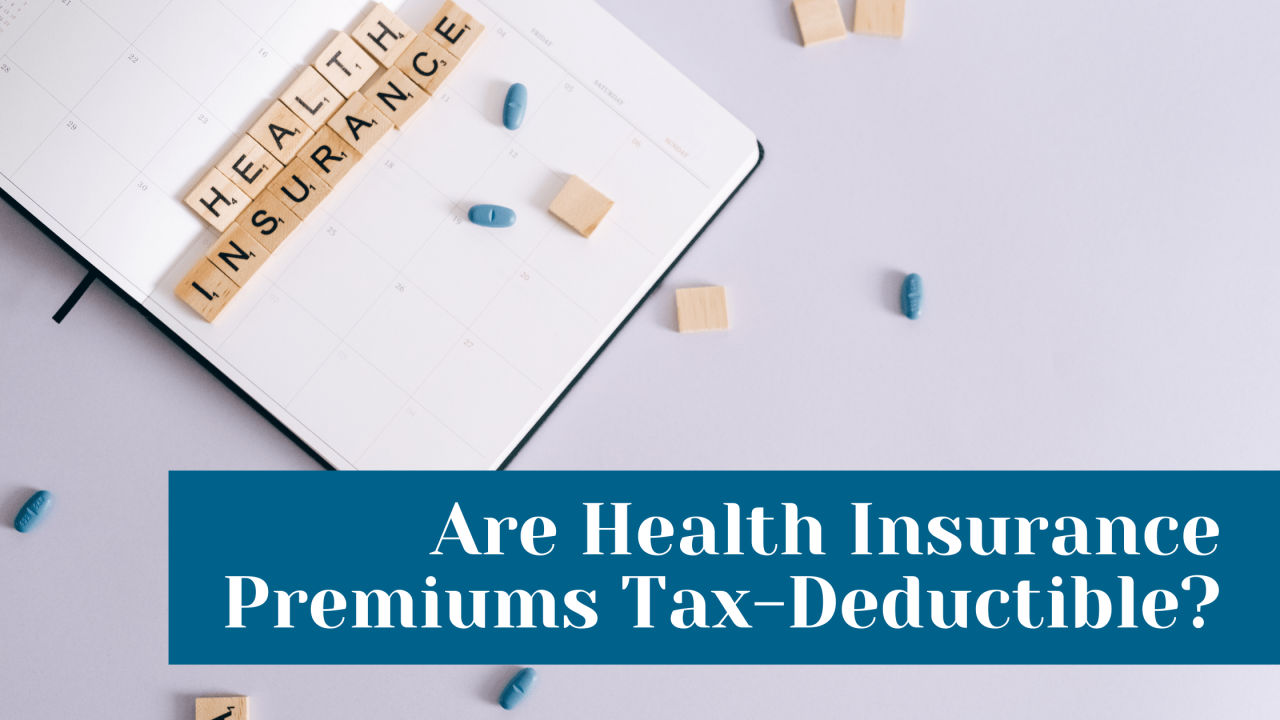

Navigating the complexities of tax deductions can be daunting, especially when it comes to healthcare expenses. The question of whether health insurance premiums are tax-deductible is a common one, impacting both self-employed individuals and employees alike. This guide delves into the intricacies of this topic, examining eligibility requirements, specific scenarios, and the necessary documentation for claiming these deductions. We’ll explore the differences between self-employment and employer-sponsored plans, providing clarity on the often-confusing regulations surrounding this critical aspect of tax planning.

Understanding the deductibility of health insurance premiums can significantly impact your tax liability. Factors such as employment status, the type of health insurance plan, and applicable state regulations all play a crucial role in determining eligibility. This guide aims to demystify the process, offering a practical and informative overview to empower you with the knowledge needed to confidently navigate this aspect of your tax obligations.

Eligibility for Deduction

Deductibility of health insurance premiums hinges on several factors, primarily your employment status and the type of health insurance plan. Understanding these factors is crucial for accurately calculating your tax liability. The rules can be complex, so consulting a tax professional is always advisable if you’re unsure about your specific situation.

Generally, self-employed individuals and some employees can deduct health insurance premiums. However, the specifics of eligibility differ significantly between these two groups. The key factor is whether the premiums are paid for qualified health insurance coverage. This typically excludes plans that offer only limited coverage, such as accident-only or disability-only insurance.

Types of Qualified Health Insurance Plans

Qualified health insurance plans for deduction purposes generally include comprehensive plans offered through the Affordable Care Act (ACA) marketplaces, plans purchased directly from insurance companies, and plans offered through employer-sponsored programs under specific circumstances (as detailed below). Plans that primarily cover specific conditions or limited healthcare services generally do not qualify. The IRS provides detailed guidance on qualifying plans, and it’s essential to refer to their official publications for the most up-to-date information.

Examples of Deductible and Non-Deductible Premiums

Deductible Premiums: A self-employed individual paying premiums for a comprehensive ACA marketplace plan can deduct the premiums. An employee who is not offered health insurance through their employer and purchases a private plan can also deduct the premiums, subject to certain limitations (AGI limitations explained below).

Non-Deductible Premiums: Premiums paid for a short-term health insurance plan (often offering limited coverage), accident-only insurance, or critical illness insurance are generally not deductible. Premiums paid for a plan offered by an employer when the employee is eligible for employer-sponsored coverage are also typically not deductible.

Comparison of Deduction Options: Self-Employed vs. Employees

The deduction for health insurance premiums differs significantly depending on whether you are self-employed or an employee. Self-employed individuals have more straightforward options, while employees face additional limitations.

| Feature | Self-Employed | Employees |

|---|---|---|

| Deduction Type | Above-the-line deduction (Form 1040, Schedule C) | Itemized deduction (Schedule A) – subject to AGI limitations |

| Eligibility | Generally eligible if self-employed and paying premiums for qualified health insurance | Generally eligible if not offered employer-sponsored health insurance and purchase a qualified health insurance plan; AGI limitations apply. |

| Limitations | None beyond the requirement of qualified health insurance | Deduction is limited to the amount of premiums paid that exceed 7.5% of your Adjusted Gross Income (AGI). |

| Reporting | Reported on Schedule C (Profit or Loss from Business) | Reported on Schedule A (Itemized Deductions) |

Self-Employed Individuals

Self-employed individuals, unlike those with traditional W-2 employment, bear the responsibility of paying both the employer and employee portions of self-employment taxes, including Social Security and Medicare taxes. A significant benefit available to them is the ability to deduct health insurance premiums paid during the tax year. This deduction can substantially reduce their taxable income and overall tax liability.

The tax implications for self-employed individuals deducting health insurance premiums are significant because it directly lowers their adjusted gross income (AGI). A lower AGI can result in a lower tax bill and may also affect eligibility for certain tax credits or deductions dependent on income levels. It’s crucial to understand the rules and regulations surrounding this deduction to ensure compliance and maximize its benefit.

Deduction Process for Self-Employed Individuals

To claim the deduction, self-employed individuals must complete Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship), to report their business income and expenses. Health insurance premiums are listed as a business expense under the appropriate category. The amount deducted cannot exceed the actual premiums paid during the tax year. The premiums must be for health insurance coverage for the self-employed individual, their spouse, and their dependents.

Required Documentation for the Deduction

Supporting documentation is essential for a successful deduction claim. This typically includes Form 1099-MISC, if applicable, showing payments made for health insurance premiums, and copies of your health insurance premium statements or invoices. These documents provide irrefutable evidence of the payments made and the amounts paid for health insurance during the tax year. Keeping detailed records of all business expenses, including health insurance premiums, is crucial for efficient tax preparation and in case of an audit.

Step-by-Step Guide to Claiming the Deduction

- Gather all necessary documentation: Collect your health insurance premium statements, invoices, and any 1099-MISC forms received.

- Complete Schedule C (Form 1040): Accurately report your business income and expenses. Include the total amount of health insurance premiums paid as a business expense in the appropriate line item.

- Attach supporting documentation: Attach copies of your health insurance premium statements and other relevant documentation to your tax return. This ensures the IRS can easily verify the deduction.

- File your tax return: File your completed tax return, including Schedule C and supporting documentation, by the tax deadline.

- Retain copies of your tax return and supporting documents: Keep these documents for at least three years in case of an audit or future tax-related inquiries.

Employees and Employer-Sponsored Plans

The tax implications of health insurance differ significantly depending on whether your coverage is employer-sponsored or self-purchased. While self-employed individuals can often deduct premiums, the rules for employees are more nuanced. Generally, premiums paid by an employer are not included in an employee’s taxable income, offering a substantial tax advantage. However, this doesn’t mean employees can never deduct health insurance premiums.

Employees with employer-sponsored health insurance plans typically do not get to deduct their premiums because the cost is not considered a direct out-of-pocket expense. The employer’s contribution is considered a form of compensation, and the employee’s share (if any) is usually handled through pre-tax deductions from their paycheck, further reducing their taxable income. This contrasts sharply with the self-employed, who can often deduct the full amount of their health insurance premiums. The key difference lies in the source of payment: the employer versus the individual.

Deductibility of Premiums with Employer-Sponsored Plans

There are limited situations where an employee might be able to deduct health insurance premiums even with employer-sponsored coverage. This often involves unusual circumstances or specific types of plans. For example, if an employee is required to pay premiums for a health plan that doesn’t meet minimum essential coverage requirements under the Affordable Care Act (ACA), they might be able to deduct these premiums as a medical expense. However, it is crucial to understand that this is subject to certain limitations and itemized deductions may not always be beneficial, depending on the employee’s overall tax situation. Another rare scenario could involve certain situations where the employee’s employer-sponsored plan does not meet minimum value standards set by the ACA, although this is uncommon.

Examples of Deductible and Non-Deductible Scenarios

Let’s consider a few scenarios:

* Scenario 1 (Non-Deductible): Jane works for a large corporation and participates in their employer-sponsored health insurance plan. Her premiums are deducted pre-tax from her paycheck. Jane cannot deduct these premiums because the cost is not considered a direct out-of-pocket expense, and the employer’s contribution is considered part of her compensation.

* Scenario 2 (Potentially Deductible): John is self-employed and has a health insurance plan through a marketplace, but it doesn’t meet minimum essential coverage requirements under the ACA. He might be able to deduct the premiums as a medical expense. However, this would only be beneficial if his itemized deductions exceed the standard deduction.

* Scenario 3 (Non-Deductible): Maria works for a small business and receives a substantial employer contribution to her health insurance, but her employer’s plan does meet the minimum value standards. Maria is still unlikely to be able to deduct her premiums.

Tax Scenarios for Employees Regarding Health Insurance Premiums

The following list summarizes the different tax scenarios employees may face regarding health insurance premiums:

- Employer-sponsored plan meeting minimum essential coverage requirements: Premiums are generally not deductible. The employer’s contribution is considered compensation, and the employee’s portion is pre-tax.

- Employer-sponsored plan not meeting minimum essential coverage requirements: Premiums may be deductible as a medical expense, subject to itemized deduction limitations.

- Employee purchases supplemental insurance alongside employer-sponsored coverage: The premiums for supplemental insurance might be deductible as a medical expense, again subject to itemized deduction limitations.

- Employee is uninsured and pays for individual coverage: The premiums are generally not deductible, except in very limited circumstances such as catastrophic health events, resulting in significant out-of-pocket medical expenses exceeding a certain threshold. However, this usually falls under itemized deductions, subject to specific limits.

Tax Forms and Reporting

Reporting health insurance premium deductions requires using specific tax forms and accurately recording the relevant information. The process involves identifying the correct form based on your filing status and accurately calculating the deductible amount. Failure to do so can result in delays or adjustments to your tax refund.

The primary tax form used to report self-employed health insurance deductions is Form 1040, Schedule C (Profit or Loss from Business). For employees, the process is slightly different, often involving Form 1040, Schedule 1 (Additional Income and Adjustments to Income). The specific form and its relevant sections will depend on your individual circumstances. Always consult the latest IRS instructions for the most up-to-date information.

Form 1040, Schedule C (Self-Employed)

For self-employed individuals, health insurance premiums are deducted as a business expense on Schedule C. This form details your business income and expenses, allowing you to calculate your net profit or loss. The premiums are entered in the relevant section for business expenses. Accurate record-keeping is crucial; retain all receipts and statements related to your health insurance premiums. The total amount of deductible premiums is subtracted from your gross business income to arrive at your net profit. This net profit is then transferred to Form 1040 to calculate your taxable income.

Form 1040, Schedule 1 (Employees)

Employees who are not covered by an employer-sponsored plan and pay for their own health insurance can deduct the premiums on Form 1040, Schedule 1. This schedule is used to report adjustments to income, and health insurance premiums qualify as an above-the-line deduction. This means it reduces your adjusted gross income (AGI) before other deductions are applied, potentially leading to a greater tax savings. The amount of the deduction is entered in the designated line for health savings account (HSA) deductions or other eligible medical expenses, depending on the specific circumstances.

Calculating the Deductible Amount

The deductible amount is the total amount of health insurance premiums you paid during the tax year that qualify for the deduction. This generally includes premiums for individual plans or family plans, but excludes amounts reimbursed by your employer or another party. You cannot deduct premiums that were paid with pre-tax dollars through a flexible spending account (FSA) or a health savings account (HSA). It is essential to maintain accurate records of all premium payments throughout the year.

For example: If John paid $7,200 in health insurance premiums during the year, and none of these were reimbursed, his deductible amount is $7,200. This amount would be reported on either Schedule C or Schedule 1, depending on his employment status.

Form 1040 Example

The following example illustrates a simplified version of how the deduction might appear on Form 1040. Note that this is a simplified example and the actual form may have additional lines and sections. Furthermore, this example assumes John is self-employed.

Form 1040, U.S. Individual Income Tax Return

…[Other sections of Form 1040]…

Schedule C: Profit or Loss from Business

…[Other sections of Schedule C]…

Line 28: Other expenses (attach Schedule C-EZ or Form 8889): $7,200

…[Further lines of Schedule C]…

Net Profit/Loss: [Calculated amount after subtracting expenses, including the $7,200 premium deduction]

…[Transfer of Net Profit/Loss to Form 1040]…

State-Specific Regulations

While the federal government sets the overarching rules for deducting health insurance premiums, individual states can implement their own regulations, leading to variations in eligibility and allowable deductions. These differences often stem from state-specific tax codes and programs aimed at supporting residents’ healthcare access. Understanding these variations is crucial for accurate tax filing.

State-Level Variations in Deductibility

State tax laws concerning the deductibility of health insurance premiums primarily affect self-employed individuals and those not covered by employer-sponsored plans. Many states align with federal guidelines, allowing deductions for self-employed individuals under specific circumstances (generally meeting the self-employment tax criteria). However, some states offer additional deductions or tax credits related to health insurance, particularly for low-to-moderate-income individuals or families. Others might have stricter limitations on what constitutes a deductible expense. The absence of a state-level deduction doesn’t necessarily preclude the federal deduction, but it impacts the overall tax liability.

Comparison of State Regulations

A comprehensive state-by-state comparison is beyond the scope of this brief overview, as regulations are subject to change and require in-depth legal research for accuracy. However, a general comparison reveals a spectrum of approaches. Some states mirror federal guidelines closely, while others have more generous or restrictive rules. Several states may offer specific tax credits for health insurance premiums, effectively reducing the tax burden in lieu of a direct deduction. The availability of these credits often depends on income levels and the type of health insurance coverage.

Examples of States with Unique Rules

While providing an exhaustive state-by-state guide is impractical here, we can illustrate the diversity with a few examples. For instance, some states might allow a deduction for health insurance premiums paid by self-employed individuals even if those premiums don’t meet the federal criteria for self-employment tax. Conversely, some states might have stricter requirements for documentation or proof of payment. California, for example, has a robust system of state-level tax credits that can significantly reduce the cost of health insurance for qualifying residents, acting as a powerful alternative to a direct premium deduction. Conversely, a state with less generous healthcare support might offer fewer deductions or tax credits related to health insurance premiums.

State-by-State Guide (Partial Example)

It is crucial to remember that this is a highly simplified example and not a comprehensive guide. Tax laws are complex and frequently change. Always consult a qualified tax professional or refer to official state tax resources for the most up-to-date and accurate information.

| State | Deductibility | Additional Notes | Resources |

|---|---|---|---|

| California | Generally follows federal guidelines, but offers significant state tax credits. | Eligibility for credits depends on income and insurance plan. | Franchise Tax Board website |

| New York | Generally follows federal guidelines. | Specific rules may apply depending on self-employment status and income. | New York State Department of Taxation and Finance website |

| Texas | Generally follows federal guidelines. | Limited state-level deductions or credits related to health insurance premiums. | Texas Comptroller of Public Accounts website |

| Florida | Generally follows federal guidelines. | No significant state-level additions or modifications to federal rules. | Florida Department of Revenue website |

Conclusive Thoughts

Successfully claiming a deduction for health insurance premiums requires careful attention to detail and a thorough understanding of the applicable regulations. While the process may seem intricate, with careful planning and the right information, you can effectively leverage these deductions to reduce your tax burden. Remember to consult with a tax professional for personalized guidance, particularly if your situation involves unique circumstances or complexities. Proper planning and understanding of the relevant tax laws can lead to significant tax savings and financial peace of mind.

FAQ Overview

Can I deduct premiums for my spouse or dependents?

Deductibility depends on your filing status and whether your spouse or dependents are claimed as dependents on your tax return. Specific rules apply; consult the IRS guidelines.

What if I have both employer-sponsored insurance and a private plan?

Deductibility will likely be limited or non-existent, depending on your employer-sponsored plan’s coverage. The IRS provides specific guidance on this complex scenario.

Are there penalties for incorrectly claiming this deduction?

Yes, inaccurate reporting can result in penalties, including interest and potential audits. Accurate record-keeping is essential.

Where can I find the most up-to-date information on this deduction?

The IRS website is the primary source for the most current and accurate information on tax deductions for health insurance premiums.