Securing your family’s financial future through life insurance is a crucial step, but understanding the cost – the premiums – can feel daunting. This guide demystifies the process of calculating life insurance premiums, exploring the numerous factors that influence the final price. From your age and health to the type of policy you choose, we’ll break down each element, providing clarity and empowering you to make informed decisions.

We’ll delve into the intricacies of different life insurance types, examining how premiums are calculated for term, whole, universal, and variable life policies. We’ll also explore the role of underwriting, the influence of insurance company practices, and the impact of various policy features. By the end, you’ll possess a comprehensive understanding of how your personal characteristics and policy choices directly impact your premium payments.

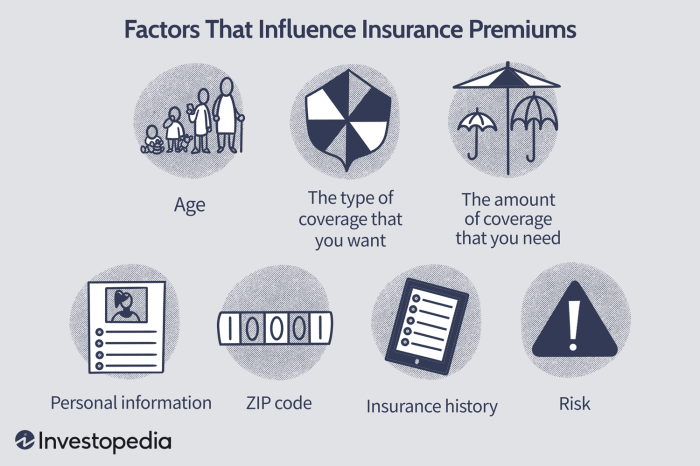

Factors Influencing Life Insurance Premiums

Life insurance premiums are not a one-size-fits-all calculation. Several factors are carefully considered by insurance companies to assess risk and determine the appropriate cost for coverage. Understanding these factors can help you make informed decisions when purchasing a policy.

Age

Age is a significant factor influencing life insurance premiums. Statistically, the older a person is, the higher their risk of mortality. Therefore, older applicants typically pay higher premiums than younger applicants for the same coverage amount. This reflects the increased likelihood of a claim being filed within the policy’s term. For example, a 30-year-old might receive a much lower premium than a 60-year-old, even if both are in excellent health.

Health Status

An applicant’s health status plays a crucial role in premium determination. Individuals with pre-existing conditions, such as heart disease, diabetes, or cancer, are considered higher risk and will generally face higher premiums. Insurance companies often require medical examinations and review medical history to assess risk accurately. Those with excellent health and no significant medical history will qualify for lower premiums.

Smoking Habits

Smoking significantly increases the risk of various health problems, including lung cancer, heart disease, and respiratory illnesses. Consequently, smokers consistently pay considerably higher premiums than non-smokers. This reflects the increased likelihood of early death and the higher cost of potential claims for the insurance company. Many insurers offer incentives for quitting smoking, potentially leading to lower premiums over time.

Gender

Historically, there have been differences in life insurance premiums based on gender. While regulations are evolving to address gender-based pricing disparities, some variations might still exist depending on the insurer and the specific policy. Generally, actuarial data has shown differences in life expectancy between genders, which has historically influenced premium calculations.

Occupation and Lifestyle

The nature of one’s occupation and lifestyle choices also impacts premium calculations. High-risk occupations, such as those involving dangerous machinery or hazardous materials, generally result in higher premiums. Similarly, individuals engaging in risky hobbies, such as extreme sports, may also face increased premiums. Lifestyle factors like diet and exercise can also be considered, although their impact may be less significant than other factors.

Premium Variations Across Different Risk Profiles

The following table illustrates how premiums can vary across different risk profiles. These are illustrative examples and actual premiums will vary depending on the insurer and specific policy details.

| Risk Profile | Age Range | Average Premium (Annual) | Premium Variation Percentage |

|---|---|---|---|

| Low Risk (Excellent Health, Non-Smoker, Low-Risk Occupation) | 30-35 | $500 | 0% (Baseline) |

| Moderate Risk (Good Health, Non-Smoker, Moderate-Risk Occupation) | 30-35 | $750 | 50% |

| High Risk (Pre-existing Condition, Smoker, High-Risk Occupation) | 30-35 | $1500 | 200% |

| Very High Risk (Multiple Pre-existing Conditions, Smoker, High-Risk Occupation) | 30-35 | $2500 | 400% |

Types of Life Insurance and Premium Calculation Methods

Understanding how life insurance premiums are calculated requires examining the different types of policies available. Each policy type employs unique calculation methods, influenced by various factors related to the insured individual and the policy’s structure. This section will delve into the specifics of premium calculation for several common life insurance types.

Term Life Insurance Premium Calculation

Term life insurance premiums are generally straightforward to calculate. The insurer assesses several key factors: the applicant’s age, health, gender, smoking status, and the desired death benefit amount. These factors are input into actuarial models that predict the probability of death within the policy’s term. The premium is then determined based on this probability, along with the insurer’s operating expenses and desired profit margin. Simpler term life insurance policies often use a mortality table – a statistical table showing the probability of death at various ages – as a core component of their calculation. The longer the term, and the higher the death benefit, the higher the premium will be. For example, a 30-year-old healthy non-smoker applying for a $500,000 10-year term policy will receive a lower premium than a 50-year-old smoker applying for a $1,000,000 20-year term policy. The calculation itself is complex and proprietary to each insurance company, but it fundamentally involves assessing risk and pricing accordingly.

Whole Life Insurance Premium Calculation

Whole life insurance premiums are calculated differently from term life insurance. Because whole life insurance provides coverage for the entire life of the insured, the calculation incorporates a longer time horizon. It considers not only the probability of death but also the guaranteed cash value accumulation component of the policy. Actuaries use complex models that factor in mortality rates, investment returns (on the cash value), and administrative expenses. The premium is designed to remain level throughout the policy’s life, ensuring sufficient funds to cover potential death benefits and the growth of the cash value. The calculation is more intricate than term life insurance, taking into account projected investment earnings and the policy’s cash value growth over decades. This leads to higher premiums compared to term life insurance, but offers lifelong coverage and a savings component.

Universal Life Insurance Premium Calculation

Universal life insurance offers more flexibility than whole life insurance. The premium calculation is less rigidly defined, allowing for adjustments in premium payments and death benefit amounts over time. The insurer still considers factors like age, health, and the death benefit, but the premium isn’t fixed. It’s often calculated based on a minimum premium requirement to maintain the policy’s cash value and cover the cost of insurance. Policyholders can adjust their premium payments upwards or downwards within certain limits, influencing the cash value growth. The cost of insurance (the portion of the premium covering the death benefit) is typically calculated annually based on the policy’s current cash value and the insured’s age. Therefore, the calculation isn’t a single event but a recurring process, adapting to changes in the policy and the insured’s circumstances.

Factors Influencing Variable Life Insurance Premiums

Variable life insurance premiums are primarily influenced by the performance of the underlying investment sub-accounts chosen by the policyholder. While there’s an initial premium calculation based on age, health, and the death benefit, the subsequent premiums are not fixed. The policy’s cash value grows or shrinks depending on the investment performance. The cost of insurance, which is a component of the premium, is also adjusted annually based on the policy’s cash value and the insured’s age. Unlike term or whole life insurance, variable life insurance doesn’t guarantee a specific rate of return, making the premium payments less predictable. Market fluctuations directly impact the cash value and consequently influence the overall premium structure, though the cost of insurance component will generally increase with age.

Comparison of Premium Calculation Methods

| Policy Type | Premium Calculation Basis | Factors Considered | Example Calculation |

|---|---|---|---|

| Term Life | Mortality tables, expenses, profit margin | Age, health, gender, smoking status, death benefit, policy term | A 30-year-old non-smoker with a $500,000, 10-year term policy might pay $500 annually. |

| Whole Life | Mortality tables, investment returns, expenses, cash value growth | Age, health, gender, smoking status, death benefit, guaranteed cash value | A 30-year-old might pay $2,000 annually for a $500,000 whole life policy. |

| Universal Life | Minimum premium to cover cost of insurance and maintain cash value | Age, health, death benefit, cash value, investment performance | Premiums are flexible, adjusting based on cash value and the cost of insurance. |

| Variable Life | Initial premium based on age, health, death benefit; subsequent premiums influenced by investment performance | Age, health, death benefit, investment sub-account performance, cost of insurance | Premiums fluctuate depending on the performance of the chosen investment options. |

Understanding Policy Features and Their Impact on Premiums

The cost of your life insurance premium isn’t solely determined by your age and health. Several policy features significantly influence the final price. Understanding these features and their impact allows for informed decision-making, ensuring you secure the appropriate coverage at a manageable cost. This section details how specific policy aspects directly affect your premium payments.

Death Benefit Amount and Premiums

The death benefit, the amount paid to your beneficiaries upon your death, is a primary factor affecting premiums. A higher death benefit necessitates a larger premium. Insurance companies assess the risk associated with paying out a larger sum, thus increasing the cost to reflect this higher potential payout. For instance, a $500,000 policy will generally command a higher premium than a $250,000 policy, all other factors being equal. This is a direct correlation: the more coverage you seek, the more you will pay.

Impact of Riders on Premium Costs

Riders are optional additions to your life insurance policy that provide supplemental coverage. These additions often increase your premium. For example, an accidental death benefit rider, which pays out an additional sum if death results from an accident, will increase your premium. Similarly, riders offering critical illness coverage or long-term care benefits also increase costs. The premium increase reflects the added risk the insurer assumes by providing these extra benefits. The extent of the increase depends on the type and scope of the rider selected.

Cash Value Accumulation and Whole Life Insurance Premiums

Whole life insurance policies build cash value over time. This cash value accumulation is funded by a portion of your premium payments. Because a portion of your premiums goes towards building this cash value, whole life insurance premiums are typically higher than term life insurance premiums, which do not build cash value. The higher premium reflects both the death benefit and the investment component. For example, a whole life policy might have a premium of $1000 annually, whereas a comparable term life policy might cost $300. The difference reflects the cash value component built into the whole life policy.

Policy Loan Provisions and Premium Payments

Whole life insurance policies typically allow policyholders to borrow against their accumulated cash value. While this feature offers flexibility, it doesn’t directly influence the initial premium calculation. However, if you consistently borrow against your policy’s cash value, you might eventually reduce the death benefit or even lapse the policy, leading to indirect cost implications. Borrowing doesn’t change your premium payments, but failing to repay the loan could result in policy changes that impact your overall coverage.

Summary of Policy Features and Premium Implications

- Death Benefit Amount: Higher death benefits result in higher premiums due to increased risk for the insurer.

- Riders: Adding riders (e.g., accidental death benefit, critical illness) increases premiums because of the additional coverage provided.

- Cash Value Accumulation: Whole life insurance, with its cash value component, typically has higher premiums than term life insurance.

- Policy Loans: While policy loans don’t directly affect premiums, failing to repay loans can impact coverage and potentially lead to increased costs or policy lapse.

The Role of the Insurance Company and Underwriting

Life insurance premium calculation isn’t solely a mathematical exercise; it’s a complex process heavily influenced by the insurance company’s role and its underwriting practices. The company’s financial health, risk assessment methods, and actuarial expertise all play crucial roles in determining the final premium a customer pays.

The underwriting process forms the backbone of premium determination. It’s a thorough evaluation of an applicant’s health, lifestyle, and other risk factors to assess the likelihood of a claim. This involves reviewing medical history, conducting lifestyle questionnaires, and potentially requiring medical examinations. The higher the perceived risk, the higher the premium. For instance, a smoker will generally pay a higher premium than a non-smoker due to the increased risk of health issues.

Underwriting Process and Premium Determination

Underwriting directly impacts premium calculations. The process involves a detailed assessment of the applicant’s risk profile. Factors considered include age, health history (including family medical history), occupation, lifestyle (smoking, alcohol consumption, hobbies), and even geographic location. Each factor contributes to a risk score, which is then used to determine the appropriate premium. A higher risk score translates to a higher premium, reflecting the increased probability of the insurance company having to pay a death benefit. For example, an applicant with a history of heart disease will likely face a higher premium compared to an applicant with a clean bill of health. The underwriting process aims to fairly price the risk associated with insuring each individual.

Financial Stability of the Insurance Company and Premiums

An insurance company’s financial stability significantly influences premium pricing. Companies with strong financial reserves and a proven track record of paying claims can afford to offer more competitive premiums. Conversely, a financially unstable company might charge higher premiums to compensate for its increased risk. This reflects the confidence the market has in the company’s ability to meet its obligations. A company with a high credit rating, indicating financial strength, generally offers lower premiums. Conversely, a company with a lower rating might be perceived as riskier, potentially leading to higher premiums to cover the increased uncertainty.

Impact of the Insurance Company’s Risk Assessment Model

Each insurance company employs a unique risk assessment model. These models utilize sophisticated statistical techniques and algorithms to analyze the data collected during the underwriting process. The complexity and accuracy of these models directly affect premium calculations. A company with a more refined model, capable of better differentiating between low-risk and high-risk individuals, can offer more tailored and potentially lower premiums to low-risk applicants while accurately pricing the risk for higher-risk applicants. Differences in these models can lead to variations in premiums offered by different insurers, even for similar applicants.

Comparison of Premium Calculation Practices

Different insurance companies employ varying premium calculation practices. While the underlying principles remain consistent, the specific algorithms, data weighting, and risk factors considered can differ significantly. This leads to variations in premiums offered by different insurers for the same applicant. These differences reflect the insurers’ unique risk appetites, data analysis techniques, and competitive strategies. Comparing quotes from multiple insurers is crucial for finding the most suitable and cost-effective policy. Factors like the insurer’s market share, investment strategies, and operational efficiency also subtly influence their pricing models.

Role of Actuarial Science in Setting Life Insurance Premiums

Actuarial science plays a central role in setting life insurance premiums. Actuaries are highly trained professionals who use statistical models and probability theory to assess and manage risk. They analyze vast amounts of data, including mortality rates, morbidity rates, and economic trends, to predict the likelihood of claims and determine appropriate premium levels. Their expertise ensures that premiums are adequately priced to cover the company’s liabilities while remaining competitive. Actuarial models continuously evolve to incorporate new data and refined risk assessment techniques, resulting in adjustments to premium calculations over time. The accuracy and sophistication of actuarial models are critical for the long-term financial health and stability of insurance companies.

Illustrative Examples of Premium Calculations

Calculating life insurance premiums involves a complex interplay of factors, but understanding the basic principles can illuminate the process. While precise calculations require actuarial expertise and proprietary software, we can explore simplified examples to illustrate the key elements involved. These examples will use hypothetical data for clarity and should not be considered actual quotes.

Term Life Insurance Premium Calculation

Let’s consider a 35-year-old non-smoker applying for a 20-year term life insurance policy with a $500,000 death benefit. Several factors will influence the premium. The insurer will assess the applicant’s age, health status (including non-smoking status), gender, and the policy’s term length. The insurer uses mortality tables, which statistically predict the likelihood of death within a specific timeframe. These tables are adjusted based on factors like age and smoking status. A simplified calculation might involve a base rate adjusted by these factors. For example, the base rate for a 35-year-old might be X dollars per $1,000 of coverage. Since the death benefit is $500,000, this would be multiplied by 500. Additional adjustments would be made for the non-smoking status, potentially reducing the base rate by a percentage (e.g., 10-15%). The final premium would then be calculated based on this adjusted rate, typically paid annually. For illustrative purposes, let’s assume a base rate of $2 per $1,000, adjusted to $1.80 due to non-smoking status. The annual premium would be approximately $900 ($1.80 x 500). This is a simplified example and actual premiums would vary widely based on the specific insurer and policy details.

Whole Life Insurance Premium Calculation

Calculating whole life insurance premiums differs significantly from term life. Whole life insurance provides lifelong coverage, meaning premiums are payable for the insured’s entire life. The calculation involves a more complex actuarial model, factoring in not only mortality risk but also the cash value component that accumulates over time. Let’s imagine a 35-year-old seeking a whole life policy with a $250,000 death benefit. The insurer would consider the same factors as with term life (age, health, etc.), but also the anticipated growth of the cash value component. This growth is influenced by the insurer’s investment performance and the policy’s interest rate guarantees. A simplified approach might involve estimating the present value of future death benefit payments, considering the probability of death at each age and discounting those payments to their present value. The premium is then set to cover these anticipated payments, along with administrative costs and a profit margin for the insurer. The actual calculation is far more intricate, often involving sophisticated software and actuarial models. A hypothetical annual premium for this policy might be $2,000, but this is a highly simplified illustration.

Premium Calculation Using Online Calculators and Industry Standard Formulas

Many online insurance calculators use proprietary algorithms based on industry standard formulas and actuarial models. These calculators typically require inputting personal information such as age, gender, health status, desired coverage amount, and policy type. The formulas themselves are complex and often not publicly available, as they are based on proprietary mortality tables and risk assessment models. However, some general principles are used, such as incorporating mortality rates from actuarial tables and adjusting for various risk factors. These calculators provide estimates and should not be considered guaranteed quotes.

Visual Representation of Premium Changes Over Time for Term Life Insurance

Imagine a graph with the horizontal axis representing time (in years) and the vertical axis representing the annual premium. For a term life insurance policy, the premium would remain relatively constant throughout the policy term. The line on the graph would be a relatively flat, horizontal line across the policy’s duration. At the end of the term, the line would abruptly drop to zero, as the policy expires. This illustrates the key feature of term life insurance: consistent premiums for a defined period, after which coverage ends.

Ultimate Conclusion

Calculating life insurance premiums isn’t simply a matter of plugging numbers into a formula; it’s a complex process influenced by a multitude of interconnected factors. Understanding these factors empowers you to navigate the insurance landscape effectively, choosing a policy that best suits your needs and budget. By considering your age, health, lifestyle, and desired coverage, you can make informed choices that provide the security and peace of mind you deserve. Remember to consult with an insurance professional for personalized advice tailored to your unique circumstances.

Q&A

What is the difference between a term and whole life insurance policy?

Term life insurance provides coverage for a specific period (term), typically at a lower premium than whole life insurance. Whole life insurance offers lifelong coverage and builds cash value, but comes with higher premiums.

Can I lower my life insurance premiums?

Yes, several factors can influence premiums. Improving your health, quitting smoking, and choosing a policy with a lower death benefit can all lead to lower premiums. Comparing quotes from multiple insurers is also crucial.

How often are life insurance premiums paid?

Premiums can be paid annually, semi-annually, quarterly, or monthly. More frequent payments typically result in slightly higher overall costs due to administrative fees.

What happens if I miss a life insurance premium payment?

Missing a payment can lead to a lapse in coverage. Most insurers offer grace periods, but prolonged non-payment will result in policy cancellation. Contact your insurer immediately if you anticipate difficulties making a payment.