Navigating the world of health insurance can feel like deciphering a complex code. Understanding your options, especially when it comes to a major provider like Aetna CVS Health, is crucial for securing the best coverage at a manageable cost. This guide delves into the intricacies of Aetna CVS Health insurance premiums, offering a clear and concise overview to empower you with the knowledge needed to make informed decisions about your healthcare.

We’ll explore the various Aetna plans offered through CVS Health, examining factors influencing premium costs, comparing them to competitors, and detailing payment options and website resources. Real-world examples and customer feedback will further illuminate the process, allowing you to confidently navigate the complexities of Aetna CVS Health insurance premiums and choose the plan that best suits your individual needs and budget.

Aetna CVS Health Insurance Plans Overview

Aetna, in collaboration with CVS Health, offers a range of health insurance plans designed to cater to diverse needs and budgets. Understanding the different plan types and their features is crucial for choosing the right coverage. This overview provides a detailed look at the key plans available.

Aetna CVS Health Insurance Plan Types

Choosing the right Aetna plan through CVS Health depends on individual needs and financial considerations. Factors like desired level of coverage, out-of-pocket costs, and network access significantly influence the selection process. The following table summarizes the key differences between common plan types. Note that specific plan details and availability may vary by location and enrollment period.

| Plan Name | Cost Range (Approximate Annual Premium) | Key Features | Eligibility Criteria |

|---|---|---|---|

| Aetna HMO | $3,000 – $12,000 | Lower premiums; requires in-network care; PCP referral often needed for specialists; generally lower out-of-pocket costs when using in-network providers. | Generally available to individuals and families; specific eligibility may depend on employment status and location. |

| Aetna PPO | $4,000 – $15,000 | Higher premiums; allows out-of-network care (at a higher cost); typically offers more flexibility in choosing doctors and specialists. | Generally available to individuals and families; specific eligibility may depend on employment status and location. |

| Aetna EPO | $3,500 – $13,000 | Similar to HMO, but may offer slightly more flexibility with specialist access; typically requires in-network care. | Generally available to individuals and families; specific eligibility may depend on employment status and location. |

| Aetna POS | $4,000 – $14,000 | Combines elements of HMO and PPO; allows out-of-network care (at a higher cost), but typically encourages in-network care for lower costs. | Generally available to individuals and families; specific eligibility may depend on employment status and location. |

Understanding Cost and Coverage

The cost range provided in the table above is approximate and can vary based on factors such as age, location, chosen plan benefits, and individual health status. It is crucial to obtain a personalized quote from Aetna or a licensed insurance broker to determine the precise cost for your specific circumstances. Coverage details, including deductibles, co-pays, and out-of-pocket maximums, will be clearly Artikeld in the plan documents. It is recommended to carefully review these details before enrolling in a plan.

Eligibility and Enrollment

Eligibility for Aetna CVS Health insurance plans depends on several factors, including residency, employment status (if employer-sponsored), and individual health conditions. Enrollment periods are typically limited, and it’s important to check the specific enrollment deadlines to avoid missing the opportunity to sign up. Contacting Aetna directly or working with a qualified insurance agent can provide assistance with the enrollment process and help determine eligibility.

Understanding Aetna CVS Health Insurance Premium Payment Options

Paying your Aetna CVS Health insurance premiums is straightforward, with several convenient methods available to ensure timely payments and avoid any service interruptions. Understanding your options and choosing the method that best suits your financial habits is key to maintaining continuous coverage. This section Artikels the various payment methods, automatic payment setup, and available financial assistance programs.

Aetna CVS Health offers a range of payment methods to accommodate diverse preferences. These options provide flexibility and convenience for managing your insurance premiums.

Accepted Payment Methods

Aetna CVS Health accepts a variety of payment methods, including online payments through their website or mobile app, payments by mail, and payments by phone. Credit cards (Visa, Mastercard, American Express, Discover), debit cards, and electronic checks are generally accepted for online and phone payments. For payments by mail, a check or money order payable to Aetna CVS Health should be mailed to the address specified on your billing statement. It’s crucial to include your policy number and member ID on all payments. Some employers may also offer payroll deduction as a payment option. Contact your employer’s human resources department for details.

Setting Up Automatic Payments and Managing Payment Schedules

Automating your premium payments simplifies the process and eliminates the risk of missed payments. Through the Aetna CVS Health website or mobile app, you can enroll in automatic payments using your chosen payment method. This allows for recurring payments on your due date, ensuring uninterrupted coverage. You can typically manage your payment schedule, including updating your payment method or cancelling automatic payments, within your online account. Detailed instructions are usually provided on the Aetna CVS Health website and within the member portal.

Payment Plans and Financial Assistance Programs

Aetna CVS Health may offer payment plans or financial assistance programs to help individuals manage their premium payments. These programs are often designed for those experiencing financial hardship. Eligibility criteria and application procedures vary, so it is recommended to contact Aetna CVS Health directly or review their website for detailed information on available programs and their specific requirements. For example, some programs might involve a reduced premium payment amount spread over several months or offer subsidies based on income and family size. It’s important to inquire about these options early to avoid potential disruptions in coverage.

Navigating the Aetna CVS Health Insurance Website and Resources

The Aetna CVS Health insurance website serves as a central hub for managing your health insurance plan. It offers a range of tools and resources designed to make accessing your policy information and managing your healthcare needs more convenient. Understanding the website’s features is crucial for efficiently navigating your insurance experience.

The Aetna CVS Health website provides easy access to a wealth of information, empowering members to manage their healthcare effectively. Key functionalities include online account management, secure messaging with customer service, and comprehensive tools for finding in-network providers. The website is designed for intuitive navigation, guiding members through the process of accessing essential information.

Accessing Policy Details, Claims Information, and Provider Directories

The website offers several methods for accessing important information. Policy details, including coverage specifics, deductible information, and out-of-pocket maximums, are typically accessible through your personalized online account. Claims information, including the status of submitted claims and explanations of benefits, can also be found within the same account dashboard. The provider directory allows you to search for in-network doctors, specialists, and hospitals within your coverage area, filtering by specialty, location, and other criteria. You can access these features by logging into your account using your username and password.

Locating Premium Information on the Aetna CVS Health Website

To find information about your Aetna CVS Health insurance premiums, follow these steps:

- Log in to your account: Visit the Aetna CVS Health website and log in using your username and password. If you haven’t created an account yet, you’ll need to register first, usually requiring your policy number.

- Navigate to your account summary: Once logged in, your account dashboard will usually display a summary of your policy. This summary may include your current premium amount.

- Access your policy details: Look for a link or section labeled “Policy Details,” “Plan Information,” or something similar. Clicking this will typically provide a more detailed view of your plan, including premium information.

- Check your billing section: Many websites have a dedicated “Billing” or “Payments” section where you can view your payment history and upcoming premium due dates. This section usually provides a clear breakdown of your premium costs.

- Use the search function: If you’re having trouble locating your premium information, use the website’s search function to search for terms like “premium,” “billing,” or “payment.” This can often quickly lead you to the relevant information.

Remember that the exact location of this information may vary slightly depending on updates to the website’s design. If you continue to have difficulty locating your premium information, contacting Aetna CVS Health customer service directly is always an option.

Illustrative Example: Premium Calculation Scenario

Let’s consider a hypothetical scenario to illustrate how Aetna CVS Health insurance premiums are calculated. We’ll examine the premium differences between various plan options for a family of four: two adults (ages 35 and 38) and two children (ages 8 and 10). This example uses fictional data for illustrative purposes and should not be considered an exact representation of actual premiums.

Premium Components and Plan Choices

Aetna CVS Health offers a range of plans, each with varying levels of coverage and associated costs. These costs are reflected in the monthly premium and influence out-of-pocket expenses. The main components impacting the premium are the plan’s deductible, co-pays, out-of-pocket maximum, and the chosen level of coverage (e.g., Bronze, Silver, Gold, Platinum). Higher coverage plans generally have lower out-of-pocket expenses but higher premiums.

Hypothetical Premium Breakdown

Let’s assume the family is considering three different plan options: a Bronze plan, a Silver plan, and a Gold plan. The following table Artikels the estimated monthly premiums and key cost components for each:

| Plan Type | Monthly Premium | Deductible (per person) | Co-pay (Doctor Visit) | Out-of-Pocket Maximum (family) |

|---|---|---|---|---|

| Bronze | $800 | $7,000 | $50 | $14,000 |

| Silver | $1,200 | $4,000 | $30 | $10,000 |

| Gold | $1,600 | $2,000 | $20 | $8,000 |

Influencing Factors on Premium Costs

Several factors influence the final premium cost beyond the plan type. These include geographic location, the age of the insured individuals, tobacco use, and the number of people covered under the plan. For instance, living in a high-cost area will generally result in a higher premium. Similarly, older individuals typically pay more than younger individuals. Tobacco use can significantly increase premium costs.

Premium Calculation Formula (Illustrative)

While the exact formula is proprietary to Aetna CVS Health, a simplified representation might look like this:

Base Premium + (Age Factor * Number of Individuals) + Location Factor + Tobacco Surcharge = Total Monthly Premium

This is a simplified illustration; the actual calculation involves many more variables and complex algorithms.

Customer Reviews and Experiences with Aetna CVS Health Insurance Premiums

Understanding customer experiences is crucial for assessing the value and overall satisfaction associated with Aetna CVS Health insurance premiums. Direct feedback offers valuable insights into both the strengths and weaknesses of the plan, helping potential customers make informed decisions. Analyzing this feedback reveals common themes and trends that highlight areas for improvement and aspects that consistently receive positive appraisal.

Positive Customer Feedback on Aetna CVS Health Insurance Premiums

Many customers report positive experiences with their Aetna CVS Health insurance premiums. These positive comments often center around specific aspects of the plan and the company’s customer service.

- “The premium was lower than I expected for the level of coverage I received. I was pleasantly surprised.”

- “The online portal is easy to use and makes managing my account and paying premiums straightforward.”

- “I had a question about my bill and customer service was incredibly helpful and resolved my issue quickly.”

- “The network of doctors and hospitals is extensive, giving me a wide choice of providers.”

Negative Customer Feedback on Aetna CVS Health Insurance Premiums

Conversely, some customers express dissatisfaction with certain aspects of their Aetna CVS Health insurance premiums and the associated services. These negative experiences often highlight areas where improvements could be made.

- “My premium increased significantly from one year to the next, making it difficult to budget for.”

- “I experienced delays in processing claims, which caused unexpected out-of-pocket expenses.”

- “Navigating the website to find specific information about my coverage was confusing and frustrating.”

- “The customer service representatives were not always knowledgeable or helpful when I contacted them with questions.”

Common Themes and Trends in Customer Reviews

Analysis of customer reviews reveals several recurring themes. A significant number of positive comments highlight the affordability and ease of use associated with the plan, while negative feedback frequently centers on premium increases and difficulties with claims processing and customer service. These trends indicate areas where Aetna CVS Health could focus its efforts to enhance customer satisfaction. For instance, improving the clarity of the website and streamlining the claims process could significantly mitigate negative experiences. Proactive communication regarding premium adjustments could also help manage customer expectations and prevent dissatisfaction.

Final Conclusion

Choosing a health insurance plan is a significant financial and personal decision. This guide has provided a framework for understanding Aetna CVS Health insurance premiums, encompassing plan details, cost factors, comparisons, and payment options. By carefully considering the information presented, and leveraging the resources available on the Aetna CVS Health website, you can confidently select a plan that offers comprehensive coverage while aligning with your financial capabilities. Remember to thoroughly review your options and consult with a qualified insurance professional for personalized advice.

FAQs

What factors affect my Aetna CVS Health insurance premium besides age, location, and health status?

Tobacco use, family size (for family plans), and the plan’s deductible and out-of-pocket maximum all influence premium costs.

Can I change my Aetna CVS Health plan during the year?

Generally, you can only change your plan during the annual open enrollment period, unless you experience a qualifying life event (like marriage, birth, or job loss).

What if I can’t afford my Aetna CVS Health premium?

Aetna CVS Health may offer payment plans or you may be eligible for government subsidies or financial assistance programs. Contact Aetna directly to explore these options.

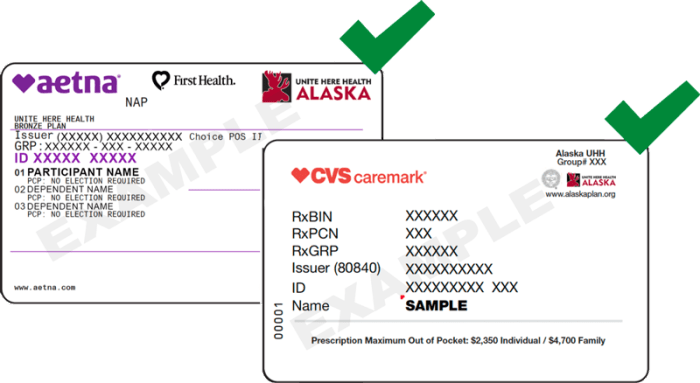

How do I access my Aetna CVS Health insurance card?

Your insurance card is usually accessible through the Aetna CVS Health website or mobile app after enrollment. You may also receive a physical card in the mail.

Where can I find a list of in-network doctors and hospitals?

The Aetna CVS Health website provides a provider directory allowing you to search for in-network healthcare professionals by specialty, location, and other criteria.