Understanding how car insurance premiums are calculated can feel like navigating a complex maze. Numerous factors intertwine to determine the final cost, from your driving history and vehicle type to your location and credit score. This guide unravels the mysteries behind those calculations, empowering you to make informed decisions about your insurance coverage and potentially save money.

This exploration will delve into the key elements that insurance companies consider, explaining the influence of individual characteristics, coverage choices, and company practices. We’ll examine how seemingly small details can significantly impact your premium, providing practical examples and insightful comparisons to illuminate the process.

Factors Influencing Car Insurance Premiums

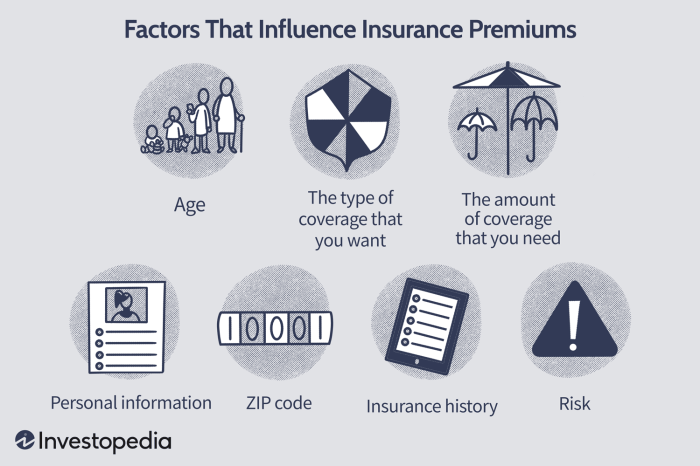

Car insurance premiums are not a random number; they are carefully calculated based on a variety of factors that assess the risk the insurance company takes in insuring you. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Driver Age

Insurance companies consider age a significant factor because younger drivers statistically have higher accident rates. Inexperience and risk-taking behaviors contribute to this. As drivers gain experience and age, their accident rates generally decrease, leading to lower premiums. For example, a 16-year-old driver will typically pay significantly more than a 30-year-old driver with a clean driving record, even if they drive the same car. This is because the statistical probability of an accident is considerably higher for the younger driver.

Driving History

Your driving history is a crucial determinant of your insurance premium. Accidents and traffic violations significantly increase your risk profile. Each at-fault accident or speeding ticket adds points to your driving record, leading to higher premiums. The severity of the accident or violation also plays a role; a DUI conviction, for instance, will dramatically increase your premiums compared to a minor parking ticket. Maintaining a clean driving record is the best way to keep your premiums low.

Vehicle Type and Make/Model

The type and make/model of your vehicle directly impact your insurance costs. Sports cars and high-performance vehicles are generally more expensive to insure due to their higher repair costs and increased risk of theft. Safer vehicles with advanced safety features, on the other hand, may qualify for discounts. For instance, insuring a compact sedan will typically be cheaper than insuring a luxury SUV, even if both vehicles are relatively new. This difference reflects the repair costs and the statistical likelihood of accidents resulting in higher damage claims.

Location

Where you live significantly affects your insurance rates. Areas with high crime rates, more accidents, or higher repair costs will generally have higher insurance premiums. Insurance companies analyze claims data for specific zip codes and geographic areas to determine risk levels. Living in a rural area with low crime and fewer accidents might lead to lower premiums compared to living in a densely populated urban area with higher accident rates.

Credit Score

In many states, your credit score is a factor in determining your insurance premium. Studies have shown a correlation between credit score and insurance claims. Individuals with lower credit scores are statistically more likely to file claims, leading to higher premiums for them. Improving your credit score can positively impact your insurance rates, although the extent of the impact varies by state and insurance company.

Relative Importance of Factors in Premium Calculation

| Factor | Importance Level | Explanation | Example |

|---|---|---|---|

| Driving History | High | Accidents and violations significantly increase risk. | Multiple at-fault accidents lead to much higher premiums. |

| Age | High | Younger drivers statistically have higher accident rates. | A teenager will pay considerably more than a middle-aged driver. |

| Vehicle Type | Medium | Repair costs and theft risk influence premiums. | A sports car is more expensive to insure than a family sedan. |

| Location | Medium | Areas with higher accident rates have higher premiums. | Urban areas often have higher rates than rural areas. |

| Credit Score | Medium (varies by state) | Credit score correlates with claim frequency in some states. | A lower credit score may result in higher premiums in states where it’s a rating factor. |

Types of Car Insurance Coverage and Their Impact

Understanding the different types of car insurance coverage and how they affect your premiums is crucial for making informed decisions. The cost of your insurance is directly tied to the level of protection you choose. Higher coverage generally means higher premiums, but it also means greater financial security in the event of an accident.

Liability Coverage and Premium Costs

Liability coverage pays for damages and injuries you cause to others in an accident. The higher your liability limits (e.g., $100,000/$300,000 versus $250,000/$500,000), the more expensive your premiums will be. This is because higher limits reflect a greater potential payout by the insurance company in the event of a serious accident. However, carrying sufficient liability coverage is vital to protect your assets. A low liability limit might leave you personally liable for significant costs if you cause a serious accident.

Collision and Comprehensive Coverage Premium Comparison

Collision coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage covers damage to your vehicle caused by events other than accidents, such as theft, vandalism, or weather damage. Collision coverage typically costs more than comprehensive coverage because accidents are statistically more frequent than other types of damage. The age, make, and model of your car also heavily influence the cost of both collision and comprehensive coverage; newer, more expensive vehicles will have higher premiums. Drivers with a history of accidents or traffic violations will also see higher premiums for these coverages.

Uninsured/Underinsured Motorist Coverage and Premiums

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident caused by a driver who lacks sufficient insurance or is uninsured. While this coverage isn’t mandatory in all states, it’s highly recommended. The cost of UM/UIM coverage is relatively modest compared to other coverages, but it offers significant protection against substantial financial losses. The premium for this coverage will vary based on the state’s minimum requirements and the selected coverage limits.

Impact of Optional Coverages on Total Cost

Adding optional coverages, such as roadside assistance, rental car reimbursement, or medical payments, will increase your overall premium. However, these add-ons can provide valuable peace of mind and financial protection in unexpected situations. The cost of each optional coverage varies by insurer and the specific benefits offered. Weigh the potential benefit of these additional coverages against the increase in your premium to determine if they are worthwhile for your individual circumstances.

Comparison of Coverage Types

| Coverage Type | Description | Premium Impact | Example Scenario |

|---|---|---|---|

| Liability | Pays for damages and injuries you cause to others. | High (varies with limits) | You cause an accident injuring another driver, liability coverage pays for their medical bills and vehicle repair. |

| Collision | Pays for repairs to your vehicle after an accident, regardless of fault. | Medium to High | Your car is damaged in a collision, collision coverage pays for the repairs. |

| Comprehensive | Covers damage to your vehicle from non-accident events (theft, vandalism, weather). | Low to Medium | Your car is damaged by a hailstorm, comprehensive coverage pays for the repairs. |

| Uninsured/Underinsured Motorist | Protects you if hit by an uninsured or underinsured driver. | Low | You are hit by an uninsured driver, UM/UIM coverage helps pay for your medical bills and vehicle repair. |

| Roadside Assistance | Provides services like towing, flat tire changes, and jump starts. | Low | You have a flat tire, roadside assistance sends a tow truck. |

The Role of Insurance Companies and Their Rating Systems

Insurance companies are the core of the car insurance market, playing a crucial role in assessing risk, setting premiums, and ultimately, providing financial protection to drivers. Their methods for evaluating risk and determining premiums are complex, involving a multitude of factors and sophisticated rating systems. Understanding these systems is key to understanding why your insurance premium is what it is.

Insurance companies utilize various methods to assess the risk associated with insuring a particular driver and vehicle. This assessment directly impacts the premium they charge. A higher perceived risk translates to a higher premium, reflecting the increased likelihood of a claim. Conversely, a lower risk profile often results in lower premiums.

Risk Assessment Methods Used by Insurance Companies

Insurance companies employ a variety of sophisticated methods to evaluate risk. These methods often combine statistical analysis with individual driver information to create a comprehensive risk profile. The goal is to accurately predict the likelihood of an accident or claim.

- Statistical Modeling: Companies use vast datasets of past claims to identify patterns and correlations between various factors (age, driving history, vehicle type, location, etc.) and the frequency/severity of accidents. This data is fed into statistical models that predict future risk.

- Credit-Based Insurance Scores: Many insurers use credit-based insurance scores, which are derived from credit reports, as an indicator of risk. The rationale is that individuals with poor credit management may also exhibit less responsible behavior in other areas, including driving. However, the use of credit scores in insurance is controversial and subject to regulations.

- Telematics Programs: Some insurers offer telematics programs, using devices or smartphone apps to monitor driving behavior. Data on speed, braking, acceleration, and mileage are collected and used to adjust premiums based on individual driving habits. Safer drivers may receive discounts.

- Geographic Location: The location where a vehicle is primarily parked and driven significantly influences risk. Areas with higher crime rates, more accidents, or harsher weather conditions tend to have higher insurance premiums.

Examples of Insurance Rating Systems

Different insurance companies use varying rating systems, but many incorporate similar factors. These systems are often proprietary and complex, involving intricate algorithms and weighting schemes. However, some common elements include:

- Point System: Many insurers use a point system where driving violations (speeding tickets, accidents) add points to a driver’s record, increasing their premium. The number of points and their impact on the premium vary by insurer.

- ISO (Insurance Services Office) Rating System: The ISO is a major provider of insurance data and analytics. While not directly used by all companies, many insurers use the ISO’s data and methodologies to inform their own rating systems. This provides a degree of standardization across the industry, though each company still applies its own adjustments.

- Proprietary Algorithms: Most large insurers have developed their own proprietary algorithms that combine various factors to calculate premiums. These algorithms are constantly refined using new data and statistical techniques.

Company Profitability and Market Competition’s Impact on Premiums

An insurance company’s profitability and the competitive landscape significantly influence premium pricing. If a company experiences a high number of claims or low investment returns, it may need to increase premiums to maintain profitability. Conversely, intense competition among insurers can lead to lower premiums as companies vie for market share. For example, a new insurer entering a market might offer lower rates initially to attract customers. However, these rates are likely to adjust over time based on claims experience.

Factors Considered by Insurance Companies

The following is a comprehensive list of factors that insurance companies typically consider when determining car insurance premiums:

- Driving History: Accidents, tickets, and DUI convictions.

- Age and Gender: Statistically, younger drivers and males are often considered higher risk.

- Vehicle Type and Features: The make, model, year, safety features, and theft risk of the vehicle.

- Location: Where the vehicle is primarily driven and parked.

- Credit Score: In many jurisdictions, credit history is a factor.

- Driving Habits (Telematics): Data from telematics devices or apps.

- Coverage Levels: The amount and types of coverage selected.

- Deductibles: The amount the policyholder pays out-of-pocket before the insurance covers the rest.

Understanding Discounts and How They Reduce Premiums

Car insurance premiums can seem daunting, but many opportunities exist to lower your costs. Discounts are a significant way to reduce your premium, often substantially impacting your overall expenditure. Understanding these discounts and how they work is crucial to securing the most affordable coverage.

Many factors influence the types and amounts of discounts available to you. Insurance companies use a complex system of risk assessment to determine your premium, and discounts essentially reflect a lower perceived risk. By demonstrating responsible behavior and utilizing specific insurance strategies, you can significantly lower your premium.

Types of Car Insurance Discounts

Insurance companies offer a wide array of discounts to incentivize safe driving and responsible insurance practices. These discounts can significantly reduce your premium, sometimes by hundreds of dollars annually. Common discount categories include those based on driving history, academic achievement, and policy bundling.

- Safe Driver Discounts: These reward drivers with clean driving records, often involving a period without accidents or traffic violations. The specific requirements and discount percentages vary by insurer. For instance, a driver with five years of accident-free driving might receive a 10-20% discount.

- Good Student Discounts: Students maintaining a high GPA (typically a B average or higher) often qualify for these discounts, reflecting the insurer’s assessment of lower risk associated with responsible academic performance. Discounts can range from 5% to 25%, depending on the insurer and the student’s academic standing.

- Multi-Car Discounts: Insuring multiple vehicles under the same policy with the same insurer often results in a discount on each vehicle’s premium. This reflects the insurer’s reduced administrative costs and increased loyalty. Discounts can vary from 10% to 25% or more, depending on the number of vehicles and the insurer.

- Defensive Driving Course Discounts: Completing a state-approved defensive driving course often qualifies drivers for discounts. These courses demonstrate a commitment to safe driving practices, leading to lower premiums. Discount percentages vary but are typically around 5-10%.

- Vehicle Safety Feature Discounts: Modern vehicles often include advanced safety features such as anti-lock brakes, airbags, and electronic stability control. These features reduce the likelihood of accidents, leading to discounts that can reach 10-20% depending on the features and the insurer.

Bundling Insurance Policies

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, is another effective way to reduce your overall premiums. Insurers often offer significant discounts for bundling policies, reflecting the increased customer loyalty and streamlined administration.

This strategy can lead to substantial savings compared to purchasing each policy separately. For example, bundling car and homeowners insurance could result in a combined discount of 15-25% or more, depending on the insurer and the specific policies.

Potential Savings from Discount Programs

The potential savings from different discount programs can vary greatly depending on individual circumstances and the specific insurer. However, it’s possible to achieve significant reductions in premiums by combining several discounts.

For instance, a good student with a clean driving record who bundles their car insurance with homeowners insurance and has a car with advanced safety features could potentially save 30% or more on their annual premium.

Hypothetical Example of Discount Savings

Let’s assume a hypothetical annual car insurance premium of $1200. If the driver qualifies for a 10% safe driver discount, a 15% good student discount, and a 10% multi-car discount, the calculations would be as follows:

Safe Driver Discount: $1200 * 0.10 = $120

Good Student Discount: $1200 * 0.15 = $180

Multi-Car Discount: $1200 * 0.10 = $120

Total Discount: $120 + $180 + $120 = $420

Discounted Premium: $1200 – $420 = $780

In this example, the total savings amount to $420, resulting in a discounted annual premium of $780.

Illustrative Examples of Premium Calculations

Understanding how car insurance premiums are calculated can seem complex, but breaking down the process into its constituent parts makes it more manageable. The following examples illustrate how various factors contribute to the final premium amount. Remember that these are simplified examples and actual calculations can be significantly more nuanced.

Example 1: Premium Calculation for a Standard Driver Profile

Let’s consider a 30-year-old driver, Sarah, with a clean driving record, living in a suburban area with a low crime rate. She drives a 2018 Honda Civic, which is considered a relatively safe and inexpensive vehicle to insure. Her chosen coverage includes liability (100/300/100), collision, and comprehensive coverage.

The insurer uses a base rate of $500 annually for her profile and vehicle type. Liability coverage accounts for 40% of the premium, collision for 30%, and comprehensive for 20%. An additional 10% is added for administrative fees and profit margin.

Liability Coverage: $500 * 0.40 = $200

Collision Coverage: $500 * 0.30 = $150

Comprehensive Coverage: $500 * 0.20 = $100

Administrative Fees & Profit Margin: $500 * 0.10 = $50

Total Annual Premium: $200 + $150 + $100 + $50 = $500

A visual representation of this breakdown would show a pie chart. 40% of the chart would be labeled “Liability,” 30% “Collision,” 20% “Comprehensive,” and 10% “Administrative/Profit.”

Example 2: Impact of an Accident on Premium

Now, let’s imagine Sarah is involved in an at-fault accident six months after purchasing her policy. This accident will significantly increase her premium. Assume the insurer applies a 25% surcharge for at-fault accidents. This surcharge is applied to the entire base premium, not just the collision portion.

Surcharge Amount: $500 * 0.25 = $125

New Annual Premium: $500 (original premium) + $125 (surcharge) = $625

This demonstrates how a single event, such as an at-fault accident, can substantially impact the cost of car insurance. The surcharge will typically remain in effect for a period of several years, gradually decreasing over time depending on the insurer’s policy. The visual representation of this would be similar to the previous one, but with an added segment representing the surcharge, making the “Liability,” “Collision,” and “Comprehensive” segments smaller proportionally.

Last Recap

Ultimately, the calculation of your car insurance premium is a multifaceted process reflecting a complex assessment of risk. By understanding the various factors at play – from your driving record and vehicle choice to your location and credit history – you can gain a clearer picture of how your premium is determined. Armed with this knowledge, you can proactively manage your risk profile and potentially secure more favorable insurance rates. Remember to regularly review your policy and explore available discounts to optimize your coverage and cost.

User Queries

What is the impact of a speeding ticket on my premiums?

A speeding ticket, like any moving violation, typically increases your premiums. The severity of the increase depends on the speed, the location, and your insurance company’s specific rating system.

How often are car insurance premiums reviewed?

Most insurance companies review premiums annually at renewal time. However, significant life events (like moving, adding a driver, or getting a new car) may trigger a mid-term adjustment.

Can I get my car insurance premium lowered if I switch to a more fuel-efficient vehicle?

Some insurers offer discounts for fuel-efficient vehicles, but this isn’t universal. It’s best to contact your insurer directly to see if this applies to your policy.

Does my marital status affect my car insurance premium?

While not always a direct factor, some insurers may consider marital status as a proxy for stability and driving habits. Married individuals sometimes receive slightly lower rates.