Insurance premiums—the cost of your insurance coverage—are far more complex than a simple price tag. They represent a carefully calculated assessment of risk, factoring in everything from your age and driving history to the prevalence of natural disasters in your region. Understanding how these premiums are determined is crucial for securing the right coverage at a price that fits your budget. This exploration will delve into the intricacies of premium calculations, offering insights into the factors that influence their cost and strategies for potentially lowering your expenses.

From the actuarial science behind the numbers to the impact of external factors like inflation and government regulations, we will unravel the mysteries surrounding insurance premiums. We’ll examine different types of insurance, comparing premium structures and coverage options across various providers, empowering you to make informed decisions about your financial protection.

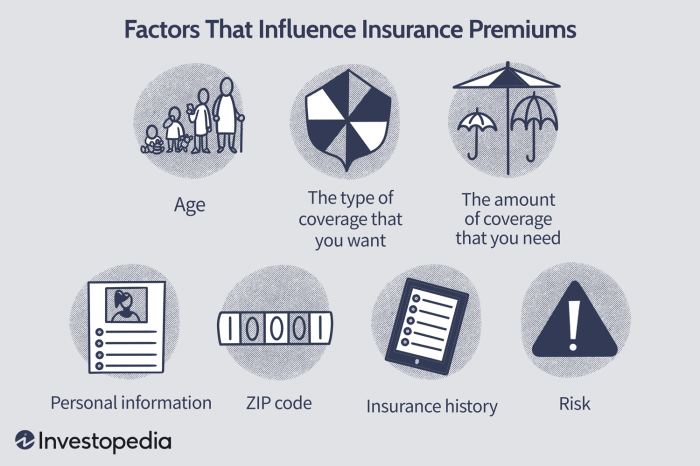

Factors Influencing Insurance Premiums

Understanding the factors that determine your insurance premiums is crucial for making informed decisions about your coverage. Several key elements contribute to the final cost, and this section will explore some of the most significant. These factors vary depending on the type of insurance, but common threads exist across different policies.

Age and Insurance Premiums

Age is a significant factor influencing premiums across various insurance types. For car insurance, younger drivers, particularly those under 25, typically pay higher premiums due to statistically higher accident rates in this age group. As drivers age and gain experience, their premiums generally decrease, reflecting a lower risk profile. Conversely, in health insurance, older individuals often face higher premiums because of the increased likelihood of needing more extensive medical care. Life insurance premiums also reflect age; younger individuals are generally offered lower premiums due to a longer life expectancy.

Driving History and Car Insurance Premiums

Driving history profoundly impacts car insurance premiums. A clean driving record with no accidents or traffic violations results in lower premiums. Conversely, accidents, especially those resulting in significant damage or injuries, lead to substantial premium increases. For example, a single at-fault accident could raise premiums by 20-40%, depending on the insurer and the specifics of the accident. Multiple accidents or serious traffic violations, such as DUI convictions, can lead to even more significant increases, potentially making insurance unaffordable for some drivers. Conversely, maintaining a spotless record for several years often leads to discounts and lower premiums.

Insurance Coverage Levels and Premium Differences

The level of coverage chosen significantly impacts insurance premiums. Liability-only coverage, which covers damages to others but not your own vehicle, is typically the cheapest option. Comprehensive coverage, which includes liability, collision (damage from accidents), and comprehensive (damage from non-accidents like theft or vandalism), is considerably more expensive. In between these extremes are various levels of coverage, offering different combinations of protection and corresponding premium costs. The higher the coverage level, the greater the protection, but also the higher the premium. Choosing the right level involves balancing the desired level of protection with affordability.

Factors Influencing Health Insurance Premiums

Beyond age, several other factors influence health insurance premiums. These include pre-existing conditions, location, and tobacco use.

| Factor | Influence on Premium | Examples |

|---|---|---|

| Pre-existing Conditions | Higher premiums due to increased risk of needing medical care | Diabetes, heart disease, cancer |

| Location | Premiums vary based on healthcare costs in the region | Higher premiums in areas with high healthcare costs, lower in areas with lower costs |

| Tobacco Use | Higher premiums due to increased risk of health problems | Smoking, chewing tobacco |

Understanding Premium Calculations

Homeowners insurance premiums aren’t plucked from thin air; they’re the result of a complex calculation process designed to reflect the risk an insurance company takes in covering your property. This process involves a careful assessment of various factors, sophisticated statistical modeling, and a deep understanding of actuarial science.

The process insurance companies use to calculate homeowners insurance premiums involves a multi-stage approach that blends statistical analysis with individual risk assessment. It begins with broad categorization of properties based on location, construction type, and other general characteristics. This allows insurers to establish baseline premiums. These baseline premiums are then adjusted based on a detailed assessment of individual risk factors specific to the property and the homeowner. This ensures that premiums accurately reflect the likelihood of a claim.

Actuarial Science in Premium Determination

Actuarial science plays a crucial role in determining insurance rates. Actuaries are highly trained professionals who use statistical models and historical data to predict the likelihood and cost of future claims. They analyze vast datasets of past claims, considering factors such as location, property type, climate, and even social trends, to develop sophisticated algorithms that estimate the probability of different types of losses. These algorithms, combined with an understanding of financial markets, are then used to calculate the premiums necessary to cover expected payouts while maintaining profitability for the insurance company. Essentially, actuaries are the architects of the pricing structure for insurance policies. They ensure that the premiums collected are sufficient to cover anticipated claims, administrative costs, and profit margins, while remaining competitive in the market.

Risk Assessment and Premium Pricing

Risk assessment is the core of premium calculation. It involves a systematic evaluation of various factors that could increase the likelihood or severity of a claim. This process typically follows a step-by-step approach:

- Property characteristics: Factors like the age, size, construction materials, and location of the home are analyzed. Older homes, those made of less fire-resistant materials, or those situated in high-risk areas (e.g., flood plains, wildfire zones) will generally command higher premiums.

- Homeowner profile: The insurer considers the homeowner’s claims history, credit score, and security measures (e.g., alarm systems, fire sprinklers). A history of claims or a poor credit score may indicate a higher risk profile, resulting in a higher premium.

- Coverage level: The amount of coverage requested impacts the premium. Higher coverage amounts naturally translate to higher premiums, as the insurer’s potential liability increases.

- Deductible selection: Choosing a higher deductible typically lowers the premium. This is because the insured is taking on more of the financial burden in case of a claim.

- Geographic location: Premiums are heavily influenced by location. Areas prone to natural disasters (hurricanes, earthquakes, wildfires) will have significantly higher premiums than those with lower risk profiles.

These risk factors are not considered in isolation. Instead, they are combined using complex algorithms to arrive at a final premium.

Hypothetical Scenario Illustrating Risk Factor Combination

Let’s consider two hypothetical homeowners:

Homeowner A: Lives in a low-risk area, owns a new home built with fire-resistant materials, has an excellent credit score, no prior claims, and selects a high deductible.

Homeowner B: Lives in a high-risk area prone to wildfires, owns an older home with outdated electrical wiring, has a poor credit score, a history of minor claims, and selects a low deductible.

Homeowner A will likely receive a significantly lower premium than Homeowner B because the combined risk factors associated with Homeowner A are much lower. The difference in premiums will reflect the increased likelihood and potential cost of claims associated with Homeowner B’s risk profile. The precise premium difference will vary depending on the specific insurer and their pricing models, but it’s reasonable to expect a substantial variation.

Strategies for Lowering Insurance Premiums

Securing affordable insurance coverage is a priority for many. Fortunately, several strategies can significantly reduce your premiums without compromising essential coverage. By understanding these strategies and taking proactive steps, you can potentially save a considerable amount of money over time.

Bundling Insurance Policies

Bundling your insurance policies, such as home and auto insurance, with the same provider often results in significant discounts. Insurance companies incentivize bundling because it simplifies their administrative processes and reduces the risk of losing a customer to a competitor. These savings can range from a few percentage points to a substantial discount depending on the insurer and the specific policies bundled. For example, a customer might receive a 10-15% discount on both their home and auto premiums by combining them under a single provider. This translates to considerable savings annually.

Improving Credit Score to Lower Premiums

Your credit score is a significant factor in determining your insurance premiums, particularly for auto and home insurance. Insurers often view a higher credit score as an indicator of responsible financial behavior, correlating with a lower likelihood of claims. Improving your credit score can therefore lead to lower premiums. Strategies include paying bills on time, reducing credit utilization, and maintaining a diverse credit history. A substantial improvement in your credit score, for instance, from a 600 to a 700, could result in a noticeable reduction in your annual insurance costs.

Reducing Risk Profile for Lower Insurance Rates

Several lifestyle choices and home modifications can significantly impact your insurance premiums. These actions demonstrate a lower risk profile to insurance companies, leading to reduced premiums.

- Home Security Upgrades: Installing security systems, including alarms and surveillance cameras, can reduce your home insurance premiums. The presence of these systems deters potential burglaries and minimizes the risk of claims.

- Defensive Driving Courses: Completing a defensive driving course can demonstrate your commitment to safe driving practices, leading to lower auto insurance premiums. Many insurers offer discounts for completing such courses.

- Maintaining a Good Driving Record: Avoiding accidents and traffic violations is crucial. A clean driving record significantly reduces your risk profile and lowers your premiums. Even minor infractions can impact your rates.

- Smoke Detectors and Fire Safety Measures: Installing and maintaining smoke detectors and taking other fire safety precautions (such as having a fire extinguisher readily available) can significantly reduce your home insurance premiums.

Negotiating Lower Premiums with Your Insurance Provider

Negotiating lower premiums requires a strategic approach. Follow these steps to maximize your chances of success:

- Review your current policy thoroughly: Understand your coverage, deductibles, and premiums before initiating negotiations.

- Research competitor rates: Obtain quotes from other insurance providers to use as leverage during negotiations.

- Contact your insurer: Explain your findings and express your desire to lower your premiums. Highlight your positive attributes, such as a good driving record or home security improvements.

- Be polite and professional: Maintain a respectful tone throughout the conversation.

- Document everything: Keep records of all communication and agreements reached.

Last Point

Navigating the world of insurance premiums can feel overwhelming, but with a clear understanding of the factors involved and available strategies for cost optimization, the process becomes significantly more manageable. By carefully considering your risk profile, comparing quotes from different providers, and exploring options like bundling policies, you can secure the coverage you need without unnecessary expense. Remember, informed decisions lead to better financial outcomes, ensuring peace of mind knowing you’re adequately protected.

Essential FAQs

What happens if I miss an insurance premium payment?

Missing a payment can lead to policy cancellation or suspension, leaving you without coverage. Late fees may also apply. Contact your insurer immediately if you anticipate difficulties making a payment.

Can I negotiate my insurance premium?

Yes, it’s often possible to negotiate, particularly if you have a clean driving record, bundle policies, or have made improvements to your home (for homeowners insurance). Be prepared to discuss your options and highlight your positive attributes.

How often are insurance premiums reviewed?

This varies by insurer and policy type. Some insurers review premiums annually, while others may do so more frequently or less frequently, depending on factors like claims history and market conditions.

What is the difference between a deductible and a premium?

A premium is the regular payment you make for insurance coverage. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in after a claim.