Navigating the complexities of tax deductions can feel like deciphering a secret code. For many, the question of whether medical insurance premiums are tax deductible is a significant one, impacting their annual tax liability. This guide unravels the intricacies surrounding this deduction, providing clarity on eligibility, types of plans, reporting procedures, and crucial limitations. Understanding these nuances can save you considerable money and alleviate tax season stress.

The deductibility of medical insurance premiums hinges on several factors, primarily your employment status (self-employed versus employed) and the type of health insurance plan you hold. This guide will dissect these factors, offering practical examples and clear explanations to empower you with the knowledge to confidently navigate your tax obligations. We’ll explore the various tax forms involved, offering step-by-step guidance on accurate reporting. Ultimately, our aim is to equip you with the information needed to maximize your tax benefits.

Eligibility for Deduction

The deductibility of medical insurance premiums hinges on several factors, primarily your employment status and the type of plan you have. Understanding these criteria is crucial for accurately claiming this tax benefit. This section details the requirements for deducting medical insurance premiums, providing clarity on eligibility based on employment status and plan type.

Eligibility Criteria for Medical Insurance Premium Deduction

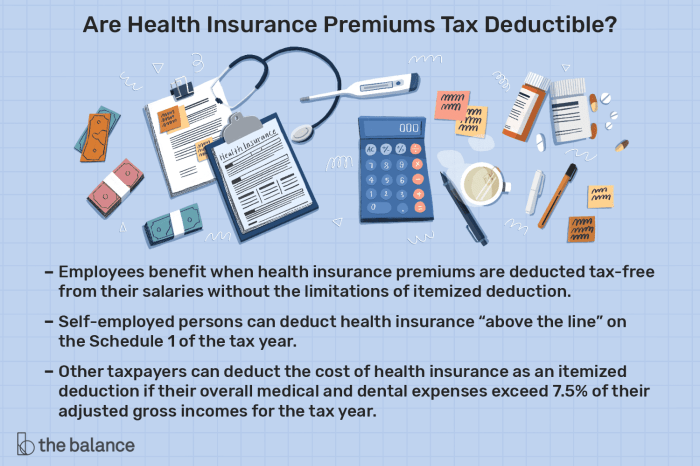

To deduct medical insurance premiums, you generally need to itemize your deductions on your tax return instead of using the standard deduction. This means your total itemized deductions must exceed the standard deduction amount to benefit from this deduction. The specific requirements vary depending on your employment status and the nature of your health insurance plan. For self-employed individuals, the rules differ from those applicable to employees.

Employment Status and Deductibility

The deductibility of medical insurance premiums significantly depends on your employment status.

| Eligibility Criteria | Employment Status | Plan Type | Deductibility Rules |

|---|---|---|---|

| Itemizing deductions; Premiums paid for self, spouse, or dependents; Business expenses for self-employed | Self-Employed | Self-purchased health insurance | Premiums are deductible as a business expense. Deduct the amount paid on Schedule C (Profit or Loss from Business) of Form 1040. |

| Employer-sponsored plan; Premiums may be partially or fully paid by employer | Employed | Employer-sponsored health insurance (HSA, FSA, etc.) | Generally, premiums paid by the employer are not deductible by the employee. However, amounts you pay as an employee contribution might be deductible if you itemize. |

| Itemizing deductions; Premiums paid for self, spouse, or dependents; May qualify under certain circumstances, such as COBRA | Unemployed or Between Jobs | Individually purchased health insurance | Premiums might be deductible as a medical expense if you itemize. However, there are limitations. The deductible amount is subject to the 7.5% AGI threshold for medical expenses. |

Qualifying Medical Insurance Plans

Several types of medical insurance plans qualify for premium deduction, including:

* Individual Health Insurance Plans: Purchased directly from an insurance company or through the Health Insurance Marketplace.

* Employer-Sponsored Plans (with employee contributions): Plans offered by employers where the employee contributes to the premium cost.

* COBRA Continuation Coverage: Coverage continued after job loss, but the employee typically pays the full premium.

* Medicare Premiums: While not strictly health insurance premiums in the same sense as others, some Medicare premiums can be deductible.

Deductibility of Individual vs. Family Plans

The deductibility rules apply equally to both individual and family health insurance plans. The total amount of premiums paid for the plan, whether it covers only the individual or the entire family, is deductible subject to the above-mentioned criteria. For example, a self-employed individual can deduct the full amount of premiums paid for a family plan, while an employee might only deduct their portion of the premiums for a family plan if their employer doesn’t cover it fully. The key factor remains whether the premiums are considered a business expense (for self-employed individuals) or an itemized medical expense (for those who itemize).

Tax Forms and Reporting

Reporting medical insurance premium deductions requires careful attention to detail and accurate record-keeping. Understanding the relevant tax forms and the process of completing them correctly is crucial for ensuring a successful claim. Failure to do so may result in delays or rejection of your deduction.

Form 1040 and Schedule 1 (Additional Income and Adjustments to Income)

The primary form used to report medical insurance premium deductions is Form 1040, U.S. Individual Income Tax Return. Specifically, you’ll use Schedule 1 (Additional Income and Adjustments to Income) to itemize deductions, including those for medical expenses. This schedule allows you to list various adjustments to your gross income, and medical expense deductions fall under this category. You will need to determine if itemizing your deductions is beneficial compared to the standard deduction.

Calculating the Deductible Amount of Premiums

The amount of medical insurance premiums you can deduct isn’t the total amount you paid. You can only deduct the premiums that exceed 7.5% of your adjusted gross income (AGI). This means you first calculate 7.5% of your AGI, then subtract that amount from your total medical insurance premiums paid during the tax year. The remaining amount, if any, is your deductible amount.

Example: If your AGI is $60,000 and you paid $5,000 in medical insurance premiums, 7.5% of your AGI is $4,500 ($60,000 x 0.075). Your deductible amount is $500 ($5,000 – $4,500).

Necessary Documentation to Support the Deduction Claim

To support your deduction, maintain meticulous records. This includes copies of your:

- Form W-2 (Wage and Tax Statement)

- 1099 forms (if applicable)

- Tax return from the previous year

- Medical insurance premium payment receipts or statements

- Any other documentation that proves the payments you made.

These documents provide irrefutable evidence of your income and premium payments, allowing the IRS to verify your claim accurately and efficiently. Keep these documents organized and readily accessible for at least three years after filing your return.

Step-by-Step Guide for Reporting Medical Insurance Premium Deductions

The following steps Artikel the process for reporting your medical insurance premium deductions:

- Calculate your AGI: Determine your adjusted gross income (AGI) using your Form W-2 and other relevant tax documents.

- Calculate 7.5% of your AGI: Multiply your AGI by 0.075.

- Determine your deductible amount: Subtract the result from step 2 from your total medical insurance premiums paid.

- Gather supporting documentation: Collect all necessary receipts and statements.

- Complete Schedule 1 (Form 1040): Enter your deductible amount on the appropriate line of Schedule 1, specifically the section for medical expense deductions.

- File your Form 1040: File your completed tax return with all supporting documentation.

Self-Employed vs. Employed Deductions

Understanding the deductibility of medical insurance premiums hinges significantly on your employment status. Self-employed individuals and employees navigate different pathways to claim these deductions, impacting their overall tax liability. This section clarifies these differences and highlights key considerations for both groups.

The primary difference stems from how the premiums are paid and subsequently reported. Employees typically have premiums deducted directly from their paychecks, while self-employed individuals make direct payments.

Premium Payment and Reporting Differences

For employees, the employer often contributes a portion of the premium, and the employee’s share is automatically deducted pre-tax. This simplifies the reporting process; the employee’s W-2 form reflects the amount paid by both the employer and employee. Self-employed individuals, however, pay the entire premium themselves. They must accurately track these expenses throughout the year to claim the deduction on their tax return. This requires meticulous record-keeping.

Deduction Methods

Employees generally cannot deduct the employer’s contribution to their health insurance premiums. Only the employee’s portion is considered a pre-tax deduction from their wages. Self-employed individuals, on the other hand, can deduct the entire amount of their health insurance premiums paid as a business expense. This deduction is taken on Schedule C (Profit or Loss from Business) or Schedule F (Profit or Loss from Farming), reducing their net self-employment income and consequently their overall tax liability.

Tax Advantages and Disadvantages

A significant tax advantage for self-employed individuals lies in the deductibility of the entire premium. This can lead to substantial tax savings, especially for those with high premiums. However, self-employed individuals must meet certain criteria, such as being actively engaged in business and having a net profit, to qualify for the deduction. Employees, while not able to deduct the employer’s contribution, benefit from the pre-tax deduction of their share, reducing their taxable income directly. A potential disadvantage for the self-employed is the increased responsibility for accurate record-keeping and the potential for penalties if the deduction isn’t properly documented.

Tax Filing Status Implications

The deductibility of premiums remains largely consistent regardless of filing status (single, married filing jointly, etc.) for both employees and self-employed individuals. However, the overall tax implications will vary depending on the individual’s income and filing status, affecting the ultimate tax savings realized from the deduction. For instance, a higher income individual in a higher tax bracket will see a greater reduction in tax liability compared to someone in a lower tax bracket, regardless of employment status.

Comparison Table: Self-Employed vs. Employed Deduction Processes

| Feature | Self-Employed | Employed |

|---|---|---|

| Premium Payment | Direct payment by the individual | Employer and employee contributions |

| Deduction Method | Deducted as a business expense on Schedule C or F | Employee’s share deducted pre-tax from wages |

| Deductible Amount | Entire premium amount | Only the employee’s portion |

| Reporting | Requires detailed record-keeping and reporting on tax return | Reflected on W-2 form |

| Tax Advantages | Significant tax savings due to full premium deductibility | Pre-tax deduction of employee’s share |

| Tax Disadvantages | Requires meticulous record-keeping; eligibility dependent on business profitability | Limited deductibility to employee’s contribution |

Limitations and Exceptions

While the deduction of medical insurance premiums can offer significant tax savings, it’s crucial to understand the limitations and exceptions that can affect the amount you can deduct. These restrictions are in place to prevent abuse of the system and ensure fairness across taxpayers. Understanding these limitations is key to accurately calculating your tax liability.

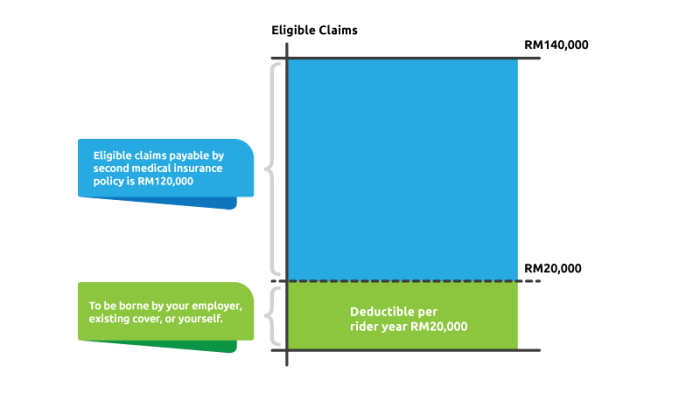

Limitations on Deductible Premium Amounts

The amount of medical insurance premiums you can deduct is not unlimited. Several factors can restrict the total amount. For example, for self-employed individuals, the deduction is limited to the amount of income derived from self-employment. If your self-employment income is $50,000 and your premiums are $10,000, you can deduct the full $10,000. However, if your premiums were $60,000, you would only be able to deduct $50,000, the amount of your self-employment income. Additionally, the amount deductible may be further limited by other applicable tax laws and regulations, including those relating to adjusted gross income (AGI) thresholds or other itemized deductions.

Situations Where Premiums May Not Be Deductible

There are specific circumstances where medical insurance premiums are not deductible. For instance, premiums paid for health insurance coverage that is considered “minimum essential coverage” under the Affordable Care Act (ACA) are generally deductible only if you are self-employed or have a qualifying self-employment situation. If you are an employee and your employer provides health insurance, you cannot generally deduct premiums for additional private insurance purchased separately. Furthermore, premiums paid for insurance policies that primarily offer other types of coverage, such as life insurance or disability insurance, even if they include a small health component, are usually not deductible as medical insurance premiums. Premiums paid for long-term care insurance are generally not deductible unless it meets very specific requirements.

Examples of Restricted or Disallowed Deductions

Let’s consider a few examples. A self-employed consultant who earns $75,000 annually and pays $8,000 in medical insurance premiums can deduct the full $8,000. However, if a different consultant earns only $5,000 and pays $10,000 in premiums, they can only deduct $5,000, the amount of their self-employment income. In another scenario, an employee covered under their employer’s health insurance plan who purchases a supplemental health insurance policy might not be able to deduct the premiums paid for the supplemental policy, depending on the specifics of the policy and the employer-provided coverage. Finally, a person paying premiums for a policy that primarily provides long-term care benefits, even with a small health component, would generally not be able to deduct these premiums.

Impact of Reimbursements or Other Benefits

If you receive reimbursements or other benefits for your medical insurance premiums, this will reduce the amount you can deduct. For instance, if your employer reimburses you $2,000 for premiums and you paid $10,000, you can only deduct $8,000. This principle applies to other benefits as well, such as those received through a flexible spending account (FSA) or health savings account (HSA). The reimbursements or benefits are effectively subtracted from the total premiums paid before calculating the deductible amount.

Common Limitations and Exceptions

The following points summarize common limitations and exceptions to the deductibility of medical insurance premiums:

- Deduction limited by self-employment income (for self-employed individuals).

- Premiums for non-minimum essential coverage may not be deductible for employees.

- Premiums for supplemental insurance policies may not be deductible if primary coverage is already provided.

- Premiums for policies primarily providing non-medical benefits (e.g., life insurance, disability insurance) are generally not deductible.

- Reimbursements or benefits reduce the deductible amount.

- Certain long-term care insurance premiums may not be deductible.

Ending Remarks

Successfully navigating the tax implications of medical insurance premiums requires a thorough understanding of eligibility criteria, reporting procedures, and potential limitations. While the process may initially seem daunting, armed with the right information, claiming this deduction can be straightforward. This guide has provided a comprehensive overview, clarifying the key aspects for both self-employed individuals and employees. Remember to always consult with a qualified tax professional for personalized advice tailored to your specific circumstances. Proactive tax planning can lead to significant savings, making this understanding a worthwhile investment in your financial well-being.

FAQ

Can I deduct premiums for my spouse’s insurance if I’m the primary policyholder?

Generally, yes, if you are claiming your spouse as a dependent and meet other eligibility requirements.

What if I received a reimbursement for some medical expenses? How does that affect my deduction?

Reimbursements may reduce the amount of medical expenses you can deduct. You should only deduct the net amount after reimbursements.

Are premiums for dental or vision insurance deductible?

The deductibility of dental and vision insurance premiums depends on your specific plan and circumstances. Some plans may be considered part of a broader medical insurance plan and thus deductible, while others may not be.

What happens if I make a mistake on my tax return regarding medical insurance premium deductions?

If you discover a mistake, file an amended tax return (Form 1040-X) to correct it. The sooner you do this, the better.