Prepaying insurance premiums offers businesses a strategic financial maneuver, creating an interesting accounting dynamic. This seemingly simple act generates an asset on the balance sheet, impacting financial statements and requiring careful management. Understanding the nuances of this asset – its recognition, measurement, and implications – is crucial for accurate financial reporting and effective risk mitigation.

This exploration delves into the complexities of prepaid insurance, examining its accounting treatment under various standards (IFRS, GAAP), its influence on liquidity ratios and income statements, and the potential legal and tax implications. We’ll also consider practical applications across industries and develop strategies for effective risk management related to this unique asset.

Defining the Asset

Prepaying an insurance premium creates an asset because the payment provides the policyholder with future insurance coverage. This prepaid amount represents a future economic benefit, as the insurance company is obligated to provide services (or pay claims) in accordance with the policy terms. This contrasts with a typical expense, which provides immediate benefit.

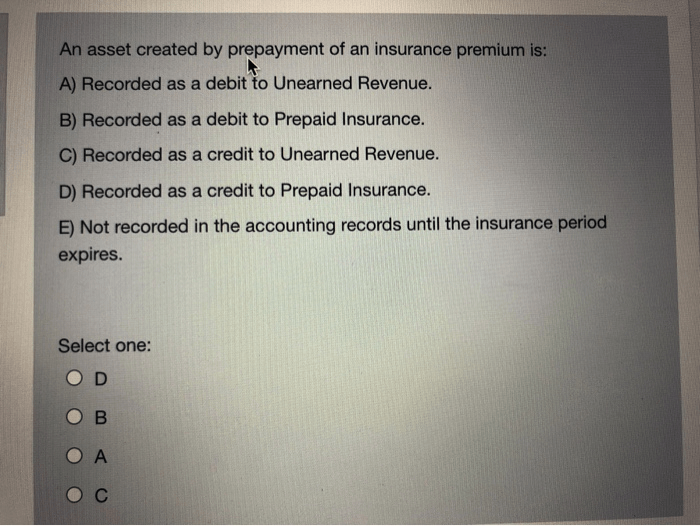

The accounting treatment of this asset follows generally accepted accounting principles (GAAP). The prepayment is initially recorded as a debit to an asset account, specifically a “Prepaid Insurance” account, and a credit to cash. Over the policy’s life, the prepaid amount is systematically expensed through an adjusting journal entry. This process reflects the consumption of the insurance coverage over time, aligning the expense with the period it benefits. The expense is debited, and the prepaid insurance asset is credited. The specific amortization method (e.g., straight-line, or other methods depending on the policy specifics) determines the amount expensed each period.

Accounting Treatment of Prepaid Insurance

The amount of prepaid insurance is recognized as an asset on the balance sheet. It is presented under current assets if the policy expires within one year, otherwise, it is classified as a non-current asset. The systematic expensing of the prepaid insurance is reflected in the income statement as an insurance expense. This ensures that the cost of insurance is matched with the period in which the coverage is received. For example, if a one-year policy costing $12,000 is purchased, $1,000 would be expensed monthly.

Examples of Insurance Prepayments Creating Assets

Prepaid insurance assets can arise from various types of insurance policies. Examples include:

- Property Insurance: A business prepays for a year’s worth of coverage for its building and equipment.

- Liability Insurance: A company prepays for general liability insurance to protect against potential lawsuits.

- Health Insurance: An individual or company may prepay for a year’s worth of health insurance premiums.

- Auto Insurance: A policyholder prepays for comprehensive and collision coverage on their vehicle.

These prepayments all represent future economic benefits that are controlled by the policyholder.

Comparison with Other Prepaid Expenses

Prepaid insurance is similar to other prepaid expenses, such as prepaid rent or prepaid subscriptions. All of these represent payments made in advance for future benefits. However, a key distinction lies in the nature of the benefit received. Prepaid rent provides access to a physical space, while prepaid subscriptions offer access to a service. Prepaid insurance, conversely, provides protection against future risks or uncertainties. The accounting treatment remains similar across these types of prepaid expenses, involving initial recognition as an asset followed by systematic amortization over the benefit period. The specific account used (e.g., Prepaid Rent, Prepaid Insurance, Prepaid Subscriptions) differentiates the type of future benefit.

Financial Statement Impact

Prepayment of insurance premiums creates an asset on the balance sheet, representing the future insurance coverage purchased. Understanding its impact on financial statements is crucial for accurate financial reporting and analysis. This section details how this prepayment asset is reflected in both the balance sheet and income statement, along with its influence on liquidity ratios.

Balance Sheet Reporting

The prepayment asset is classified as a current asset on the balance sheet because it represents a benefit that will be consumed within the next accounting period (usually one year). It’s listed separately from other current assets, such as cash and accounts receivable, to provide a clear picture of the company’s prepaid expenses. The value reported is the unexpired portion of the premium—the amount representing the remaining coverage yet to be utilized.

Impact on Liquidity Ratios

The presence of a prepaid insurance asset influences a company’s liquidity ratios, specifically the current ratio and the quick ratio. The current ratio (Current Assets / Current Liabilities) will be higher due to the inclusion of the prepaid asset in current assets. Similarly, the quick ratio ( (Current Assets – Inventory – Prepaid Expenses) / Current Liabilities), while not directly increased by the prepaid asset, is only minimally affected since the prepaid asset is relatively small in comparison to other current assets. A higher current ratio generally indicates a stronger ability to meet short-term obligations, although it’s important to consider other factors as well.

Amortization and Income Statement Impact

As the insurance coverage is consumed over time, the prepaid insurance asset is systematically reduced through a process called amortization. This expense is recognized on the income statement over the period the insurance coverage applies to, reflecting the portion of the premium that has been used. For example, if a company prepays $12,000 for a one-year insurance policy, $1,000 ($12,000/12 months) would be recognized as insurance expense each month on the income statement. This amortization process ensures that the expense is matched with the revenue it helps generate.

Sample Balance Sheet Entry

The following table illustrates a sample balance sheet entry reflecting a prepaid insurance asset:

| Account Name | Debit | Credit | Description |

|---|---|---|---|

| Prepaid Insurance | $12,000 | Prepayment for one-year insurance policy | |

| Cash | $12,000 | Payment for insurance policy |

Risk Management Aspects

Prepaying insurance premiums creates an asset, but this asset carries inherent risks that require careful management. Understanding these risks and implementing appropriate mitigation strategies is crucial to protect the value of the prepayment. This section details potential risks and Artikels a risk management plan.

Potential Risks Associated with Holding a Prepaid Insurance Premium Asset

The primary risk associated with a prepaid insurance premium is the potential loss of value if the insurer experiences financial difficulties or insolvency. This could lead to a partial or total loss of the prepaid amount. Further risks include the potential for changes in the insurance contract terms, unexpected increases in premiums, or even the inability to utilize the prepaid premium for its intended purpose due to unforeseen circumstances. For example, a business might prepay for liability insurance, but if the business is subsequently dissolved, the prepaid premium might be lost or difficult to recover.

Methods for Mitigating Risks Related to Prepayment

Effective risk mitigation involves a multi-pronged approach. Firstly, thorough due diligence on the insurer’s financial stability is paramount. This includes reviewing the insurer’s financial statements, credit ratings, and regulatory compliance history. Secondly, diversification can help reduce risk. Instead of prepaying a large sum to a single insurer, spreading the prepayment across multiple insurers with strong financial standings can limit exposure to any single entity’s potential failure. Thirdly, negotiating contractual safeguards, such as clauses that guarantee a refund or transfer of the prepayment in case of insurer insolvency, provides additional protection. Finally, regularly monitoring the insurer’s financial health and promptly reacting to any signs of deterioration can help minimize potential losses.

Insurer Financial Stability and its Impact on the Asset

An insurer’s financial stability is directly linked to the value of the prepaid premium asset. Factors such as the insurer’s capital adequacy, underwriting performance, investment portfolio performance, and regulatory oversight all contribute to its overall financial strength. A decline in the insurer’s financial health, indicated by downgrades in credit ratings, increased claims payouts, or regulatory actions, significantly increases the risk of loss. For example, a major hurricane could severely impact an insurer’s solvency, potentially jeopardizing prepaid premiums held with that insurer. This underscores the importance of continuous monitoring and proactive risk management.

Risk Management Plan for Potential Loss of Value

A comprehensive risk management plan should incorporate the following elements: Regular monitoring of the insurer’s financial condition through review of publicly available financial statements and credit ratings. Diversification of the prepayment across multiple financially strong insurers to reduce the impact of a single insurer’s failure. Implementation of contractual safeguards to protect the prepayment in case of insurer insolvency. Development of a contingency plan outlining actions to be taken in the event of insurer financial distress, including potential claims procedures or asset recovery strategies. Finally, regular review and update of the risk management plan to reflect changes in the insurer’s financial condition or the broader insurance market.

Conclusion

Prepaid insurance, while seemingly straightforward, presents a multifaceted accounting and financial management challenge. Its proper handling is essential for accurate financial reporting, compliance with accounting standards, and effective risk mitigation. By understanding the nature of this asset, its impact on financial statements, and the associated legal and regulatory considerations, businesses can leverage prepayment strategies while minimizing potential risks and maximizing financial transparency.

FAQ Guide

What happens if the insurance company goes bankrupt after I prepay my premiums?

This poses a significant risk. The value of your prepaid insurance asset could be diminished or even lost entirely. Consider purchasing insurance from financially stable companies and explore options like insurance recovery funds.

Can I deduct the entire prepayment in the year of payment for tax purposes?

Generally, no. You can only deduct the portion of the premium that covers the insurance period within the tax year. The remaining amount is considered an asset and amortized over the policy period.

How is the amortization of prepaid insurance handled differently under IFRS and GAAP?

While both standards require systematic amortization, the specific methods and allowed estimations may differ slightly. Consult the relevant standards for detailed guidance.

What are some common industries where prepaying insurance is prevalent?

Large corporations, particularly those with significant property and liability insurance needs, often prepay premiums for cost savings and budget predictability. Real estate companies and manufacturing businesses are also common examples.