Navigating the complexities of healthcare insurance and tax deductions can feel like traversing a maze. Understanding whether your healthcare insurance premiums are tax deductible is crucial for optimizing your tax return and maximizing your financial well-being. This guide unravels the intricacies of this often-confusing topic, providing clear explanations and practical examples to help you determine your eligibility and claim any applicable deductions.

We’ll explore the eligibility criteria, delve into the differences between deductions for self-employed individuals and those employed by companies, and clarify the distinctions between itemized and standard deductions. We will also examine the impact of the Affordable Care Act (ACA) and address potential variations in state-specific regulations. By the end of this guide, you’ll have a comprehensive understanding of how to determine if your healthcare insurance premiums are tax deductible and how to claim the deduction effectively.

Eligibility for Deduction

Deductibility of health insurance premiums hinges on several factors, primarily relating to the type of plan, your employment status, and whether you itemize deductions on your tax return. Understanding these criteria is crucial for accurately claiming this potential tax benefit. This section clarifies the eligibility requirements and provides illustrative examples.

Types of Health Insurance Plans Qualifying for Deduction

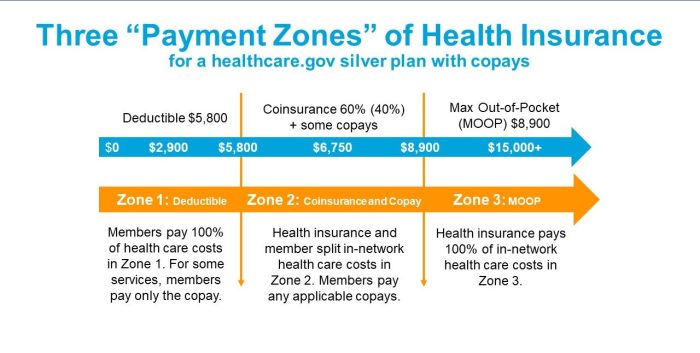

Generally, premiums paid for self-employed individuals, or for those not covered by an employer-sponsored plan, are deductible. This includes plans purchased through the Health Insurance Marketplace (often referred to as Obamacare), as well as individual plans purchased directly from insurance providers. However, specific rules apply depending on the type of plan and your income. Medicare premiums are generally not deductible, with some exceptions for those with high incomes. Medicaid premiums are also not deductible as it is a government-funded program.

Examples of Deductible and Non-Deductible Premiums

Deductible premiums are often associated with self-employed individuals or those who purchase insurance independently. For instance, a freelance writer who purchases a comprehensive health plan through a private insurer can generally deduct the premiums. Conversely, premiums paid by an employer for an employee’s health insurance are typically not deductible by the employee, as the employer covers the cost. Similarly, premiums for long-term care insurance are generally not deductible, unless you meet specific criteria related to chronic illness and qualify for other tax deductions.

Eligibility Requirements for Premium Deduction

| Requirement | Description | Example of Qualification | Example of Disqualification |

|---|---|---|---|

| Self-Employment | You must be self-employed or have income from a business where you are not considered an employee. | A freelancer who pays for their own health insurance. | A salaried employee whose employer provides health insurance. |

| Itemized Deductions | You must itemize deductions on your tax return rather than taking the standard deduction. The total amount of your itemized deductions must exceed the standard deduction amount to provide a tax benefit. | A taxpayer whose medical expenses and other itemized deductions exceed the standard deduction threshold. | A taxpayer whose itemized deductions are less than the standard deduction. |

| Adjusted Gross Income (AGI) Limits | For some deductions, there may be income limits. These limits vary and depend on the specific tax year and filing status. | An individual whose AGI falls below the specified threshold for their filing status and the tax year. | An individual whose AGI exceeds the specified threshold. |

| Health Insurance Plan Type | The plan must be a qualified health insurance plan. | A comprehensive health insurance plan purchased through the Health Insurance Marketplace or a private insurer. | Premiums for long-term care insurance (generally), or supplemental insurance that doesn’t cover major medical expenses. |

Self-Employed Individuals

Self-employed individuals, unlike those employed by companies, bear the sole responsibility for securing their own health insurance. However, the IRS offers a valuable tax deduction to help offset these costs, making healthcare more affordable for this group. This deduction can significantly reduce their taxable income and ultimately, their tax liability.

Self-employed individuals can deduct the amount they paid in health insurance premiums for themselves, their spouse, and their dependents. This differs from employees of companies, who often see their premiums paid (at least partially) by their employer, and thus do not receive the same direct tax deduction for the portion paid by the employer. However, the self-employed deduction allows for a similar financial benefit, albeit through a different mechanism.

Deduction Process for Self-Employed Individuals

The process for claiming this deduction involves using Form 1040, Schedule C (Profit or Loss from Business) or Schedule F (Profit or Loss from Farming). Self-employed individuals report their business income and expenses on these schedules. Health insurance premiums are considered a business expense for self-employed individuals and are deducted from their gross business income to arrive at their net profit. This net profit is then subject to self-employment tax. The deduction reduces the amount of income subject to both income tax and self-employment tax. This is different from employees who generally don’t directly deduct health insurance premiums from their W-2 income; their employers handle the premium payment.

Examples of Claiming the Deduction

Let’s consider two examples. John, a freelance graphic designer, paid $7,200 in health insurance premiums during the tax year. He will report this amount as a business expense on Schedule C. Similarly, Maria, a self-employed farmer, paid $4,800 in premiums for herself and her family. She’ll deduct this expense on Schedule F. In both cases, the deducted amount reduces their net profit, leading to a lower tax bill.

Step-by-Step Guide to Claiming the Deduction

- Gather your documentation: Collect all your health insurance premium payment receipts and statements for the tax year.

- Determine your eligibility: Ensure you meet the criteria for deducting health insurance premiums as a self-employed individual. This primarily involves being self-employed and having paid for health insurance.

- Complete the appropriate Schedule: Use Schedule C if your business is a non-farm business and Schedule F if your business is a farm. Accurately report your business income and expenses, including the health insurance premiums, in the designated sections.

- Calculate your net profit or loss: Subtract your total business expenses, including health insurance premiums, from your gross business income to determine your net profit or loss.

- Report the net profit or loss on Form 1040: Transfer the net profit or loss from Schedule C or F to the appropriate line on Form 1040.

- File your tax return: Submit your completed Form 1040 and accompanying schedules to the IRS by the tax deadline.

Maximum Deductible Amount

The amount of health insurance premiums you can deduct is not unlimited. The IRS imposes limits on the deduction, primarily based on your adjusted gross income (AGI). Understanding these limits is crucial for accurately calculating your tax liability. This section will detail these limitations and provide illustrative examples.

The maximum amount you can deduct for health insurance premiums is tied to your AGI. Specifically, the deduction is limited to the amount of your medical expenses that exceed 7.5% of your AGI. However, for self-employed individuals, the deduction for health insurance premiums is different. They can deduct the full amount of their premiums, up to a certain limit, which is influenced by their AGI. This limit is not directly tied to the 7.5% AGI threshold applicable to other medical expense deductions. The AGI acts as a gatekeeper to determine the maximum deductible amount for self-employed individuals, preventing an excessive deduction.

AGI’s Influence on the Maximum Deductible Amount

The adjusted gross income (AGI) significantly impacts the maximum deductible amount for health insurance premiums, particularly for self-employed individuals. A higher AGI generally results in a higher limit on the deductible amount, allowing for a larger portion of premiums to be deducted. However, this relationship isn’t linear; the exact calculation is complex and dependent on several factors beyond the scope of this explanation. Instead, we’ll focus on illustrating the concept with examples.

The following examples illustrate how different AGI levels can affect the maximum deductible amount. These are simplified examples and do not encompass all potential scenarios or complexities within the tax code. Consult a tax professional for personalized guidance.

- Example 1: Low AGI Let’s say a self-employed individual has an AGI of $30,000 and paid $5,000 in health insurance premiums. Their AGI is low enough to allow them to potentially deduct the full $5,000 (depending on the specific IRS limits for their filing status and tax year). The AGI here does not limit the deduction in this hypothetical scenario.

- Example 2: Moderate AGI Consider a self-employed individual with an AGI of $70,000 and $8,000 in health insurance premiums. In this case, the maximum deductible amount might be limited to a figure below $8,000, based on the applicable IRS rules and their filing status for that tax year. The exact limit would need to be determined using the relevant IRS guidelines for their tax year. The AGI plays a role in determining the specific limitation.

- Example 3: High AGI Suppose a self-employed individual has an AGI of $150,000 and paid $12,000 in health insurance premiums. The AGI here would likely place a significant constraint on the maximum deductible amount, potentially reducing the deductible premiums to a considerably lower amount than the $12,000 paid. The higher AGI would significantly impact the allowed deduction.

Note: These examples are for illustrative purposes only. The actual maximum deductible amount will depend on the specific rules and regulations in effect for the relevant tax year and the individual’s filing status. Always refer to the current IRS publications and seek professional tax advice for accurate calculations.

State-Specific Regulations

While the federal government sets the general rules for deducting health insurance premiums, individual states can have their own regulations that impact this deduction. These variations often stem from state-specific tax codes and how they interact with the federal Internal Revenue Code. Understanding these differences is crucial for accurate tax filing.

State tax laws can either expand upon or limit the federal deduction. Some states might offer additional deductions for health insurance premiums beyond what’s allowed federally, while others might have stricter limitations. This can significantly impact the amount a taxpayer can deduct, particularly for self-employed individuals. The interaction between federal and state laws requires careful consideration to avoid overstating or understating deductions.

State Tax Law Variations

The impact of state tax laws on the deductibility of health insurance premiums varies considerably. Some states may mirror the federal rules closely, while others have significantly different regulations. For example, a state might allow a deduction for premiums paid even if the taxpayer is not self-employed, or it might impose additional requirements for eligibility. These differences highlight the need for taxpayers to consult their state’s specific tax guidelines.

Examples of State-Specific Rules

Several states demonstrate the diverse approaches to health insurance premium deductions. For instance, some states may offer additional tax credits or deductions for individuals purchasing insurance through state-run marketplaces. Others might have specific rules for individuals enrolled in Medicaid or other state-sponsored health programs. These variations often depend on the state’s healthcare policy objectives and its overall tax structure. A thorough understanding of the specific state regulations is essential for accurate tax preparation.

State-Level Regulations Compared to Federal Laws

State tax laws concerning health insurance premium deductions interact with federal laws in several ways. The federal government generally allows a deduction for self-employed individuals, and states can either expand or restrict this deduction. For example, a state might allow a deduction for premiums paid by certain employees not covered by the federal rules, or it might limit the amount deductible based on income thresholds not present in the federal guidelines. This complex interplay necessitates consulting both federal and state tax documents.

Table of State-Specific Regulations

The following table provides a simplified overview. Note that this is not exhaustive and state laws are subject to change. It is crucial to consult official state tax resources for the most up-to-date and accurate information.

| State | Relevant Law (Example – Not a comprehensive list and should be verified) | Key Differences from Federal Rules (Example – Not a comprehensive list and should be verified) |

|---|---|---|

| California | California Revenue and Taxation Code (Example) | May have specific deductions for individuals enrolled in state healthcare programs (Example). |

| New York | New York Tax Law (Example) | Might have different income thresholds for eligibility for the deduction (Example). |

| Texas | Texas Tax Code (Example) | May follow federal rules closely with minimal deviations (Example). |

Conclusive Thoughts

Successfully navigating the landscape of healthcare insurance premium deductions requires careful consideration of your individual circumstances and a thorough understanding of both federal and state tax laws. While the process may seem intricate, this guide has provided a clear framework for determining eligibility, understanding the various deduction methods, and gathering the necessary documentation. Remember to consult with a qualified tax professional for personalized advice tailored to your specific situation to ensure you maximize your tax benefits and remain compliant with all applicable regulations.

FAQ Section

Can I deduct premiums for my spouse’s health insurance?

Generally, yes, if you are claiming your spouse as a dependent and meet other eligibility requirements.

What if I paid premiums but didn’t itemize?

If you didn’t itemize, you couldn’t deduct the premiums. You can only deduct medical expenses exceeding 7.5% of your adjusted gross income (AGI) when itemizing.

Are dental and vision insurance premiums deductible?

Premiums for dental and vision insurance are usually considered part of your medical expenses and can be included when itemizing, provided the total medical expenses exceed the 7.5% AGI threshold.

What happens if I overestimate my deductible amount?

If you overestimate, you may need to amend your tax return to correct the deduction. This is why accurate record-keeping is crucial.

Where can I find more information about state-specific regulations?

Consult your state’s department of revenue website or a qualified tax professional for details on state-specific rules.