The question of whether employer-paid health insurance premiums constitute taxable income for employees is a common one, fraught with complexities stemming from tax laws and the intricacies of employee benefits packages. Understanding this nuance is crucial for both employees accurately calculating their taxable income and employers ensuring compliance. This guide delves into the tax implications of employer-sponsored health insurance, clarifying the often-confusing interplay between employer contributions, employee contributions, and the ultimate impact on an individual’s tax liability.

We will explore how the Affordable Care Act (ACA) influences this landscape, examine the differences in tax treatment across various health insurance plan types (HMO, PPO, HSA, etc.), and provide practical guidance on accurate tax reporting. Furthermore, we’ll analyze the broader impact of employer-paid premiums on employee compensation and overall financial well-being, comparing different compensation structures to illustrate the financial implications for both employees and employers.

Employer-Sponsored Health Insurance Premiums

Employer-sponsored health insurance is a significant benefit for many employees, but understanding its tax implications is crucial. This section clarifies the tax treatment of employer-paid and employee-paid health insurance premiums, highlighting the key differences and providing illustrative examples.

Tax Treatment of Employer-Paid Premiums

Generally, the premiums your employer pays for your health insurance are not included in your taxable income. This is a significant tax advantage, as it effectively reduces your overall tax burden. The IRS considers this a non-taxable fringe benefit. This exclusion applies to both the employee and their dependents covered under the plan. However, it’s important to note that this only applies to premiums paid by the employer; any contributions made by the employee are treated differently.

Tax Treatment of Employee-Paid Premiums

Unlike employer-paid premiums, the premiums you personally contribute towards your health insurance are deductible only under certain circumstances and only to the extent allowed by law. These deductions are typically made through pre-tax deductions from your paycheck, which effectively reduces your taxable income. The availability and amount of this deduction may vary based on factors such as your income and whether you itemize deductions on your tax return. It’s always best to consult with a tax professional or refer to the IRS guidelines for the most up-to-date information.

Examples of Tax Implications

Let’s illustrate with some examples. Suppose an employer pays $10,000 annually for an employee’s health insurance premium. In this scenario, the $10,000 is excluded from the employee’s taxable income. If the employee’s annual income is $60,000, their taxable income remains at $60,000, not $70,000. This results in tax savings for the employee. Now, consider a different scenario where the employee contributes $2,000 annually towards their health insurance premium. This $2,000 may be deductible, depending on the aforementioned conditions, resulting in a reduction of their taxable income. The actual tax savings will depend on their individual tax bracket and other deductions.

Comparison of Tax Implications

The following table summarizes the tax implications of employer-paid versus employee-paid health insurance premiums:

| Scenario | Employer Paid | Employee Paid | Tax Impact |

|---|---|---|---|

| Employer pays full premium ($10,000) | Excluded from taxable income | $0 | Significant tax savings |

| Employee pays part of premium ($2,000) | Excluded from taxable income | May be deductible (depending on individual circumstances) | Reduced taxable income, resulting in tax savings |

| Employee pays full premium ($10,000) | $0 | May be deductible (depending on individual circumstances) | Tax savings dependent on deduction eligibility and tax bracket |

The Affordable Care Act (ACA) and Employer-Paid Premiums

The Affordable Care Act (ACA) significantly altered the landscape of employer-sponsored health insurance, impacting both the tax treatment of premiums and the overall accessibility of healthcare. Prior to the ACA, the tax advantages of employer-sponsored health insurance were largely unregulated, leading to disparities in coverage and affordability. The ACA introduced provisions aimed at increasing coverage and regulating the tax benefits associated with these plans.

The ACA’s influence on the tax treatment of employer-paid health insurance premiums is multifaceted. It didn’t eliminate the tax benefits entirely, but it did introduce certain regulations and limitations, particularly regarding the affordability and value of the plans offered. This impacts both the employer, who deducts the premium payments from their taxable income, and the employee, who generally receives the benefit of employer-paid premiums tax-free.

Tax Implications for Employers Under the ACA

The ACA generally maintains the existing tax advantages for employers who provide health insurance to their employees. Employers can still deduct the cost of premiums paid on behalf of their employees from their taxable income. However, the ACA introduced the employer shared responsibility payment (ESR), a penalty for employers with 50 or more full-time equivalent employees who don’t offer affordable minimum essential coverage to their employees. This penalty incentivizes employers to provide health insurance and ensures that a certain level of coverage is available to a larger segment of the workforce. The calculation of the ESR is complex and depends on factors such as the number of employees and the affordability and value of the coverage offered. Failure to comply can result in substantial financial penalties.

Tax Implications for Employees Under the ACA

Under the ACA, employees generally do not include the value of employer-paid health insurance premiums in their gross income. This remains a significant tax advantage for employees. However, the value of any employer contributions exceeding the minimum essential coverage requirements is not considered tax-free. For instance, if an employer offers a premium plan that significantly exceeds the minimum value standards set by the ACA, the portion above the minimum value might be subject to taxation for the employee. The ACA’s impact on the employee is primarily indirect, affecting the affordability and availability of employer-sponsored insurance, thus influencing their overall tax burden.

ACA Provisions Relating to the Taxability of Employer-Paid Premiums

Several key ACA provisions directly relate to the taxability of employer-paid premiums. The Affordable Care Act’s definition of “minimum essential coverage” (MEC) is crucial. Employer plans must meet the MEC standards to qualify for the tax advantages. The ACA also establishes requirements for “affordable” coverage, based on the employee’s household income and the cost of the plan. If a plan is not considered affordable, the employer may face penalties. Furthermore, the ACA’s focus on the value of coverage ensures that plans offer a certain level of health benefits to be considered tax-advantaged. These provisions are designed to balance the tax benefits with the need for affordable and meaningful health insurance coverage.

Decision-Making Flowchart for Taxability of Employer-Paid Premiums Under the ACA

This flowchart simplifies the decision-making process:

[Imagine a flowchart here. It would begin with a box: “Does the employer have 50 or more full-time equivalent employees?” A “Yes” branch leads to a box: “Does the employer offer affordable minimum essential coverage?” A “Yes” branch leads to a box: “Employer premiums are generally tax-deductible; employee premiums are generally tax-free.” A “No” branch leads to a box: “Employer may be subject to employer shared responsibility payment.” A “No” branch from the second box leads to a box: “Employer may be subject to employer shared responsibility payment.” All “Employer may be subject to employer shared responsibility payment” boxes lead to a box: “Employee premiums may be taxable depending on plan details.” ]

Impact of Employer-Paid Premiums on Employee Benefits and Compensation

Employer-paid health insurance premiums significantly impact an employee’s overall compensation package and financial well-being. Understanding this impact requires examining both the direct and indirect effects on an employee’s net income and overall benefits. This analysis considers the tax advantages, the value of the benefit itself, and the trade-offs involved in different compensation structures.

Employer-paid health insurance premiums are generally considered a tax-advantaged benefit. The cost of the premium is not included in an employee’s taxable income, meaning they pay less in income taxes than if they received the equivalent amount as salary. This reduces their tax burden, effectively increasing their disposable income. However, this tax advantage does not translate to a direct one-to-one increase in net income, as the value of the insurance coverage itself is not directly reflected in a cash equivalent. The tax savings are a consequence of the structure of the benefit.

Tax Implications of Employer-Paid Premiums

The tax implications of employer-paid premiums are substantial. The premium amount is excluded from the employee’s gross income, reducing their taxable income and, consequently, their income tax liability. This results in a higher net income compared to a scenario where the employee receives the equivalent amount as salary and pays the premiums themselves. The actual tax savings vary based on the individual’s tax bracket and the cost of the premiums. For example, a high-income earner in a higher tax bracket will experience a larger tax saving than a lower-income earner. This is because a higher percentage of their salary is subject to higher tax rates.

Benefits and Drawbacks of Employer-Paid Health Insurance

Employer-paid health insurance offers several benefits to both employees and employers. For employees, it provides valuable health coverage, often at a lower cost than purchasing individual insurance. The peace of mind from having health insurance is a significant benefit, especially during unexpected health crises. However, a drawback for employees is the potential loss of flexibility. They may be locked into a specific plan that doesn’t perfectly align with their needs, or they may be unable to change plans easily. Employers benefit from increased employee loyalty and productivity, as employees with good health insurance are generally healthier and more likely to stay with the company. However, the cost of providing health insurance can be a significant expense for employers, potentially impacting their profitability.

Financial Implications of Different Compensation Structures

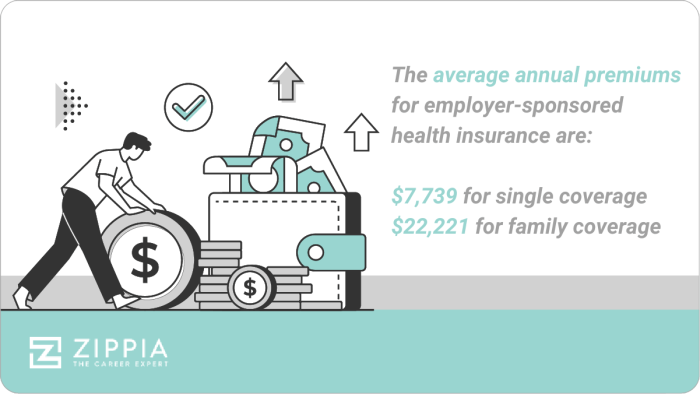

The following table compares the financial implications of different compensation structures, illustrating the impact of employer-paid premiums on an employee’s net income. These figures are illustrative and will vary based on individual circumstances, tax laws, and the specific cost of health insurance premiums.

| Compensation Structure | Gross Income | Net Income (estimated) | Tax Implications |

|---|---|---|---|

| $70,000 Salary + Employer-Paid Premiums ($7,000) | $70,000 | $55,000 (example) | Lower tax burden due to premium exclusion. |

| $77,000 Salary + Employee-Paid Premiums ($7,000) | $77,000 | $53,000 (example) | Higher tax burden due to premium inclusion; net income is lower despite higher gross income. |

Final Summary

Navigating the tax implications of employer-sponsored health insurance requires careful consideration of various factors, including the type of plan, the amount of employer contribution, and the applicable tax laws. While employer-paid premiums are generally not considered taxable income for employees, understanding the intricacies of tax reporting and the potential impact on overall compensation is essential for both financial planning and compliance. This guide has provided a comprehensive overview, equipping individuals and businesses with the knowledge necessary to make informed decisions and ensure accurate tax reporting.

Question & Answer Hub

What if my employer pays part of my health insurance premium and I pay the rest?

Only the portion you pay is considered taxable income. The employer’s contribution is generally excluded.

Are there penalties for incorrectly reporting employer-paid health insurance premiums?

Yes, inaccuracies in reporting can lead to penalties, including interest and potential audits. Accurate reporting is crucial.

How are employer-paid premiums reported on my W-2 form?

The value of employer-paid premiums is not directly shown on your W-2. Your taxable wages reflect the total compensation less the excluded premiums.

Does the type of health savings account (HSA) affect taxability?

Employer contributions to an HSA are generally tax-deductible for the employer and tax-free for the employee (when used for qualified medical expenses).