Securing affordable healthcare is paramount, and in California, a robust network of programs assists residents with health insurance premium payments. This guide delves into the intricacies of these programs, offering clarity on eligibility, application processes, and the crucial role of Covered California and the Affordable Care Act (ACA). We aim to equip Californians with the knowledge necessary to navigate this vital aspect of healthcare access.

Understanding the landscape of financial assistance for health insurance premiums in California requires exploring various state and federally funded programs. From Covered California’s subsidies to state-sponsored initiatives, each program offers unique benefits and eligibility criteria. This guide will break down these complexities, providing a clear path to securing affordable healthcare coverage.

Overview of Health Insurance Premium Payment Programs in California

California offers several programs designed to assist residents in paying their health insurance premiums. These programs aim to make health coverage more accessible and affordable, particularly for low- and moderate-income individuals and families. Understanding the nuances of each program is crucial for Californians seeking financial assistance with their health insurance costs.

Types of Premium Payment Programs in California

California provides several avenues for premium payment assistance, primarily through the Covered California marketplace and state-sponsored programs. These programs often have different eligibility requirements and application processes. The most prominent programs include Covered California’s financial assistance, which includes subsidies and cost-sharing reductions, and state-specific programs that may offer additional support.

Eligibility Criteria for Premium Payment Programs

Eligibility for California’s premium payment programs hinges primarily on income and household size. Covered California’s financial assistance is available to individuals and families whose income falls below certain thresholds, which are adjusted annually. These thresholds are based on the Federal Poverty Level (FPL). Additional factors, such as citizenship status and immigration documentation, may also influence eligibility. Some state-specific programs may have further restrictions, such as age or disability status. It is crucial to check the specific requirements for each program.

Application Process for Premium Payment Programs

Applying for premium payment assistance usually involves completing an application through the Covered California website. Applicants will need to provide information about their income, household size, and citizenship status. Covered California will then determine their eligibility for financial assistance, including premium subsidies and cost-sharing reductions. The application process is generally straightforward, with online assistance and customer support available. For state-specific programs, separate applications may be required, and the application process might vary.

Comparison of Key Features of Different Programs

| Program | Eligibility | Assistance Type | Application Method |

|---|---|---|---|

| Covered California Subsidies | Income-based (below certain FPL percentage) | Premium tax credits, cost-sharing reductions | Online application through Covered California website |

| [State-Specific Program 1 – Example: A hypothetical program for seniors] | Age 65+, income below a specific threshold | Premium assistance, potentially additional benefits | Application through [Specific Agency/Website] |

| [State-Specific Program 2 – Example: A hypothetical program for disabled individuals] | Disability status, income below a specific threshold | Premium assistance, potentially additional benefits | Application through [Specific Agency/Website] |

| [State-Specific Program 3 – Example: A hypothetical program for low-income families] | Low income, family size considerations | Premium assistance, potentially additional benefits | Application through [Specific Agency/Website] |

Covered California and Premium Payment Assistance

Covered California plays a vital role in making health insurance more accessible and affordable for Californians. It acts as a marketplace where individuals and families can compare plans and enroll in qualified health plans, many of which offer financial assistance to help manage the cost of premiums. Understanding the available assistance programs is crucial for maximizing affordability.

Covered California offers several types of financial assistance to help individuals and families afford their health insurance premiums. This assistance is designed to lower monthly costs and make health coverage more attainable. The amount of assistance received depends on factors such as income, household size, and the chosen health plan.

Types of Financial Assistance Available Through Covered California

Covered California offers two primary types of financial assistance: premium tax credits and cost-sharing reductions. Premium tax credits directly reduce the monthly premium amount owed, while cost-sharing reductions lower out-of-pocket costs like deductibles, copayments, and coinsurance. Eligibility for both is based on income and household size, and both are applied automatically if the applicant qualifies.

Applying for Financial Assistance Through Covered California

Applying for financial assistance through Covered California is a straightforward process. The application is integrated into the enrollment process. The following steps Artikel the process:

- Gather Necessary Information: Before starting, collect information such as household income, Social Security numbers for all household members, and details about any employer-sponsored health insurance.

- Create an Account: Visit the Covered California website and create an online account. This will allow you to save your progress and easily access your application.

- Complete the Application: Follow the online prompts to complete the application accurately and thoroughly. Be sure to provide all requested information.

- Review and Submit: Carefully review your application for accuracy before submitting it. Once submitted, Covered California will process your application and determine your eligibility for financial assistance.

- Enroll in a Plan: After determining eligibility, choose a health plan that meets your needs and budget. The premium tax credits and cost-sharing reductions will be automatically applied if you qualify.

Examples of Successful Applications and Outcomes

While specific details of individual applications are confidential, general examples illustrate the impact of Covered California’s financial assistance. For instance, a family of four earning $60,000 annually might see their monthly premium reduced by hundreds of dollars through premium tax credits, making a previously unaffordable plan suddenly within reach. Similarly, cost-sharing reductions could significantly lower their out-of-pocket expenses during the year, protecting them from unexpected medical bills. Another example could be a single individual earning near the poverty level, who, through the assistance program, may be able to access a comprehensive health plan for a minimal or even no monthly premium cost. The impact of these programs varies depending on income, household size, and plan selection.

State-Sponsored Programs and Subsidies

California offers several state-sponsored programs designed to help residents afford health insurance premiums. These programs often work in conjunction with federal subsidies available through Covered California, expanding access to affordable healthcare for low- and moderate-income individuals and families. Understanding the nuances of each program is crucial for Californians seeking financial assistance with their health insurance costs.

Covered California Subsidies

Covered California, the state’s health insurance marketplace, offers federal subsidies based on income. These subsidies directly reduce the monthly premium a consumer pays. Eligibility is determined by household income and size, with subsidies increasing as income decreases. The amount of the subsidy varies, but it can significantly lower the cost of coverage, making health insurance more accessible to many. Limitations include income restrictions; individuals exceeding the income limits are not eligible for these subsidies. There are also limits on the amount of assistance available, even for those within the income guidelines. The subsidies are also subject to change based on federal legislation and budget allocations.

California’s Medi-Cal Program

Medi-Cal is California’s Medicaid program, providing low-cost or free health coverage to eligible individuals and families. It covers a wide range of medical services, including doctor visits, hospital stays, and prescription drugs. Eligibility is based on income and other factors, such as age, disability, and pregnancy. The benefits are extensive, offering comprehensive medical coverage. Limitations include strict income eligibility requirements; those with higher incomes are generally not eligible. The program also has specific enrollment periods and renewal processes that must be followed.

Comparison of Covered California Subsidies and Medi-Cal

Both Covered California subsidies and Medi-Cal aim to increase access to affordable healthcare, but they differ significantly in their approach and eligibility criteria. Covered California subsidies assist individuals purchasing plans through the marketplace, allowing them to choose from a range of plans. Medi-Cal, on the other hand, provides a specific, state-funded health plan. Covered California subsidies are income-based, offering varying levels of assistance, while Medi-Cal has stricter income thresholds, providing comprehensive coverage for those who qualify. Choosing between the two depends on individual income and health needs.

Application Process Flowchart for Medi-Cal

[Diagram description: The flowchart would begin with a “Start” box. It would then branch into a decision box asking “Do you meet the income requirements for Medi-Cal?” A “Yes” branch would lead to a box labeled “Complete the Medi-Cal application online or through a local office.” This would connect to a box labeled “Submit application.” This box connects to a decision box asking “Application Approved?”. A “Yes” branch would lead to a “Receive Medi-Cal coverage” box. A “No” branch would lead to a box labeled “Review denial reasons and appeal if necessary.” A “No” branch from the initial decision box would lead to a box labeled “Explore other options, such as Covered California subsidies.” Finally, both the “Receive Medi-Cal coverage” box and the “Explore other options” box would connect to an “End” box.]

Impact of the Affordable Care Act (ACA) on Premium Payments

The Affordable Care Act (ACA) significantly reshaped the landscape of health insurance premium payments in California, and across the nation. Its core aim was to expand health insurance coverage and increase affordability, impacting both individual and employer-sponsored plans. This involved substantial changes to how premiums are calculated, who is eligible for assistance, and the payment options available to consumers.

The ACA’s influence is primarily felt through its subsidy program and the establishment of state-based marketplaces like Covered California. These provisions work together to make health insurance more accessible and affordable for millions of Americans, including Californians. The Act’s impact on premium payments is multifaceted, affecting eligibility criteria, the amount individuals pay, and the methods used to make those payments.

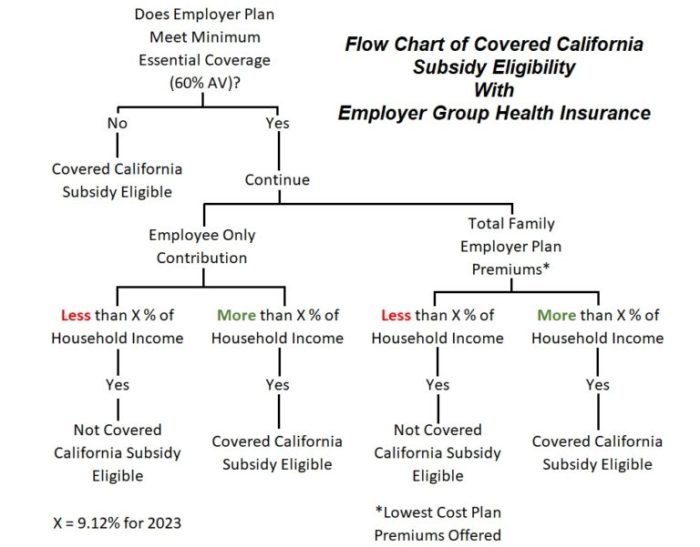

ACA Subsidies and Eligibility

The ACA introduced a system of premium tax credits and cost-sharing reductions to help individuals and families afford health insurance. These subsidies are based on income and family size, reducing the monthly premium an individual pays. Eligibility is determined through a calculation based on the federal poverty level (FPL). Those with incomes between 100% and 400% of the FPL are typically eligible for premium tax credits. The higher the income, the smaller the subsidy. For example, a family earning 200% of the FPL would receive a larger subsidy than a family earning 350% of the FPL. The subsidies are directly applied to the premium, lowering the out-of-pocket cost for the consumer. Cost-sharing reductions further lessen out-of-pocket expenses by reducing deductibles, copayments, and other cost-sharing obligations.

Changes in Premium Payment Options

Prior to the ACA, many payment options were limited or varied greatly depending on the insurer. The ACA standardized certain aspects, encouraging more consistent and user-friendly payment processes. For instance, the establishment of Covered California provided a centralized platform for individuals to compare plans and enroll, often facilitating online payment options. This contrasted with the sometimes fragmented and less accessible payment systems of the pre-ACA era. Furthermore, the ACA’s emphasis on transparency in pricing and plan details helped consumers make informed decisions about their insurance choices and payment plans.

Key ACA Provisions Related to Premium Assistance

The following points summarize key ACA provisions directly related to premium assistance:

- Premium Tax Credits: Subsidies based on income to lower monthly premiums.

- Cost-Sharing Reductions: Lowering out-of-pocket costs such as deductibles and copayments.

- Expanded Eligibility: Broadened the pool of individuals eligible for subsidized health insurance.

- Simplified Enrollment Process: Facilitated enrollment through state-based marketplaces like Covered California.

- Increased Transparency: Improved access to information about plan costs and benefits.

Resources and Support for Californians

Navigating the complexities of health insurance can be challenging, especially when it comes to managing premium payments. Fortunately, California offers a robust network of resources and support organizations dedicated to assisting residents in accessing affordable healthcare coverage. These resources provide a range of services, from financial assistance and enrollment guidance to general information and advocacy. Understanding these options is crucial for Californians seeking help with their health insurance premiums.

Key Resources and Support Organizations

Several agencies and organizations provide crucial support to Californians facing challenges with health insurance premium payments. These resources offer a variety of services, including financial assistance, enrollment help, and general information about available programs. The following table summarizes key contact information and the types of support offered.

| Organization | Contact Information | Type of Support Offered | Website |

|---|---|---|---|

| Covered California | Phone: 1-800-300-1506 Website: CoveredCA.com |

Enrollment assistance, information on subsidies and financial assistance programs, plan comparison tools. | CoveredCA.com |

| YourHealthCalifornia | Website: YourHealthCalifornia.org | Information about health insurance options, enrollment assistance, and resources for finding affordable coverage. | YourHealthCalifornia.org |

| HealthCare.gov | Phone: 1-800-318-2596 Website: Healthcare.gov |

Federal marketplace for health insurance, provides information and enrollment assistance for those eligible. While focused on federal programs, it can be a valuable resource for understanding broader healthcare options. | Healthcare.gov |

| Local Health Departments | Contact information varies by county. Search online for “[Your County] Public Health Department”. | May offer enrollment assistance, information on local resources, and connections to community-based organizations providing support. | Contact information varies by county. |

Future Trends and Potential Changes

California’s health insurance premium payment programs are constantly evolving, influenced by factors such as budgetary constraints, shifts in the healthcare landscape, and ongoing efforts to expand access to affordable coverage. Predicting the future with certainty is impossible, but analyzing current trends and policy discussions allows us to anticipate potential changes and their impact on Californians.

Future modifications to California’s premium payment programs will likely center on improving affordability and accessibility. This involves a complex interplay of factors including federal policy changes, state budget allocations, and the ongoing need to balance the demands of a diverse population with varying healthcare needs and financial capabilities.

Potential Program Modifications

Several modifications to existing programs are plausible. These might include adjustments to income eligibility thresholds for subsidies, alterations to the structure of premium assistance, or the introduction of new programs targeting specific underserved populations. For example, we might see an expansion of programs aimed at assisting young adults or those in specific industries, such as gig workers, who may face unique challenges in securing affordable health insurance. Alternatively, there might be an increased focus on outreach and enrollment assistance to improve program awareness and uptake among eligible individuals.

Impact on Californians

Changes to premium payment programs will undoubtedly have a ripple effect across different segments of the California population. Increased subsidies could significantly reduce out-of-pocket costs for low- and moderate-income individuals and families, improving access to care and potentially reducing medical debt. Conversely, reductions in subsidies or stricter eligibility criteria could leave some individuals with increased financial burdens, potentially leading to delayed or forgone care. These impacts would disproportionately affect vulnerable populations, such as seniors, individuals with pre-existing conditions, and those in low-income brackets. For example, a reduction in subsidy levels could lead to a significant increase in the number of uninsured individuals among low-income families, impacting their access to preventative care and potentially leading to poorer health outcomes.

Predictions for Premium Assistance Programs

Looking ahead, it is likely that California will continue to prioritize efforts to expand access to affordable health insurance. This could involve strategic investments in outreach and enrollment assistance programs, as well as exploring innovative models of premium assistance that are more responsive to the changing needs of the population. We might see increased integration of technology in the enrollment and payment processes, making it easier for individuals to navigate the system and access the assistance they need. For instance, the state might invest in user-friendly online platforms or mobile applications to simplify the application process and provide real-time updates on eligibility and payment status.

Demographic Impact of Changes

The impact of changes to premium assistance programs will vary considerably across different demographics. Low-income families, for example, are particularly vulnerable to changes in subsidy levels, as even small reductions could create significant financial strain. Similarly, individuals with pre-existing conditions, who often face higher premiums, could be disproportionately affected by any changes that reduce the level of financial support available. Conversely, higher-income individuals may experience a less dramatic impact, as they are often less reliant on government subsidies. To illustrate, consider the example of a family of four earning just above the poverty line. A decrease in subsidies could render health insurance unaffordable, leading to potentially serious health consequences if they lack access to care.

Final Review

California’s commitment to accessible healthcare is evident in its comprehensive system of health insurance premium payment programs. By understanding the nuances of Covered California, state-sponsored initiatives, and the impact of the ACA, Californians can effectively navigate the application process and secure the financial assistance they need. This guide serves as a starting point for a journey towards affordable and accessible healthcare, empowering individuals to make informed decisions about their health insurance coverage.

FAQ Corner

What happens if my income changes during the year?

You should report any significant income changes to Covered California immediately. This may affect your eligibility for financial assistance and your premium amount.

Are there penalties for not having health insurance in California?

The individual mandate penalty under the ACA is no longer enforced. However, maintaining continuous coverage is generally advisable for avoiding gaps in care and potential high costs.

Can I get help with my application process?

Yes, Covered California and many community organizations offer assistance with applications. You can find contact information for assistance programs on the Covered California website.

What documents will I need to apply for premium assistance?

Required documents typically include proof of income, identification, and household size information. Specific requirements may vary depending on the program.

How long does it take to process an application for premium assistance?

Processing times can vary, but it’s advisable to apply well in advance of the open enrollment period to avoid delays.