Navigating the complexities of healthcare costs often leaves individuals questioning the potential tax benefits available. A crucial aspect of this is understanding the deductibility of health insurance premiums. This guide unravels the intricacies of claiming this deduction, providing clarity on eligibility criteria, limitations, and reporting requirements. We’ll explore how different health plans, the Affordable Care Act (ACA), and accounts like HSAs and FSAs impact your ability to deduct premiums, ultimately helping you maximize your tax savings.

This comprehensive overview will equip you with the knowledge to confidently navigate the process, ensuring you claim all eligible deductions and avoid common pitfalls. We’ll examine both federal and state-level regulations, providing practical examples and comparisons to make the information easily digestible and applicable to your specific situation.

Eligibility for Deductibility

Determining whether you can deduct health insurance premiums hinges on several factors, primarily your employment status and the type of health insurance plan you have. The rules can be complex, so understanding these factors is crucial for accurate tax filing. This section clarifies the criteria for deducting health insurance premiums.

Self-Employment and Premium Deductibility

Self-employed individuals can deduct the amount they pay for health insurance premiums as a business expense. This deduction is taken on Schedule C (Profit or Loss from Business) of Form 1040. Crucially, the self-employed individual must be considered an eligible self-employed person, meaning they are not covered under another health insurance plan. The deduction is limited to the amount of self-employment income. For example, if a freelancer earns $50,000 and pays $6,000 in health insurance premiums, they can deduct the full $6,000. However, if their income was only $4,000, they could only deduct $4,000. This deduction reduces taxable income, thus lowering the overall tax liability.

Employment Status and Premium Deductibility

For those employed by a company, the deductibility of health insurance premiums is generally not permitted. This is because the employer typically covers a portion, or sometimes all, of the premiums, and the employee’s contribution is often included in their compensation package. The premiums paid by the employer are considered a non-taxable fringe benefit to the employee. There are exceptions, however, which would be addressed on a case-by-case basis by a qualified tax professional.

Examples of Deductible and Non-Deductible Premiums

Several scenarios illustrate when premiums are deductible and non-deductible:

Deductible: A freelance graphic designer pays $7,000 in health insurance premiums annually and reports $70,000 in self-employment income. They can deduct the full $7,000.

Non-Deductible: A salaried employee at a tech company receives employer-sponsored health insurance with a monthly contribution from their paycheck. This employee generally cannot deduct their contributions as a tax deduction.

Deductible (with caveats): A part-time employee who also runs a small online business and pays for a separate health insurance policy for themselves and their family might be able to deduct a portion of the premiums paid, dependent on their self-employment income. This requires careful calculation and adherence to IRS guidelines.

Deductibility Rules for Different Health Insurance Plans

The following table summarizes the deductibility rules for various health insurance plans. Note that these are general guidelines, and specific situations may require consultation with a tax advisor.

| Type of Plan | Deductibility for Self-Employed | Deductibility for Employees | Notes |

|---|---|---|---|

| Employer-Sponsored | Generally No | Generally No | Premiums are usually considered a non-taxable benefit. |

| Individual Plan (purchased by self-employed) | Yes, subject to income limitations | Generally No | Deductible as a business expense, limited to the amount of self-employment income. |

| Individual Plan (purchased by an employee) | Generally No | Generally No | Deductible only under very specific circumstances. |

| COBRA | Potentially, if considered part of self-employment expenses. | Generally No | Consult a tax professional to determine eligibility. |

Limitations and Restrictions on Deductibility

While the ability to deduct health insurance premiums can offer significant tax savings, several limitations and restrictions govern this deduction. Understanding these constraints is crucial for accurately calculating your tax liability and avoiding potential penalties. These limitations often depend on your specific circumstances, your employer’s contribution to your health insurance, and the type of health insurance plan you have.

The amount of health insurance premiums you can deduct is not unlimited. Several factors significantly impact the amount you can claim. For example, the type of plan (self-employed vs. employee), the amount of employer contributions, and the existence of other tax benefits related to health care will all influence the ultimate deductible amount.

Premium Deductibility Limits

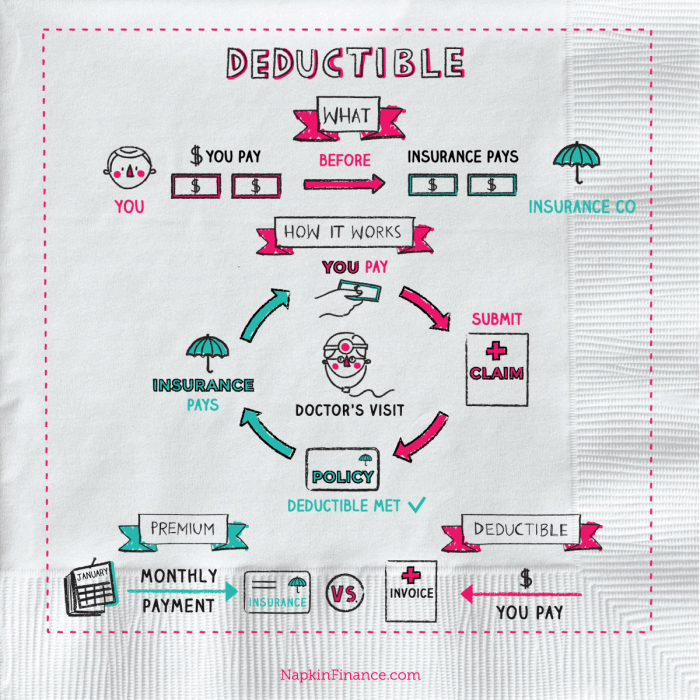

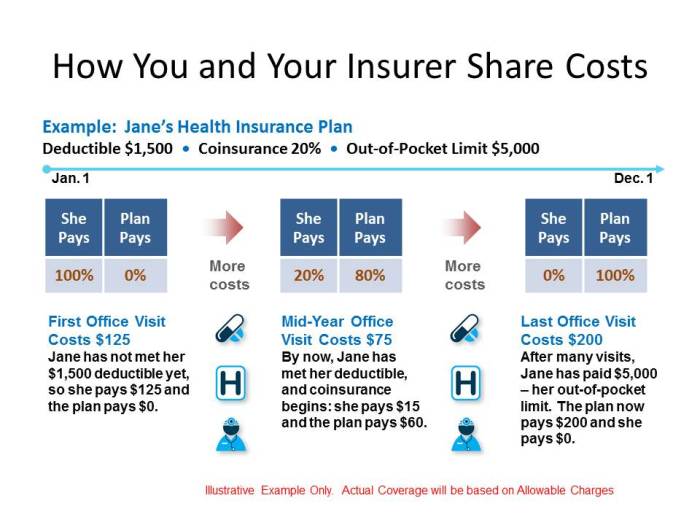

The maximum amount of premiums you can deduct is generally limited to the amount you actually paid during the tax year. This seems straightforward, but the calculation becomes more complex when considering employer contributions. If your employer contributes to your health insurance premiums, you can only deduct the portion you paid yourself. For example, if your total premiums were $10,000 annually and your employer paid $5,000, you can only deduct the remaining $5,000. Additionally, the deduction is subject to your adjusted gross income (AGI), and in some cases, it may be phased out entirely for higher income taxpayers.

Impact of the Affordable Care Act (ACA)

The Affordable Care Act (ACA) significantly altered the landscape of health insurance and, consequently, its tax deductibility. While the ACA expanded health insurance coverage, it didn’t necessarily broaden the scope of premium deductibility for everyone. For those who purchase insurance through the ACA marketplaces (often referred to as the exchanges), the premium tax credit may reduce the actual amount you pay, thus influencing the deductible amount. The tax credit itself is not directly deductible, but it reduces your out-of-pocket expenses, indirectly affecting the final amount you can deduct. Furthermore, the ACA’s individual mandate (previously in effect) imposed penalties on individuals who did not maintain minimum essential health coverage. This mandate has since been repealed. However, understanding the historical context of the ACA and its impact on premium deductibility is important for understanding current tax rules.

Circumstances Limiting or Preventing Premium Deductibility

Several circumstances can limit or completely prevent the deductibility of health insurance premiums. One common scenario involves receiving reimbursements for premiums from a source other than your employer. For instance, if you receive a reimbursement from a scholarship or grant specifically for health insurance premiums, that reimbursed amount is not deductible. Similarly, if you are claimed as a dependent on someone else’s tax return, you generally cannot deduct health insurance premiums. Additionally, if you are covered under an employer-sponsored plan, and your employer pays a significant portion of the premiums, your ability to deduct the remaining amount might be severely restricted or non-existent depending on your income and the specific plan.

Examples of Disallowed or Reduced Deductions

Consider the following examples: A self-employed individual who paid $7,000 in health insurance premiums for the year can deduct the full $7,000 (subject to AGI limitations). However, an employee whose employer paid $6,000 of their $10,000 annual premium can only deduct $4,000. Another example: A taxpayer receiving a $2,000 reimbursement for health insurance premiums from a family member can only deduct the premiums they personally paid, minus the $2,000 reimbursement. Finally, a high-income taxpayer might find that their ability to deduct health insurance premiums is significantly reduced or eliminated due to AGI limitations as determined by the IRS.

Documentation and Reporting Requirements

Claiming a deduction for health insurance premiums requires meticulous record-keeping and accurate reporting. Failing to provide sufficient documentation can result in the denial of your deduction, so it’s crucial to understand what’s needed and how to correctly report it on your tax return. This section Artikels the necessary steps to ensure a smooth and successful deduction process.

Necessary Documentation

Supporting documentation is essential for substantiating your health insurance premium deduction. This documentation serves as proof of payment and eligibility for the deduction. Without it, the IRS may disallow your claim. Key documents include:

- Form 1095-B or 1095-C: If your health insurance was obtained through the Affordable Care Act (ACA) marketplace or your employer, you should receive a Form 1095-B (for coverage purchased through the marketplace) or 1095-C (for employer-sponsored coverage). These forms provide details about your coverage, including the dates of coverage and the amount of premiums paid. While not strictly required to claim the deduction (depending on your specific situation and whether you itemize), they are highly beneficial in supporting your claim.

- Premium Payment Records: Maintain detailed records of all premium payments made throughout the year. This includes bank statements, canceled checks, credit card statements, or payment confirmations from your insurance provider. Ensure these records clearly show the date of payment, the amount paid, and the payer’s name.

- Insurance Policy Documents: Keep a copy of your insurance policy. This document provides crucial information about your coverage, such as the policy number, the covered individuals, and the dates of coverage.

Reporting Deductible Health Insurance Premiums on Tax Forms

The method of reporting deductible health insurance premiums depends on whether you itemize deductions or use the standard deduction. If you itemize, you’ll report your medical expenses, including health insurance premiums, on Schedule A (Form 1040), Itemized Deductions.

Step-by-Step Guide to Claiming the Deduction

- Gather your documentation: Collect all necessary documents, including Forms 1095-B or 1095-C, premium payment records, and your insurance policy.

- Calculate your medical expenses: Add up all your medical expenses, including health insurance premiums, doctor visits, prescription drugs, and other qualified medical expenses.

- Determine your deductible amount: You can only deduct medical expenses that exceed 7.5% of your adjusted gross income (AGI). Subtract 7.5% of your AGI from your total medical expenses. The remaining amount is your deductible medical expense.

- Complete Schedule A (Form 1040): Report your deductible medical expenses on Schedule A, Itemized Deductions, in the appropriate section for medical expenses.

- File your tax return: File your tax return with all necessary documentation attached.

Sample Tax Form Section

Below is a sample illustration of how a portion of Schedule A (Form 1040) might look when reporting health insurance premium deductions. Note that this is a simplified example and the actual form may vary slightly.

| Medical and Dental Expenses | Amount |

|---|---|

| Health Insurance Premiums | $5,000 |

| Doctor Visits | $1,000 |

| Prescription Drugs | $500 |

| Total Medical Expenses | $6,500 |

| 7.5% AGI (Assume AGI of $50,000) | $3,750 |

| Deductible Medical Expenses | $2,750 |

Comparison with Other Tax Benefits Related to Healthcare

Understanding the deductibility of health insurance premiums requires comparing it to other healthcare-related tax benefits. This allows for a more comprehensive understanding of the overall tax landscape affecting healthcare expenses and facilitates informed decision-making regarding healthcare financial planning. Several other tax advantages may impact your healthcare costs, and comparing them highlights the relative benefits of each.

Many individuals and families utilize various tax benefits to offset the cost of healthcare. A comprehensive understanding of these benefits, including their eligibility criteria, limitations, and potential interactions, is crucial for maximizing tax savings. Failing to utilize available tax benefits can result in unnecessary financial burdens.

Comparison of Healthcare Tax Benefits

The following bullet points compare the deductibility of health insurance premiums with other common healthcare-related tax benefits. This comparison considers eligibility requirements, limitations, and the overall impact on taxable income.

- Deductibility of Health Insurance Premiums: This allows taxpayers to deduct the amount they paid for health insurance premiums from their taxable income, reducing their overall tax liability. Eligibility often depends on whether the insurance is purchased through an employer or independently, and whether the taxpayer itemizes deductions. Limitations may include the type of health insurance plan and the taxpayer’s adjusted gross income (AGI). For example, self-employed individuals can often deduct the full amount of their health insurance premiums, while those with employer-sponsored plans may have more limited options.

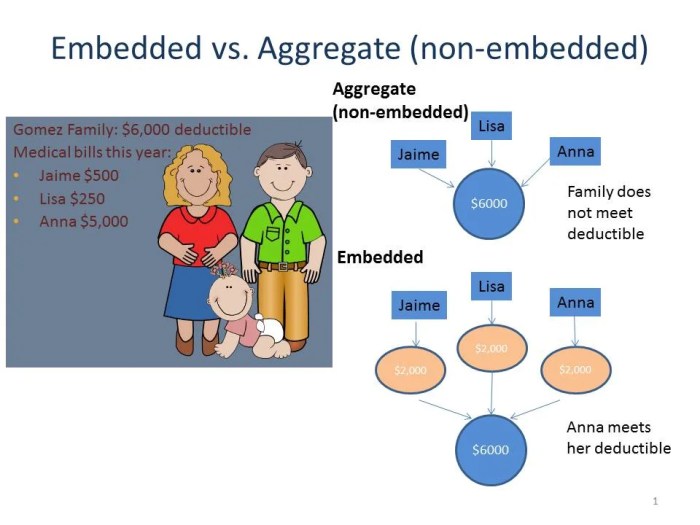

- Health Savings Accounts (HSAs): HSAs allow individuals with high-deductible health plans to contribute pre-tax dollars to a dedicated account to pay for eligible medical expenses. Contributions reduce taxable income, and withdrawals for qualified medical expenses are tax-free. Unlike premium deductibility, HSAs offer a triple tax advantage: tax-deductible contributions, tax-deferred growth, and tax-free withdrawals for qualified medical expenses. For example, a family with a high deductible health plan might contribute the maximum allowed annually, lowering their taxable income and accumulating funds for future medical expenses.

- Flexible Spending Accounts (FSAs): FSAs are employer-sponsored accounts that allow pre-tax contributions for medical and dependent care expenses. Unlike HSAs, FSA funds typically must be used within a plan year, or they are forfeited. This “use-it-or-lose-it” provision is a key difference from HSAs. For example, an employee might contribute to an FSA to cover routine medical expenses, such as co-pays and prescription drugs, throughout the year.

- Medical Expense Deduction: This allows taxpayers to deduct medical expenses exceeding a certain percentage of their adjusted gross income (AGI). This percentage varies yearly. This benefit is only available to those who itemize deductions and typically only covers expenses not covered by insurance or other tax-advantaged accounts. For example, a taxpayer might deduct significant out-of-pocket medical expenses, such as those incurred during a major illness or injury, after meeting the AGI threshold.

End of Discussion

Successfully navigating the deductibility of health insurance premiums requires a thorough understanding of various factors, from eligibility criteria and limitations to accurate reporting procedures. This guide has provided a framework for comprehending these complexities, empowering you to confidently claim eligible deductions and optimize your tax liability. Remember to consult with a tax professional for personalized advice tailored to your unique circumstances, ensuring you leverage all available tax benefits related to healthcare expenses.

Questions Often Asked

Can I deduct health insurance premiums if I’m employed and my employer offers a plan?

Generally, no. Premiums paid by your employer are not deductible if they are considered part of your compensation. However, if you pay additional premiums for a supplemental plan above what your employer covers, those additional premiums *might* be deductible depending on other factors.

What if I’m self-employed and have a significant medical expense? Does that impact premium deductibility?

While a high medical expense itself doesn’t directly affect the deductibility of your premiums, it may influence your overall tax situation. High medical expenses can lead to itemized deductions, but these are separate from the premium deduction for self-employed individuals.

Are there any penalties for incorrectly claiming a health insurance premium deduction?

Yes, incorrectly claiming deductions can lead to penalties, including interest and potential audits. It’s crucial to maintain accurate records and ensure you meet all eligibility requirements.

How long should I keep records of my health insurance premium payments and related documentation?

The IRS recommends keeping tax records for at least three years, but it’s best practice to retain them longer for added protection.