Navigating the complexities of tax deductions can feel like deciphering a secret code, especially when it comes to healthcare expenses. The question of whether health insurance premiums are tax deductible is a common one, impacting both self-employed individuals and employees alike. This guide unravels the intricacies, providing clarity on eligibility criteria, applicable tax forms, and state-specific regulations, empowering you to confidently navigate this aspect of your tax obligations.

Understanding the deductibility of your health insurance premiums can significantly impact your tax liability. Factors such as employment status, the type of health insurance plan, and even your state of residence play crucial roles in determining your eligibility. This guide aims to clarify these factors, offering practical examples and a step-by-step approach to claiming deductions, ensuring you receive the maximum tax benefits you are entitled to.

Employees and Employer-Sponsored Plans

Many employees receive health insurance through their employers. This often leads to questions about the tax deductibility of premiums. Understanding the rules surrounding employer-sponsored plans is crucial for accurate tax filing. The deductibility of premiums depends on several factors, including the type of plan and the employee’s specific circumstances.

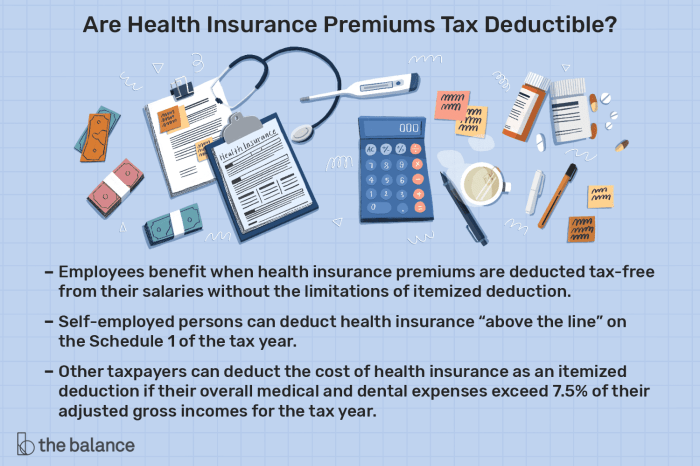

Generally, premiums paid by an employer are not deductible by the employee. However, there are exceptions, and employees may still have deductible medical expenses even with employer-sponsored coverage. The tax implications differ significantly between employees with and without employer-sponsored plans, primarily due to the employer’s contribution.

Deductible Premiums Despite Employer-Sponsored Plans

In limited situations, employees might be able to deduct premiums even if their employer provides a plan. This typically occurs when the employee’s plan doesn’t cover certain expenses, or the employee purchases supplemental insurance to cover those gaps. For example, if an employer-sponsored plan has a high deductible, an employee might purchase a supplemental plan to help manage out-of-pocket costs. Premiums paid for this supplemental coverage could potentially be deductible as a medical expense if the total medical expenses exceed a certain threshold (7.5% of Adjusted Gross Income (AGI) in many cases).

Additional Deductible Medical Expenses

Employees with employer-sponsored plans can still incur additional medical expenses beyond their insurance premiums. These expenses, if they exceed the 7.5% AGI threshold, may be deductible. These expenses include doctor visits, hospital stays, prescription drugs, and other qualified medical costs.

For example, an employee with employer-sponsored insurance might still incur significant out-of-pocket costs like co-pays, deductibles, and co-insurance. If the sum of these expenses, plus any premiums paid for supplemental insurance, exceeds 7.5% of their AGI, the excess amount is potentially deductible.

Non-Deductible Premiums with Employer-Sponsored Plans

Most commonly, premiums paid by an employer are not deductible by the employee, even if the employee contributes to the plan. The employer’s contribution is considered a non-taxable benefit. The employee’s portion of the premium may also not be deductible unless it falls under the exceptions described above regarding supplemental coverage and exceeding the AGI threshold.

For instance, if an employee’s employer pays 80% of the premium and the employee pays the remaining 20%, the employee generally cannot deduct their 20% contribution. This is because the employer’s contribution is considered compensation, and the employee’s portion is generally not considered a separately deductible medical expense.

Tax Implications: Comparison

Employees without employer-sponsored plans face higher upfront costs for health insurance premiums. However, they may be able to deduct the entire amount of their premiums as a medical expense, provided their total medical expenses, including premiums, exceed 7.5% of their AGI. In contrast, employees with employer-sponsored plans usually cannot deduct their premiums (or only a portion, in exceptional cases) but benefit from lower monthly costs. The overall tax advantage depends on individual circumstances and the specific amounts involved.

Calculating Deductible Amount for Employees with Employer-Sponsored Plans

To calculate the deductible amount, employees need to determine their total medical expenses for the year. This includes premiums for supplemental insurance (if any), doctor visits, hospital bills, prescription drugs, etc. They then subtract 7.5% of their AGI from their total medical expenses. The resulting amount, if positive, represents the deductible medical expenses.

The formula is: Deductible Medical Expenses = Total Medical Expenses – (7.5% x AGI)

It is crucial to maintain detailed records of all medical expenses throughout the year to accurately calculate this amount during tax season.

Tax Forms and Documentation

Claiming a deduction for health insurance premiums requires careful attention to detail and the accurate completion of specific tax forms. Understanding the necessary documentation and maintaining organized records are crucial for a successful claim and avoiding potential tax penalties.

Relevant Tax Forms

The primary tax form used to claim the deduction for health insurance premiums is Form 1040, Schedule A (Itemized Deductions). This form allows taxpayers to itemize their deductions instead of using the standard deduction. The specific line on Schedule A where the deduction is entered will depend on the type of health insurance coverage and whether it’s self-employed or employer-sponsored (the latter is already covered in previous sections). Additional forms might be required depending on individual circumstances, such as documentation supporting self-employment status or proof of premium payments. It is advisable to consult the latest IRS instructions for Form 1040 and Schedule A for the most up-to-date information.

Necessary Supporting Documentation

To substantiate the deduction, taxpayers need to provide clear and comprehensive documentation. This typically includes Form W-2 (for employer-sponsored plans, showing the amount of premiums paid by the employer), premium payment receipts or bank statements showing payments made, and a copy of the health insurance policy itself. For self-employed individuals, additional documentation might be necessary to prove self-employment status, such as a Schedule C (Profit or Loss from Business) or Schedule F (Profit or Loss from Farming). If premiums were paid through a health savings account (HSA), documentation supporting HSA contributions and withdrawals will also be needed.

Best Practices for Organizing and Storing Documentation

Maintaining organized tax records is paramount. A dedicated folder or digital system for tax documents is recommended. Clearly label all documents with the tax year and the type of expense. Consider using a cloud-based storage system for easy access and backup. Scanning paper documents and storing them digitally can help streamline the process and reduce the risk of loss or damage. Keep records for at least three years after filing your tax return in case of an audit.

Checklist of Required Documents

- Form 1040

- Schedule A (Itemized Deductions)

- Proof of health insurance premium payments (receipts, bank statements)

- Copy of health insurance policy

- Form W-2 (if applicable)

- Schedule C or Schedule F (if self-employed)

- HSA documentation (if applicable)

Consequences of Insufficient Documentation

Failure to provide sufficient documentation to support the deduction claim can result in the IRS disallowing the deduction. This could lead to a higher tax liability and potentially penalties and interest charges. In some cases, the IRS might initiate an audit to verify the information provided. Therefore, maintaining meticulous records and providing complete documentation is crucial to avoid potential tax complications.

State-Specific Regulations

The deductibility of health insurance premiums, while generally governed by federal tax laws, is significantly influenced by individual state regulations. These variations can impact both the eligibility for deductions and the availability of state-specific tax credits or other financial assistance programs. Understanding these state-level nuances is crucial for accurate tax preparation and maximizing potential savings.

State laws can affect premium deductibility in several ways. Some states may offer additional tax deductions or credits beyond those provided at the federal level, while others might have stricter requirements for eligibility. These differences often stem from variations in state tax codes, healthcare initiatives, and overall economic policies. Navigating this complex landscape requires careful attention to detail and access to reliable, up-to-date information.

State-Specific Tax Credits and Deductions

Several states offer their own tax credits or deductions related to health insurance premiums, often targeting specific demographics or income levels. These state-level benefits can significantly reduce the overall cost of health insurance, complementing federal tax advantages. For example, some states may provide credits for individuals purchasing insurance through the state marketplace or for those meeting certain income thresholds. The specific requirements and amounts vary considerably depending on the state’s individual healthcare policies and budget allocations. These programs are often designed to make health insurance more accessible and affordable for residents.

Examples of States with Differing Regulations

California, for instance, offers a state tax credit for individuals who purchase health insurance through Covered California, the state’s health insurance marketplace. This credit is designed to help make health insurance more affordable for low- and moderate-income residents. In contrast, a state like Texas may not have a comparable state-level tax credit, relying primarily on federal deductions and subsidies. These differences highlight the need for individuals to research the specific regulations within their state of residence. New York, for example, has a different approach than either California or Texas, potentially including tax incentives for employers offering specific health insurance plans to their employees. These varied approaches demonstrate the lack of uniformity in state-level healthcare tax policies across the US.

Comparison of State Tax Laws

A direct comparison of state tax laws regarding health insurance premium deductibility reveals significant inconsistencies. Some states may allow a deduction for self-employed individuals, while others may not. Similarly, the criteria for eligibility, such as income limits or types of health insurance plans, can differ greatly. Furthermore, the amount of the deduction or credit, if offered, is not standardized across states. This variability underscores the importance of consulting state-specific tax guidelines and seeking professional tax advice when necessary. It’s essential to recognize that even within a single state, specific regulations may change annually, highlighting the need for continuous updates and awareness.

Resources for Finding State-Specific Information

Reliable information on state-specific regulations regarding health insurance premium deductibility can be found through several avenues. State tax agency websites are primary sources, offering detailed guidelines, forms, and frequently asked questions (FAQs). Professional tax advisors, such as Certified Public Accountants (CPAs), are also valuable resources, possessing expertise in navigating complex state and federal tax laws. Additionally, consulting with health insurance brokers or representatives can provide insights into potential tax implications related to specific insurance plans. Finally, reputable financial websites and publications often offer summaries of state-level tax policies, though it’s always best to verify this information with official sources.

Final Review

Successfully navigating the tax implications of health insurance premiums requires a thorough understanding of the rules and regulations. While the specifics can be complex, this guide has provided a framework for determining eligibility, claiming deductions, and understanding state-specific variations. By carefully reviewing your individual circumstances and utilizing the resources provided, you can confidently manage your tax obligations related to health insurance and maximize your tax savings. Remember to consult with a tax professional for personalized advice based on your unique situation.

Quick FAQs

Can I deduct premiums if I have employer-sponsored insurance?

Generally, no, unless you itemize deductions and your medical expenses exceed a certain percentage of your adjusted gross income (AGI).

What form do I use to claim the deduction?

Self-employed individuals typically use Schedule C (Form 1040) and Schedule SE (Form 1040). The specific forms may vary depending on your situation.

What if I made a mistake on my tax return regarding health insurance premium deductions?

You can file an amended tax return (Form 1040-X) to correct any errors. It’s advisable to consult a tax professional for guidance.

Where can I find my state’s specific regulations on health insurance premium deductibility?

Your state’s department of revenue website or a tax professional specializing in your state’s tax laws are good resources.

Are short-term health insurance premiums deductible?

Generally, no. The deductibility of short-term health insurance premiums is often more restrictive than for longer-term plans.