Navigating the complexities of self-employment often leaves individuals questioning various tax deductions. One common query revolves around health insurance premiums: can the self-employed deduct these expenses? The answer, while generally yes, is nuanced, depending on several factors including income, insurance type, and adherence to specific IRS regulations. This guide unravels the intricacies of claiming this deduction, ensuring you understand the eligibility criteria, calculation methods, and potential pitfalls to avoid.

Understanding this deduction is crucial for self-employed individuals aiming to minimize their tax liability. Properly claiming this deduction can significantly impact your overall tax burden, providing valuable financial relief. This guide will equip you with the knowledge to confidently navigate this aspect of self-employment taxation.

Eligibility for Deduction

Self-employed individuals can deduct the cost of health insurance premiums, but it’s crucial to understand the specific criteria to ensure eligibility. The deduction isn’t automatic; it hinges on several factors related to your income and insurance coverage. Properly navigating these requirements is essential for maximizing tax benefits.

Self-employment income and health insurance coverage must meet specific requirements for the deduction to be allowed. The premiums must be for health insurance coverage for yourself, your spouse, and your dependents. Importantly, you must be considered self-employed, meaning you’re not an employee of another business. This means you are responsible for paying self-employment taxes. You also cannot be eligible for employer-sponsored health insurance.

Requirements Regarding Self-Employment Income and Health Insurance Coverage

To claim the deduction, your health insurance premiums must be paid during the tax year, and you must have been self-employed during the same tax year. The amount you can deduct is limited to the amount of your net earnings from self-employment. Net earnings are calculated after deducting one-half of your self-employment tax. If your health insurance premiums exceed your net earnings from self-employment, you can only deduct the amount equal to your net earnings. You must itemize your deductions on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship), or Schedule F (Form 1040), Profit or Loss from Farming.

Examples of Eligible and Ineligible Deductions

Several scenarios illustrate when the deduction is allowed and when it’s not.

For example, a freelance graphic designer who earns $50,000 in net self-employment income and pays $8,000 in health insurance premiums can deduct the full $8,000. However, if the same designer’s net earnings were only $6,000, they could only deduct $6,000.

Conversely, a self-employed individual who is also covered under their spouse’s employer-sponsored health insurance plan cannot deduct the premiums they pay for their own individual health insurance policy, even if they are self-employed. Similarly, an individual who is not self-employed, even if they are paying for health insurance premiums, is not eligible for this deduction.

Eligible vs. Ineligible Scenarios

| Scenario | Self-Employment Status | Health Insurance Coverage | Deduction Allowed? |

|---|---|---|---|

| Freelance writer with net earnings of $40,000 and $7,000 in premiums. | Self-Employed | Individual health insurance plan | Yes |

| Consultant with net earnings of $10,000 and $12,000 in premiums. | Self-Employed | Individual health insurance plan | No (Limited to $10,000) |

| Employee of a company with $60,000 salary and $10,000 in premiums. | Employed | Individual health insurance plan | No |

| Self-employed plumber with net earnings of $35,000 and covered by spouse’s employer plan. | Self-Employed | Covered under spouse’s employer plan | No |

Calculating the Deduction

Calculating the deduction for self-employed health insurance premiums involves determining the eligible amount and correctly reporting it on your tax return. The process is straightforward, but understanding the key components is crucial for accurate tax preparation. This section details the calculation methods and provides a practical example.

The deductible amount is the total amount of health insurance premiums you paid during the tax year that are considered eligible expenses. This excludes premiums for dependents unless they are also self-employed and meet the eligibility criteria. You can deduct the amount of premiums paid for yourself as a self-employed individual. Remember to keep accurate records of all premium payments throughout the year.

Premium Payment Accounting

Accurately accounting for premiums paid throughout the year is vital for claiming the correct deduction. You should maintain detailed records, including receipts, bank statements, or payment confirmations from your insurance provider. These documents should clearly show the payment date, the amount paid, and that the payment was for health insurance premiums for yourself (and potentially your spouse, if eligible).

Calculation Example

Let’s assume Sarah is self-employed and paid $7,200 in health insurance premiums during the tax year. She meets all the eligibility requirements for the deduction. In this case, Sarah can deduct the full $7,200 from her self-employment income before calculating her self-employment tax.

Step-by-Step Deduction Calculation

The calculation process is generally straightforward. Follow these steps to ensure accuracy:

- Gather Documentation: Collect all records of health insurance premium payments made during the tax year. This includes receipts, bank statements, or online payment confirmations.

- Determine Eligible Premiums: Identify the premiums paid specifically for your own health insurance coverage. Exclude premiums paid for dependents unless they also qualify for the self-employed deduction.

- Calculate Total Eligible Premiums: Sum up the total amount of eligible premiums paid throughout the year.

- Report on Tax Return: Enter the total eligible premium amount on the appropriate section of your tax return (Schedule C for self-employment income). The exact location will depend on the specific tax form you are using.

Impact of Different Health Insurance Plans

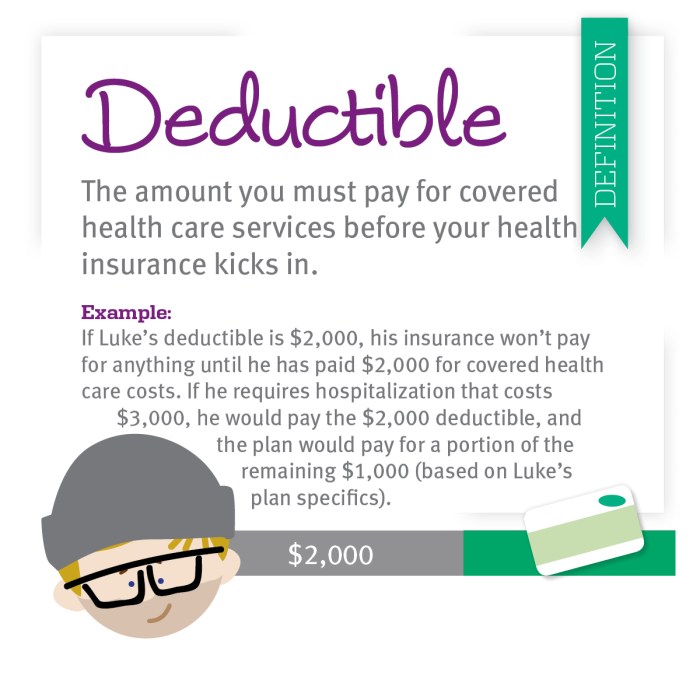

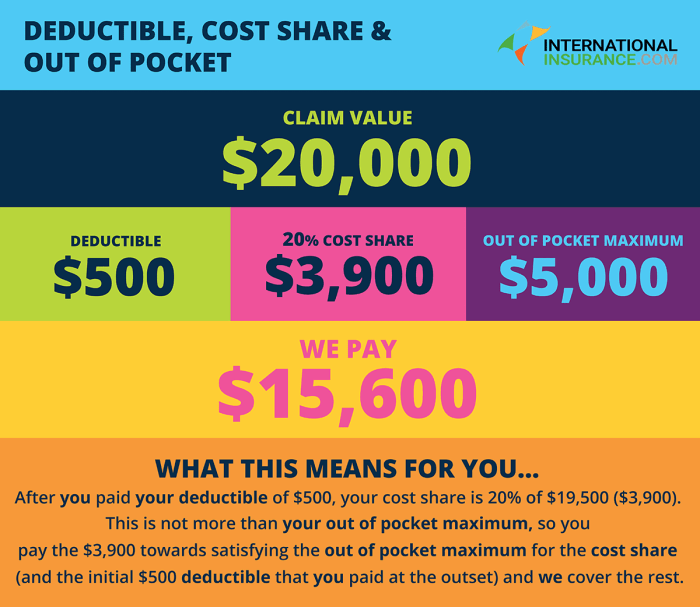

The deductibility of your self-employed health insurance premiums remains consistent regardless of the specific type of plan you choose—be it an HMO, PPO, or another type. However, the features within each plan, such as deductibles, co-pays, and out-of-pocket maximums, can indirectly influence your overall tax liability by affecting your medical expenses. Understanding these nuances is key to maximizing your tax benefits.

Deductibility Across Different Plan Types

The IRS allows the deduction of health insurance premiums paid for self-employment, irrespective of the plan’s structure (HMO, PPO, EPO, etc.). The crucial factor is that the plan is qualified health insurance. The type of plan doesn’t affect the eligibility for the deduction itself; it only influences the amount you might spend out-of-pocket, which in turn could impact itemized deductions if you exceed certain thresholds.

Impact of Plan Features on Deduction

Different plan features, while not directly impacting premium deductibility, affect your overall tax situation. High deductibles mean you pay more out-of-pocket before your insurance coverage kicks in. These out-of-pocket expenses might be deductible as medical expenses on Schedule A (Itemized Deductions), but only to the extent that they exceed 7.5% of your adjusted gross income (AGI). Conversely, lower deductibles and co-pays mean lower out-of-pocket expenses, reducing the likelihood of exceeding the 7.5% AGI threshold for itemized medical expense deductions.

Examples of Plan Feature Impact on Tax Liability

Let’s consider two scenarios:

Scenario 1: Sarah, a self-employed consultant, chooses a high-deductible health plan (HDHP) with a $10,000 deductible and a $6,000 out-of-pocket maximum. She incurs $8,000 in medical expenses during the year. While she can deduct her premiums, her out-of-pocket medical expenses don’t exceed the 7.5% AGI threshold, meaning she cannot deduct them.

Scenario 2: John, a freelance writer, opts for a lower-deductible PPO plan. His medical expenses total $15,000, and his AGI is $50,000. The 7.5% AGI threshold is $3,750 ($50,000 * 0.075). Since his medical expenses significantly exceed this, he can deduct the amount exceeding $3,750 ($11,250) as an itemized deduction, further reducing his tax liability.

Summary Table: Plan Type Impact on Deductible Amount

| Plan Type | Premium Deductibility | Impact on Out-of-Pocket Expenses | Potential Impact on Itemized Deductions |

|---|---|---|---|

| HMO | Fully deductible | Generally lower out-of-pocket costs | Less likely to exceed 7.5% AGI threshold |

| PPO | Fully deductible | Variable out-of-pocket costs | Potential for exceeding 7.5% AGI threshold, leading to additional deductions |

| EPO | Fully deductible | Similar to HMO, generally lower out-of-pocket costs | Less likely to exceed 7.5% AGI threshold |

| HDHP | Fully deductible | Higher out-of-pocket costs initially | Less likely to exceed 7.5% AGI threshold unless significant medical expenses are incurred |

State-Specific Regulations

While the federal government provides the basic framework for deducting self-employed health insurance premiums, states can and do add their own regulations, creating a patchwork of rules across the country. These state-level variations can significantly impact the final amount a self-employed individual can deduct. Understanding these differences is crucial for accurate tax preparation.

State-level tax laws interact with federal regulations in a complex manner. Generally, states conform to federal tax law to varying degrees. This means that while a deduction might be allowed federally, a state might impose additional limitations or not allow the deduction at all. In other instances, a state might offer additional deductions or credits beyond what’s permitted federally. This can lead to discrepancies in the total tax burden between states.

State Variations in Deductibility Rules

The deductibility of self-employed health insurance premiums isn’t universally consistent across all states. Some states might mirror the federal guidelines closely, while others could have stricter limitations on the amount deductible or even exclude certain types of plans. For example, some states may place caps on the amount that can be deducted, irrespective of the actual premium paid. Others might only allow deductions for specific types of health insurance plans, excluding those deemed “high-risk” or non-compliant with state regulations.

Examples of States with Differing Regulations

While providing a comprehensive list of all 50 states’ regulations is beyond the scope of this section, we can illustrate the variability with a few examples. California, for instance, generally follows federal guidelines but may have specific regulations regarding the types of plans eligible for deduction. Conversely, a state like New York might have stricter rules regarding the documentation required to claim the deduction, potentially requiring more extensive proof of premium payments and plan details. It’s important to consult a state’s specific tax code or a tax professional for the most accurate information.

Interaction of State and Federal Regulations

Federal tax law establishes the basic framework for the deduction. However, state income tax laws can either conform to this framework, partially conform, or diverge completely. A state that conforms fully will largely mirror the federal rules. A partially conforming state might adopt some federal provisions but modify others, often introducing limitations or exceptions. A state that doesn’t conform at all will have its own independent rules for the deduction, potentially making the process more complicated. This interaction means that taxpayers need to be aware of both federal and state regulations to correctly calculate their deduction.

State-Specific Deduction Summary Table

| State | Conformity to Federal Rules | Additional State Regulations | Notes |

|---|---|---|---|

| California | Generally conforms | Specific requirements for plan documentation | Consult California Franchise Tax Board for details |

| New York | Partially conforms | Potentially stricter rules on deductible amounts | Refer to New York State Department of Taxation and Finance |

| Texas | Does not have a state income tax | N/A | No state-level deduction to consider |

| Florida | Does not have a state income tax | N/A | No state-level deduction to consider |

Potential Penalties for Incorrect Deduction

Claiming the self-employed health insurance deduction incorrectly can lead to significant consequences from the IRS. Understanding these potential penalties and how to avoid them is crucial for responsible tax filing. Accurate record-keeping and a thorough understanding of the relevant tax laws are essential to minimize risk.

Penalties for Incorrect Deduction

Incorrectly claiming the self-employed health insurance deduction can result in several penalties. These penalties can range from additional taxes owed to interest charges and, in some cases, even legal action. The severity of the penalty depends on factors such as the amount of the error, whether the error was intentional (fraudulent), and the taxpayer’s history of tax compliance. The IRS may assess penalties for underpayment of taxes, which includes failing to properly claim deductions.

Scenarios Leading to Penalties

Several scenarios can lead to penalties for incorrect deductions. One common mistake is claiming the deduction without meeting all eligibility requirements. For example, if a self-employed individual did not have qualifying self-employment income or was covered by another employer’s health insurance plan for a significant portion of the year, claiming the deduction would be inappropriate and subject to penalty. Another common error is improperly calculating the deduction, perhaps by misinterpreting the rules regarding the AGI limitation or failing to accurately track and document health insurance premiums paid. Finally, failing to maintain adequate records to support the deduction can also lead to penalties. The IRS requires substantial documentation to verify the deduction, and a lack thereof could result in disallowance of the claim and potential penalties.

Correcting Errors on Tax Returns

If you discover an error on your tax return, it’s crucial to correct it as soon as possible. The IRS provides several ways to amend your return, including filing an amended return (Form 1040-X). This form allows you to correct mistakes and report any additional tax owed or request a refund. It’s important to be thorough and accurate when filing an amended return, providing all necessary documentation to support the corrections. Delaying the correction only increases the potential for additional penalties and interest charges.

Financial Consequences of Incorrect Deductions

The financial consequences of incorrect deductions can be substantial. For instance, if a taxpayer incorrectly claims a $5,000 deduction, they could face additional taxes owed, plus interest on that amount. Interest rates charged by the IRS are typically higher than standard interest rates, significantly increasing the overall financial burden. In addition to taxes and interest, the IRS may also impose penalties for negligence or intentional disregard of tax rules. These penalties can be a percentage of the underpaid tax, potentially reaching a substantial amount depending on the circumstances. For example, a $5,000 error might result in several hundred dollars in additional penalties, on top of the additional tax and interest. In severe cases of intentional misrepresentation (fraud), the penalties can be far more significant, potentially involving criminal charges.

Epilogue

Successfully claiming the health insurance premium deduction as a self-employed individual requires careful attention to detail and a thorough understanding of IRS regulations. While the potential tax savings are significant, inaccuracies can lead to penalties. By diligently following the guidelines Artikeld in this guide, and consulting with a tax professional if needed, you can confidently navigate this process and maximize your tax benefits. Remember, proactive planning and accurate record-keeping are paramount to successful tax compliance.

FAQ Compilation

Can I deduct premiums for my spouse and children?

Yes, provided they are claimed as dependents and are covered under your health insurance plan.

What if I only paid premiums for part of the year?

You can only deduct premiums for the portion of the year you were self-employed and had qualifying health insurance coverage.

What happens if I make a mistake on my tax return?

File an amended return (Form 1040-X) to correct the error. Penalties may apply depending on the nature and extent of the mistake.

Are there any limitations on the amount I can deduct?

The deductible amount is limited to the actual premiums paid, and it may be subject to adjustments based on your adjusted gross income (AGI).

Where can I find more information?

Consult the IRS website (irs.gov) and Publication 535, Business Expenses.