Navigating the complexities of Medicare and tax deductions can be daunting. Understanding whether your Medicare insurance premiums are tax deductible is crucial for maximizing your tax benefits. This guide delves into the intricacies of Medicare premium deductibility, exploring the various factors that influence eligibility and the process of claiming deductions. We’ll examine the different parts of Medicare, the role of Adjusted Gross Income (AGI), and the choices between itemized and standard deductions, ensuring you have a clear understanding of how to navigate this aspect of your taxes.

This guide provides a practical, step-by-step approach to help you determine your eligibility for Medicare premium deductions and successfully navigate the tax filing process. We will cover common pitfalls to avoid and offer illustrative examples to clarify the often-confusing aspects of Medicare tax deductions, leaving you better equipped to manage your finances effectively.

Medicare Premium Deductibility

Understanding whether your Medicare premiums are tax-deductible can significantly impact your tax liability. The rules surrounding this can be complex, depending on your specific circumstances and the type of Medicare coverage you have. This section provides a general overview of the deductibility of Medicare premiums.

Medicare Premium Deductibility Rules

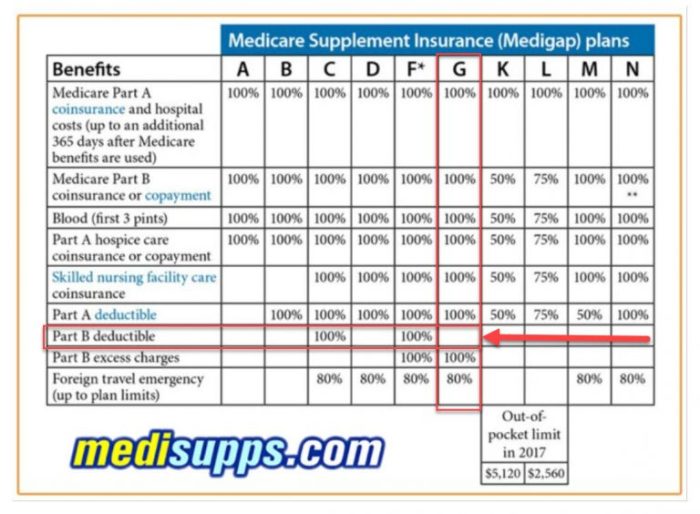

The deductibility of Medicare premiums hinges on whether you are itemizing deductions on your tax return. If you choose to take the standard deduction, you cannot deduct your Medicare premiums. However, if you itemize, you can potentially deduct the amount you paid for Medicare Part B and Part D premiums. Importantly, premiums paid for Medicare Part A are generally not deductible. This is because Part A is typically premium-free for those who qualify based on their work history.

Medicare Part B Premium Deductibility

Medicare Part B covers doctor visits, outpatient care, and some other medical services. Premiums for Part B are generally income-based, meaning higher earners pay more. You can deduct the amount you paid in Part B premiums as a medical expense on Schedule A (Form 1040), provided you itemize your deductions. The amount you can deduct is limited to the amount of medical expenses that exceed 7.5% of your adjusted gross income (AGI).

Medicare Part D Premium Deductibility

Medicare Part D covers prescription drugs. Like Part B, premiums for Part D are also deductible as a medical expense on Schedule A (Form 1040) if you itemize. Again, the deduction is subject to the 7.5% AGI threshold for medical expenses. This means that you can only deduct the amount exceeding 7.5% of your AGI. For example, if your AGI is $50,000, you can only deduct the portion of your Part D premiums exceeding $3,750 ($50,000 x 0.075).

Requirements for Claiming Medicare Premium Deductions

To claim a deduction for your Medicare premiums, you must itemize your deductions instead of taking the standard deduction. You will need Form 1099-SA, which shows the premiums you paid for Medicare Part B and Part D. You’ll report these premiums on Schedule A (Form 1040), along with other medical expenses. Accurate record-keeping of all medical expenses is crucial to ensure you claim the correct amount. It is recommended to consult a tax professional if you have complex medical expenses or are unsure about the deductibility of your premiums.

Adjusted Gross Income (AGI) and Deductibility

Your Adjusted Gross Income (AGI) plays a crucial role in determining whether you can deduct your Medicare premiums. Essentially, the higher your AGI, the less likely you are to be able to deduct these premiums. This is because the ability to deduct premiums is often tied to income thresholds set by the IRS.

Understanding how AGI impacts Medicare premium deductibility requires a grasp of AGI calculation.

AGI Calculation and its Relevance to Medicare Premium Deductions

Adjusted Gross Income (AGI) is your gross income less certain above-the-line deductions. Gross income includes wages, salaries, self-employment income, interest, dividends, capital gains, and other sources of income. Above-the-line deductions are adjustments made to your gross income before calculating your taxable income. These deductions can include contributions to traditional IRAs, student loan interest payments, and self-employment tax deductions. The resulting figure, your AGI, is a key factor in determining eligibility for various tax benefits, including the potential deductibility of Medicare premiums. The IRS uses your AGI to establish income thresholds for various tax credits and deductions. If your AGI falls below a certain threshold, you might be able to deduct your Medicare premiums. If it exceeds that threshold, you likely won’t be able to claim this deduction.

Examples of AGI and Medicare Premium Deductibility

Let’s consider two hypothetical individuals to illustrate how different AGI levels affect deductibility.

Imagine Sarah, a retiree with an AGI of $25,000. Based on current IRS guidelines (which are subject to change and should be verified annually), her AGI might fall below the threshold for deducting Medicare premiums. This means she could potentially reduce her taxable income by the amount of her Medicare premiums, resulting in a lower tax bill.

Now, consider John, another retiree with an AGI of $70,000. John’s higher AGI might place him above the income threshold for deducting Medicare premiums. Therefore, he would not be able to claim this deduction, and his Medicare premiums would not reduce his taxable income.

It’s crucial to note that these are hypothetical examples, and the specific AGI thresholds for Medicare premium deductibility change annually. Consulting the latest IRS publications or a qualified tax professional is vital to determine your eligibility. The IRS provides detailed information and publications each year outlining the specific rules and thresholds for various deductions, including those related to Medicare premiums.

Itemized Deductions vs. Standard Deduction

To claim a deduction for your Medicare premiums, you must decide whether itemizing your deductions or taking the standard deduction will result in a lower tax liability. The choice depends on the total amount of your itemized deductions compared to the standard deduction amount. The standard deduction is a fixed amount determined annually by the IRS, while itemized deductions are a sum of various eligible expenses.

The standard deduction provides a simplified way to reduce your taxable income. It’s a flat amount that varies based on your filing status (single, married filing jointly, etc.) and age. Itemizing, on the other hand, allows you to deduct specific expenses, including medical expenses exceeding a certain percentage of your adjusted gross income (AGI). Medicare premiums, when they exceed the 7.5% AGI threshold, become part of these itemized medical expenses.

Comparison of Itemizing and Standard Deduction for Medicare Premiums

Itemizing deductions is advantageous only when the total of your itemized deductions, including your Medicare premiums, exceeds the standard deduction amount for your filing status. If your itemized deductions are less than the standard deduction, you’ll pay less tax by taking the standard deduction. The decision is entirely dependent on your individual financial circumstances and the sum of your deductible expenses.

Scenarios Where Itemizing is Beneficial

Consider a scenario where a married couple, both over 65, has an AGI of $70,000. Their standard deduction is significantly higher than the single filer’s standard deduction. They paid $10,000 in Medicare premiums during the year. Additionally, they incurred $6,000 in other unreimbursed medical expenses. The 7.5% AGI threshold for medical expense deductions is $5,250 ($70,000 x 0.075). Therefore, they can deduct the amount exceeding this threshold: $10,000 (Medicare premiums) + $6,000 (other medical expenses) – $5,250 = $10,750. If their other itemized deductions (such as state and local taxes, mortgage interest, charitable contributions) total $4,000, their total itemized deductions would be $14,750. If their standard deduction is less than $14,750, itemizing would reduce their taxable income and result in a lower tax liability. Conversely, if their standard deduction is higher, claiming the standard deduction would be more beneficial.

Medicare Premium Deduction Forms and Documentation

Successfully claiming a deduction for your Medicare premiums requires accurate completion of the necessary tax forms and the careful gathering of supporting documentation. This ensures the IRS can properly verify your eligibility and the amount of your deduction. Failing to provide the correct information can lead to delays in processing your return or even rejection of your claim.

The process of claiming this deduction is relatively straightforward, but it’s crucial to understand which forms are needed and what information must be included. This section details the necessary forms and provides a step-by-step guide to accurate completion.

Medicare Premium Deduction Form Requirements

Accurately claiming the Medicare premium deduction involves using specific IRS forms and providing supporting documentation. The primary form used is Form 1040, Schedule A (Itemized Deductions), where medical expenses, including Medicare premiums, are reported. Additional documentation, such as your Medicare summary notice (MSN) or premium payment receipts, is necessary to substantiate your claim.

| Form Name | Purpose | Required Information | Example |

|---|---|---|---|

| Form 1040, Schedule A (Itemized Deductions) | Reports itemized deductions, including medical expenses. | Total medical expenses (including Medicare premiums), AGI, other itemized deductions. | You paid $3,000 in Medicare premiums and $2,000 in other medical expenses. Your AGI is $50,000. You would report a total of $5,000 in medical expenses on Schedule A. |

| Medicare Summary Notice (MSN) | Provides details of Medicare Part B premiums paid. | Your name, Medicare number, premium amounts paid, dates of payment. | Your MSN shows you paid $164.90 per month for Part B premiums. |

| Payment Receipts | Proof of payment for Medicare premiums. | Date of payment, amount paid, payment method (check, bank draft, etc.). | A bank statement showing a debit of $164.90 to your account for your Medicare Part B premium. |

Illustrative Examples

Understanding Medicare premium deductibility can be complex, varying based on individual income and filing status. The following scenarios illustrate how different factors influence the amount of premium deduction a taxpayer can claim. Each example provides a clear breakdown of income, expenses, and the resulting tax implications.

Scenario 1: High Income, Itemized Deductions

This scenario depicts a high-income individual who itemizes deductions. Let’s assume a married couple filing jointly with an Adjusted Gross Income (AGI) of $200,000 and Medicare premiums totaling $20,000. Since they itemize, they can deduct the portion of their Medicare premiums that exceeds 7.5% of their AGI. In this case, 7.5% of $200,000 is $15,000. Therefore, they can deduct $5,000 ($20,000 – $15,000). This deduction would reduce their taxable income and, consequently, their overall tax liability.

A visual representation could be a simple bar chart showing the total Medicare premiums ($20,000), the AGI threshold ($15,000), and the deductible amount ($5,000). The chart would clearly illustrate the portion of premiums that qualify for the deduction.

Scenario 2: Low Income, Standard Deduction

This scenario involves a single individual with a low AGI of $25,000 and Medicare premiums of $5,000. This individual chooses to use the standard deduction instead of itemizing. Because their Medicare premiums are less than 7.5% of their AGI ($1,875), they cannot deduct any portion of their premiums. Their total tax liability will not be affected by their Medicare premiums in this case.

A pie chart could visually represent this scenario, showing the proportion of their AGI ($25,000) allocated to Medicare premiums ($5,000) and highlighting that this amount falls below the 7.5% threshold for deductibility.

Scenario 3: Moderate Income, Itemized Deductions with Other Deductions

This example showcases a taxpayer with a moderate income who itemizes. Consider a single filer with an AGI of $70,000, Medicare premiums of $8,000, and other itemized deductions totaling $10,000. The 7.5% AGI threshold is $5,250. They can deduct $2,750 ($8,000 – $5,250) in Medicare premiums. Their total itemized deductions would be $12,750 ($10,000 + $2,750), which would be compared to the standard deduction to determine the most beneficial deduction method for their tax situation.

A table could effectively present this information, showing the AGI, Medicare premiums, other itemized deductions, the deductible portion of Medicare premiums, total itemized deductions, and the standard deduction amount for comparison. This would allow for a clear comparison of the different deduction amounts and their impact on the taxpayer’s tax liability.

Final Wrap-Up

Successfully navigating the complexities of Medicare premium deductibility requires careful attention to detail and a thorough understanding of the relevant tax laws. By understanding the interplay between your AGI, the choice between itemized and standard deductions, and the specific requirements for each part of Medicare, you can accurately claim your deductions and minimize your tax burden. Remember to keep accurate records and consult with a tax professional if you have any questions or complex situations. Taking the time to understand these rules empowers you to optimize your tax planning and ensure you receive all the benefits you are entitled to.

Commonly Asked Questions

Can I deduct Medicare Part A premiums?

Generally, no. Part A premiums are usually only paid if you haven’t accumulated enough work credits. Deductibility is not typically applicable.

What if I’m itemizing but my Medicare premiums are less than my standard deduction?

You would use the standard deduction, as it would result in a lower tax liability.

Are there penalties for incorrectly claiming Medicare premium deductions?

Yes, incorrect deductions can lead to penalties, including interest and back taxes. Accuracy is crucial.

Where can I find the necessary tax forms?

The IRS website (irs.gov) provides access to all necessary forms, including Form 1040 and Schedule A (for itemized deductions).

Does my state’s tax laws affect my federal Medicare premium deduction?

Federal tax laws govern the deduction of Medicare premiums. However, state tax laws may have their own provisions, which you should research separately.