Navigating the complexities of tax deductions can be daunting, especially when it comes to understanding whether your insurance premiums qualify. This guide delves into the intricacies of deducting insurance premiums on your taxes, exploring various insurance types, eligibility criteria, and the differences between itemized and standard deductions. We’ll clarify the rules and regulations, providing practical examples and scenarios to illuminate the process and empower you to make informed decisions about your tax obligations.

Understanding the deductibility of insurance premiums is crucial for minimizing your tax liability. Whether you’re self-employed, employed, or managing a family’s finances, this guide will equip you with the knowledge to confidently navigate the relevant tax laws and maximize your potential tax savings. We’ll cover a range of insurance types, from health and auto to home and life, detailing the specific requirements and limitations for each.

Self-Employment and Deductibility

Self-employed individuals face unique tax situations, differing significantly from those employed by a company. One key difference lies in the deductibility of health insurance premiums. While employees often have premiums covered partially or fully by their employers, the self-employed must cover the entire cost themselves. Fortunately, the IRS allows for the deduction of these premiums, offering a valuable tax break for this group.

The deductibility of health insurance premiums for the self-employed is governed by specific rules and limitations. Understanding these is crucial for accurately filing your taxes and maximizing your deductions. Incorrectly claiming this deduction can lead to penalties and complications.

Health Insurance Premium Deduction Requirements

To claim the deduction for self-employed health insurance premiums, you must meet several criteria. First, you must be self-employed or a sole proprietor. This means you’re actively involved in a business and earn income from it. You also need to be considered an eligible self-employed individual for the tax year in question. Secondly, you must have paid health insurance premiums for yourself, your spouse, and/or your dependents. Crucially, the premiums must be for medical insurance coverage, not other types of insurance. Finally, you cannot be eligible to participate in an employer-sponsored health plan. If you were eligible for employer-sponsored coverage, you generally cannot deduct your self-paid premiums.

Calculating the Deduction

The amount you can deduct is the actual amount you paid in premiums during the tax year. This includes premiums paid for yourself, your spouse, and any qualifying dependents. You should retain all receipts and documentation related to your premium payments. These records are vital in case of an audit. The deduction is taken on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship), as a business expense. It is important to note that the deduction is taken *above the line*, meaning it reduces your adjusted gross income (AGI). This contrasts with itemized deductions which are taken *below the line* after AGI is calculated.

Step-by-Step Guide to Claiming the Deduction

- Gather your documentation: Collect all your health insurance premium payment receipts and statements for the tax year. Ensure the documents clearly show the dates of payment, the amount paid, and who the coverage was for.

- Determine your eligibility: Verify that you meet all the requirements for claiming the deduction. Confirm your self-employment status and that you weren’t eligible for employer-sponsored health insurance.

- Complete Schedule C (Form 1040): Enter your health insurance premium payments in the appropriate section of Schedule C, usually under “Other Expenses”. Be sure to accurately record the total amount paid.

- File your tax return: Attach Schedule C to your Form 1040 and file your tax return by the tax deadline.

Note: Consult a tax professional for personalized advice, as tax laws are complex and can change. This guide is for informational purposes only and does not constitute tax advice.

Tax Laws and Regulations

Understanding the specific tax laws and regulations governing the deductibility of insurance premiums is crucial for accurate tax filing. These laws are complex and can vary depending on the type of insurance, the nature of the business, and the specific tax jurisdiction. Changes in tax legislation can significantly impact the deductibility of these premiums, necessitating careful monitoring of relevant updates.

Relevant Sections of the Tax Code

The deductibility of insurance premiums is primarily governed by the Internal Revenue Code (IRC). While specific sections can vary depending on the type of insurance (health, business, etc.), key provisions often relate to the nature of the expense and whether it’s considered “ordinary and necessary” for the business or trade. For example, premiums paid for health insurance for self-employed individuals might fall under different sections than premiums for liability insurance for a business. Precise section numbers should be verified through official IRS publications and consulted with a tax professional as they are subject to change. Generally, deductions are allowed for expenses incurred in carrying on a trade or business, provided they meet certain criteria. This often includes verifying the insurance policy covers risks associated with the business.

Implications of Changes in Tax Laws

Changes in tax laws can dramatically alter the deductibility of insurance premiums. For instance, a modification to the definition of “ordinary and necessary” business expenses could affect the deductibility of certain types of insurance. Similarly, changes in tax rates or the introduction of new tax credits could indirectly influence the net benefit of deducting premiums. A hypothetical example: if the tax rate is lowered, the overall tax savings from deducting premiums would also decrease, even if the deductibility itself remains unchanged. Furthermore, legislative changes could introduce new limitations or restrictions on deductible expenses, potentially affecting the types of insurance premiums eligible for deduction. Keeping abreast of tax law updates is therefore paramount for accurate tax compliance.

Key Legal Aspects of Insurance Premium Deductibility

- Ordinary and Necessary Business Expense: Premiums must be considered ordinary and necessary for the business to be deductible. This means they are common in the industry and helpful for the business’s operations.

- Directly Related to Business Activity: The insurance coverage must directly protect the business from risks associated with its operations. Premiums for personal insurance are generally not deductible.

- Proper Documentation: Adequate documentation, such as insurance policies and receipts, is essential to substantiate the deduction claimed. Failure to provide sufficient documentation can lead to disallowance of the deduction.

- Specific Tax Regulations: The specific rules governing the deductibility of premiums vary depending on the type of insurance (e.g., health insurance for self-employed individuals, liability insurance for businesses, etc.) and the relevant tax laws.

- Compliance with IRS Guidelines: It is imperative to adhere to all IRS guidelines and regulations pertaining to insurance premium deductibility. Non-compliance can result in penalties and interest charges.

Illustrative Examples (Visual Aid)

Visual representations can significantly clarify the complexities of tax deductions for insurance premiums. By presenting data graphically, we can easily compare different scenarios and understand the potential impact on an individual’s tax liability. The following examples utilize bar charts to illustrate these impacts.

Bar Chart: Tax Implications of Various Insurance Premiums

This bar chart displays the tax savings resulting from deducting different types of insurance premiums. The horizontal axis represents the type of insurance premium (e.g., health, long-term care, disability). The vertical axis represents the dollar amount of tax savings. Data points would show the tax savings achieved for each premium type, assuming a consistent tax bracket for simplification. For example, a bar for “Health Insurance Premiums” might show a tax savings of $1,000, while “Long-Term Care Insurance Premiums” might show $500, reflecting the varying deductibility rules and premium amounts. The chart clearly illustrates how the deductibility of different insurance premiums varies, allowing for a quick comparison of their relative tax benefits. The difference in bar heights directly reflects the difference in tax savings generated by each type of insurance premium deduction. This visual makes it immediately apparent which types of insurance offer the greatest tax advantages.

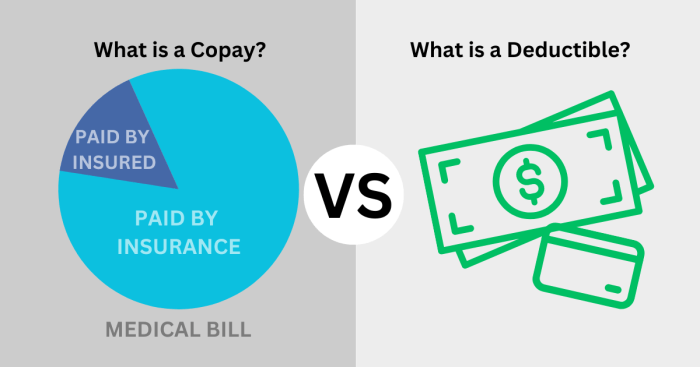

Comparison of Itemized vs. Standard Deduction: Impact of Insurance Premiums

This chart compares the total tax liability under both itemized and standard deduction methods, considering the inclusion of deductible insurance premiums. The horizontal axis represents different income levels, while the vertical axis represents the total tax liability. Two lines are plotted: one representing the total tax liability using the standard deduction, and the other representing the total tax liability using the itemized deduction, incorporating deductible insurance premiums. The difference between the two lines at each income level illustrates the tax benefit of itemizing deductions when insurance premiums are significant enough to exceed the standard deduction amount. For instance, at a hypothetical income level of $75,000, the standard deduction might result in a tax liability of $10,000, while itemizing (including, say, $5,000 in deductible health insurance premiums) might lower the tax liability to $9,000, demonstrating a $1,000 savings. As income increases, the standard deduction amount also increases, potentially reducing the benefit of itemizing, as shown by the converging lines at higher income levels. This visual clearly demonstrates the threshold at which itemizing becomes more advantageous due to the inclusion of deductible insurance premiums. This allows taxpayers to quickly assess whether itemizing will yield greater tax savings in their specific situation.

Concluding Remarks

Successfully navigating the landscape of tax deductions requires a clear understanding of the applicable rules and regulations. While the deductibility of insurance premiums can vary depending on factors such as your employment status and the type of insurance, this guide has provided a comprehensive overview of the key considerations. By maintaining meticulous records, understanding the distinctions between itemized and standard deductions, and staying informed about relevant tax laws, you can effectively manage your tax obligations and potentially reduce your overall tax liability. Remember to consult with a tax professional for personalized advice tailored to your specific circumstances.

Top FAQs

Can I deduct insurance premiums for my pet?

Generally, pet insurance premiums are not deductible unless the pet is used for business purposes (e.g., a service animal).

What if I overpaid my insurance premiums?

You can typically claim a refund for overpaid premiums. Keep all documentation related to the overpayment and contact your insurance provider.

Are there penalties for claiming incorrect deductions?

Yes, claiming incorrect deductions can result in penalties, including interest and additional taxes. Accurate record-keeping is crucial.

Where can I find more information on current tax laws regarding insurance deductions?

Consult the official website of your country’s tax authority (e.g., the IRS website in the US) for the most up-to-date information and relevant publications.