Planning for long-term care is a crucial aspect of financial security, and understanding the tax implications of long-term care insurance is paramount. This guide delves into the complexities of whether long-term care insurance premiums are tax deductible, exploring the relevant regulations, factors influencing deductibility, and alternative tax strategies. We’ll navigate the often-confusing landscape of tax laws to provide a clear and concise understanding of this important financial consideration.

The question of tax deductibility significantly impacts the overall cost and affordability of long-term care insurance. Understanding the rules and regulations surrounding deductions can help individuals and families make informed decisions about their long-term care planning, optimizing both financial protection and tax efficiency. We will examine the interplay between medical expense deductions, the specifics of long-term care insurance policies, and the documentation required to claim any potential tax benefits.

Tax Deductibility Basics

In the United States, taxpayers can potentially reduce their taxable income by deducting certain medical expenses. Understanding the rules governing these deductions is crucial for maximizing tax benefits. The ability to deduct medical expenses is subject to specific limitations and requirements.

Medical Expense Deduction Rules

The Internal Revenue Service (IRS) allows taxpayers to deduct medical expenses that exceed a certain percentage of their adjusted gross income (AGI). This percentage threshold changes annually and is published in IRS publications. Only expenses exceeding this threshold are deductible. It’s important to note that this is an *above-the-line* deduction, meaning it reduces your AGI before calculating your taxable income, potentially offering greater tax savings than itemized deductions. Detailed information on the current AGI threshold can be found on the IRS website.

Qualifying Medical Expenses

A wide range of medical expenses may qualify for deduction. Generally, these expenses must be for the diagnosis, cure, mitigation, treatment, or prevention of disease, and for the purpose of affecting any structure or function of the body. The expense must be for you, your spouse, or your dependents. It’s essential to keep detailed records of all medical expenses, including receipts and explanations of the services rendered.

Examples of Deductible and Non-Deductible Medical Expenses

To illustrate, let’s consider several examples. Deductible expenses often include doctor visits, hospital stays, prescription drugs, and medical equipment. Non-deductible expenses typically include cosmetic surgery (unless medically necessary), health club memberships, and over-the-counter medications. The line between deductible and non-deductible can sometimes be blurry, so consulting a tax professional is advisable in uncertain situations.

| Expense Type | Deductibility Status | Qualifying Conditions | Example |

|---|---|---|---|

| Doctor Visits | Deductible | Expenses for diagnosis and treatment of illness or injury. | Physician’s fee for a routine checkup. |

| Prescription Drugs | Deductible | Medications prescribed by a licensed physician for a specific medical condition. | Insulin for a diabetic patient. |

| Hospital Stays | Deductible | Expenses incurred during a medically necessary hospital stay. | Charges for room and board, surgery, and other medical services in a hospital. |

| Cosmetic Surgery | Generally Non-Deductible | Deductible only if medically necessary (e.g., reconstructive surgery following an accident). | Facelift for purely cosmetic reasons. |

| Health Club Membership | Non-Deductible | Generally considered a personal expense, not directly related to medical treatment. | Monthly fee for a gym membership. |

| Over-the-Counter Medications | Non-Deductible | Unless specifically prescribed by a physician. | Ibuprofen purchased at a drugstore. |

Long-Term Care Insurance Premiums

Long-term care insurance is a crucial financial planning tool designed to help individuals cover the substantial costs associated with long-term care services. These services are often necessary when someone becomes unable to perform daily tasks due to aging, illness, or injury, and can include assistance with bathing, dressing, eating, and other personal care needs. Understanding the nuances of long-term care insurance premiums is vital for making informed decisions about this important type of coverage.

Types of Long-Term Care Insurance Policies

Long-term care insurance policies vary significantly in their structure and benefits. The key differences often lie in the type of care covered, the benefit amount, and the duration of coverage. Common policy types include traditional policies offering a daily or monthly benefit for a specified period, hybrid policies combining life insurance with long-term care benefits, and policies that offer only limited coverage for specific types of care, such as assisted living. Policyholders should carefully review the terms and conditions of each policy to understand the specific benefits and limitations.

Factors Influencing Premium Costs

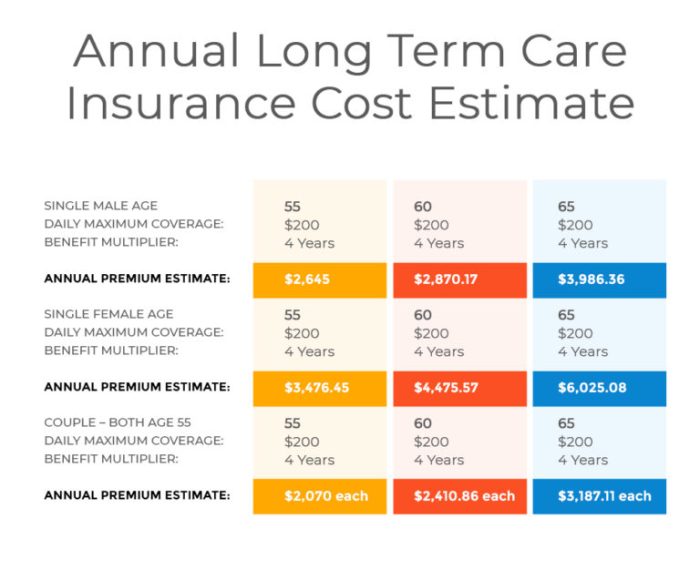

Several factors play a significant role in determining the cost of long-term care insurance premiums. These include the applicant’s age, health status, the benefit amount selected (daily or monthly payout), the length of the benefit period (how long the policy will pay benefits), and the type of care covered (home care, assisted living, nursing home). Premiums generally increase with age and are higher for individuals with pre-existing health conditions. Choosing a higher daily benefit amount or a longer benefit period will also result in higher premiums. Furthermore, inflation protection riders, which adjust benefits to account for future inflation, add to the premium cost. For example, a 55-year-old in excellent health might pay significantly less than a 70-year-old with a pre-existing condition for the same coverage.

Situations Requiring Long-Term Care Insurance

Long-term care insurance can be essential in various circumstances. Consider the case of an individual diagnosed with Alzheimer’s disease requiring extensive home health care, or a stroke survivor needing rehabilitation and ongoing nursing home care. Similarly, individuals facing a debilitating accident or chronic illness that leaves them unable to perform basic daily tasks could find long-term care insurance invaluable. The financial burden of long-term care can be substantial, easily reaching hundreds of thousands of dollars over time. For instance, the average annual cost of a nursing home stay in the United States is significantly high, putting a considerable strain on personal savings and family resources. Long-term care insurance can help mitigate these financial risks and allow individuals to maintain their financial stability and independence.

Interaction of Long-Term Care Premiums and Tax Deductions

Understanding the tax implications of long-term care insurance premiums is crucial for effective financial planning. While premiums themselves aren’t directly deductible, the potential for tax benefits arises through the interaction of these premiums with other aspects of your tax return, primarily through medical expense deductions. This section will clarify the rules and regulations surrounding this interaction.

The deductibility of long-term care insurance premiums is governed by Section 213 of the Internal Revenue Code. This section addresses medical expense deductions, allowing taxpayers to deduct medical expenses exceeding a certain percentage of their adjusted gross income (AGI). Crucially, the IRS doesn’t classify long-term care insurance premiums as a medical expense *in themselves*. Instead, any benefits received from a long-term care insurance policy are considered medical expenses, and *only those benefits* can be included in calculating your total medical expense deduction. This is a key distinction.

Long-Term Care Insurance Premiums and Medical Expense Deduction

The tax treatment of long-term care insurance premiums differs significantly from the direct deductibility of certain other medical expenses, such as prescription drugs or doctor visits. These expenses are typically deductible (up to the AGI threshold), whereas the premiums themselves are not. The deduction only applies to the actual *expenses incurred for long-term care*, covered by the insurance policy. For example, if you pay $5,000 in premiums annually and receive $2,000 in benefits to cover assisted living expenses, only the $2,000 in benefits can be included in calculating your medical expense deduction. This underscores the importance of carefully considering the policy’s benefits and coverage before purchasing.

Steps to Determine Deductibility of Long-Term Care Expenses

To determine the deductibility of your long-term care expenses, follow these steps:

- Calculate your total medical expenses for the year. This includes expenses paid for doctor visits, prescription drugs, hospital stays, and, importantly, benefits received from your long-term care insurance policy.

- Determine your adjusted gross income (AGI). This is your gross income minus certain deductions.

- Calculate 7.5% of your AGI. This is the threshold for medical expense deductions.

- Subtract 7.5% of your AGI from your total medical expenses. Only the amount exceeding this threshold is deductible.

- Include the deductible amount on Schedule A (Form 1040), Itemized Deductions.

Tax Forms and Documentation

Claiming a tax deduction for long-term care insurance premiums requires careful record-keeping and accurate completion of the relevant tax forms. Understanding the process ensures you receive the maximum allowable deduction. This section details the necessary steps and documentation.

Form 1040, Schedule A (Itemized Deductions)

To claim the deduction, you’ll need to complete Schedule A (Itemized Deductions) of Form 1040, the U.S. Individual Income Tax Return. This schedule allows you to itemize your deductions rather than using the standard deduction. The long-term care insurance premium deduction is reported as a medical expense. It’s crucial to accurately record all eligible expenses. The amount you can deduct is limited to the amount exceeding 7.5% of your adjusted gross income (AGI).

Necessary Documentation

Maintaining organized records is vital for a successful deduction claim. You should gather the following documents:

- Policy information: This includes your policy number, the insurance company’s name, and the dates of coverage for the year in question. It’s essential to confirm that the policy meets IRS guidelines for qualifying long-term care insurance.

- Premium payment receipts: These receipts should clearly show the date, amount, and the fact that the payment is for long-term care insurance premiums. Keep canceled checks or electronic payment confirmations as well.

- Form 1099-MISC: If your insurance company issued a Form 1099-MISC, this form will report the premiums you paid during the tax year. This is important supporting documentation for your claim.

- Tax return from the previous year: You will need your prior year’s tax return to determine your adjusted gross income (AGI), which is used to calculate the 7.5% threshold for medical expense deductions.

Reporting Long-Term Care Insurance Premiums

To correctly report your premiums on your tax return, follow these steps:

- Calculate your AGI: Determine your adjusted gross income (AGI) using your tax return from the previous year. This is the total income minus certain deductions.

- Calculate the 7.5% AGI threshold: Multiply your AGI by 0.075. This is the amount of medical expenses you must exceed to claim a deduction.

- Determine the deductible amount: Subtract the 7.5% AGI threshold from your total medical expenses, including your long-term care insurance premiums. Only the amount exceeding the threshold is deductible.

- Complete Schedule A: Report the deductible amount of your long-term care insurance premiums on Schedule A, line 1, as part of your total medical expenses.

Checklist of Documents

Before filing your tax return, use this checklist to ensure you have all the necessary documents:

- Copy of your long-term care insurance policy

- Premium payment receipts or bank statements showing payments

- Form 1099-MISC (if applicable)

- Prior year’s tax return (for AGI calculation)

- Completed Schedule A (Form 1040)

Alternative Tax Strategies

While the direct deduction of long-term care insurance premiums offers a significant tax advantage, other strategies can further optimize your tax situation related to long-term care expenses. These strategies often involve leveraging other aspects of the tax code to minimize your overall tax burden, particularly during retirement when long-term care needs are most likely to arise. Careful planning is crucial, as the effectiveness of these strategies depends on individual circumstances and financial situations.

Health Savings Accounts (HSAs)

Health Savings Accounts offer a tax-advantaged way to save for qualified medical expenses, including some long-term care services. Contributions to an HSA are typically tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses are also tax-free. This makes HSAs a powerful tool for those anticipating long-term care needs, allowing them to build a dedicated fund for these expenses while simultaneously reducing their current tax liability. For example, a couple contributing the maximum annual amount to their HSA could significantly reduce their taxable income and accumulate a substantial sum over time, potentially offsetting a portion of future long-term care costs. It’s important to note that only expenses specifically eligible under HSA guidelines are covered, so careful planning is necessary to maximize the benefits.

Medicaid Planning

Medicaid is a government program providing healthcare assistance to low-income individuals. While not a tax strategy in the traditional sense, effective Medicaid planning can significantly reduce the out-of-pocket expenses associated with long-term care. Strategies often involve transferring assets to protect them from Medicaid’s asset limits, while still qualifying for benefits. However, these strategies are complex and involve navigating strict regulations, requiring the guidance of a qualified elder law attorney. For instance, a family might consider gifting assets to children or setting up trusts to protect a larger portion of their estate while still meeting Medicaid’s eligibility requirements for long-term care assistance. The timing and structure of these transfers are crucial to avoid penalties.

Qualified Long-Term Care Insurance Contracts

Some long-term care insurance policies are structured as qualified long-term care insurance contracts. These contracts offer tax advantages beyond the standard premium deductions. Specifically, benefits received under these policies may be excluded from gross income under certain circumstances. The precise rules are complex and depend on factors such as the policy’s design and the individual’s health status. For example, a policy holder who purchases a qualified long-term care insurance contract and subsequently receives benefits for nursing home care might find that those benefits are not subject to taxation, further mitigating the overall financial impact of long-term care.

Tax-Advantaged Investments

While not directly related to long-term care expenses, strategically utilizing tax-advantaged investment accounts such as Roth IRAs or 401(k)s can indirectly reduce the tax burden related to long-term care. By minimizing taxable income during working years, individuals can lower their overall tax liability and accumulate more funds for retirement, which can be used to cover long-term care expenses. This approach focuses on building a larger financial cushion for long-term care rather than directly deducting expenses. For instance, someone consistently contributing to a Roth IRA, knowing they won’t pay taxes on withdrawals in retirement, has more flexibility in how they use their retirement savings, including paying for long-term care without additional tax penalties.

Last Point

Securing long-term care is a vital part of comprehensive financial planning, and the potential for tax deductions on insurance premiums adds another layer of complexity. While the deductibility of long-term care insurance premiums isn’t a guaranteed benefit, understanding the factors that influence eligibility—such as age, health status, and policy features—is crucial for maximizing tax advantages. By carefully considering these factors and employing appropriate tax strategies, individuals can potentially mitigate the financial burden associated with long-term care and enhance their overall financial well-being.

Essential Questionnaire

Can I deduct premiums if I haven’t yet used the insurance?

Generally, you can deduct premiums paid even if you haven’t yet needed to use the long-term care benefits. The deduction is for the premiums themselves, not the benefits received.

What if I have multiple long-term care insurance policies?

The rules regarding deductibility generally apply to each policy individually. You would need to consider the limitations and conditions for each policy separately when calculating your deduction.

Are there any income limitations for claiming this deduction?

There are no specific income limitations for deducting long-term care insurance premiums, but the overall deduction is limited to the amount of medical expenses exceeding 7.5% of your adjusted gross income (AGI).

My policy includes a home health care component; does this affect deductibility?

The inclusion of home health care in your policy doesn’t directly impact the deductibility of the premiums. The deductibility is based on the premiums paid, not the specific benefits covered.