Navigating the complexities of tax deductions can feel like deciphering a secret code, especially when it comes to medical insurance premiums. The question, “Are medical insurance premiums deductible?” is a common one, with the answer often depending on your specific employment status and the type of insurance plan you hold. This guide unravels the intricacies of this topic, providing clarity and insights into the deductibility rules for both self-employed individuals and employees, shedding light on potential tax savings and clarifying common misconceptions.

Understanding the deductibility of medical insurance premiums is crucial for maximizing your tax benefits. Whether you’re self-employed, employed by a company, or navigating the nuances of long-term care insurance, the information presented here will empower you to make informed decisions and accurately report your deductions. We’ll explore the various tax forms involved, the required documentation, and the step-by-step process of claiming these deductions, ensuring you’re well-equipped to navigate the tax landscape with confidence.

Deductibility Basics

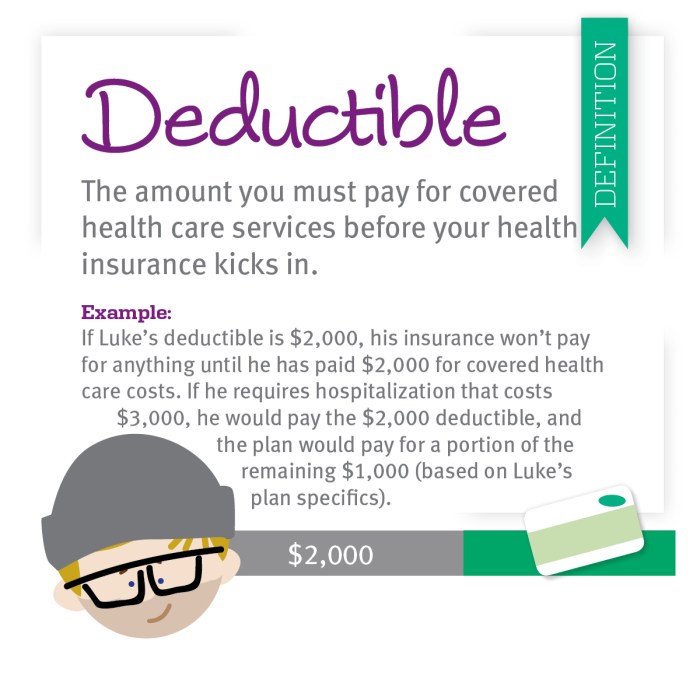

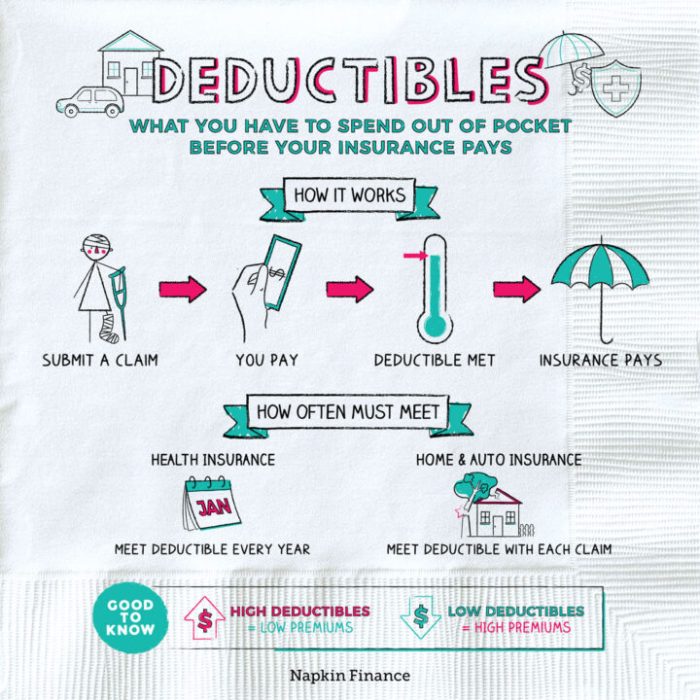

Understanding the deductibility of medical insurance premiums can significantly impact your tax liability. The rules surrounding this deduction are complex and depend heavily on your employment status and the type of plan you have. This section clarifies the key aspects of deductibility.

Generally, medical insurance premiums are deductible only under specific circumstances. The most common situation involves self-employed individuals or those who are not covered by an employer-sponsored plan. For employees, the situation is different; premiums paid through an employer-sponsored plan are usually not directly deductible by the employee, as the employer often handles the associated tax implications. However, the employee may still benefit indirectly through lower taxable income, as the premiums are typically considered a pre-tax deduction from their salary.

Deductible vs. Non-Deductible Premiums

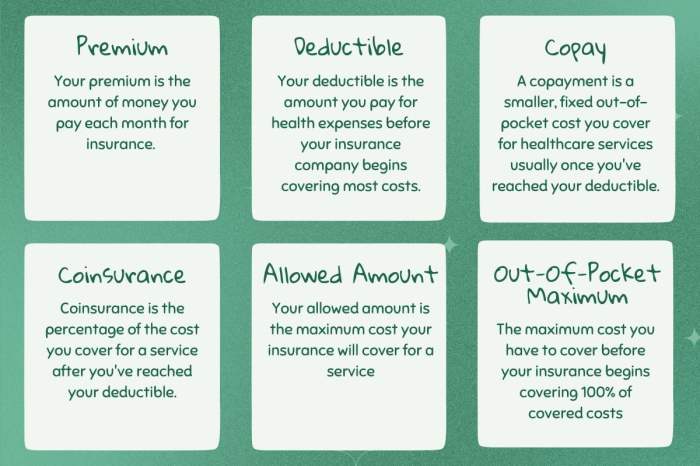

Several factors determine whether your medical insurance premiums are deductible. A key factor is whether you are self-employed or an employee. For self-employed individuals, premiums paid for health insurance are often deductible as a business expense. This deduction is claimed on Schedule C (Profit or Loss from Business) of Form 1040. However, there are limits on the amount that can be deducted; this deduction is subject to adjusted gross income (AGI) limitations. For example, a self-employed individual with a high AGI might not be able to deduct the full amount of their premiums. Conversely, premiums paid by an employee through an employer-sponsored plan are generally not deductible directly. The employee benefits from the pre-tax deduction from their paycheck, effectively lowering their taxable income. However, if an employee pays for supplemental insurance beyond the employer-sponsored plan, they may be able to deduct some or all of those premiums, depending on the specifics of their policy and other factors.

Self-Employed vs. Employee Deductibility

The deductibility rules significantly differ for self-employed individuals and employees. Self-employed individuals can deduct their health insurance premiums as a business expense, reducing their taxable income. This deduction helps offset the cost of health insurance, a significant expense for many self-employed individuals. Employees, on the other hand, typically do not deduct premiums paid through their employer’s plan, as the employer handles the tax implications. However, premiums paid for supplemental insurance beyond the employer-sponsored plan might be deductible by the employee, subject to specific requirements and limitations.

Relevant Tax Forms

Several tax forms are relevant when claiming deductions for medical insurance premiums. The specific form depends on your employment status and the type of insurance you have.

| Form | Purpose | Applicable Scenario | Additional Notes |

|---|---|---|---|

| Form 1040, Schedule C | Profit or Loss from Business | Self-employed individuals deducting health insurance premiums as a business expense. | Used to calculate net profit or loss from self-employment. |

| Form 1040, Schedule 1 | Additional Income and Adjustments to Income | May be used in conjunction with other forms to report adjustments to income, including some self-employment health insurance deductions. | Used to report various adjustments to income. |

| Form 8889 | Health Savings Accounts (HSAs) | Used to report contributions made to an HSA. | Applicable if you have an HSA and contribute to it. |

| Form W-2 | Wage and Tax Statement | Shows the amount of pre-tax deductions for health insurance made by the employer. | Provides information about wages and tax withholdings. |

Self-Employed Individuals

Self-employed individuals face unique challenges when it comes to health insurance, as they are responsible for securing and paying for their own coverage. Unlike employees who often have employer-sponsored plans, the self-employed can deduct a portion of their health insurance premiums from their taxable income, offering a significant tax advantage. This section details the specifics of this deduction.

Self-employed individuals can deduct the amount they paid in health insurance premiums for themselves, their spouse, and their dependents. This deduction is taken on Schedule C (Profit or Loss from Business) or Schedule F (Profit or Loss from Farming), depending on the nature of their self-employment. The deduction is above the line, meaning it reduces your adjusted gross income (AGI), potentially leading to a lower tax liability.

Deduction Requirements and Documentation

To claim the deduction, you must maintain accurate records of all health insurance premium payments. This includes receipts, bank statements, or canceled checks showing the payments made throughout the tax year. The documentation should clearly indicate the payer, the amount paid, the dates of payment, and that the payments were for health insurance premiums. Furthermore, you must be self-employed and have reported your self-employment income on your tax return. You cannot deduct premiums if you were eligible for employer-sponsored health insurance but chose not to enroll. The self-employment tax return (Schedule SE) is used to calculate the self-employment tax and is linked to this deduction.

Self-Employed vs. Employer-Sponsored Plans: Tax Implications

Choosing a self-employed health insurance plan versus an employer-sponsored plan has significant tax implications. With an employer-sponsored plan, premiums are often deducted pre-tax from your paycheck, meaning you don’t pay taxes on that portion of your income. However, with a self-employed plan, you pay the premiums yourself and deduct them from your income after calculating your gross income. While this may seem less advantageous, the deduction can still result in considerable tax savings, especially for those with higher incomes and significant self-employment income. The specific tax benefit will depend on individual circumstances and tax brackets. For example, a self-employed individual in a high tax bracket might find that the deduction significantly reduces their overall tax liability, even compared to the pre-tax deduction of employer-sponsored plans.

Step-by-Step Guide to Claiming the Deduction

Claiming the health insurance deduction for self-employed individuals involves a straightforward process.

- Gather your documentation: Collect all receipts, bank statements, or canceled checks showing your health insurance premium payments for the tax year.

- Determine your self-employment income: Calculate your net earnings from self-employment using Schedule C or Schedule F.

- Complete Schedule C or Schedule F: Enter your health insurance premium payments on the appropriate line of Schedule C (for business income) or Schedule F (for farming income). The specific line will vary depending on the year and tax form version, so consult the instructions for the relevant tax year.

- Transfer the deduction to Form 1040: Transfer the amount from Schedule C or Schedule F to the appropriate line on Form 1040, your individual income tax return. This will reduce your adjusted gross income (AGI).

- File your tax return: File your completed tax return along with all supporting documentation.

Specific Circumstances and Limitations

The deductibility of medical insurance premiums isn’t a straightforward yes or no. Several specific circumstances and limitations can affect whether you can claim these premiums as a deduction, even if you meet the general criteria for self-employment or itemized deductions. Understanding these nuances is crucial for accurate tax filing.

Long-Term Care Insurance Premiums

Premiums paid for long-term care insurance policies can be deductible, but only under specific conditions. The policy must meet IRS requirements for qualified long-term care insurance contracts. These requirements often relate to the type of care covered, the policy’s duration, and the benefits provided. If the policy qualifies, you can deduct the amount you paid in premiums, subject to certain age-based limits. For example, the amount you can deduct might increase as you age. It’s important to consult the IRS guidelines and potentially seek professional tax advice to determine eligibility. The deduction is generally taken as an itemized deduction on Schedule A (Form 1040).

Deductibility for Individuals Covered Under a Spouse’s Plan

If you are covered under your spouse’s employer-sponsored health insurance plan, you generally cannot deduct the premiums paid by your spouse. The premiums are considered a personal expense of your spouse, and you cannot claim them as a deduction on your tax return. However, if you have other qualifying medical expenses, you may still be able to itemize those expenses on Schedule A (Form 1040), provided they exceed the specified threshold. The key here is that the premiums themselves are not deductible, only other out-of-pocket medical expenses you may have incurred.

Non-Deductible Medical Expenses Related to Insurance

While many medical expenses are deductible, certain situations prevent you from deducting even those seemingly related to insurance. For example, health club membership fees, even if recommended by a doctor, are generally not deductible. Similarly, cosmetic surgery, unless medically necessary, is not deductible, regardless of insurance coverage. Furthermore, penalties for non-payment of insurance premiums are not deductible. These examples highlight that the connection to health or medical care must be directly related to treatment or prevention of illness to be considered deductible.

Common Misconceptions About Medical Insurance Premium Deductibility

It’s essential to clarify some frequently held misconceptions regarding the deductibility of medical insurance premiums:

- Misconception: All medical insurance premiums are deductible. Reality: Only premiums paid for self-employment health insurance or for qualified long-term care insurance, under specific conditions, are deductible.

- Misconception: If I itemize, all my medical expenses, including premiums, are deductible. Reality: Only qualifying medical expenses that exceed a certain percentage of your adjusted gross income (AGI) are deductible. The threshold changes yearly.

- Misconception: Premiums paid for my children’s insurance are always deductible. Reality: The deductibility depends on whether you are self-employed and the specific requirements of the insurance policy. It is not an automatic deduction.

- Misconception: Over-the-counter medications are always deductible. Reality: Generally, only prescription medications are deductible, and then only as part of the overall itemized medical expenses exceeding the AGI threshold.

Outcome Summary

Successfully navigating the tax implications of medical insurance premiums requires a thorough understanding of the applicable rules and regulations. This guide has provided a comprehensive overview, covering deductibility for self-employed individuals and employees, highlighting key differences and potential tax advantages. By carefully considering your specific circumstances and utilizing the provided information, you can effectively manage your tax obligations and maximize your potential tax savings. Remember to consult with a qualified tax professional for personalized advice tailored to your individual situation.

Query Resolution

Can I deduct premiums for my spouse’s health insurance?

Generally, no. You can only deduct premiums for health insurance plans covering yourself, your spouse, and your dependents.

What if I’m partially self-employed and partially employed?

The deductibility will depend on the specifics of your employment arrangements and the type of insurance coverage. Professional tax advice is recommended in such situations.

Are dental and vision insurance premiums deductible?

The deductibility of dental and vision insurance premiums depends on whether they are part of a comprehensive health insurance plan. They may be deductible as part of medical expenses if the plan is considered a qualified health plan.

What happens if I make a mistake on my tax form?

Amend your tax return using the appropriate form and provide the corrected information. The IRS provides instructions and resources for amending returns.