Securing your family’s financial future through life insurance is a crucial decision, but understanding the intricacies of premium calculation can feel daunting. This guide demystifies the process, exploring the numerous factors that influence the cost of your life insurance policy. From your age and health to your lifestyle choices and the type of policy you choose, we’ll break down how these elements contribute to your premium. We aim to provide you with a clear and comprehensive understanding, empowering you to make informed decisions about your insurance coverage.

Navigating the world of life insurance can be complex, with various policy types and calculation methods. This guide offers a detailed explanation of these complexities, covering term life, whole life, universal life, and variable life insurance, comparing their respective premium calculation approaches. We will delve into the specific components of your premium, including mortality costs, expenses, and profit margins, to paint a complete picture of the cost structure.

Understanding Policy Details and Premium Components

Life insurance premiums are not a single, monolithic figure. Instead, they’re comprised of several key elements, each contributing to the overall cost. Understanding these components allows for a more informed assessment of the policy’s value and ensures you’re paying a fair price for the coverage you receive. This section will break down the essential factors influencing your premium calculation.

Several factors contribute to the final premium amount you pay for your life insurance policy. These factors are intricately linked and work together to determine the cost of providing you with the financial security the policy offers. Understanding these components helps you appreciate the pricing structure and make informed decisions.

Mortality Costs

Mortality costs represent the insurer’s estimation of the likelihood of you passing away during the policy’s term. This is calculated using actuarial tables, which track mortality rates based on age, gender, health status, and other relevant factors. Higher mortality risk translates to a higher premium, as the insurer needs to set aside more funds to cover potential payouts. For instance, a smoker will typically pay a higher premium than a non-smoker of the same age and health due to increased mortality risk associated with smoking.

Expenses

Insurers incur various expenses in operating their business, and these costs are factored into premiums. These expenses include administrative costs (salaries, office space, technology), marketing and sales costs, and the costs associated with claims processing and underwriting. A company with higher operational expenses might charge slightly higher premiums to cover these costs. Efficient cost management by the insurer can lead to lower premiums for the policyholder.

Profit Margin

The insurer’s desired profit margin is an integral part of the premium calculation. This margin represents the return the company aims to achieve on its investment in providing life insurance. While a reasonable profit margin is essential for the insurer’s financial stability and continued operation, excessive profit margins could lead to higher premiums for the policyholder. Competition within the insurance market typically helps keep profit margins in check.

Reserve Fund

The reserve fund is a crucial component of the premium calculation. This fund is a pool of money set aside by the insurer to ensure they can meet future claims obligations. A larger reserve fund provides greater financial security for the insurer and the policyholders. The size of the reserve fund needed is influenced by factors like the policy’s terms, the number of policies issued, and the anticipated claims payouts. A higher reserve requirement translates to higher premiums.

Administrative Costs

Administrative costs encompass all the expenses related to managing the policy. These include underwriting (assessing risk), policy administration (record-keeping, customer service), and claims processing. These costs are spread across all policies, influencing the overall premium. Insurers strive for efficient administrative processes to minimize these costs and, consequently, the premiums.

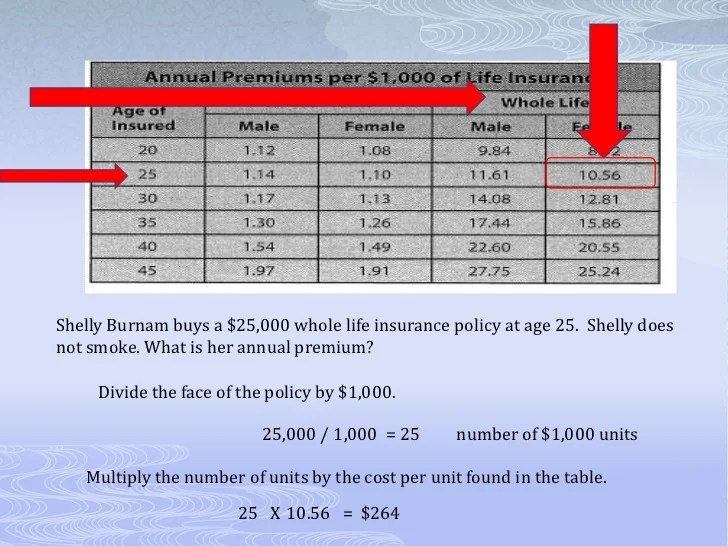

Illustrative Examples of Premium Calculations

Understanding how life insurance premiums are calculated can seem complex, but a simplified example can illuminate the key factors involved. While actual calculations are far more intricate, this illustration provides a foundational understanding.

Let’s consider a simplified term life insurance premium calculation. We’ll focus on the most significant factors to illustrate the process. Remember, real-world calculations incorporate many more variables and utilize sophisticated actuarial models.

Simplified Term Life Insurance Premium Calculation

This example demonstrates a basic calculation, highlighting the key factors influencing premium cost. Assume a healthy 30-year-old male is seeking a $250,000, 10-year term life insurance policy.

For this simplified example, let’s assume the following factors and their associated values:

- Mortality Rate: 0.1% (This represents the statistical probability of death within the policy term for this demographic). This is a drastically simplified representation of mortality tables used by insurers.

- Expenses: 15% (This covers administrative costs, commissions, and other expenses associated with underwriting and policy management). This is a simplified representation of the many operational costs of an insurance company.

- Interest Rate: 4% (This reflects the insurer’s assumed investment return on the premiums collected. Insurers invest premiums to help offset future payouts).

- Policy Term: 10 years

- Death Benefit: $250,000

A simplified calculation might look like this:

Step 1: Calculate Expected Claims: Mortality Rate x Death Benefit = Expected Claims per policy. In this case: 0.001 x $250,000 = $250

Step 2: Account for Expenses: Expected Claims / (1 – Expenses) = Adjusted Claims. In this case: $250 / (1 – 0.15) = $294.12

Step 3: Calculate Present Value of Claims: This step accounts for the time value of money, discounting future payouts to their present value using the assumed interest rate. This requires a more complex calculation involving a present value annuity factor, which we’ll simplify here for illustrative purposes. For this example, let’s assume a simplified present value factor of 8.11 (this would be calculated using standard actuarial present value formulas). Then, Adjusted Claims x Present Value Factor = Present Value of Claims. In this case: $294.12 x 8.11 = $2384.50

Step 4: Determine Annual Premium: Present Value of Claims / Policy Term = Annual Premium. In this case: $2384.50 / 10 = $238.45

Therefore, in this simplified example, the annual premium would be approximately $238.45.

Impact of a Single Factor Change

Let’s see how a change in age affects the premium. If the applicant were 40 instead of 30, the mortality rate would increase significantly, leading to a higher expected claim cost and thus a higher premium. The exact increase would depend on the insurer’s specific mortality tables, but it could easily be double or more.

Limitations of Simplified Examples

This simplified example omits numerous factors crucial to real-world premium calculations. Actual calculations consider factors like health status (medical history, lifestyle choices), occupation, geographic location, policy riders (additional benefits), and the insurer’s specific risk assessment models. These models use sophisticated statistical techniques and vast datasets to predict future claims accurately. Furthermore, this example omits the complexities of reserving and capital requirements for insurance companies. The simplified model also assumes a constant mortality rate and interest rate over the policy term, which is unlikely in reality.

Ending Remarks

Understanding the calculation of your life insurance premium is key to securing appropriate coverage without unnecessary expense. By carefully considering the factors influencing premium costs, from your personal health and lifestyle to the specific type of policy and added riders, you can make an informed decision that best protects your family’s financial well-being. This guide provides a foundational understanding, but remember to consult with a qualified insurance professional for personalized advice tailored to your individual circumstances.

Essential Questionnaire

What is the difference between term and whole life insurance premiums?

Term life insurance premiums are generally lower because they cover a specific period. Whole life insurance premiums are typically higher and remain constant throughout your life, offering lifelong coverage.

Can I lower my life insurance premium?

Yes, you can potentially lower your premiums by improving your health, quitting smoking, and choosing a policy with fewer riders or a shorter term.

How often are life insurance premiums reviewed?

This depends on the type of policy. Term life insurance premiums are typically fixed for the policy term, while some whole life policies may have adjustable premiums based on investment performance (e.g., universal life).

What happens if I miss a life insurance premium payment?

Missing payments can lead to policy lapse, meaning your coverage ends. Grace periods are usually offered, but it’s crucial to contact your insurer immediately if you anticipate difficulty making a payment.