Securing insurance is a crucial step in managing risk, but understanding the cost – the premium – can feel like navigating a complex maze. This guide unravels the mystery behind insurance premium calculation, exploring the multifaceted factors that influence the final price you pay. From actuarial science and risk assessment to demographic details and policy choices, we’ll illuminate the intricate process that determines your individual premium.

We’ll delve into the role of insurers, the impact of your personal characteristics, and the influence of policy features. By understanding these elements, you can gain a clearer picture of how your premium is calculated and make informed decisions about your insurance coverage.

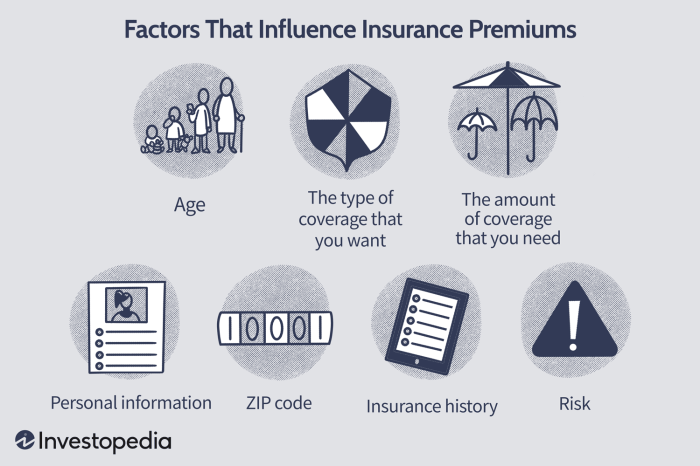

Factors Influencing Insurance Premiums

Insurance premiums, the payments made to secure coverage, are meticulously calculated based on a complex interplay of factors. Actuaries, skilled professionals specializing in financial risk assessment, play a pivotal role in this process, employing sophisticated models to predict future claims and set premiums accordingly. This ensures that the insurer can meet its financial obligations while maintaining profitability.

Actuarial Science in Premium Determination

Actuarial science forms the backbone of premium calculation. Actuaries utilize statistical methods and historical data to analyze patterns in claims, identify trends, and predict future losses. They build probabilistic models that incorporate various risk factors to estimate the likelihood and potential cost of future claims. This involves sophisticated mathematical modeling, incorporating large datasets on past claims, demographics, and other relevant information. The goal is to create a model that accurately reflects the risk profile of the insured population, allowing for the fair pricing of insurance products.

Risk Assessment Methodologies and Their Influence

Risk assessment methodologies are crucial in determining premiums. These methodologies involve a systematic evaluation of the factors that could lead to a claim. Insurers use various techniques, such as statistical modeling, machine learning, and expert judgment, to assess risk. The more accurately the risk is assessed, the more precise the premium calculation becomes. For example, in auto insurance, factors like driving history, vehicle type, and location influence risk assessment and ultimately the premium.

Types of Risks Considered in Premium Calculation

Several types of risks are considered, depending on the type of insurance. Mortality risk is central to life insurance, assessing the probability of death within a specific timeframe. Morbidity risk, relevant to health insurance, focuses on the probability of illness or injury requiring medical care. Property damage risk is a key factor in home and auto insurance, encompassing the likelihood of damage due to various perils such as fire, theft, or accidents. Liability risk, important across many insurance types, covers the potential for legal responsibility for causing harm to others.

Premium Calculation Methods Across Different Insurance Types

Premium calculation methods vary across different insurance types. Life insurance premiums often rely on life tables and mortality models to predict the probability of death at various ages. Health insurance premiums consider factors like age, health status, and the chosen plan’s coverage level. Auto insurance premiums typically incorporate factors such as driving history, vehicle type, location, and coverage limits. The methods used reflect the specific risks and complexities associated with each insurance type.

Comparative Weight of Factors in Different Insurance Types

The following table illustrates the relative importance of various factors in determining premiums for different insurance types. Note that these weights are illustrative and can vary significantly based on specific insurer practices and individual circumstances.

| Factor | Life Insurance | Health Insurance | Auto Insurance |

|---|---|---|---|

| Age | High | High | Medium |

| Health Status | Medium | High | Low |

| Driving Record | Low | Low | High |

| Location | Low | Medium | High |

The Role of Demographics in Premium Setting

Insurance premiums are not a one-size-fits-all proposition. Insurers carefully consider a range of factors to assess risk and price their policies accordingly. A significant component of this risk assessment involves demographic data, which provides valuable insights into the likelihood of claims. Understanding how demographics influence premium calculations is crucial for consumers to make informed decisions about their insurance coverage.

Age significantly impacts insurance premiums across various policy types. This is because statistical data demonstrates a clear correlation between age and the probability of certain events.

Age and Insurance Premiums

Older individuals generally pay higher premiums for health insurance due to the increased likelihood of needing medical care. Conversely, younger, healthier individuals often receive lower premiums, reflecting a lower statistical risk profile. Auto insurance premiums typically follow a similar pattern, with younger drivers (especially those under 25) facing higher rates due to higher accident statistics. However, premiums often decrease as drivers age and accumulate a clean driving record. Home insurance premiums may also be influenced by age, albeit less directly. Older homes may require more maintenance, potentially leading to higher premiums, while the age of the homeowner might indirectly correlate with risk assessment through other factors like health.

Geographic Location and Premium Costs

Location plays a critical role in determining insurance premiums. Areas with higher crime rates, for instance, typically have higher premiums for home and auto insurance. Natural disaster risk significantly impacts premiums as well; those living in areas prone to hurricanes, earthquakes, or wildfires will likely face higher premiums for home and property insurance. The density of the population and the availability of emergency services also factor into the equation. Rural areas might have lower auto insurance premiums due to fewer accidents, but higher home insurance premiums due to longer response times for emergency services.

Other Demographic Factors Influencing Premiums

Several other demographic factors influence premium calculations. Gender, historically, has played a role in some insurance types, though regulations are increasingly mitigating this. Occupation can impact premiums, particularly in worker’s compensation insurance, where high-risk occupations lead to higher premiums. Health history is a crucial factor in health insurance, with pre-existing conditions and health screenings influencing premium costs. Driving history and credit score are also frequently used to assess risk and determine auto insurance premiums.

Responsible and Ethical Use of Demographic Data

Insurers have a responsibility to use demographic data responsibly and ethically. This means ensuring data is used fairly and without discrimination, complying with all relevant privacy regulations, and transparently communicating how data is used in the premium setting process. Many insurers use anonymized and aggregated data to identify trends and risks, protecting individual privacy while still accurately assessing risk. For example, an insurer might analyze the average claim frequency for a specific age group in a particular geographic location without disclosing individual-level data.

Hypothetical Scenario Illustrating Varying Premium Costs

Consider two individuals applying for auto insurance:

* Individual A: A 22-year-old living in a high-crime urban area with a clean driving record. They work as a software engineer.

* Individual B: A 45-year-old living in a rural area with a minor accident on their record. They work as a teacher.

Individual A is likely to receive a higher premium due to their age and location. Individual B’s age and clean driving record (excluding the minor accident) might offset the impact of their rural location, potentially resulting in a lower premium than Individual A. The specific occupation of each individual may also play a subtle role, though the other factors are more significant in this case. Ultimately, the insurer’s algorithm will weigh these factors to determine each individual’s premium.

The Insurer’s Role in Premium Determination

Insurers play a pivotal role in determining insurance premiums, employing a complex interplay of internal processes, data analysis, regulatory considerations, and financial management. The ultimate goal is to strike a balance between profitability and providing affordable coverage to policyholders. This involves a multifaceted approach that considers numerous variables and undergoes continuous refinement.

Internal processes within an insurance company for premium calculation involve a sophisticated workflow. Actuaries, underwriters, and data scientists collaborate to analyze vast datasets, build predictive models, and ultimately set prices that reflect the risk associated with each policy. This process integrates multiple factors, from historical claims data to external economic indicators, to ensure accuracy and fairness.

Internal Processes for Premium Calculation

The premium calculation process is iterative and involves several key steps. First, data scientists and actuaries analyze historical claims data to identify trends and patterns in risk. This involves statistical modeling to predict future claims costs. Next, underwriters assess individual applications, considering factors like age, health, location, and driving history (for auto insurance), to determine the specific risk profile of each applicant. This risk profile is then fed into the pricing models developed by actuaries, which incorporate various factors and weighting to arrive at a base premium. Finally, the base premium is adjusted based on factors such as discounts, policy features, and regulatory requirements before being presented to the customer.

Data Analytics in Premium Refinement

Insurers leverage advanced data analytics to refine their pricing models continuously. For example, using machine learning algorithms, insurers can analyze vast datasets, including socioeconomic data, geographic information, and even social media activity (with appropriate privacy considerations), to identify previously unrecognized risk factors. This allows for more precise risk segmentation and more accurate premium pricing. Imagine an insurer using machine learning to identify a correlation between specific social media usage patterns and increased accident risk among young drivers. This would allow them to refine their pricing model to more accurately reflect the risk associated with this group, leading to fairer premiums for both high- and low-risk individuals. Another example could be the use of telematics data from in-car devices to monitor driving behavior and offer customized premiums based on individual driving habits. This provides incentives for safe driving and fairer premiums for safer drivers.

Regulatory Environment and Premium Setting

The regulatory environment significantly influences premium setting. Insurance companies are subject to strict regulations that vary by jurisdiction, governing factors such as reserve requirements, pricing practices, and consumer protection. These regulations aim to prevent unfair or discriminatory pricing, ensure solvency, and protect consumers. For example, regulations might prohibit insurers from using certain demographic factors (like race) in pricing, or mandate the use of specific actuarial methods for calculating reserves. Compliance with these regulations is crucial for insurers to operate legally and maintain their licenses. Non-compliance can lead to significant penalties.

Insurer’s Financial Reserves and Premium Levels

Insurers maintain financial reserves to ensure they can meet their future claims obligations. The level of reserves held directly impacts premium levels. Higher reserves generally indicate greater financial stability and capacity to handle large or unexpected claims. However, maintaining excessive reserves can reduce profitability and lead to higher premiums for policyholders. Conversely, inadequate reserves increase the risk of insolvency, which could result in the inability to pay claims. Therefore, insurers carefully manage their reserves to balance financial security with the need to offer competitive premiums. The regulatory environment dictates minimum reserve requirements, providing a framework for insurers to manage their financial health and meet their obligations to policyholders. For example, an insurer experiencing a high number of claims in a particular year might need to increase its reserves, potentially leading to a premium increase in subsequent years to replenish those reserves.

Illustration of Premium Calculation Workflow

Imagine a simplified workflow: The process begins with data collection (claims data, demographic information, etc.). This data is then analyzed by actuaries and data scientists who develop and refine pricing models. Underwriters assess individual applications and assign risk scores based on these models. These scores, along with regulatory requirements and company profit targets, are input into a pricing engine which calculates the base premium. Finally, adjustments are made for discounts, policy features, and other factors, resulting in the final premium offered to the customer. This entire process is subject to continuous monitoring and improvement, with regular reviews and adjustments to ensure accuracy and fairness.

Last Recap

Ultimately, understanding how insurance premiums are determined empowers you as a consumer. By grasping the key factors at play – from actuarial science and risk assessment to your individual profile and policy choices – you can make more informed decisions about your insurance needs. Remember that comparing quotes from multiple insurers is crucial to securing the best value for your coverage. Armed with this knowledge, you can navigate the insurance landscape with confidence and secure the protection you need at a price you understand.

User Queries

What is the difference between a deductible and a premium?

A premium is the regular payment you make to maintain your insurance coverage. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in.

Can my premium change after the first year?

Yes, premiums can adjust annually based on factors like claims history, changes in risk assessment models, or alterations to your policy coverage.

How does my driving record affect my car insurance premium?

A poor driving record, including accidents or traffic violations, generally leads to higher car insurance premiums due to increased risk.

Does paying my premium annually versus monthly affect the total cost?

Some insurers may offer a slight discount for annual payments, but the difference is usually minimal. Convenience often outweighs any potential savings.