Navigating the world of dental insurance can feel like deciphering a complex code. Understanding dental insurance premiums is crucial for securing affordable and comprehensive oral healthcare. This guide unravels the key factors influencing premium costs, from age and pre-existing conditions to plan type and geographic location, empowering you to make informed decisions about your dental coverage.

We’ll explore the various components that contribute to your premium, examine different plan options and their associated costs, and provide practical strategies for reducing your overall expenses. Ultimately, this guide aims to equip you with the knowledge necessary to select a dental insurance plan that best fits your needs and budget.

Types of Dental Insurance Plans and Their Premiums

Choosing the right dental insurance plan can significantly impact your out-of-pocket costs. Understanding the different types of plans and their associated premiums is crucial for making an informed decision. This section will Artikel the key differences between common dental insurance plan types and their premium structures.

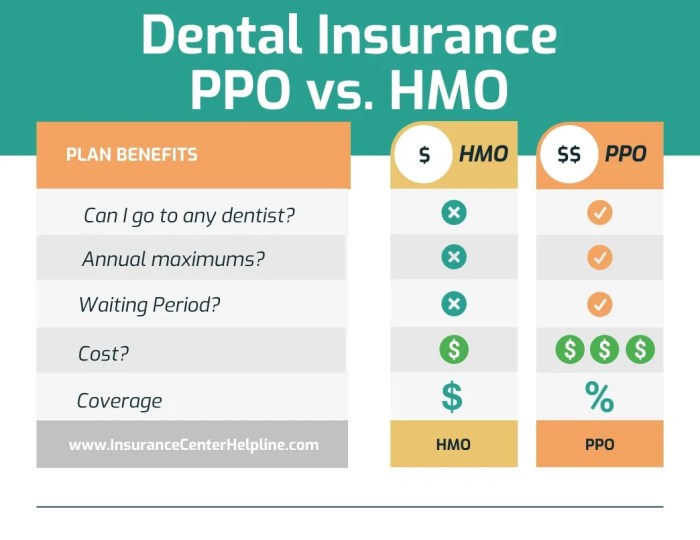

Dental insurance plans typically fall into three main categories: HMO (Health Maintenance Organization), PPO (Preferred Provider Organization), and Indemnity plans. Each offers a different level of coverage and flexibility, which directly affects the monthly premium you pay.

Dental Insurance Plan Types and Coverage Differences

The primary differences between HMO, PPO, and Indemnity plans lie in their network of dentists, cost-sharing mechanisms, and the level of freedom you have in choosing your dental provider.

HMO Plans generally offer lower premiums because they typically require you to see dentists within their network. These plans often feature a predetermined fee schedule, meaning the dentist is paid a set amount for each service. While this keeps costs predictable, it can limit your choices. If you choose to see a dentist outside the network, you’ll likely bear the full cost of treatment.

PPO Plans offer more flexibility. While they still encourage using dentists within their network (in-network dentists), they also allow you to see out-of-network providers, although at a higher cost. In-network dentists usually have negotiated rates with the insurance company, leading to lower out-of-pocket expenses. Out-of-network visits typically involve higher co-pays and a greater percentage of the cost falling on you. Premiums for PPO plans are generally higher than HMO plans due to the increased flexibility.

Indemnity Plans offer the greatest flexibility. You can choose any dentist you want, and the insurance company will reimburse you for a portion of the costs after you’ve paid your portion. These plans often have the highest premiums due to their lack of restrictions. However, you may have higher out-of-pocket expenses depending on the services required and your plan’s reimbursement percentage.

Premium Variations Across Plan Types and Coverage Levels

The table below illustrates hypothetical premium variations for a single adult based on plan type and coverage level. Remember that actual premiums vary widely depending on your location, age, and the specific insurance provider.

| Plan Type | Basic Coverage (Annual Maximum $1000) | Standard Coverage (Annual Maximum $1500) | Premium Coverage (Annual Maximum $2000) |

|---|---|---|---|

| HMO | $30/month | $40/month | $50/month |

| PPO | $45/month | $60/month | $75/month |

| Indemnity | $60/month | $80/month | $100/month |

Benefits and Limitations Related to Premium Costs

The relationship between premium costs and benefits/limitations is directly proportional. Lower premiums usually mean more restrictions on provider choice and potentially higher out-of-pocket costs. Higher premiums generally offer more flexibility and potentially lower out-of-pocket expenses, but at a greater monthly cost.

For example, an HMO plan might have a lower monthly premium but require you to see a specific dentist, potentially leading to longer wait times for appointments. Conversely, a PPO plan with a higher premium may allow you more choice in dentists, potentially resulting in shorter wait times and a more convenient experience. An Indemnity plan offers the most choice but carries the highest premium and potentially the greatest financial risk if extensive dental work is needed.

Strategies for Reducing Dental Insurance Premiums

Securing affordable dental insurance can significantly impact your oral health and overall well-being. High premiums can be a barrier, but several strategies can help you find and maintain cost-effective coverage. Understanding these strategies can empower you to make informed decisions and access the dental care you need without breaking the bank.

Finding Affordable Dental Insurance Plans

Several avenues exist for locating more affordable dental insurance plans. Comparing plans from different providers is crucial. Online comparison tools and independent insurance brokers can help you assess various options side-by-side, focusing on factors like premium costs, coverage levels, and network dentists. Additionally, exploring group plans offered through employers or professional organizations can often yield lower premiums due to economies of scale. Consider the value proposition – a slightly higher premium might be worth it if it translates to significantly better coverage and lower out-of-pocket expenses in the long run.

Negotiating Lower Premiums with Insurance Providers

While less common, negotiating lower premiums is possible. This typically involves demonstrating your commitment to responsible dental care, such as maintaining a consistent history of preventative visits. You could also highlight your excellent credit history, as insurers may use this information to assess risk. Furthermore, inquiring about discounts for paying premiums annually instead of monthly can sometimes result in savings. It’s important to be polite, prepared, and to present your case clearly and concisely when contacting your insurance provider. Remember to document all communication.

Comparing Different Approaches to Lowering Dental Insurance Costs

The most effective approach to reducing dental insurance costs often involves a combination of strategies. For example, choosing a plan with a higher deductible and lower premium might be suitable for individuals who rarely require extensive dental work. Conversely, a higher premium with a lower deductible could be preferable for those anticipating more significant dental needs. Careful analysis of your personal dental history and anticipated future needs is essential to make the most appropriate choice. This necessitates considering the trade-off between premium payments and potential out-of-pocket expenses for dental procedures.

Potential Savings from Preventive Dental Care

Preventive dental care, including regular checkups and cleanings, can lead to substantial long-term savings. Early detection and treatment of dental issues are significantly less expensive than addressing advanced problems later. For instance, a small cavity filled early might cost a fraction of what a root canal or extraction would cost if left untreated. This preventative approach minimizes the likelihood of requiring more extensive and costly procedures, directly impacting your overall dental expenses and reducing the need for extensive insurance coverage for major dental work. A regular checkup can often save more than the cost of the visit itself in the long run.

Tips for Consumers Seeking Lower Premiums

Finding the most affordable dental insurance requires proactive research and planning. Here are some key tips:

- Compare plans from multiple insurers using online comparison tools.

- Explore group rates offered through employers or professional organizations.

- Inquire about discounts for annual premium payments.

- Consider plans with higher deductibles if you rarely need extensive dental care.

- Prioritize preventative dental care to minimize the need for costly procedures.

- Negotiate with your insurer, highlighting factors like good credit and a history of preventative care.

- Read the fine print carefully, paying close attention to coverage details and exclusions.

The Impact of Dental Health on Premiums

Your dental health significantly influences the cost of your dental insurance premiums. Maintaining good oral hygiene and undergoing regular preventative care can lead to substantial long-term savings, while neglecting these aspects can result in unexpectedly high costs. The connection between oral health and insurance premiums is a direct one, impacting both the likelihood of needing expensive procedures and the overall cost of coverage.

Good oral hygiene directly reduces the need for costly dental procedures. Regular brushing and flossing prevent cavities and gum disease, which are the leading causes of many expensive treatments like root canals, crowns, and extractions. These procedures can cost thousands of dollars, significantly impacting both your out-of-pocket expenses and your insurance premiums over time.

Preventative Dental Care and Long-Term Costs

Preventative dental care acts as a crucial investment in your long-term dental health and financial well-being. Regular checkups and cleanings allow dentists to identify and address potential problems early, before they develop into more severe and costly issues. Early detection of cavities, gum disease, or oral cancer can mean less invasive and more affordable treatment options, ultimately lowering your overall dental expenses and potentially influencing lower premiums in the future. For example, a simple filling for a cavity detected early might cost a few hundred dollars, while neglecting it could lead to a root canal costing thousands.

Financial Benefits of Maintaining Good Oral Health

Maintaining good oral health translates directly into significant financial benefits. By preventing costly procedures, you reduce your out-of-pocket expenses and lower your insurance premiums. Consider the following: a person who diligently practices good oral hygiene and attends regular checkups might only require routine cleanings, resulting in minimal dental costs over several years. In contrast, someone who neglects their oral health could face a cascade of expensive treatments, leading to high out-of-pocket costs and potentially higher premiums due to increased risk. This difference can amount to thousands of dollars over a lifetime.

Illustration: Oral Health and Insurance Costs

Imagine two individuals, both with similar dental insurance plans. Individual A diligently practices good oral hygiene, attends regular checkups, and addresses minor issues promptly. Their annual dental expenses consist primarily of routine cleanings and occasional minor fillings, totaling approximately $500 annually. Individual B neglects their oral hygiene, skips regular checkups, and only seeks dental care when experiencing significant pain. They develop severe gum disease, requiring extensive periodontal treatment, multiple fillings, and eventually a crown, resulting in annual dental expenses exceeding $5,000. Over ten years, Individual A’s total dental expenses would be approximately $5,000, while Individual B’s would exceed $50,000. This significant difference in dental costs would likely influence their future insurance premiums, with Individual B facing potentially higher premiums due to their higher risk profile. This illustration demonstrates how proactive dental care significantly impacts long-term dental expenses and, subsequently, insurance costs.

Conclusive Thoughts

Securing affordable and effective dental insurance requires careful consideration of numerous factors. By understanding the components of dental insurance premiums, comparing different plan types, and implementing cost-saving strategies, individuals can make informed choices that protect their oral health without breaking the bank. Remember, proactive dental care not only benefits your smile but can also positively impact your long-term insurance costs. Take control of your dental health and financial well-being by utilizing the information presented in this comprehensive guide.

FAQ Summary

What is the difference between an HMO and a PPO dental plan?

HMO plans typically require you to see dentists within their network, offering lower premiums but less flexibility. PPO plans allow you to see any dentist, with higher premiums but greater choice.

Can I get dental insurance if I have pre-existing conditions?

Yes, but pre-existing conditions can influence your premium. Insurers may adjust premiums based on the severity and treatment history of the condition.

How often are dental insurance premiums reviewed and adjusted?

Premiums are typically reviewed annually and can be adjusted based on factors such as claims costs, administrative expenses, and changes in the healthcare market.

What happens if I don’t use my dental insurance benefits?

Most dental insurance plans don’t refund unused benefits at the end of the year. However, some plans may allow rollover of a small portion of unused funds to the next year.

Are there tax benefits associated with dental insurance premiums?

In some cases, employer-sponsored dental insurance premiums may be tax-deductible, depending on your country’s tax laws. Consult a tax professional for specific guidance.