Navigating the complexities of homeownership often involves understanding the intricacies of mortgage insurance. A significant question for many homeowners is whether the premiums paid for this insurance are deductible from their taxes. This guide delves into the often-confusing world of mortgage insurance premium deductibility, exploring the rules, eligibility requirements, and potential tax benefits. We’ll examine different mortgage types, state-specific regulations, and potential future changes to help you better understand how this deduction might impact your financial situation.

Understanding mortgage insurance premium deductibility can significantly impact your annual tax liability. This guide aims to clarify the often-murky waters of tax regulations surrounding this topic, providing you with the knowledge to make informed decisions about your finances and homeownership. We will cover the historical context of these deductions, the current rules and regulations, and offer insights into potential future changes.

Itemized Deductions and Standard Deduction

Understanding how mortgage insurance premiums (MIPs) factor into your tax return hinges on the choice between itemizing deductions and taking the standard deduction. Both methods allow you to reduce your taxable income, but the most advantageous approach depends on your individual financial circumstances.

The standard deduction is a flat amount set by the IRS, varying based on filing status (single, married filing jointly, etc.). Itemizing, conversely, involves listing specific deductible expenses, including mortgage interest, state and local taxes, and, in some cases, mortgage insurance premiums. To itemize, the total of your itemized deductions must exceed your standard deduction.

Interaction Between MIP Deduction and Standard Deduction

The deduction for MIPs, if applicable, is added to your other itemized deductions. Only if the sum of your itemized deductions (including MIPs) surpasses your standard deduction will itemizing be more beneficial. Otherwise, taking the standard deduction will result in a lower tax liability. It’s crucial to calculate both to make an informed decision. For example, a taxpayer with a high standard deduction and relatively low itemized deductions, including MIPs, would likely benefit from taking the standard deduction. Conversely, a taxpayer with significant itemized deductions, including substantial MIPs and other eligible expenses, would likely find itemizing more advantageous.

Comparison of Itemized Deductions and Standard Deduction

The standard deduction offers simplicity and convenience. It requires minimal record-keeping and is a straightforward calculation. Itemizing, while potentially leading to a larger deduction, requires meticulous record-keeping of all eligible expenses and a more complex calculation. The IRS provides detailed instructions and forms to assist with itemizing, but it’s often more time-consuming than simply claiming the standard deduction. The optimal choice depends on whether the sum of your itemized deductions, including MIPs, exceeds the standard deduction for your filing status.

Scenarios Favoring Itemization Over Standard Deduction

The following scenarios illustrate situations where itemizing, considering MIPs, could be more advantageous than taking the standard deduction:

Before reviewing these examples, remember that the specific amounts for standard deductions and tax brackets change yearly. Consult the latest IRS guidelines for the most up-to-date information.

- High Mortgage Insurance Premiums and Other Itemized Deductions: A taxpayer with substantial MIPs, significant medical expenses, state and local taxes exceeding the SALT limitation, and large charitable contributions might find that their total itemized deductions significantly surpass their standard deduction. For example, a homeowner paying $5,000 annually in MIPs, coupled with $10,000 in medical expenses and $12,000 in state and local taxes (after the SALT limitation), could easily exceed the standard deduction, making itemization beneficial.

- High-Value Home with Significant MIPs: Taxpayers purchasing a high-value home with a low down payment might face higher MIPs. If these MIPs, along with other potential itemized deductions, exceed their standard deduction, itemizing would be the more tax-efficient strategy. For instance, a first-time homebuyer with a large mortgage and a substantial MIP payment exceeding $4000 annually, coupled with other itemized deductions might find itemizing preferable.

- Self-Employed Individuals with High Deductions: Self-employed individuals often have higher itemized deductions due to business expenses. If these expenses, combined with MIPs, surpass the standard deduction, itemizing becomes a more beneficial choice. A self-employed individual with high business expenses and significant MIPs might see a substantial tax advantage from itemizing.

State-Specific Deduction Rules

While the federal government allows the deduction of mortgage insurance premiums under certain conditions, the deductibility of these premiums at the state level varies significantly. State tax laws often mirror federal guidelines but can include additional stipulations or limitations, impacting a homeowner’s overall tax liability. Understanding these variations is crucial for accurate tax preparation.

State tax codes regarding mortgage insurance premium deductibility are not uniform across the United States. Some states may allow a full deduction mirroring the federal rules, while others may impose restrictions or offer no deduction at all. This discrepancy arises from the diverse tax structures and policy priorities of individual states. The impact on a homeowner’s tax liability can be substantial, potentially resulting in significant differences in the amount of state income tax owed.

Deductibility in California, New York, and Texas

California, New York, and Texas offer contrasting examples of how state tax laws handle the deductibility of mortgage insurance premiums. These states represent different approaches to state income tax and illustrate the potential range of outcomes for homeowners.

California generally conforms to federal tax law, meaning that if the mortgage insurance premiums are deductible at the federal level (based on factors such as loan-to-value ratio and income limits), they are likely also deductible on the California state income tax return. However, specific requirements and limitations may apply, and taxpayers should consult the California Franchise Tax Board’s publications for the most up-to-date information. For instance, the California tax code might have specific filing requirements or additional documentation needs that differ slightly from federal standards.

New York, on the other hand, may have a more restrictive approach. While New York generally follows federal guidelines, there might be specific limitations on the deductibility of mortgage insurance premiums not present in the federal code. This could include income thresholds or specific types of mortgages ineligible for the deduction. Homeowners in New York should refer to the New York State Department of Taxation and Finance’s guidelines to determine their eligibility. For example, New York might impose a higher income limit for deductibility than the federal government, thus excluding a segment of taxpayers eligible under federal rules.

Texas, as a state without a personal income tax, offers no state-level deduction for mortgage insurance premiums. Regardless of whether the premiums are deductible federally, Texas residents will not receive any state tax benefit from this deduction. This exemplifies how the absence of a state income tax entirely removes a potential tax break. A homeowner in Texas paying $2,000 annually in mortgage insurance premiums will not see any reduction in their state tax liability compared to a homeowner in California or New York who might be able to deduct these premiums.

Final Conclusion

Successfully navigating the tax implications of mortgage insurance premiums requires careful consideration of various factors, including your income, loan type, and state of residence. While the deductibility of these premiums can offer significant tax savings, it’s crucial to understand the specific requirements and regulations that apply to your situation. By understanding the information presented here, you can confidently approach tax season and potentially maximize your tax benefits.

FAQ Compilation

Can I deduct mortgage insurance premiums if I itemize deductions but am above the income limits?

No, exceeding the income limits generally disqualifies you from deducting mortgage insurance premiums, even if you itemize.

What if my mortgage insurance is part of my monthly payment? How do I track it for tax purposes?

Your mortgage statement should clearly Artikel the portion of your payment allocated to mortgage insurance. Keep this information for your tax records.

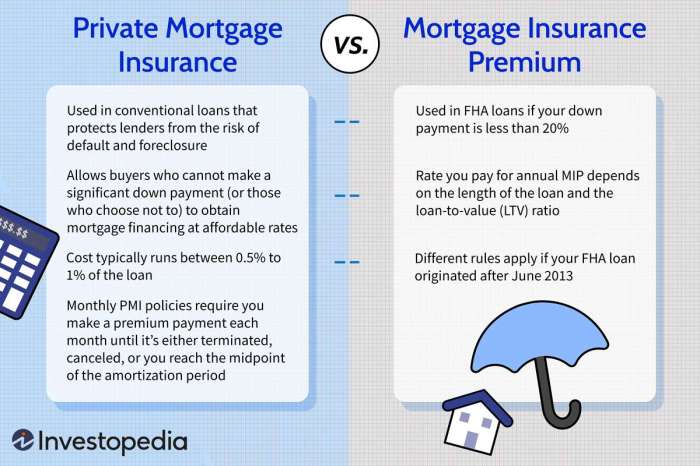

Are private mortgage insurance (PMI) premiums deductible?

The deductibility of PMI premiums depends on factors like your loan-to-value ratio, income, and the year the mortgage was obtained. Refer to current IRS guidelines.

My mortgage is a VA loan. Are the premiums deductible?

VA loans typically don’t have premiums in the same way conventional or FHA loans do. However, certain funding fees might be deductible under specific circumstances. Consult a tax professional.