Insurance premiums: the price we pay for peace of mind. But what exactly *are* they, and why do they vary so dramatically? This guide delves into the intricacies of insurance premiums, explaining their components, the factors influencing their cost, and how to navigate the payment process. We’ll demystify the often-confusing world of insurance pricing, empowering you to make informed decisions about your coverage.

From understanding the basic concept of risk transfer to exploring various payment options and the impact of personal factors, we’ll provide a clear and concise overview of insurance premiums. This guide aims to equip you with the knowledge to confidently manage your insurance costs and ensure you have the right level of protection.

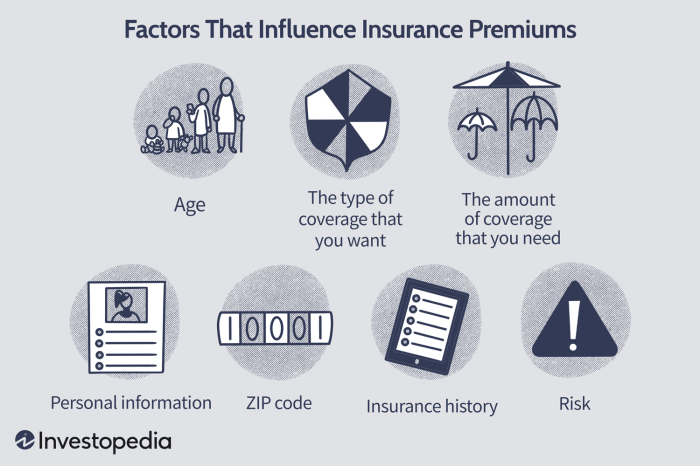

Factors Influencing Premium Costs

Insurance premiums are not arbitrarily set; they are carefully calculated based on a multitude of factors that assess the level of risk an insurance company assumes when covering a policyholder. Understanding these factors is crucial for consumers to make informed decisions about their insurance coverage and to potentially mitigate the cost of their premiums.

Key Factors Considered by Insurance Companies

Insurance companies utilize sophisticated actuarial models to determine premiums. These models incorporate a wide range of data points, aiming to accurately predict the likelihood of a claim. Central to this process is a comprehensive risk assessment, which considers both quantifiable and qualitative aspects of the insured individual or property. Key factors consistently incorporated include the type of coverage sought (e.g., liability, collision, comprehensive), the policy’s coverage limits, the insured’s claims history, and the statistical likelihood of claims within a specific demographic group. Furthermore, external factors like inflation and reinsurance costs can also influence premium calculations.

Impact of Age, Location, and Lifestyle

Age is a significant factor in many types of insurance. For example, car insurance premiums are generally higher for younger drivers due to their statistically higher accident rates. As drivers age and accumulate a clean driving record, their premiums tend to decrease. Similarly, health insurance premiums often increase with age, reflecting the increased likelihood of health issues. Location also plays a critical role. Premiums for home and auto insurance can vary significantly based on geographic location, reflecting factors such as crime rates, the frequency of natural disasters (like hurricanes or earthquakes), and the cost of repairs or medical care in a particular area. Lifestyle choices, such as smoking or engaging in high-risk activities, can significantly impact health and life insurance premiums. Insurers consider these factors as they increase the likelihood of claims.

Risk Assessment and Premium Calculation

Risk assessment is the cornerstone of premium calculation. Insurers use a variety of data points to assess risk, including credit scores (for some types of insurance), driving records (for auto insurance), and medical history (for health insurance). The more risk an insurer perceives, the higher the premium will be. This assessment is not subjective; it relies on statistical analysis of vast datasets and predictive modeling techniques. For example, a person with a history of speeding tickets and accidents will likely pay a higher premium for car insurance than someone with a spotless driving record. Similarly, a person with a pre-existing health condition may pay more for health insurance. This process ensures that premiums accurately reflect the likelihood of claims, enabling insurers to maintain financial solvency.

Hypothetical Scenario Illustrating Premium Influences

Consider two individuals, both applying for car insurance with similar coverage. Individual A is a 22-year-old living in a high-crime urban area with a history of speeding tickets. Individual B is a 45-year-old living in a rural area with a clean driving record. Even with the same car and coverage level, Individual A will likely pay significantly higher premiums than Individual B. This is because Individual A presents a higher risk to the insurance company due to their age, location, and driving history. The insurer’s risk assessment model would assign a higher risk score to Individual A, resulting in a higher premium to compensate for the increased probability of a claim.

The Role of Insurance Premiums in Risk Management

Insurance premiums are the cornerstone of a robust risk management strategy for both individuals and businesses. They represent the cost of transferring risk to an insurance company, allowing individuals and businesses to protect themselves from potentially devastating financial losses. Understanding how premiums function within this context is crucial for effective risk mitigation.

Insurance premiums contribute to risk management by providing a financial safety net against unforeseen events. By paying a predetermined amount regularly, policyholders gain access to coverage that can compensate them for losses stemming from accidents, illnesses, property damage, or other covered events. This predictable expense helps to budget for potential risks, preventing unexpected financial strain. The ability to transfer this risk, therefore, is a fundamental component of a comprehensive risk management plan.

The Relationship Between Premiums and Coverage

The amount of the insurance premium is directly related to the level of coverage provided. Higher premiums generally correspond to broader coverage and higher payout limits. For example, a comprehensive car insurance policy offering extensive liability and collision coverage will cost more than a basic liability-only policy. This relationship reflects the increased financial responsibility the insurer undertakes when providing more extensive coverage. Choosing the appropriate level of coverage involves carefully weighing the cost of the premium against the potential financial consequences of insufficient coverage in the event of a loss.

Premium Costs Versus the Consequences of No Insurance

The cost of insurance premiums, while a significant expense, is vastly outweighed by the potential financial consequences of not having insurance. Consider a homeowner without insurance whose house is destroyed by a fire. The cost of rebuilding could easily reach hundreds of thousands of dollars, potentially leading to bankruptcy. In contrast, the annual cost of homeowner’s insurance is typically a fraction of the potential rebuilding cost. Similarly, a car accident without insurance could result in crippling medical bills and legal expenses, whereas the relatively small premium cost prevents this catastrophic financial burden.

Balancing Premium Cost and Risk Mitigation

Imagine a graph with premium cost on the x-axis and risk mitigation on the y-axis. A line starts low on both axes, representing minimal premium cost and minimal risk mitigation (no insurance). As the premium cost increases (moving along the x-axis), the risk mitigation also increases (moving up the y-axis), but at a diminishing rate. Initially, a small increase in premium provides a large increase in risk mitigation. However, as you move further along the line, the incremental increase in risk mitigation from higher premiums becomes smaller. The optimal point lies somewhere in the middle, representing a balance between affordable premiums and adequate risk protection. This “sweet spot” varies depending on individual circumstances, risk tolerance, and financial capabilities. Finding this balance is a key aspect of effective personal and business risk management.

Closure

Ultimately, understanding insurance premiums is key to responsible financial planning. By grasping the factors influencing their cost, utilizing efficient payment methods, and advocating for fair adjustments when necessary, you can effectively manage your insurance expenses while maintaining adequate coverage. Remember, the cost of insurance is a balance between protecting yourself from potential financial hardship and managing your budget effectively. This guide serves as a starting point for a deeper understanding of this crucial aspect of personal and business finance.

Common Queries

What happens if I miss an insurance premium payment?

Missing a payment can lead to a lapse in coverage, leaving you vulnerable to financial consequences should an insured event occur. Late fees may also apply. Contact your insurer immediately if you anticipate difficulty making a payment; they may offer options to avoid cancellation.

Can I negotiate my insurance premiums?

While not always guaranteed, it’s worth exploring options like increasing your deductible, bundling policies, or improving your credit score to potentially lower your premiums. Shop around and compare quotes from different insurers.

How often are insurance premiums reviewed?

The frequency of premium reviews varies depending on the insurer and the type of insurance. Some policies are reviewed annually, while others may be reviewed less frequently. Your policy documents will Artikel the review process.

What factors influence the deductible amount on my insurance policy?

The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. It’s typically influenced by your chosen coverage level and the risk assessment of your specific circumstances (e.g., your driving record for car insurance).