Permanent life insurance, characterized by its lifelong coverage and cash value accumulation, offers a powerful tool for long-term financial security. Understanding the nuances of policy types, premium structures, and cash value management is crucial for making informed decisions. This guide delves into the intricacies of permanent life insurance policies where the policyowner pays premiums, empowering you to navigate this complex landscape with confidence.

From the fundamental differences between whole life, universal life, and variable life insurance to the strategic implications of various premium payment options, we explore the key aspects that contribute to a sound financial plan. We’ll also address crucial considerations such as cash value growth, tax implications, and beneficiary designations, providing a holistic understanding of this valuable financial instrument.

Policy Types and Features

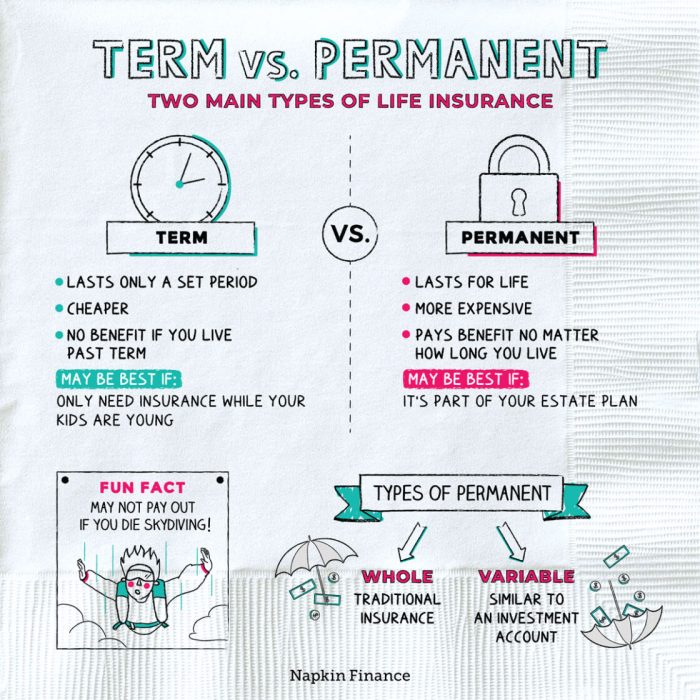

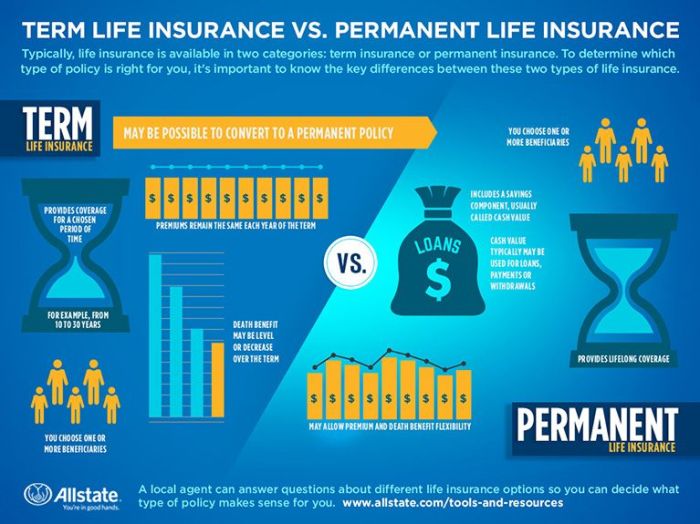

Permanent life insurance offers lifelong coverage, unlike term life insurance. However, several types exist, each with unique features and implications for policyholders. Understanding these differences is crucial for choosing the right policy to meet individual financial goals and risk tolerance.

Whole Life Insurance

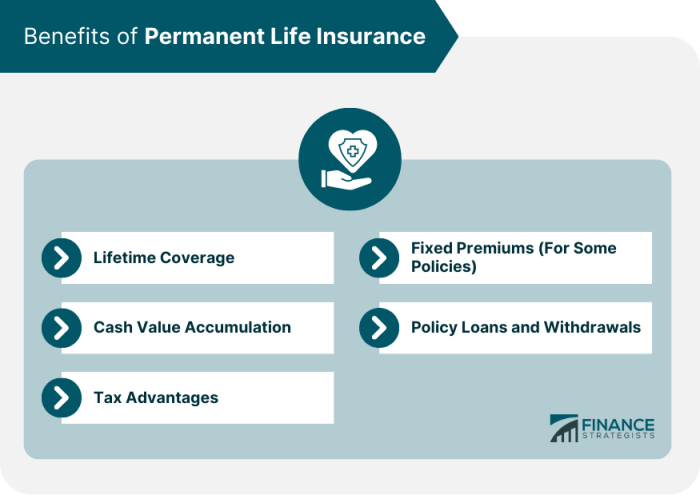

Whole life insurance provides a fixed death benefit for the insured’s entire life, and it builds cash value that grows tax-deferred. Premiums are typically level throughout the policy’s duration, making it predictable and stable. The cash value component can be borrowed against or withdrawn, although withdrawals may reduce the death benefit and cash value. Whole life policies are generally more expensive than term life policies due to the guaranteed lifelong coverage and cash value accumulation.

Universal Life Insurance

Universal life insurance offers more flexibility than whole life. It also provides a death benefit and cash value, but the premiums and death benefit are adjustable within certain limits. Policyholders can change their premium payments and death benefit amount (subject to underwriting requirements) to suit their changing financial circumstances. The cash value grows tax-deferred, similar to whole life, and the interest rate credited to the cash value can be variable, meaning it can fluctuate based on market conditions.

Variable Life Insurance

Variable life insurance is another flexible option that combines a death benefit with a cash value component. However, unlike whole life and universal life, the cash value in a variable life policy is invested in sub-accounts that mirror various market indices, such as stocks or bonds. This means the cash value growth potential is higher but also carries more risk, as the value can fluctuate depending on market performance. The death benefit can also vary depending on the performance of the sub-accounts.

Common Features of Permanent Life Insurance Policies

Permanent life insurance policies share several key features. The most important are the death benefit and cash value accumulation. The death benefit is a guaranteed payout to the beneficiaries upon the insured’s death. The cash value component grows tax-deferred over time, providing a savings element and a source of funds that can be accessed during the policyholder’s lifetime. This cash value accumulation is a significant difference between permanent and term life insurance.

Tax Implications of Permanent Life Insurance

The tax advantages of permanent life insurance policies are significant. The cash value grows tax-deferred, meaning no taxes are paid on the earnings until they are withdrawn. However, withdrawals may be subject to income tax depending on the amount withdrawn and the policy’s cash value. Furthermore, death benefits are generally tax-free to beneficiaries. The specific tax implications can vary depending on the type of policy and how it is structured, so consulting a tax professional is advisable. For example, excessive withdrawals from a policy could trigger tax implications beyond the usual income tax, particularly if the policy is deemed a Modified Endowment Contract (MEC).

Common Riders and Their Benefits

Many permanent life insurance policies offer riders, which are add-ons that enhance the policy’s coverage. Common riders include:

- Waiver of Premium Rider: This rider waives future premiums if the insured becomes totally disabled.

- Accidental Death Benefit Rider: This rider pays an additional death benefit if the insured dies due to an accident.

- Long-Term Care Rider: This rider provides funds to cover long-term care expenses, potentially preserving the policy’s death benefit.

- Guaranteed Insurability Rider: This rider allows the policyholder to purchase additional insurance coverage at specific times in the future without undergoing further medical underwriting.

These riders offer additional protection and peace of mind, but they come with added costs. It’s important to weigh the benefits against the extra premiums when deciding which riders to include. For example, a waiver of premium rider can be particularly valuable for individuals whose income is crucial to their family’s financial stability. The long-term care rider is increasingly popular given the rising costs of long-term care services.

Premium Payment Structures

Choosing the right premium payment structure for your permanent life insurance policy is a crucial decision that significantly impacts your overall cost and the policy’s long-term value. Understanding the various options available and their implications is essential for making an informed choice that aligns with your financial goals and circumstances.

Premium amounts for permanent life insurance are determined by several interconnected factors. This section will detail the various premium payment structures and the key factors influencing the cost of your premiums.

Level Premium Payments

Level premium payments represent the most common structure for permanent life insurance. Under this arrangement, you pay a fixed premium amount throughout the policy’s duration. This predictability offers financial stability, allowing for easy budgeting and ensuring consistent coverage. While the initial premium may seem higher compared to other options, the fixed nature eliminates the risk of future premium increases, which can become substantial over time. This structure provides a sense of security and avoids the uncertainty associated with fluctuating premium payments.

Flexible Premium Payments

Flexible premium payments offer greater flexibility in managing your premium contributions. You can adjust your payments within certain limits set by the insurance company, allowing for increased payments during periods of higher income and reduced payments during times of financial constraint. This adaptability can be beneficial for individuals whose income fluctuates significantly. However, it’s crucial to understand that lowering payments could impact the policy’s cash value growth and potentially lead to policy lapse if payments fall too far below the minimum required.

Single Premium Payments

With a single premium payment, the entire cost of the policy is paid upfront in one lump sum. This option eliminates the need for ongoing premium payments, providing complete financial certainty. However, it requires a significant upfront capital investment. The substantial initial outlay might not be feasible for everyone. This method is often preferred by individuals with substantial wealth who seek immediate, lifelong coverage without the burden of recurring premiums.

Factors Influencing Premium Amounts

Several factors significantly influence the premium amount you’ll pay for your permanent life insurance. These factors interact to determine your individual premium.

| Factor | Impact on Premium | Explanation |

|---|---|---|

| Age | Higher age = Higher premium | Older individuals have a statistically higher risk of mortality, resulting in higher premiums. |

| Health | Poor health = Higher premium | Pre-existing health conditions or lifestyle factors can increase the risk of early death, leading to higher premiums. |

| Policy Type | Whole life > Universal life > Variable life | Different policy types offer varying levels of coverage and features, influencing premium costs. Whole life generally has higher premiums due to guaranteed cash value growth. |

| Death Benefit | Higher death benefit = Higher premium | A larger death benefit means a higher payout to your beneficiaries, resulting in a correspondingly higher premium. |

Hypothetical Scenario: Premium Payment Strategies

Let’s consider two individuals, both aged 40, purchasing a $500,000 whole life insurance policy.

* Individual A: Chooses level premium payments. Their annual premium is $5,000, resulting in consistent payments over their lifetime. The policy builds cash value steadily.

* Individual B: Chooses flexible premium payments. They initially pay $7,000 annually for five years, building a substantial cash value. They then reduce payments to $3,000 annually for the next 10 years. Their cash value growth is initially faster but could potentially slow or even decrease if the lower payments continue for an extended period and fall below the minimum required.

This scenario illustrates how different payment strategies can impact the policy’s cash value accumulation. While Individual B initially enjoys faster growth due to higher early payments, Individual A maintains a predictable, consistent growth trajectory. The long-term outcome depends on various factors, including the length of time the reduced premium payments are maintained and the policy’s specific terms. It’s important to consult with an insurance professional to determine the best strategy based on individual financial goals and circumstances.

Cash Value Growth and Withdrawals

Permanent life insurance policies offer a unique benefit: the accumulation of cash value. This cash value grows over time and can be accessed in various ways, providing financial flexibility for policyholders. Understanding how this growth occurs and the options for accessing the funds is crucial for making informed decisions about your financial future.

Cash value growth in a permanent life insurance policy is primarily driven by the investment earnings generated by the insurance company’s underlying investment portfolio. A portion of your premiums, after deducting mortality and expense charges, is allocated to the cash value account. This account then earns interest, the rate of which can vary depending on market conditions and the specific policy’s investment options. Policy fees, including administrative costs and mortality charges, will reduce the overall growth of the cash value. Higher interest rates generally lead to faster cash value growth, while lower rates result in slower growth. The impact of policy fees is also significant, as they directly reduce the amount available for investment and subsequent growth.

Cash Value Access Options

Policyholders have several options for accessing the accumulated cash value within their permanent life insurance policy. These options offer varying degrees of flexibility and tax implications.

- Withdrawals: A withdrawal involves taking a portion of the cash value directly from the policy. Withdrawals typically reduce the policy’s death benefit and may impact future cash value growth, depending on the policy’s terms.

- Loans: Policyholders can borrow against their accumulated cash value. This is often considered a more flexible option, as the loan does not reduce the death benefit. However, interest charges accrue on outstanding loans, and failure to repay the loan could lead to policy lapse.

- Partial Surrenders: A partial surrender involves surrendering a portion of the policy, receiving a cash payment in return. Similar to withdrawals, this reduces the policy’s death benefit and future cash value growth potential.

Tax Implications of Cash Value Access

The tax implications of accessing cash value depend on the method used. Withdrawals and partial surrenders are generally taxed on any gains exceeding the amount of premiums paid into the policy. Loans, on the other hand, are not taxed until the loan is repaid or the policy lapses, at which point the difference between the loan and the cash surrender value may be taxed as income. It’s important to consult with a tax professional to fully understand the tax implications specific to your situation.

Cash Value Growth Examples

To illustrate potential long-term growth, let’s consider two hypothetical scenarios:

Scenario 1: A policyholder invests $10,000 annually for 20 years, with an average annual interest rate of 5% and moderate policy fees. Assuming consistent contributions and a conservative investment approach, the cash value could potentially reach approximately $330,000 after 20 years.

Scenario 2: The same policyholder invests the same amount, but with an average annual interest rate of 7% and lower policy fees due to a different policy type. Under this more favorable scenario, the cash value could potentially reach approximately $450,000 after 20 years. These figures are illustrative and do not account for market volatility or changes in interest rates. Actual results may vary.

It is crucial to remember that these are just examples, and actual cash value growth will depend on numerous factors, including the specific policy terms, interest rates, and the performance of the underlying investments. Consulting with a financial advisor is recommended for personalized guidance.

Illustrative Examples

Understanding the nuances of permanent life insurance can be challenging without concrete examples. The following scenarios illustrate the growth potential and cost comparisons between different policy types, providing a clearer picture of how these policies function over time.

Whole Life Insurance with Level Premiums: A Projected Growth Scenario

This example details a hypothetical whole life insurance policy with a $100,000 death benefit and level annual premiums of $2,000. We will project the cash value growth over a 30-year period, assuming a conservative annual interest rate of 4%. Note that actual cash value growth can vary depending on the insurer’s investment performance and the specific policy terms.

| Year | Premium Paid (Cumulative) | Projected Cash Value | Death Benefit |

|---|---|---|---|

| 10 | $20,000 | $15,000 | $100,000 |

| 20 | $40,000 | $40,000 | $100,000 |

| 30 | $60,000 | $75,000 | $100,000 |

This table demonstrates how the cash value gradually accumulates over time, eventually exceeding the total premiums paid. The death benefit remains constant at $100,000 throughout the policy term. Remember, this is a simplified projection; actual results may differ.

Universal Life Insurance vs. Whole Life Insurance: A Cost and Benefit Comparison

Let’s compare a $100,000 death benefit policy under two scenarios: a whole life policy with level premiums of $2,000 annually and a universal life policy with flexible premiums.

For the universal life policy, we’ll assume an initial premium of $1,500 annually. However, this premium can be adjusted upwards or downwards, depending on the policyholder’s financial situation and investment performance within the policy’s cash value account. This flexibility is a key advantage of universal life.

The whole life policy provides guaranteed premiums and a guaranteed death benefit. Its cash value grows predictably at a rate specified in the policy. The universal life policy, on the other hand, offers more flexibility in premium payments, but the death benefit is not guaranteed and depends on the performance of the underlying investments and the premium payments made. If premium payments fall short of the policy’s cost of insurance, the policy may lapse. Choosing between these policies depends on individual financial goals and risk tolerance.

Visual Representation of Permanent Life Insurance Components

Imagine a three-line graph. The horizontal axis represents time (years), and the vertical axis represents the monetary value (dollars).

The first line represents cumulative premium payments, starting at zero and steadily increasing linearly over time. This line demonstrates the total amount of money paid into the policy.

The second line represents the cash value of the policy. It starts at zero, increases slowly at first, then accelerates as the policy matures, eventually surpassing the cumulative premium payments. This line shows the policy’s accumulated value, reflecting the growth of the invested premiums.

The third line represents the death benefit, which is a horizontal line at a constant value (e.g., $100,000). This line demonstrates the guaranteed payout upon the death of the insured, remaining constant regardless of cash value fluctuations.

The visual clearly illustrates how the cash value grows over time, eventually exceeding the total premiums paid, and how the death benefit remains constant, providing a guaranteed payout to beneficiaries.

Last Word

Ultimately, securing a permanent life insurance policy with premium payments is a significant financial decision requiring careful consideration of individual needs and long-term goals. By understanding the diverse policy types, flexible premium structures, and the potential for cash value growth, individuals can make informed choices that align with their financial objectives. This comprehensive guide serves as a valuable resource to help you navigate the complexities and make the best decision for your future financial well-being.

Expert Answers

What is the difference between level and flexible premiums?

Level premiums remain constant throughout the policy’s duration, offering predictable budgeting. Flexible premiums allow for adjustments based on financial circumstances, but may lead to lower cash value accumulation or policy lapse if payments are insufficient.

Can I borrow against my cash value without tax consequences?

While borrowing against your cash value typically isn’t taxed, interest accrued on the loan is generally taxable. Furthermore, if the policy lapses, the outstanding loan amount could be considered taxable income.

What happens to my policy if I stop paying premiums?

The consequences of ceasing premium payments depend on the policy type and the cash value accumulated. The policy may lapse, resulting in the loss of coverage and accumulated cash value. However, some policies offer grace periods or options to reinstate coverage.

How are beneficiaries chosen and what are the implications?

Beneficiaries are designated to receive the death benefit upon the policyholder’s death. Primary beneficiaries receive the death benefit first, while contingent beneficiaries receive it if the primary beneficiary is deceased. Careful consideration of beneficiary designations is essential to ensure the intended distribution of funds.