Navigating the world of health insurance can feel like deciphering a complex code. A crucial element of this code is understanding your premium – the recurring payment you make for coverage. This exploration will demystify health insurance premiums, examining their components, influencing factors, and ultimately, how they contribute to your overall healthcare costs. We’ll delve into the nuances of different plan types and payment options, equipping you with the knowledge to make informed decisions about your health insurance.

This guide provides a comprehensive overview of health insurance premiums, from the fundamental definition to the impact of government subsidies. We will explore how premiums are calculated, the factors that influence their cost, and the various payment methods available. Understanding these aspects is vital for choosing a plan that best suits your individual needs and budget.

Core Definition of “Premium”

In the realm of health insurance, the premium represents the recurring payment you make to your insurance company in exchange for coverage. Think of it as your monthly (or sometimes quarterly or annual) membership fee for access to their healthcare services and financial protection. This payment ensures that you have a safety net should you require medical attention.

The amount of your premium isn’t arbitrarily chosen; it’s carefully calculated based on a variety of factors, reflecting the anticipated cost of providing you with coverage.

Premium Components

Several key elements contribute to the final cost of your health insurance premium. These components reflect the insurance company’s expenses and the level of risk associated with insuring you. Understanding these components can provide valuable insight into your premium’s structure.

- Administrative Costs: This includes the expenses incurred by the insurance company in running its operations, such as salaries for employees, rent for office space, and marketing costs.

- Claims Costs: This is the largest portion of your premium, representing the money the insurance company anticipates paying out to cover your medical expenses and those of other policyholders. This is heavily influenced by factors such as the prevalence of chronic illnesses within the insured population and the overall cost of healthcare services.

- Profit Margin: Insurance companies, like any business, aim to make a profit. A portion of your premium contributes to their overall profitability.

- Reserves: Insurance companies set aside a portion of premiums to build reserves, which act as a financial cushion to cover unexpected increases in claims costs or other unforeseen circumstances.

Premium Calculation Factors

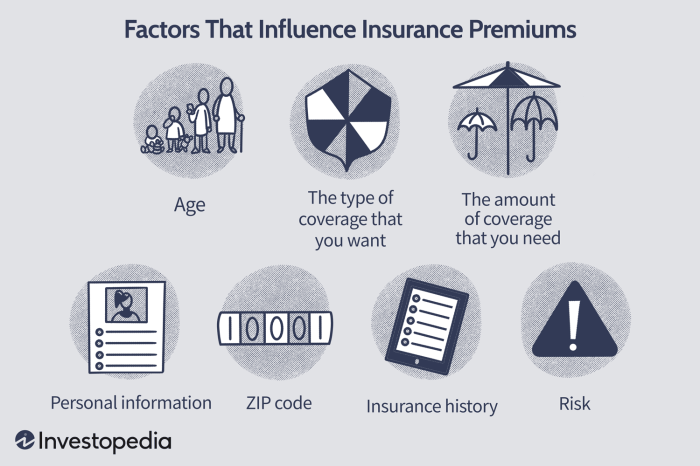

Numerous factors influence the calculation of your health insurance premium. These factors help insurance companies assess the level of risk associated with covering you and accurately price your policy.

- Age: Older individuals generally pay higher premiums due to the increased likelihood of needing healthcare services.

- Location: Premiums vary geographically, reflecting differences in healthcare costs across regions.

- Tobacco Use: Smokers typically pay higher premiums because smoking significantly increases the risk of various health problems.

- Health Status: Individuals with pre-existing conditions may face higher premiums, reflecting the increased risk of needing medical care.

- Plan Type: The type of health insurance plan you choose (HMO, PPO, EPO, etc.) directly impacts your premium. More comprehensive plans with lower out-of-pocket costs generally come with higher premiums.

- Family Size: Premiums often increase with the number of people covered under the plan.

Premium Structures Across Different Plan Types

Different health insurance plans have varying premium structures. While the factors above influence all plans, the way they are weighted and the overall cost vary considerably.

For example, HMOs (Health Maintenance Organizations) typically offer lower premiums than PPOs (Preferred Provider Organizations) because they often have narrower networks of doctors and hospitals. This restricted network allows HMOs to negotiate lower rates with providers, resulting in lower premiums for consumers. PPOs, on the other hand, offer greater flexibility in choosing healthcare providers but generally come with higher premiums to reflect this increased choice. EPOs (Exclusive Provider Organizations) fall somewhere in between, offering a balance of cost and choice. The specific premium will depend on the individual plan and insurer.

Factors Influencing Premium Costs

Several interconnected factors influence the cost of health insurance premiums. Understanding these factors can help individuals make informed decisions when choosing a plan. These factors broadly fall into categories related to the insured individual’s characteristics, the plan’s features, and the overall healthcare landscape.

Demographic Factors

Demographic characteristics significantly impact premium costs. Insurance companies use actuarial data to assess the likelihood of healthcare utilization based on these factors. Higher risk profiles generally translate to higher premiums.

- Age: Older individuals typically pay more for health insurance due to a statistically higher likelihood of needing more extensive medical care.

- Location: Premiums vary geographically due to differences in the cost of healthcare services. Areas with high healthcare costs, such as major metropolitan areas, tend to have higher premiums.

- Health Status: Individuals with pre-existing conditions or a history of significant health issues may face higher premiums. This is because insurers anticipate a greater need for healthcare services for this population.

Plan Features

The features included in a health insurance plan directly influence the premium. Choosing a plan with more comprehensive coverage will typically result in a higher premium.

- Deductibles: A higher deductible (the amount you pay out-of-pocket before insurance coverage begins) usually corresponds to a lower premium. Conversely, a lower deductible means a higher premium.

- Co-pays: Co-pays (fixed amounts paid at the time of service) also affect premiums. Plans with lower co-pays generally have higher premiums.

- Out-of-Pocket Maximums: The out-of-pocket maximum is the most you’ll pay in a year for covered services. A lower out-of-pocket maximum typically results in a higher premium.

Pre-existing Conditions

Prior to the Affordable Care Act (ACA) in the United States, pre-existing conditions often led to significantly higher premiums or even denial of coverage. The ACA largely eliminated this practice, prohibiting insurers from denying coverage or charging higher premiums based solely on pre-existing conditions. However, the impact of pre-existing conditions on premium costs can still be indirectly felt through higher overall healthcare utilization for individuals with these conditions.

Individual vs. Family Plans

Family health insurance plans generally cost more than individual plans. This is because family plans cover multiple individuals, increasing the potential for healthcare utilization and the associated costs. The exact cost difference varies significantly depending on the number of family members covered and the specific plan features. For example, a family plan covering a parent and two children will typically be substantially more expensive than a single individual plan, even when considering economies of scale.

Final Review

In conclusion, understanding the definition of a health insurance premium is paramount to effective healthcare planning. By grasping the factors that influence premium costs, available payment options, and the relationship between premiums and out-of-pocket expenses, individuals can make informed choices that align with their financial situation and healthcare needs. This knowledge empowers consumers to navigate the complexities of health insurance with confidence and select a plan that provides optimal value and peace of mind.

Frequently Asked Questions

What happens if I miss a premium payment?

Missing a premium payment may result in your coverage being suspended or cancelled. Late fees may also apply. Contact your insurer immediately if you anticipate difficulty making a payment to explore options like payment plans.

Can I change my payment method?

Yes, most insurers allow you to change your payment method. You can typically do this through their online portal or by contacting customer service. Common methods include automatic bank drafts, credit/debit cards, and mail-in checks.

Are premiums tax deductible?

The deductibility of health insurance premiums depends on your country’s tax laws and your specific circumstances. In some cases, premiums paid for self-employed individuals or those with specific health conditions may be deductible. Consult a tax professional for personalized advice.

How often are premiums paid?

Premiums are typically paid monthly, but some insurers may offer options for quarterly or annual payments.