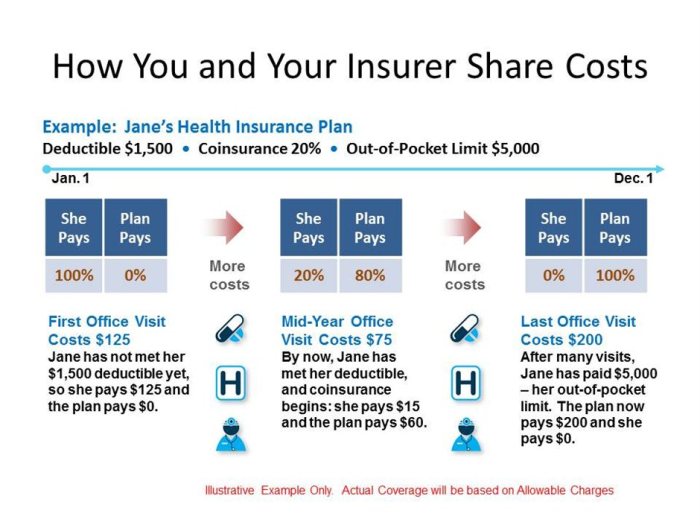

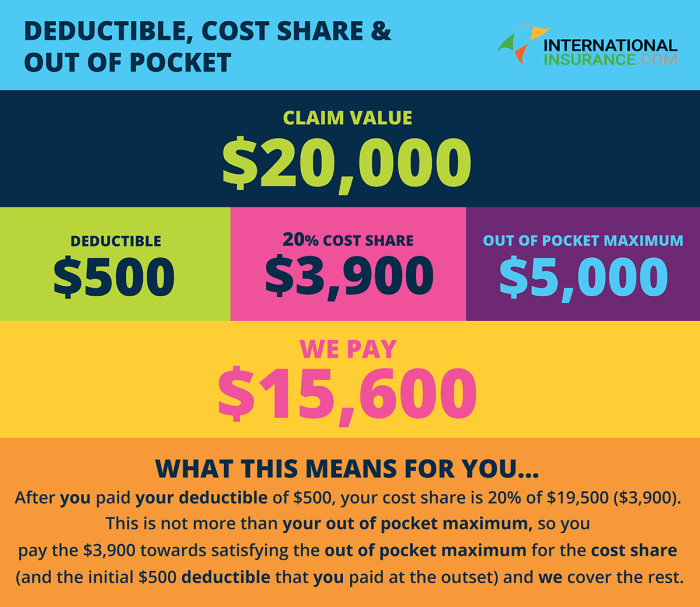

Interaction of Plan Features with Premium Deductibility

Deductibles, co-pays, and out-of-pocket maximums interact with premium deductibility in a significant way, though not directly in terms of eligibility for the deduction itself. A high deductible plan, for example, will have lower premiums, making the tax deduction on those lower premiums less substantial. However, the lower premiums are offset by potentially higher out-of-pocket costs when you need care. Conversely, a low-deductible plan with higher premiums will offer a larger tax deduction on premiums, but you’ll likely pay less out-of-pocket for healthcare services. The optimal choice depends on individual health needs and risk tolerance.

Illustrative Examples of Plan Structures and Overall Cost

Let’s consider two individuals, both eligible for the same premium deduction.

Individual A chooses a high-deductible PPO plan with annual premiums of $3,000 and a $5,000 deductible. Individual B opts for a low-deductible HMO plan with annual premiums of $6,000 and a $1,000 deductible. Assuming both individuals incurred $2,000 in medical expenses, Individual A would pay $2,000 (the deductible) plus $3,000 in premiums. Individual B would pay $1,000 (the deductible) plus $6,000 in premiums. However, Individual B’s larger premium allows for a larger tax deduction, potentially reducing their overall cost more than Individual A’s, despite having higher premiums. The exact tax savings depend on individual tax brackets and other deductions.

Another example: Consider two families, both eligible for the standard deduction. Family A chooses a high-deductible health plan with a $10,000 deductible and $6,000 in premiums. Family B chooses a low-deductible plan with a $2,000 deductible and $12,000 in premiums. If Family A has $8,000 in medical expenses, they pay $8,000 plus $6,000 in premiums. Family B, with the same medical expenses, pays $2,000 plus $12,000 in premiums. Again, the tax deduction on the higher premium for Family B could potentially offset the higher premium cost, depending on individual tax circumstances. The optimal plan depends heavily on the expected healthcare usage and the individual’s tax bracket.

Illustrative Examples of Premium Deductibility

Understanding the deductibility of health insurance premiums can significantly impact your tax liability. The rules surrounding deductibility vary depending on your employment status, the type of health insurance plan you have, and other factors. The following scenarios illustrate how these factors influence the potential tax savings.

Self-Employed Individual with a Qualified Health Plan

Sarah is a self-employed freelance writer. She purchased a qualified health insurance plan with annual premiums totaling $12,000. As a self-employed individual, she can deduct the amount of her health insurance premiums paid during the year from her business income. This deduction reduces her taxable income, resulting in lower tax liability. Assuming a 22% marginal tax bracket, her potential tax savings would be $2,640 ($12,000 x 0.22). However, it’s crucial to note that the deduction is subject to limitations based on her adjusted gross income (AGI). If her AGI exceeds a certain threshold, the deduction may be partially or fully disallowed. Additionally, she must itemize her deductions on her tax return to claim this deduction; she cannot take the standard deduction and deduct health insurance premiums simultaneously.

Employee with Employer-Sponsored Insurance and a High Deductible Plan

John works for a large corporation and participates in their employer-sponsored health insurance plan. His employer pays a portion of his premium, while John contributes $3,000 annually. John also has a health savings account (HSA). Generally, premiums paid by the employer are not deductible by the employee. However, John’s contributions to his HSA are tax-deductible, potentially offering tax advantages. The amount he can deduct depends on his contribution limits, his age, and his family coverage status. The tax savings from his HSA contributions would depend on his tax bracket. For example, if his marginal tax rate is 24%, a $3,000 contribution to the HSA would reduce his taxable income by $3,000, resulting in a tax saving of $720 ($3,000 x 0.24).

Family with Multiple Health Insurance Plans

The Miller family consists of two working parents, David and Mary, and two children. David’s employer provides health insurance, but the family opted for a supplemental plan for broader coverage, costing $6,000 annually. Mary is self-employed and has her own health insurance plan costing $8,000 annually. David’s employer-sponsored premiums are not deductible. However, Mary can deduct her self-employed health insurance premiums, subject to AGI limitations. The potential tax savings for Mary depend on her tax bracket and AGI. Assuming a 28% marginal tax bracket and no AGI limitations, her potential tax savings would be $2,240 ($8,000 x 0.28). The family might also consider the deductibility of HSA contributions, depending on the plans they have.

Outcome Summary

Ultimately, the deductibility of your health insurance premiums hinges on a variety of factors, including your employment status, the type of plan you have, and your state of residence. While the process might seem daunting at first, understanding the underlying principles and utilizing the resources available can empower you to maximize your tax benefits. Remember to consult with a tax professional for personalized advice tailored to your specific situation to ensure you are taking full advantage of all available deductions.

Popular Questions

Can I deduct premiums if I have employer-sponsored insurance?

Generally, no. Premiums for employer-sponsored insurance are typically not deductible for federal income tax purposes, unless you itemize deductions and meet specific criteria related to unreimbursed medical expenses.

What if I’m self-employed and my spouse also works?

The deductibility rules for self-employed individuals still apply. Your spouse’s employment status doesn’t affect your eligibility, although your combined income may impact your overall tax liability.

Are there penalties for incorrectly claiming a deduction?

Yes, claiming a deduction you are not eligible for can result in penalties and interest charges from the IRS. Accurate record-keeping and a thorough understanding of the rules are essential.

What forms are needed to claim the deduction?

For self-employed individuals, you’ll typically use Form 1040, Schedule C, and Form 8889. Specific state forms will vary.

Where can I find more information on state-specific rules?

Consult your state’s department of revenue website or a qualified tax professional for details on state-specific deductibility rules.