Navigating the complex world of insurance and taxes can be daunting. Understanding whether your insurance premiums are deductible before taxes significantly impacts your overall financial picture. This guide unravels the intricacies of tax treatment for various insurance types, exploring both employer-sponsored and self-employed scenarios. We’ll clarify common misconceptions and provide practical examples to help you determine your tax liability.

From health and life insurance to homeowner’s and auto insurance, the deductibility of premiums varies widely depending on your circumstances and the specific type of insurance. This guide will equip you with the knowledge to confidently navigate the tax implications of your insurance costs, ensuring you maximize potential tax benefits and avoid costly mistakes.

Tax Treatment of Insurance Premiums

The tax treatment of insurance premiums varies significantly across countries and depends heavily on the type of insurance. Generally, tax laws aim to balance incentivizing individuals to secure appropriate coverage with preventing excessive tax avoidance through insurance schemes. Understanding these nuances is crucial for both individuals and businesses to optimize their tax positions legally.

General Tax Rules Regarding Insurance Premiums

Tax regulations concerning insurance premiums differ substantially worldwide. In some countries, premiums paid for certain types of insurance are deductible from taxable income, while others may offer tax credits or subsidies instead. The specific rules depend on factors such as the type of insurance, the insured individual’s circumstances (e.g., employment status, income level), and the country’s overall tax code. For example, the United States allows deductions for certain health insurance premiums for self-employed individuals and those without employer-sponsored plans, while Canada offers tax credits for eligible medical expenses, including some insurance premiums. In the UK, deductibility is often linked to business insurance rather than personal insurance. It’s essential to consult the relevant tax authority’s guidelines for a definitive answer regarding a specific jurisdiction.

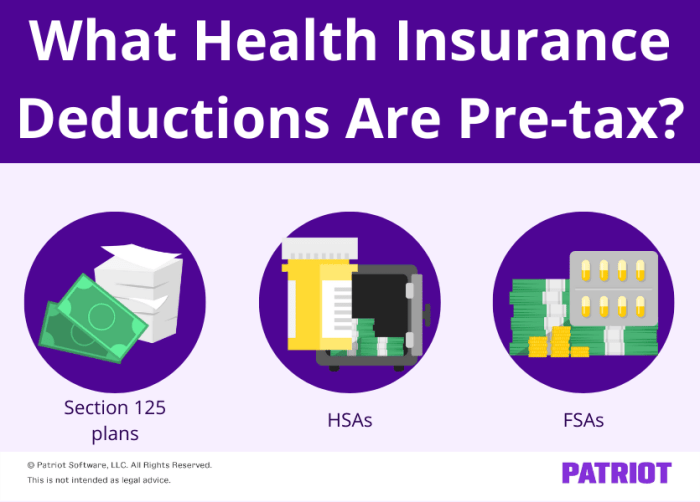

Examples of Deductible Insurance Premiums

Several types of insurance premiums often qualify for tax deductions in various countries, although the specifics vary. Common examples include premiums paid for health insurance (under certain conditions, as noted above), disability insurance, and premiums associated with business insurance policies such as professional liability insurance (errors and omissions insurance) or commercial property insurance. The deductibility typically hinges on the purpose of the insurance; policies protecting against business risks or providing essential personal coverage are more likely to be eligible for tax benefits.

Examples of Non-Deductible Insurance Premiums

Conversely, many insurance premiums are not tax-deductible. This often includes premiums for life insurance, unless it is a policy specifically designed for business purposes (such as key-person insurance). Premiums for investments like annuities or insurance products with a significant investment component may also not be deductible. Similarly, premiums for insurance policies that primarily offer investment or savings benefits, rather than protection against risk, are usually not eligible for tax relief. The key determining factor is the primary purpose of the policy: is it primarily for risk protection or investment growth?

Claiming Deductions for Insurance Premiums

The process of claiming deductions for insurance premiums varies by country and tax system. Generally, it involves documenting the premiums paid during the tax year, often through receipts or policy statements. These documents are then included with the tax return, usually on designated forms or schedules. The specific forms and the method of claiming the deduction will be Artikeld in the instructions provided by the relevant tax authority. Failing to maintain proper documentation can result in the rejection of the deduction claim. Professional tax advice is frequently recommended, particularly in complex cases.

Comparison: Health Insurance Premiums vs. Life Insurance Premiums

| Feature | Health Insurance Premiums | Life Insurance Premiums | Notes |

|---|---|---|---|

| Tax Deductibility | Often deductible (subject to specific conditions and country regulations) | Generally not deductible (exceptions exist for business-related policies) | Eligibility varies significantly by country and individual circumstances. |

| Purpose | Covers medical expenses and healthcare costs. | Provides a death benefit to beneficiaries. | Distinct purposes impact tax treatment. |

| Tax Implications | May reduce taxable income, leading to lower tax liability. | Typically no direct tax benefits for the premium itself; death benefit may have tax implications for beneficiaries. | Consult tax professionals for specific advice. |

| Examples of Deductibility | Self-employed individuals, those without employer-sponsored plans (in some countries). | Key-person insurance (business-related policies). | Regulations vary greatly between countries. |

Employer-Sponsored Health Insurance

Employer-sponsored health insurance represents a significant portion of the employee benefits landscape in many countries. Understanding its tax implications is crucial for both employees and employers. This section details how these plans are treated for tax purposes, highlighting key differences from individually purchased plans.

Employer-sponsored health insurance plans offer substantial tax advantages compared to individually purchased plans. These advantages stem from the way premiums are handled, impacting both the employer’s and employee’s tax liabilities. The primary benefit lies in the tax-deductibility of premiums for the employer and the tax-free nature of the benefit for the employee, up to certain limits.

Employer’s Tax Treatment of Premiums

Employers can deduct the cost of premiums paid for employee health insurance as a business expense. This deduction reduces the employer’s taxable income, leading to lower tax payments. This deduction is a significant incentive for employers to offer health insurance as a benefit. The amount deducted is the total premium paid by the employer on behalf of the employee. There are no limits on the amount the employer can deduct, provided it’s considered an ordinary and necessary business expense.

Employee’s Tax Treatment of Premiums

Generally, employees do not include the value of employer-sponsored health insurance premiums in their gross income. This means the premiums paid by the employer are not considered taxable income for the employee. This is a substantial tax benefit, saving employees a considerable amount in taxes. This tax-free status applies only to premiums paid by the employer; any premiums paid by the employee are treated differently.

Situations Where Employees May Pay Taxes on Employer-Sponsored Health Insurance

While the majority of employer-sponsored health insurance premiums are tax-free for employees, there are exceptions. If an employee receives a highly valuable or unusually generous health insurance plan far exceeding typical market rates, the IRS may consider a portion of the benefit taxable. This situation is rare and usually applies to high-level executives or individuals in exceptional circumstances. Additionally, if an employee receives reimbursement for medical expenses that exceed the cost of their premiums, the excess may be considered taxable income.

Comparison of Tax Advantages: Employer-Sponsored vs. Individually Purchased Plans

The tax advantages of employer-sponsored plans are substantial when compared to individually purchased plans. With individually purchased plans, the entire premium cost is paid by the individual and is not tax-deductible for most individuals. The employee bears the full financial burden and tax liability. In contrast, employer-sponsored plans offer tax-deductibility for the employer and tax-free status for the employee on the employer’s contribution. This significant difference often results in substantial savings for both parties.

Common Misconceptions About the Taxability of Employer-Sponsored Health Insurance

Before summarizing common misconceptions, it’s important to note that tax laws are complex and can change. Always consult a tax professional for personalized advice.

- Misconception: All employer-sponsored health insurance premiums are completely tax-free for employees. Reality: While generally true, exceptionally generous plans may result in a portion being taxed.

- Misconception: The employer’s contribution to health insurance is not considered income for the employee. Reality: This is generally true, but only for the employer’s portion; employee contributions are taxable.

- Misconception: Employer-sponsored health insurance is always more affordable than individually purchased insurance. Reality: While tax advantages exist, the actual cost of the plan itself, including deductibles and co-pays, can vary greatly.

Impact of Tax Laws on Insurance Premium Costs

Tax laws significantly influence the affordability and accessibility of insurance for consumers. These laws affect not only the premiums individuals pay but also the types of insurance plans available and the overall structure of the insurance market. Understanding this interplay is crucial for both consumers making insurance decisions and policymakers shaping insurance regulation.

Tax laws interact with insurance premiums in several key ways. The most direct impact is through tax deductions or credits for insurance premiums. Indirectly, tax policies can affect the profitability and solvency of insurance companies, influencing the pricing strategies they adopt. Furthermore, tax incentives can be used to encourage the purchase of specific types of insurance, such as health insurance or long-term care insurance.

Tax Deductibility and Premium Costs

Tax deductions for health insurance premiums, for instance, directly reduce the net cost of insurance for taxpayers. The amount of the deduction depends on the taxpayer’s income, the type of insurance plan, and the applicable tax laws. A higher tax bracket translates to greater savings from a tax deduction. This makes insurance more affordable for higher-income individuals, potentially impacting their choice of plans. They may be more willing to opt for more comprehensive, higher-premium plans due to the tax benefits. Conversely, those in lower tax brackets benefit less from the deduction, making insurance relatively more expensive for them.

Effects of Changes in Tax Policies on the Insurance Market

Changes in tax policies related to insurance can have ripple effects throughout the market. For example, a reduction in tax deductions for health insurance premiums could lead to higher demand for less expensive plans, potentially affecting the profitability of insurers offering comprehensive coverage. This could incentivize insurers to adjust their offerings, potentially leading to fewer choices for consumers or higher premiums overall. Conversely, the introduction of tax credits for specific types of insurance could increase the demand for those types of coverage, prompting insurers to expand their offerings in those areas.

Tax Deductions and Individual Decision-Making

The availability of tax deductions plays a substantial role in the insurance plan selection process. Consider two individuals, both needing health insurance. Individual A is in a high tax bracket and is eligible for a significant tax deduction on their premiums. Individual B is in a low tax bracket and receives a smaller deduction. Both are considering two plans: a comprehensive plan with high premiums and a basic plan with low premiums. While the comprehensive plan might seem prohibitively expensive at first glance, the substantial tax deduction for Individual A might make it a financially viable option. For Individual B, the limited tax benefit might make the basic plan a more attractive choice, despite its limited coverage.

Hypothetical Scenario: Impact of Tax Deductibility

Let’s assume Sarah pays $10,000 annually for health insurance premiums. Her tax bracket is such that she receives a 25% tax deduction. This means she receives a $2,500 deduction, reducing her net cost to $7,500. If tax laws changed and this deduction was eliminated, her net cost would increase to $10,000, a significant financial impact. Conversely, if the deduction increased to 30%, her net cost would drop to $7,000, highlighting the substantial influence tax policies have on the actual cost borne by individuals.

Illustrative Examples

Understanding the tax implications of different insurance types can significantly impact your overall financial planning. While the deductibility of premiums varies, it’s crucial to know which policies offer tax advantages and which don’t. The following examples illustrate the tax treatment of common insurance policies.

Homeowner’s Insurance Premiums

Homeowner’s insurance premiums are generally not deductible as a personal expense. This means the cost of your homeowner’s insurance policy reduces your disposable income directly, without any tax benefits. For example, if your annual homeowner’s insurance premium is $1,200, you will pay the full $1,200, and this amount will not be factored into your taxable income calculation. There are some exceptions, such as if the insurance is part of a larger business expense, but these are generally uncommon for personal homeowners’ policies.

Auto Insurance Premiums

Similar to homeowner’s insurance, auto insurance premiums are typically not deductible as a personal expense. The cost of your car insurance policy is a personal expense that directly reduces your disposable income, and it does not affect your taxable income. If your annual auto insurance premium is $800, you’ll pay the full amount, and this expense will not be reflected in your tax calculations. Again, exceptions may exist for business-related use of the vehicle, requiring proper documentation and accounting practices.

Disability Insurance Premiums

The tax treatment of disability insurance premiums depends on whether the policy was purchased by you personally or through your employer. Premiums paid for individually purchased disability insurance are generally not deductible. However, if your employer provides disability insurance as a benefit, the premiums paid by your employer are usually considered taxable income to you. For instance, if your employer pays $500 annually for your disability insurance, this amount will be included in your W-2 form as taxable income. Conversely, if you personally pay $500 for disability insurance, this expense is not deductible from your taxes.

Visual Representation of Tax Law Impact on Net Insurance Costs

A bar graph could effectively illustrate this. The horizontal axis would list the different insurance types (Homeowner’s, Auto, Employer-Sponsored Disability, Individually Purchased Disability). The vertical axis would represent the net cost after tax implications. For Homeowner’s and Auto insurance, the bar would represent the full premium amount, showing no tax reduction. For employer-sponsored disability insurance, the bar would be taller, reflecting the added cost of the taxable benefit. The bar for individually purchased disability insurance would also show the full premium amount, indicating no tax deduction. This visual would clearly demonstrate how the net cost of insurance varies depending on the type of policy and its tax treatment. The differences in bar heights would visually represent the financial impact of tax laws on the different insurance types.

Epilogue

Ultimately, the question of whether insurance premiums are pre-tax deductible hinges on several factors, including the type of insurance, your employment status, and prevailing tax laws. While some premiums offer valuable tax advantages, others may not. By carefully reviewing your specific situation and consulting relevant tax resources or professionals when needed, you can ensure accurate reporting and maximize your financial well-being. Understanding these nuances empowers you to make informed decisions about your insurance coverage and financial planning.

Common Queries

What if I pay my insurance premiums through payroll deductions?

The tax treatment depends on the type of insurance. Employer-sponsored health insurance premiums are typically pre-tax deductions, while others may not be.

Can I deduct insurance premiums for my pet?

Generally, pet insurance premiums are not tax deductible.

Where can I find more information on specific tax forms related to insurance deductions?

Consult the IRS website (for US taxpayers) or your country’s equivalent tax authority website. They provide detailed information on relevant tax forms and instructions.

Are there penalties for incorrectly claiming insurance premium deductions?

Yes, inaccurate reporting can lead to penalties and interest charges. It’s crucial to ensure accuracy when filing your tax return.