Navigating the complexities of US tax law can be daunting, especially when it comes to healthcare. One common question revolves around the deductibility of health insurance premiums. Understanding whether or not you can deduct these costs can significantly impact your tax liability, offering potential savings for both employees and the self-employed. This guide will unravel the intricacies of premium deductibility, exploring the rules, regulations, and exceptions that govern this important aspect of tax planning.

This exploration will cover the fundamental rules regarding premium deductibility, comparing the situations of employees and self-employed individuals. We’ll delve into the specifics of different health insurance plans (HMOs, PPOs, HSA-compatible plans) and how their deductibility may vary. Furthermore, we’ll examine the impact of the Affordable Care Act (ACA) and highlight any state-specific regulations that might influence your eligibility for a deduction. Through illustrative scenarios and clear explanations, we aim to provide a comprehensive understanding of this often-confusing topic.

Deductibility of Health Insurance Premiums

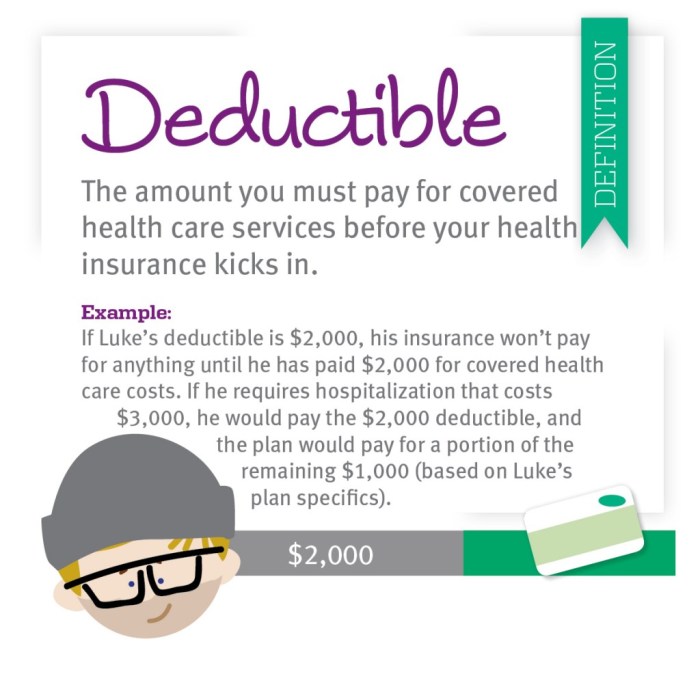

The deductibility of health insurance premiums in the United States hinges on several factors, primarily your employment status and the type of health insurance plan. Understanding these rules can significantly impact your tax liability. Generally, premiums are deductible if you meet specific criteria Artikeld in the Internal Revenue Code. Failure to meet these requirements can result in the premiums being ineligible for deduction.

Deductibility Rules for Self-Employed Individuals

Self-employed individuals can deduct the amount they paid for health insurance premiums as a business expense. This deduction is taken on Schedule C (Profit or Loss from Business) or Schedule F (Profit or Loss from Farming) of Form 1040. Crucially, the self-employed individual must be actively engaged in a trade or business, and the health insurance premiums must be for coverage for themselves, their spouse, and/or their dependents. The deduction is limited to the amount of net earnings from self-employment. If the premiums exceed the net earnings, the excess cannot be deducted in the current year but may be carried forward to future years.

Deductibility Rules for Employees

Employees generally cannot deduct health insurance premiums if their employer provides health insurance coverage as part of their compensation package. This is because the cost of the premiums is considered a non-taxable fringe benefit. However, there are exceptions. For instance, if an employee pays premiums for supplemental health insurance coverage beyond what their employer provides, those premiums *may* be deductible as a medical expense, but only to the extent that total medical expenses exceed a certain percentage of the taxpayer’s adjusted gross income (AGI). This is subject to the overall limitations on medical expense deductions.

Requirements for Deductible Premiums

Several requirements must be met for health insurance premiums to be considered deductible, regardless of employment status. The insurance must be for qualified medical expenses, meaning expenses related to the diagnosis, cure, mitigation, treatment, or prevention of disease, or for the purpose of affecting any structure or function of the body. Premiums paid for cosmetic procedures, for example, are generally not deductible. Additionally, the taxpayer must have paid the premiums; they cannot deduct premiums paid by another person. Finally, proper documentation, such as insurance statements showing payments made, is crucial for supporting the deduction during a tax audit. Failure to provide adequate documentation can result in the disallowance of the deduction.

Types of Health Insurance Plans and Deductibility

Understanding the deductibility of health insurance premiums hinges significantly on the type of plan you have. Different plans offer varying levels of coverage and, consequently, may impact how much, or if any, of your premiums are deductible. This section will explore the deductibility rules surrounding common health insurance plans.

The deductibility of health insurance premiums isn’t a universal “yes” or “no.” It’s largely dependent on factors like whether the plan is purchased through an employer, whether it’s considered self-employed coverage, and whether you meet specific income requirements for itemized deductions. Even the type of plan itself—HMO, PPO, or HSA-compatible—can affect your eligibility. Additionally, certain limitations may apply regardless of plan type.

Deductibility of Premiums for Different Plan Types

While the specifics can vary depending on your tax situation and the year, generally, premiums paid for self-employed health insurance are deductible as an above-the-line deduction, meaning they reduce your adjusted gross income (AGI) before other deductions are applied. This is a significant advantage, reducing your taxable income and, thus, your tax liability. However, the deductibility of premiums for employer-sponsored plans is significantly different. Typically, the employee’s portion of the premiums is not deductible.

Let’s consider the common plan types:

| Plan Type | Deductibility | Limitations | Example |

|---|---|---|---|

| HMO (Health Maintenance Organization) | Generally deductible for self-employed individuals; not deductible for employer-sponsored plans (employee portion). | Subject to self-employment income limits and AGI limitations for itemized deductions. | A self-employed freelancer pays $600 monthly for an HMO plan. They can deduct this amount when filing their taxes, subject to limitations. |

| PPO (Preferred Provider Organization) | Generally deductible for self-employed individuals; not deductible for employer-sponsored plans (employee portion). | Subject to self-employment income limits and AGI limitations for itemized deductions. | A small business owner pays $800 monthly for a PPO plan for themselves. They can deduct this amount subject to applicable rules. |

| HSA-Compatible Plan (High Deductible Health Plan) | Premiums are deductible for self-employed individuals; not deductible for employer-sponsored plans (employee portion). Contributions to the HSA are also deductible, up to annual limits. | Subject to self-employment income limits, AGI limitations, and HSA contribution limits. | A self-employed consultant pays $500 monthly for an HSA-compatible plan and contributes the maximum allowable amount to their HSA. Both the premiums and HSA contributions are deductible, up to the applicable limits. |

Situations Where Premiums Might Not Be Fully Deductible

Several scenarios can limit the full deductibility of health insurance premiums. These limitations often involve income thresholds or specific plan features.

For instance, if you’re itemizing deductions and your adjusted gross income (AGI) exceeds certain thresholds, you may not be able to deduct the full amount of your premiums. The amount deductible might be phased out based on your AGI. Another limitation involves situations where you receive premium subsidies or tax credits. These subsidies can affect your ability to deduct premiums. Lastly, if you’re covered under both an employer-sponsored plan and a self-purchased plan, the deductibility of the self-purchased premiums may be limited.

Self-Employed Individuals and Deductions

Self-employed individuals, unlike employees who have premiums automatically deducted from their paychecks, must navigate the process of deducting health insurance premiums themselves. Understanding the rules and regulations surrounding this deduction is crucial for maximizing tax savings and ensuring compliance. This section Artikels the specific requirements and potential challenges involved.

Self-employed individuals can deduct the amount they paid in health insurance premiums for themselves, their spouse, and their dependents. This deduction is taken above the line, meaning it reduces your adjusted gross income (AGI) before other deductions are calculated. This results in a larger tax benefit compared to itemized deductions which are taken after AGI is calculated. However, there are specific limitations and requirements that must be met.

Eligibility Requirements for Self-Employed Health Insurance Deduction

To claim this deduction, you must be self-employed, a freelancer, or an independent contractor. You must also have paid the premiums for qualifying health insurance coverage. The IRS defines qualifying health insurance as coverage that meets the minimum essential coverage standards set by the Affordable Care Act (ACA). This generally includes plans offered through the Marketplace, employer-sponsored plans, and many other types of plans. Crucially, you cannot be eligible for employer-sponsored health insurance. If you are eligible for employer-sponsored health insurance, you cannot deduct the premiums you pay for other coverage.

Limitations and Challenges

One significant limitation is that the deduction is only allowed for the amount you actually paid in premiums during the tax year. You cannot deduct premiums paid in advance or premiums that were reimbursed. Furthermore, you must itemize certain business expenses on Schedule C (Profit or Loss from Business) of Form 1040. Accurately tracking all premium payments and related documentation is essential for a successful claim. Failure to maintain proper records can lead to delays or denial of the deduction. Additionally, the self-employment tax significantly reduces the net amount you can deduct as the premiums are paid with after-tax dollars. This means the tax savings are reduced by the amount of self-employment tax owed.

Step-by-Step Guide to Claiming the Deduction

- Gather your documentation: Collect all documentation related to your health insurance premiums, including Form 1095-B or 1095-A (if applicable) and your payment receipts.

- Determine your eligible expenses: Calculate the total amount you paid in premiums for qualifying health insurance coverage during the tax year. This includes premiums for yourself, your spouse, and your dependents.

- Complete Schedule C (Form 1040): Report your business income and expenses, including the health insurance premium deduction. The premiums are reported on line 16, “Other expenses.” You should keep detailed records supporting these expenses.

- Complete Form 8889 (Health Savings Accounts): If you contributed to a Health Savings Account (HSA), you’ll need to complete this form to report those contributions. This can also affect the amount of premiums you can deduct.

- File your tax return: File your tax return (Form 1040) along with all supporting documentation, including Schedule C and Form 8889 (if applicable). Ensure you accurately report all income and deductions to avoid penalties.

The Affordable Care Act (ACA) and Deductibility

The Affordable Care Act (ACA) significantly altered the landscape of health insurance in the United States, impacting not only access to coverage but also the tax deductibility of premiums. Understanding these changes is crucial for individuals and families navigating the complexities of health insurance and tax planning.

The ACA’s primary impact on premium deductibility lies in its creation of health insurance marketplaces and the availability of subsidies. Before the ACA, the deductibility of health insurance premiums largely depended on the type of plan and the taxpayer’s employment status. Self-employed individuals could generally deduct premiums, while those with employer-sponsored insurance typically could not. The ACA introduced a new layer of complexity, particularly for those obtaining coverage through the marketplaces.

Subsidy Impact on Premium Deductibility

Receiving a subsidy through the ACA marketplace generally renders health insurance premiums non-deductible. This is because the subsidy is considered a reduction in the cost of the insurance, not a separate, deductible expense. For example, if an individual receives a $2,000 subsidy towards their $4,000 annual premium, they only paid $2,000 out of pocket. Only the amount actually paid by the individual is considered for tax purposes, and this amount may be too low to meet the minimum threshold for itemized deductions. The total premium amount, including the subsidy, is not deductible. This is a significant difference from the pre-ACA landscape where premiums, regardless of subsidies, might be deductible depending on other factors.

Tax Implications: Marketplace vs. Private Purchase

Purchasing insurance through the ACA marketplace versus privately carries distinct tax implications regarding premium deductibility. As previously mentioned, premiums purchased through the marketplace and subsidized are generally not deductible. However, those who purchase insurance privately, outside the marketplace, and meet specific requirements (such as being self-employed or having unreimbursed medical expenses exceeding a certain percentage of their adjusted gross income) may still be able to deduct their premiums. This highlights the importance of understanding the specific rules and regulations that apply to different situations. Consulting a tax professional can be highly beneficial in determining the best course of action for individual circumstances. For instance, a freelancer might be able to deduct premiums purchased outside the marketplace, while a salaried employee with employer-sponsored insurance would not be able to deduct anything related to health insurance premiums. The self-employed individual would need to itemize deductions and meet the threshold for medical expense deductions, which depends on their adjusted gross income.

State-Specific Regulations

The deductibility of health insurance premiums, while largely governed by federal tax laws, can be impacted by individual state regulations. These variations often relate to specific state tax credits, additional deductions for certain taxpayers, or nuances in how the federal rules are interpreted at the state level. Understanding these differences is crucial for accurate tax filing.

State-level tax laws regarding the deductibility of health insurance premiums are complex and vary significantly. There isn’t a single, readily available, comprehensive database that details every state’s specific rules. Tax laws change frequently, so it’s always best to consult with a qualified tax professional or refer to the most up-to-date information from your state’s tax agency. The information below is for general guidance only and should not be considered exhaustive or a substitute for professional tax advice.

State-Specific Deductibility Variations

It is important to understand that the information below is a simplified overview and may not encompass all aspects of state-specific regulations. The deductibility of health insurance premiums is a complex area of tax law, and the rules can change. Therefore, consulting a tax professional is strongly recommended.

| State | Potential Variations | Notes |

|---|---|---|

| California | May offer additional state tax credits or deductions for certain taxpayers purchasing health insurance through the Covered California marketplace. | Specific eligibility requirements and amounts vary annually. |

| New York | May have specific rules regarding the deductibility of premiums for self-employed individuals or those with certain health conditions. | Consult the New York State Department of Taxation and Finance for current regulations. |

| Texas | Generally follows federal guidelines, but state-specific tax credits or deductions may exist for certain populations. | Tax laws in Texas are subject to change. |

| Florida | Generally aligns with federal tax laws regarding health insurance premium deductibility. | There are no significant state-level variations reported at this time. |

| Illinois | May offer tax credits or deductions for individuals purchasing insurance through the state’s health insurance marketplace. | Eligibility criteria and amounts can change yearly. |

Disclaimer: This information is for general guidance only and does not constitute tax advice. Tax laws are complex and subject to change. Consult with a qualified tax professional for personalized advice.

Last Word

Successfully navigating the landscape of health insurance premium deductibility requires a thorough understanding of various factors, including your employment status, the type of health plan you have, and the specifics of federal and state tax laws. While the potential for tax savings exists, careful attention to detail and accurate record-keeping are crucial. This guide has provided a framework for understanding the key aspects of this complex issue; however, consulting with a qualified tax professional is always recommended for personalized advice tailored to your specific circumstances. Remember, accurate tax preparation is vital for compliance and maximizing your potential tax benefits.

Commonly Asked Questions

Can I deduct premiums for my spouse’s health insurance?

Generally, yes, if you are claiming your spouse as a dependent and meet other eligibility requirements.

What if I received a health insurance subsidy through the ACA marketplace?

The deductibility of premiums may be affected; the rules are complex and vary depending on your income and the subsidy amount. Consult a tax professional for clarification.

Are COBRA premiums deductible?

In most cases, no. COBRA premiums are generally not deductible unless they are paid as a result of a job loss due to certain qualifying events.

Where can I find the necessary tax forms?

The IRS website (irs.gov) provides access to all relevant tax forms, including Form 1040 and Schedule A (for itemized deductions).

What documentation should I keep?

Keep copies of your insurance premium statements, tax forms, and any other supporting documentation that proves your expenses.