Navigating the complexities of the Affordable Care Act (ACA), often referred to as Obamacare, can be challenging, particularly when it comes to understanding the tax implications. Many individuals, especially self-employed workers, question whether their insurance premiums are tax deductible. This guide unravels the intricacies of ACA premium deductibility, offering clarity on eligibility, procedures, and potential tax savings.

We will explore the different types of ACA plans, the factors affecting premium costs, and the role of government subsidies. We’ll then delve into the specific tax rules concerning premium deductions for self-employed individuals, comparing them to those with employer-sponsored insurance. This comprehensive overview will equip you with the knowledge to confidently navigate this important aspect of healthcare and tax planning.

Understanding the Affordable Care Act (ACA) and Premiums

The Affordable Care Act (ACA), also known as Obamacare, significantly reshaped the American healthcare landscape. A key component is the establishment of health insurance marketplaces, where individuals and families can purchase health insurance plans. Understanding the nuances of these plans and the factors influencing their cost is crucial for navigating the system effectively.

The ACA offers a range of health insurance plans, each with varying levels of coverage and cost.

Types of ACA Health Insurance Plans

The ACA marketplace offers several metal tiers of health insurance plans, each representing a different balance between cost-sharing and premium payments. These tiers categorize plans based on their actuarial value (AV), which indicates the percentage of healthcare costs the plan covers on average. Bronze plans have the lowest premiums but higher out-of-pocket costs, while Platinum plans have the highest premiums but the lowest out-of-pocket costs. Silver, Gold, and Catastrophic plans fall between these extremes. The specific plans available vary by state and insurance provider.

Factors Influencing ACA Premium Costs

Several factors contribute to the cost of ACA insurance premiums. These include the individual’s age, location, tobacco use, the chosen plan’s metal tier (Bronze, Silver, Gold, Platinum), and the chosen plan’s provider network. Geographic location plays a significant role, with premiums typically higher in areas with higher healthcare costs. The plan’s network size also affects premiums; a larger network generally translates to higher premiums due to greater access to providers. Finally, the plan’s deductible, co-pays, and out-of-pocket maximums influence the overall cost. For example, a plan with a high deductible will generally have a lower premium, but higher costs if significant medical care is needed.

ACA Subsidies and Their Impact on Premium Costs

The ACA offers subsidies, or tax credits, to help individuals and families afford health insurance. These subsidies are based on income and family size. The amount of the subsidy reduces the monthly premium cost, making health insurance more affordable. Eligibility for subsidies is determined by income relative to the federal poverty level (FPL). For instance, a family earning 200% of the FPL may qualify for a significant subsidy, significantly lowering their monthly premium. The subsidy amount is calculated to ensure that the individual’s contribution to the premium doesn’t exceed a certain percentage of their income. This makes ACA plans accessible to a wider range of individuals. It’s important to note that the subsidy amount can vary year to year based on income and changes to the FPL.

Tax Deductibility of Health Insurance Premiums

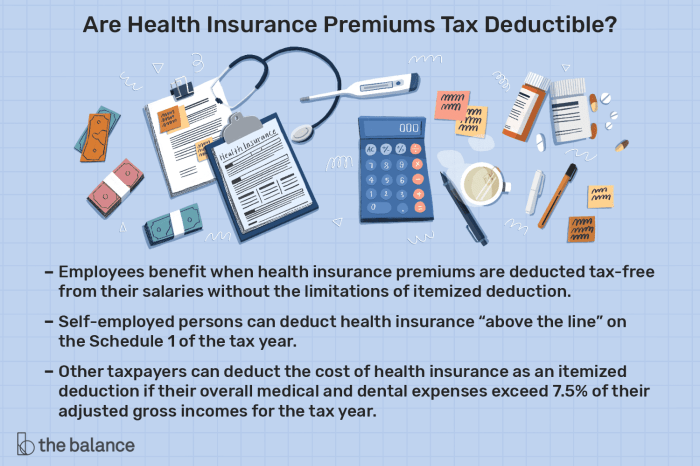

Self-employed individuals and those without employer-sponsored health insurance often face the responsibility of securing their own health coverage. Understanding the tax implications of these premiums is crucial for maximizing tax savings. This section details the rules governing the deductibility of health insurance premiums, comparing self-employed individuals’ options with those enrolled in ACA plans and employer-sponsored insurance.

Deductibility for Self-Employed Individuals

Self-employed individuals can deduct the cost of health insurance premiums paid for themselves, their spouse, and their dependents. This deduction is taken above the line, meaning it reduces your adjusted gross income (AGI), potentially leading to a larger tax refund or lower tax liability. To qualify, the individual must be self-employed or a part-owner of a business and have earned income from that business. The premiums must be for a health plan that meets minimum coverage requirements under the Affordable Care Act. It’s important to note that this deduction is not available for those who are eligible for employer-sponsored health insurance.

Comparison with ACA and Employer-Sponsored Insurance

Individuals enrolled in ACA plans can deduct their premiums under certain circumstances, largely mirroring the rules for self-employed individuals. The key difference lies in the availability of the deduction. While self-employed individuals actively choose their plans and can deduct the premiums regardless of income, ACA plan enrollees may have income limitations that affect their eligibility for premium tax credits, which could impact the overall deductibility. Those with employer-sponsored insurance generally cannot deduct their premiums, as the employer typically covers a portion or all of the cost. The employee’s share of premiums may be paid pre-tax through payroll deductions, but these are not deductible.

Tax Forms and Schedules for Claiming Deductions

To claim the deduction for health insurance premiums, self-employed individuals use Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship), or Schedule F (Form 1040), Profit or Loss from Farming. The premium amount is reported as a business expense. For those with more complex situations, additional forms may be required. Accurate record-keeping of premium payments is essential for accurate reporting. Consult a tax professional if needed to ensure compliance.

Potential Tax Savings

The following table illustrates potential tax savings based on different income levels and premium amounts. These are simplified examples and do not account for all individual circumstances or tax brackets. Consult a tax professional for personalized advice.

| Annual Income | Annual Premium | Tax Rate (Example) | Potential Tax Savings |

|---|---|---|---|

| $40,000 | $5,000 | 22% | $1,100 |

| $60,000 | $7,000 | 24% | $1,680 |

| $80,000 | $9,000 | 28% | $2,520 |

| $100,000 | $10,000 | 32% | $3,200 |

Illustrative Examples

Understanding the tax implications of ACA premiums requires looking at concrete examples. This section provides hypothetical scenarios to illustrate how the deduction works and how various factors can affect the potential tax savings.

Let’s consider a hypothetical individual, Sarah, who purchased a health insurance plan through the ACA marketplace. Her modified adjusted gross income (MAGI) falls within the range that allows for the premium tax credit. We will explore how this impacts her tax liability.

ACA Premium Tax Deduction Calculation

To calculate the potential tax savings, we need Sarah’s information. Assume Sarah’s annual ACA premiums were $7,200, and her total tax liability before considering the premium tax credit was $5,000. Further assume that based on her income and the ACA marketplace rules, she received a premium tax credit of $3,600 which reduced her actual out-of-pocket premium cost to $3,600 ($7200-$3600). This $3,600 is what is deductible. The amount of the deduction depends on the individual’s adjusted gross income (AGI) and other factors. The premium tax credit is not the same as the deduction; the credit reduces the tax owed, while the deduction reduces the taxable income. In this case, the deduction reduces her taxable income by $3,600, resulting in a lower tax liability. The exact tax savings will depend on Sarah’s marginal tax rate. If her marginal tax rate is 22%, her tax savings would be $792 ($3,600 x 0.22). Therefore, her total tax liability after the deduction would be approximately $4,208 ($5,000 – $792). Note that this is a simplified example and doesn’t account for all potential tax complexities.

Visual Representation of ACA Premium Tax Deduction

Imagine a simple diagram. A box represents Sarah’s total income. From this box, we subtract deductions and exemptions, leading to a smaller box representing her taxable income. The ACA premium deduction is represented as a further subtraction from this taxable income box. This smaller box, representing her taxable income *after* the ACA premium deduction, is then multiplied by her marginal tax rate to arrive at her final tax liability. The difference between her tax liability before and after the deduction represents her tax savings.

Impact of Income and Premium Changes

Changes in Sarah’s income or her ACA premium costs will directly influence the amount of her tax deduction. If her income increases, her premium tax credit might decrease or disappear entirely, reducing the deductible amount. Conversely, a higher premium cost (even with a stable income) could lead to a larger premium tax credit and therefore a larger deduction, assuming she remains eligible. If her income decreases significantly, she might qualify for a larger premium tax credit, increasing the deductible amount. It’s important to note that the eligibility for and amount of the premium tax credit are determined annually and are subject to change based on income and other factors.

Final Wrap-Up

Understanding the tax deductibility of your Obamacare premiums can significantly impact your overall tax burden. While the rules can seem intricate, careful consideration of your individual circumstances, coupled with the information presented here, will empower you to make informed decisions and maximize your potential tax savings. Remember to consult with a qualified tax professional for personalized advice tailored to your specific situation.

FAQ Corner

Can I deduct premiums if I receive a subsidy?

The subsidy reduces your out-of-pocket premium cost. You generally cannot deduct the subsidized portion, but you can deduct the amount you paid above the subsidy.

What if I’m covered under my spouse’s employer-sponsored plan?

Premiums paid for employer-sponsored insurance are generally not deductible.

Are there any income limits for deducting premiums?

There are no income limits for deducting health insurance premiums for self-employed individuals, but the amount you can deduct is limited to your net self-employment income.

What form do I use to claim the deduction?

You’ll use Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship), to report your business income and expenses, including health insurance premiums.

What happens if I make a mistake on my tax return regarding this deduction?

Incorrectly claiming deductions can result in penalties from the IRS, including interest and fines. It’s crucial to ensure accuracy.