The question of whether mortgage insurance premiums (MIPs) are tax-deductible in 2023 is a crucial one for many homeowners. Understanding the intricacies of MIP deductibility can significantly impact your annual tax liability. This guide delves into the current tax laws, eligibility criteria, and calculation methods, providing a clear understanding of this often-complex financial matter. We’ll explore various loan types and offer strategies for managing MIP costs effectively.

This comprehensive analysis will equip you with the knowledge to navigate the complexities of MIP deductions, helping you maximize your tax benefits and make informed financial decisions. We’ll examine both the current landscape and potential future changes, ensuring you’re well-prepared for whatever lies ahead.

Calculating the Deductible Amount

Determining the deductible portion of your mortgage insurance premiums (MIPs) involves a straightforward calculation. The amount you can deduct depends on your specific circumstances and the type of mortgage you have. Generally, you can deduct the amount of MIPs paid during the tax year.

Calculating the deductible MIP amount requires knowing your annual MIP cost. This information is usually found on your mortgage statement or your lender’s annual disclosure. The annual MIP cost is then used to determine the deductible portion. It’s crucial to keep accurate records of your mortgage payments throughout the year to ensure accurate tax calculations.

MIP Deduction Calculation

The calculation itself is simple: the deductible amount is equal to the total MIPs paid during the tax year. There are no further adjustments or complexities for the basic calculation. However, it is important to note that other factors, such as your adjusted gross income (AGI) and other itemized deductions, may affect your overall tax liability. Therefore, it is always advisable to consult a tax professional for personalized advice.

MIP Deduction Examples

To illustrate, let’s consider several scenarios:

| Loan Amount | MIP Percentage | Annual MIP Cost | Deductible Amount |

|---|---|---|---|

| $200,000 | 0.5% | $1,000 | $1,000 |

| $300,000 | 0.75% | $2,250 | $2,250 |

| $150,000 | 1% | $1,500 | $1,500 |

| $400,000 | 0.8% | $3,200 | $3,200 |

Note: These examples assume the entire annual MIP cost is deductible. This may not always be the case, depending on individual circumstances and tax laws. The MIP percentage is an annual rate applied to the loan amount to determine the annual MIP cost. Always consult with a tax professional or refer to the latest IRS guidelines for the most accurate and up-to-date information.

Impact of Loan Type on MIP Deductibility

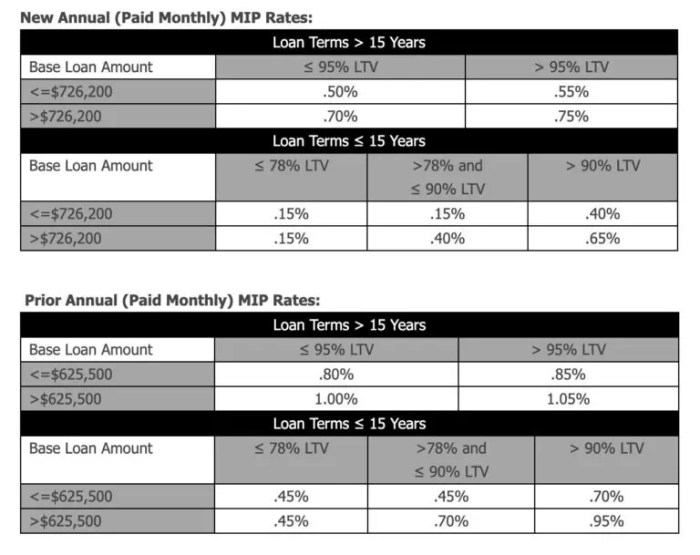

The deductibility of mortgage insurance premiums (MIPs) in the United States hinges significantly on the type of mortgage loan. Different loan programs, such as FHA, VA, and conventional loans, have varying rules regarding MIPs and their tax treatment. Understanding these differences is crucial for accurately calculating your tax deductions.

The primary factor determining MIP deductibility is whether the loan is considered a qualified mortgage under IRS guidelines. This designation impacts how the premiums are handled for tax purposes. Furthermore, loan terms, such as the length of the loan and the type of insurance, can also affect deductibility.

MIP Deductibility for FHA Loans

FHA loans, insured by the Federal Housing Administration, typically require the payment of MIPs. These premiums are usually paid monthly and are added to your regular mortgage payment. For FHA loans obtained after December 31, 2017, the annual MIP is generally deductible. However, it’s important to note that the rules surrounding FHA MIP deductibility can be complex and depend on the specific details of your loan. Always consult your tax advisor or the IRS for the most up-to-date information.

MIP Deductibility for VA Loans

VA loans, guaranteed by the Department of Veterans Affairs, generally do not require MIPs in the traditional sense. Instead, they often involve a funding fee, which is a one-time or upfront charge. This funding fee is usually not deductible. However, some VA loan programs might include other insurance components, and their deductibility should be determined on a case-by-case basis with professional tax advice.

MIP Deductibility for Conventional Loans

Conventional loans, which are not backed by a government agency, may or may not require private mortgage insurance (PMI). PMI functions similarly to MIP, but is offered by private insurers. The deductibility of PMI depends on several factors, including the loan-to-value ratio (LTV) and the year the loan was originated. Generally, PMI is not deductible if the loan was originated after 2017, unless specific circumstances apply. For example, loans with an LTV ratio exceeding 80% may still require PMI, and the deductibility of that PMI needs careful consideration.

Summary of MIP Deductibility Rules by Loan Type

Understanding the nuances of MIP deductibility across different loan types requires careful attention to detail. The following bullet points summarize the key differences:

- FHA Loans: Annual MIP is generally deductible for loans originated after December 31, 2017. Consult a tax professional for specific guidance.

- VA Loans: Funding fees are generally not deductible. Other insurance components may exist and require individual assessment.

- Conventional Loans: PMI is generally not deductible for loans originated after 2017 unless specific conditions are met (e.g., LTV > 80%).

It is crucial to consult with a qualified tax professional to determine the deductibility of your specific MIPs or PMI, as tax laws are subject to change and individual circumstances can significantly impact eligibility.

Tax Form and Filing Procedures

Claiming the deduction for mortgage insurance premiums (MIPs) requires understanding the relevant tax forms and the proper filing procedures. Accurate reporting ensures you receive the tax benefits you’re entitled to. Incorrect reporting can lead to delays or even penalties.

To claim the MIP deduction, you’ll need to use Form 1040, U.S. Individual Income Tax Return, and Schedule A (Form 1040), Itemized Deductions. The MIP deduction is considered an itemized deduction, meaning you can only claim it if you itemize your deductions instead of taking the standard deduction.

Reporting MIP Deductions on Tax Returns

The MIP deduction is reported on Schedule A, specifically in the “Other Miscellaneous Deductions” section. You’ll need to gather all relevant documentation, including your mortgage statement showing the MIP payments made during the tax year. It’s crucial to accurately record the total amount paid in MIPs. Remember, only the amount paid during the tax year is deductible; you cannot deduct payments from previous years.

Step-by-Step Guide for Claiming the MIP Deduction

- Gather your documentation: Collect your mortgage statement(s) clearly showing the MIP payments made during the tax year. Ensure you have the total amount of MIPs paid.

- Complete Form 1040: Fill out your Form 1040, including your personal information and income details.

- Complete Schedule A (Form 1040): Itemize your deductions on Schedule A. This form will include various deductions; find the section for “Other Miscellaneous Deductions.”

- Report MIP payments: In the “Other Miscellaneous Deductions” section of Schedule A, enter the total amount of MIPs you paid during the tax year. You may need to provide a brief description next to the entry, such as “Mortgage Insurance Premiums.”

- Attach supporting documentation: Attach copies of your mortgage statements showing the MIP payments as supporting documentation to your tax return. This helps substantiate your claim and avoids potential issues during an audit.

- File your return: File your completed Form 1040 and Schedule A with the IRS by the tax deadline. You can file electronically or by mail, depending on your preference.

It’s advisable to keep a copy of your completed tax return and all supporting documentation for your records. This is important for future reference and in case of any IRS inquiries. Consider consulting a tax professional if you have complex tax situations or require assistance with the filing process. They can provide personalized guidance and ensure you claim all eligible deductions accurately.

Potential Changes in Future Years

The deductibility of mortgage insurance premiums (MIPs) is a dynamic aspect of the tax code, subject to potential changes influenced by various economic and political factors. While currently deductible for many homeowners, this benefit isn’t guaranteed to remain unchanged indefinitely. Understanding the possibilities of future alterations is crucial for responsible financial planning.

Predicting future tax law changes is inherently speculative, but analyzing historical trends and current economic conditions provides valuable insights. Several factors could significantly influence future decisions regarding MIP deductibility. These include shifts in government revenue needs, evolving housing market dynamics, and changes in the overall philosophy towards homeownership incentives. For instance, a significant increase in national debt might lead to a reassessment of various tax deductions, including MIPs, as a means of increasing government revenue. Conversely, a prolonged period of low homeownership rates could prompt policymakers to consider expanding tax incentives to boost the housing market.

Factors Influencing Future MIP Deductibility

Several interconnected factors could drive changes to the tax treatment of MIPs. Government budgetary pressures might necessitate reducing tax deductions to balance the budget. Changes in housing policy, such as increased focus on affordable housing initiatives, could also affect the deductibility of MIPs. Furthermore, shifts in public opinion regarding homeownership as a primary financial goal could influence legislative decisions. A growing perception that homeownership is less attainable or desirable could lead to a reduction or elimination of MIP deductibility. Finally, the complexity of the current tax code and the desire for simplification might encourage lawmakers to streamline deductions, potentially impacting the status of MIPs.

Hypothetical Scenario: A Change in Tax Law

Let’s imagine a scenario where, in 2025, Congress eliminates the deductibility of MIPs for mortgages exceeding $500,000. This change would disproportionately affect higher-income homeowners in high-cost housing markets like San Francisco or New York City. For example, consider a couple in San Francisco purchasing a home for $1.2 million with a 20% down payment. Their mortgage would be $960,000, exceeding the $500,000 threshold. Prior to the change, they could deduct their MIP payments, reducing their taxable income. After the change, this deduction would be lost, resulting in a higher tax bill. This could potentially translate to an extra $2,000 to $5,000 annually in taxes depending on their tax bracket, significantly impacting their disposable income. This illustrates how even seemingly small changes in tax law can have a substantial impact on individual homeowners’ financial situations.

Ending Remarks

Successfully navigating the tax implications of mortgage insurance premiums requires careful attention to detail and a thorough understanding of current regulations. While the deductibility of MIPs offers potential tax savings, eligibility criteria and calculation methods can be intricate. This guide has provided a comprehensive overview of the 2023 tax landscape regarding MIP deductions, empowering you to confidently assess your own situation and make informed choices about managing your mortgage insurance costs. Remember to consult with a qualified tax professional for personalized advice.

Q&A

What is the difference between PMI and MIP?

PMI (Private Mortgage Insurance) is typically required for conventional loans with down payments below 20%, while MIP (Mortgage Insurance Premium) is required for FHA loans regardless of the down payment. Key differences also exist in how they are handled for tax purposes.

Can I deduct MIPs if I itemize or take the standard deduction?

The deductibility of MIPs is determined by your itemized deductions. If you itemize, you may be able to deduct certain mortgage-related expenses, including potentially some portion of your MIPs, depending on your specific circumstances and the relevant IRS code sections. The standard deduction does not allow for this specific deduction.

What if my MIPs are paid through escrow?

Even if your MIPs are paid through your escrow account, you can still claim the deduction if you meet the eligibility requirements. You will need documentation from your lender detailing the amount paid for MIPs.

Where can I find the specific IRS code sections related to MIP deductions?

The specific IRS code sections pertaining to MIP deductibility can change, so it’s best to consult the most up-to-date IRS publications and guidelines or seek advice from a tax professional for the most accurate information.