Ever wondered why your insurance premiums are what they are? The seemingly arbitrary numbers attached to your policy actually stem from a complex calculation involving numerous factors, a sophisticated risk assessment, and the ever-shifting forces of the insurance market. Understanding this process empowers you to make informed decisions about your coverage and potentially save money.

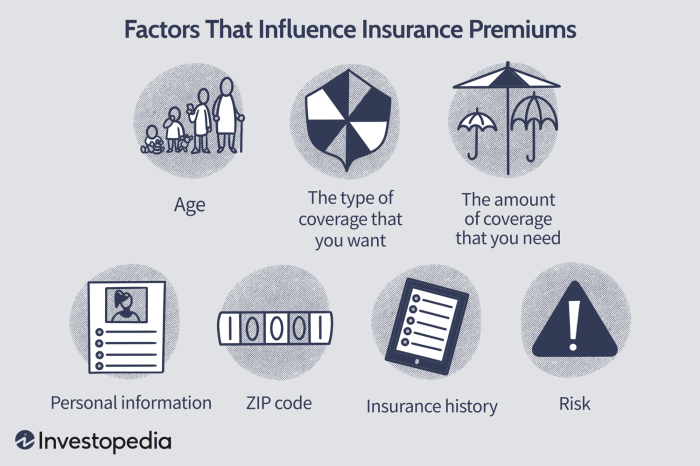

This comprehensive guide delves into the intricacies of insurance premium calculation, exploring the key elements that determine your costs. From your age and health status to your driving record and location, we’ll examine how these and other factors contribute to the final premium. We will also discuss the role of risk assessment, underwriting, and market forces in shaping the pricing landscape.

Risk Assessment and Underwriting

Insurance premium calculation is fundamentally driven by a comprehensive assessment of risk. This process, known as underwriting, involves a detailed evaluation of the likelihood and potential cost of future claims for a specific individual or entity. The more likely and costly the potential claims, the higher the premium.

Actuarial Data in Premium Calculation

Actuarial science plays a crucial role in determining premiums. Actuaries use historical data, statistical models, and sophisticated algorithms to analyze past claims and predict future losses. This data includes information on the frequency and severity of claims, demographic trends, economic conditions, and other relevant factors. For example, an actuary might analyze the number of car accidents in a specific region over the past decade, factoring in variables like road conditions, traffic density, and driver demographics, to predict future accident rates and the associated costs. This analysis then informs the pricing of auto insurance premiums. The core of this process involves calculating the expected value of future claims, a crucial metric in determining fair and profitable premiums.

Key Risk Metrics for Different Insurance Products

Different insurance products utilize different key metrics to assess risk. For auto insurance, factors like driving history (accidents, tickets), vehicle type, age of the driver, and location are crucial. Home insurance might focus on the age and condition of the property, its location (fire risk, flood zones), security systems, and the value of the contents. Health insurance uses factors such as age, medical history, family history, lifestyle choices (smoking, diet), and pre-existing conditions. Life insurance assesses risk based on age, health status, lifestyle, occupation, and family history.

Risk Factor Weighting in Premium Calculation

Insurance companies employ complex algorithms to weight different risk factors. For example, a driver with multiple speeding tickets might see a higher premium increase than someone with a single minor accident, reflecting the greater likelihood of future claims. Similarly, a home located in a high-risk flood zone will result in a substantially higher premium than a home in a low-risk area. These weightings are not arbitrary; they are derived from actuarial data demonstrating the correlation between specific risk factors and claim costs. A person with a pre-existing condition for health insurance might have a higher premium compared to a healthy individual, reflecting the higher probability of future healthcare costs. The weighting system is constantly refined as new data becomes available and risk profiles evolve.

The Underwriting Process and its Impact on Premium Determination

The underwriting process is the systematic evaluation of an applicant’s risk profile. This involves reviewing applications, verifying information provided by the applicant, and potentially conducting additional investigations (e.g., inspections for home insurance, driving record checks for auto insurance). The underwriter’s assessment directly influences the premium offered. A favorable risk profile (e.g., a driver with a clean driving record) will typically result in a lower premium, while a higher-risk profile will lead to a higher premium or even rejection of the application. The underwriting process ensures that premiums accurately reflect the individual risk and helps maintain the financial stability of the insurance company by mitigating the risk of excessive claims.

Types of Insurance and Premium Structures

Insurance premiums, the price you pay for coverage, are calculated differently depending on the type of insurance. Several factors influence these calculations, ranging from your personal risk profile to the specific terms of your policy. Understanding these variations is crucial for making informed decisions about your insurance needs.

Term Life Insurance versus Whole Life Insurance Premiums

Term life insurance premiums are generally lower than whole life insurance premiums because they provide coverage for a specified period (the term). The calculation considers factors like age, health, and the length of the term. Older applicants and those with pre-existing health conditions will generally pay higher premiums. Longer terms also result in higher premiums, reflecting the increased risk over a longer duration. Whole life insurance, conversely, provides lifelong coverage and often includes a cash value component. This added benefit necessitates higher premiums, as the insurer assumes a longer-term obligation and provides additional financial features. The premium calculation for whole life insurance is more complex, incorporating factors such as the policy’s cash value growth projections. While term life insurance offers affordability for a defined period, whole life insurance provides lifelong security at a higher cost.

Factors Influencing Health Insurance Premiums

Health insurance premiums are determined by a complex interplay of factors. Coverage levels significantly impact the cost; comprehensive plans with extensive benefits naturally command higher premiums than basic plans. Deductibles, the amount you pay out-of-pocket before your insurance coverage kicks in, also play a crucial role. Higher deductibles usually correlate with lower premiums, as you assume more of the initial risk. Age, location (geographic variations in healthcare costs), family size, and pre-existing conditions are other key determinants. For example, a smoker will typically pay more than a non-smoker due to increased health risks. Similarly, individuals residing in areas with higher healthcare costs will generally face higher premiums.

Auto Insurance Premiums and Coverage Options

Auto insurance premiums are directly influenced by the level of coverage selected. Liability coverage, which protects you against claims from others if you cause an accident, is typically mandatory and affects premiums. Higher liability limits lead to higher premiums, reflecting the increased potential payout in case of a significant accident. Collision coverage, which covers damage to your vehicle in an accident regardless of fault, increases premiums. Comprehensive coverage, which protects against non-accident-related damage (e.g., theft, vandalism), also adds to the overall cost. Factors such as driving history (accidents, tickets), vehicle type (make, model, year), and location also impact premiums. A driver with a history of accidents will generally pay more than a driver with a clean record.

Premium Structures for Different Insurance Types: A Summary

The following list summarizes the key premium structure characteristics for various insurance types:

- Term Life Insurance: Premiums are relatively low, fixed for the policy term, and dependent on age, health, and term length.

- Whole Life Insurance: Premiums are higher, typically level throughout life, and incorporate a cash value component.

- Health Insurance: Premiums vary significantly based on coverage level, deductible, age, location, health status, and family size.

- Auto Insurance: Premiums are affected by liability limits, collision and comprehensive coverage choices, driving record, vehicle type, and location.

Impact of Coverage Levels on Insurance Premiums: A Visual Representation

The visual representation would be a bar chart. The x-axis would represent different coverage levels (e.g., Basic, Standard, Premium for health insurance or Liability Only, Liability + Collision, Full Coverage for auto insurance). The y-axis would represent the corresponding premium amounts. Each bar would be color-coded, for instance, Basic coverage could be light blue, Standard could be medium blue, and Premium could be dark blue. Clear labels would be provided for each bar indicating the coverage level and the associated premium amount (e.g., $500, $800, $1200). A title such as “Impact of Coverage Level on Insurance Premiums” would be displayed prominently at the top. The chart would clearly illustrate how higher coverage levels generally translate to higher premiums. For example, a comparison between a basic health insurance plan with a high deductible and a comprehensive plan with a low deductible would visually demonstrate the premium difference. Similarly, for auto insurance, the chart would illustrate the escalating cost as more coverage options are added.

Discounts and Premium Adjustments

Insurance premiums aren’t static; they’re often adjusted based on a variety of factors, leading to both increases and decreases in your overall cost. Understanding these adjustments is key to managing your insurance expenses effectively. Several factors influence these changes, including your driving record, policy bundling, and lifestyle choices.

Safe Driving Discounts

Safe driving discounts are a common way insurers reward responsible drivers. These discounts are typically applied based on your driving history, which is assessed through your motor vehicle record (MVR). Insurers look at factors such as the number of accidents, traffic violations (speeding tickets, reckless driving citations), and even the severity of those incidents. A clean driving record over a specified period (often three to five years) usually qualifies you for a significant discount. The percentage of the discount varies by insurer and state, but it can substantially reduce your premium. For example, a driver with a clean record might receive a 20% discount, while someone with a recent at-fault accident might see a smaller discount or even a premium increase.

Bundling Insurance Policies

Bundling your insurance policies – combining your auto, home, renters, or life insurance with the same provider – frequently results in significant cost savings. Insurers offer these discounts because managing multiple policies for a single customer is more efficient for them. The discount percentage varies depending on the specific policies bundled and the insurer. A common discount for bundling auto and home insurance could be around 10-15%, but some insurers offer even more substantial reductions. For example, a customer bundling their car and home insurance might see a $200 annual savings compared to purchasing each policy separately.

Discounts for Home Security Systems and Health Habits

Several insurers offer discounts for proactive measures that reduce risk. Installing a home security system, for instance, can lead to a discount on your homeowner’s or renter’s insurance. This is because security systems deter burglaries and reduce the likelihood of insurance claims. Similarly, some insurers may offer discounts for maintaining healthy habits, such as regular exercise or non-smoking. These discounts recognize the lower risk associated with healthier lifestyles. These discounts can vary significantly, from a few percentage points to a more substantial reduction, depending on the insurer and the specific program. A 5% discount for a home security system or a 10% discount for a non-smoking status are examples of typical reductions.

Other Factors Affecting Premium Adjustments

Numerous other factors can influence your insurance premiums. Increases might occur due to factors like age (younger drivers often pay more), location (higher crime rates or accident frequency in your area), vehicle type (sports cars tend to be more expensive to insure), and claims history (filing multiple claims can lead to increased premiums). Conversely, decreases might be seen due to factors such as increased credit score (demonstrating financial responsibility), completing a defensive driving course (showing commitment to safe driving), or installing anti-theft devices in your vehicle (reducing the risk of theft).

Discount Calculation Example

Let’s say your initial car insurance premium is $1000 per year. You qualify for a 15% safe driving discount and a 5% discount for bundling with your home insurance. The safe driving discount is calculated as 0.15 * $1000 = $150. The bundling discount is 0.05 * ($1000 – $150) = $42.50. The total discount is $150 + $42.50 = $192.50. Your final premium after discounts would be $1000 – $192.50 = $807.50.

The formula for calculating the final premium is: Final Premium = Initial Premium – (Discount 1 + Discount 2 + … + Discount n)

Closing Notes

In conclusion, understanding how insurance premiums are calculated is crucial for navigating the complexities of insurance coverage. By recognizing the interplay of individual risk factors, actuarial data, and market dynamics, consumers can gain a clearer understanding of their premiums and make more informed decisions about their insurance needs. Remember, while the process may seem opaque, with a little knowledge, you can take control and optimize your insurance costs.

Popular Questions

What is an actuarial table, and how does it affect my premiums?

An actuarial table is a statistical database used by insurance companies to predict the likelihood of certain events, like accidents or death. These tables, based on extensive historical data, help insurers assess risk and set premiums accordingly. Higher-risk profiles, as indicated by the actuarial tables, generally result in higher premiums.

Can I negotiate my insurance premium?

While you can’t directly negotiate the base premium calculation, you can often influence the final cost. This can be achieved by securing discounts (e.g., for bundling policies or safe driving), improving your risk profile (e.g., by installing a security system), or shopping around for more competitive rates from different insurers.

How frequently are insurance premiums reviewed and adjusted?

The frequency of premium adjustments varies by insurer and policy type. Some policies have annual reviews, while others might be adjusted less frequently. Factors such as changes in your risk profile, market conditions, and company profitability all influence the timing and extent of premium adjustments.

What happens if I provide inaccurate information on my application?

Providing inaccurate information on your insurance application is considered misrepresentation and can lead to policy cancellation, denial of claims, or even legal consequences. It’s crucial to be truthful and accurate in your application to ensure your policy remains valid.