Navigating the complexities of the US tax system can be daunting, especially when it comes to healthcare expenses. Understanding whether your health insurance premiums are tax-deductible is crucial for maximizing your tax benefits and minimizing your tax liability. This guide explores the intricacies of deducting health insurance premiums, examining various factors that influence deductibility, such as employment status, the Affordable Care Act (ACA), and the type of health insurance plan. We’ll clarify the rules, provide practical examples, and help you determine if you qualify for this valuable deduction.

This guide aims to provide a clear and comprehensive understanding of the deductibility of health insurance premiums, covering various scenarios and situations. We’ll explore the impact of self-employment, the ACA, and different health insurance plans on your ability to deduct premiums. We will also cover important aspects like record-keeping, claiming the deduction on your tax return, and the potential tax savings involved. Finally, we’ll discuss when it’s advisable to seek professional tax advice.

Deductibility of Health Insurance Premiums

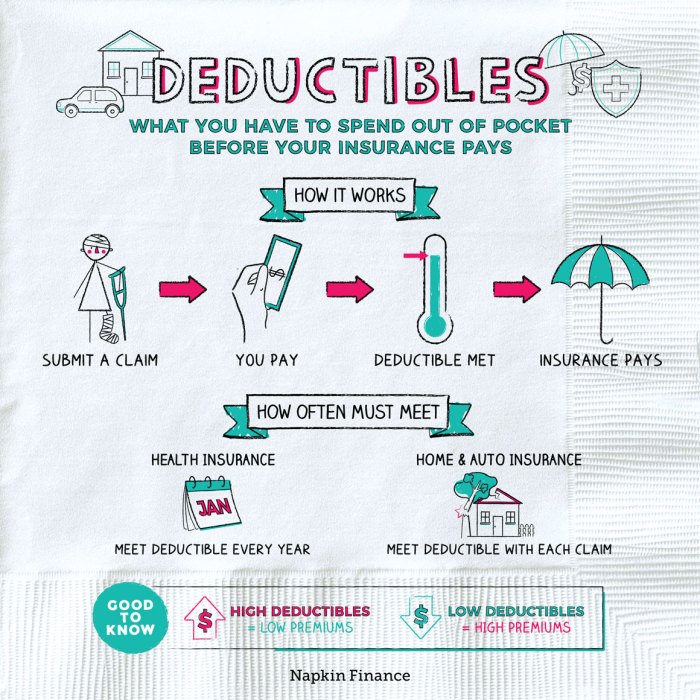

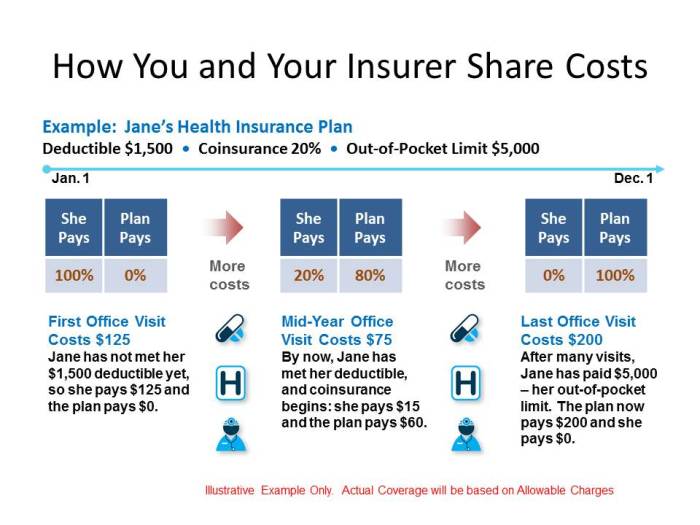

Understanding the tax implications of your healthcare expenses can significantly impact your overall tax burden. Tax deductions, in general, allow you to reduce your taxable income by subtracting certain eligible expenses. This means you pay less in taxes. For healthcare, this often involves deducting expenses not covered by insurance or, in some specific cases, the premiums themselves. The deductibility of health insurance premiums, however, depends heavily on the type of plan and your employment status.

The landscape of health insurance is diverse, ranging from employer-sponsored plans to individually purchased plans, and even government-sponsored programs like Medicare and Medicaid. Employer-sponsored plans often see premiums paid pre-tax, reducing taxable income directly. Individually purchased plans, however, may offer different deductibility rules, depending on factors such as the Affordable Care Act (ACA) and self-employment status. The specific type of health insurance plan significantly influences whether your premiums are deductible.

Types of Health Insurance Plans and Deductibility

Employer-sponsored health insurance plans typically allow employees to pay premiums through pre-tax deductions from their paychecks. This reduces their taxable income, effectively lowering their tax liability. For example, if an employee pays $500 per month in premiums pre-tax, that $6000 annual amount is not included in their annual taxable income. Conversely, if an employee pays premiums after tax, they cannot deduct those payments. The tax benefit of employer-sponsored insurance lies in the pre-tax payment option.

Self-Employed Individuals and Health Insurance Deductions

Self-employed individuals often have different rules regarding the deductibility of their health insurance premiums. Under certain circumstances, they can deduct the amount they paid in health insurance premiums as a business expense. This deduction is taken on Schedule C of their tax return, reducing their net business income and, consequently, their overall tax liability. For instance, a self-employed consultant who paid $10,000 in health insurance premiums during the year can deduct this amount, lowering their taxable income by $10,000. However, this deduction is subject to limitations and requirements Artikeld in the tax code, and careful documentation is crucial.

Situations Where Premiums May Not Be Deductible

There are situations where health insurance premiums are not deductible. For example, if an individual receives a health insurance subsidy through the Affordable Care Act (ACA), they generally cannot deduct their premiums. Similarly, premiums paid for supplemental health insurance policies (like Medicare Supplement plans) are usually not deductible. It’s crucial to understand the specific rules and regulations governing your particular circumstances to determine whether your premiums qualify for a deduction. Individuals should consult a tax professional for personalized advice.

Factors Affecting Deductibility

The deductibility of health insurance premiums hinges on several key factors, primarily your employment status and the type of health insurance plan you possess. Understanding these factors is crucial for accurately calculating your tax liability. The rules surrounding deductibility are complex and can vary depending on your specific circumstances.

Self-Employment and Health Insurance Premium Deductibility

Self-employed individuals can deduct the amount they pay for health insurance premiums as a business expense. This deduction is taken on Schedule C (Profit or Loss from Business) of Form 1040. It’s important to note that only premiums for health insurance covering the self-employed individual, their spouse, and their dependents are deductible. The deduction is above the line, meaning it reduces your adjusted gross income (AGI) directly. This can significantly impact your overall tax liability. For example, a self-employed plumber paying $10,000 annually in health insurance premiums could deduct this full amount, potentially lowering their taxable income substantially.

The Affordable Care Act (ACA) and Premium Deductibility

The Affordable Care Act (ACA) significantly impacted the healthcare landscape, but its direct influence on premium deductibility is less straightforward than often assumed. The ACA doesn’t inherently change the *eligibility* for deducting premiums for those who qualify under existing rules (like the self-employed). However, the ACA’s expansion of health insurance coverage and the introduction of subsidies and tax credits indirectly affect the deductibility situation for many. For example, individuals receiving ACA subsidies may find their net premium costs lower, impacting the ultimate amount they can deduct. The ACA didn’t create a new avenue for deduction but rather interacts with existing rules in nuanced ways.

Itemized Deductions and Health Insurance Premiums

Health insurance premiums are typically claimed as an itemized deduction, meaning they are part of a larger list of deductible expenses. To itemize, your total itemized deductions must exceed the standard deduction amount. This threshold varies based on filing status and income. If your itemized deductions are less than the standard deduction, you’ll likely benefit more from taking the standard deduction. Therefore, the deductibility of health insurance premiums is often contingent upon exceeding the standard deduction threshold. For example, if an individual has high medical expenses, they may be able to itemize and deduct their health insurance premiums, even if their premium costs alone wouldn’t exceed the standard deduction.

Limitations and Restrictions on Premium Deductions

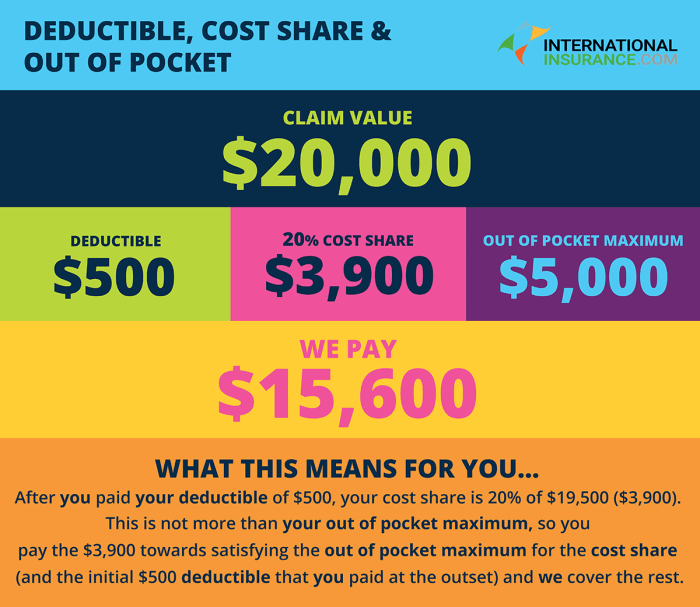

There are no specific dollar limits on the amount of health insurance premiums that can be deducted, provided you meet the eligibility requirements. However, the deduction is only for the premiums paid, and not for other healthcare costs such as co-pays, deductibles, or out-of-pocket expenses. The deductibility is also limited to the amounts actually paid during the tax year. Prepaid premiums for future years are not deductible in the current year.

Deductibility Rules: Individual vs. Employer-Sponsored Plans

The deductibility rules differ significantly between individual and employer-sponsored health insurance plans. For employer-sponsored plans, premiums are generally not deductible by the employee because the employer pays a portion (or all) of the premiums. The employer’s contribution is a non-taxable benefit. However, for self-employed individuals or those who purchase individual plans, the premiums are deductible as Artikeld above, provided they meet the qualifying criteria. This disparity arises from the differing tax treatments of employer-provided benefits versus individual purchases.

Deductibility Summary Table

| Plan Type | Deductibility Status | Qualifying Conditions | Maximum Deductible Amount |

|---|---|---|---|

| Self-Employed Individual Plan | Deductible | Premiums paid for self, spouse, and dependents; itemized deductions exceed standard deduction | No limit (up to the amount paid) |

| Individual Plan (not self-employed) | Deductible | Premiums paid; itemized deductions exceed standard deduction | No limit (up to the amount paid) |

| Employer-Sponsored Plan | Generally Not Deductible | Employer pays a portion or all of premiums | N/A |

| ACA Marketplace Plan (with subsidy) | Potentially Deductible (part of itemized deductions) | Premiums paid after subsidy; itemized deductions exceed standard deduction | No limit (up to the amount paid after subsidy) |

Tax Implications and Strategies

Deducting your health insurance premiums can lead to significant tax savings, reducing your overall tax liability. The amount you save depends on your tax bracket and the total amount of premiums paid. Understanding how this deduction works and strategically claiming it can make a considerable difference in your finances.

The potential tax savings from deducting health insurance premiums are directly related to your individual tax bracket. A higher tax bracket means a larger percentage of your deduction is saved. For example, someone in a 22% tax bracket will save $22 for every $100 deducted, while someone in a 32% bracket will save $32. This translates to substantial savings for individuals and families with significant healthcare costs. Properly utilizing this deduction is a key aspect of effective tax planning.

Claiming the Deduction on Tax Returns

Claiming the health insurance premium deduction involves a straightforward process. First, gather all necessary documentation, including your Form 1095-B (if applicable) and your premium payment records. Next, determine if you are eligible for the deduction, considering factors previously discussed, such as self-employment status or participation in a health savings account (HSA). Then, accurately report the deductible premiums on the appropriate section of your tax return (Schedule A, Itemized Deductions). Finally, review your completed return carefully before filing.

Illustrative Examples of Tax Liability

Let’s consider two hypothetical taxpayers, both with $5,000 in health insurance premiums. Taxpayer A itemizes deductions and is in the 22% tax bracket. Taxpayer B takes the standard deduction and is in the same tax bracket. Taxpayer A can deduct the full $5,000, resulting in a tax savings of $1,100 ($5,000 x 0.22). Taxpayer B, however, receives no tax benefit from their premiums. This illustrates how utilizing the deduction can significantly reduce tax liability.

Now, let’s consider another scenario. Taxpayer C, a self-employed individual, paid $10,000 in health insurance premiums and is in the 35% tax bracket. They can deduct the full $10,000, resulting in a tax savings of $3,500 ($10,000 x 0.35). This highlights the increased benefit for higher-income taxpayers with substantial health insurance costs. These examples demonstrate the substantial impact this deduction can have on your final tax bill.

Closure

Successfully navigating the intricacies of deducting health insurance premiums requires careful consideration of several factors. While this guide provides a thorough overview, individual circumstances can significantly impact eligibility. Remember to maintain meticulous records of your premium payments and consult with a qualified tax professional for personalized guidance. By understanding the rules and properly documenting your expenses, you can maximize your tax benefits and ensure compliance with IRS regulations. Proactive planning and accurate record-keeping are key to realizing the potential tax savings associated with deducting your health insurance premiums.

FAQ Summary

Can I deduct premiums for my spouse’s health insurance?

Generally, yes, if you are claiming your spouse as a dependent and meet other eligibility requirements, such as being self-employed or having a qualifying health plan.

What if I have both employer-sponsored and individual health insurance?

The deductibility will depend on the specifics of your plans and your employment status. Employer-sponsored plans generally aren’t deductible, while premiums for self-employed individuals may be. Consult a tax professional for personalized advice.

Are short-term health insurance premiums deductible?

Deductibility depends on the specifics of the plan and your circumstances. It is generally less likely than for long-term plans. Consult a tax professional for guidance.

What forms do I need to file for the deduction?

You’ll typically use Schedule A (Form 1040), Itemized Deductions, to claim the deduction. You’ll need documentation such as your 1099-MISC or other records showing premium payments.