Navigating the complexities of tax deductions can be daunting, especially when it comes to healthcare costs. Understanding whether your health insurance premiums are tax deductible is crucial for maximizing your tax savings and minimizing your overall tax burden. This guide delves into the intricacies of deducting health insurance premiums, providing clear explanations and practical examples to help you determine your eligibility and navigate the process effectively.

We’ll explore the various factors that influence deductibility, including employment status, income level, the type of health insurance plan, and even state-specific regulations. We’ll also cover the necessary documentation, reporting procedures, and potential tax implications to ensure you’re well-equipped to handle this aspect of your tax preparation. Whether you’re self-employed, employed, or have a family to consider, this guide offers valuable insights to help you understand your rights and responsibilities.

Eligibility for Deduction

The deductibility of health insurance premiums hinges on several factors, primarily your employment status and the type of health insurance plan you possess. Understanding these criteria is crucial for accurately claiming this deduction on your tax return. Incorrectly claiming this deduction can lead to penalties, so careful consideration is necessary.

Criteria for Premium Deduction

To deduct health insurance premiums, you must generally be self-employed, or have a health insurance plan that isn’t provided by an employer. The premiums must be paid for medical insurance covering yourself, your spouse, and/or your dependents. Importantly, the deduction is for the amount you personally paid, not what your employer contributed. This deduction is claimed on Schedule C (Profit or Loss from Business) or Schedule F (Profit or Loss from Farming) for self-employed individuals. For those with employer-sponsored plans, the employer’s contribution is not deductible by the employee, even if they contribute to the premium cost.

Deductibility for Self-Employed Individuals

Self-employed individuals can deduct the cost of health insurance premiums as a business expense. This is a significant tax advantage, offsetting the cost of healthcare. However, there are specific requirements. You must be actively engaged in a trade or business, and the insurance must cover medical care, not just supplemental services. The premiums must be paid during the tax year, and proper documentation, such as receipts or statements from the insurance provider, must be maintained for audit purposes. The amount you can deduct is limited to the amount of your net profit from self-employment.

Examples of Deductible and Non-Deductible Premiums

- Deductible: A freelance writer pays for a health insurance plan to cover themselves and their spouse. They can deduct the premiums paid on their Schedule C.

- Deductible: A self-employed plumber pays for a family health insurance plan. The premiums are deductible against their business income on Schedule C.

- Non-Deductible: An employee receives health insurance coverage as part of their employment benefits package from their employer. They cannot deduct the portion of the premiums paid by the employer or their own contribution.

- Non-Deductible: An individual purchases long-term care insurance. While important, premiums for long-term care insurance are generally not deductible as medical insurance premiums.

Deductibility Rules for Different Health Insurance Plans

The deductibility of health insurance premiums generally applies to most types of plans, including HMOs, PPOs, and high-deductible health plans (HDHPs) with or without a health savings account (HSA). However, the specific rules and limitations may vary depending on the plan details and your tax situation. Always consult with a tax professional or refer to the IRS guidelines for clarification.

Eligibility Based on Employment Status and Income Level

| Employment Status | Income Level | Deductibility | Example |

|---|---|---|---|

| Self-Employed | Any | Generally Deductible (subject to limitations) | Freelancer deducting premiums against business income. |

| Employee (with employer-sponsored plan) | Any | Not Deductible | Salaried employee with company-provided health insurance. |

| Unemployed (purchasing individual plan) | Below certain threshold | May be deductible depending on specific circumstances and tax credits. | Individual purchasing insurance and qualifying for a tax credit. |

| Unemployed (purchasing individual plan) | Above certain threshold | Not deductible unless other specific criteria are met (e.g., specific health conditions) | High-income individual without other qualifying factors. |

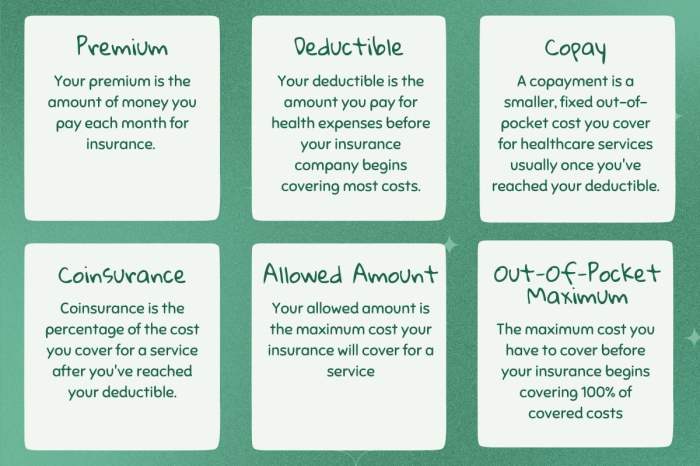

Types of Deductible Premiums

Understanding which health insurance premiums are deductible can significantly impact your tax liability. This section clarifies the types of premiums eligible for deduction, addressing various scenarios and their tax implications. Remember to always consult with a tax professional for personalized advice.

Several factors determine the deductibility of health insurance premiums. Generally, premiums paid for self-employed individuals, their spouses, and dependents are often deductible. However, specific rules and limitations apply depending on the type of coverage and how the premiums are paid.

Self-Employed Premiums

Self-employed individuals can deduct the amount they pay for health insurance premiums as a business expense. This deduction is taken on Schedule C (Profit or Loss from Business) or Schedule F (Profit or Loss from Farming) of Form 1040. The amount you can deduct is limited to the amount of your net earnings from self-employment, but it can be a valuable tax break for those running their own businesses. For example, a freelancer who paid $5,000 in health insurance premiums and had a net profit of $7,000 could deduct the full $5,000. If their net profit was only $4,000, they could only deduct $4,000.

Premiums for Spouses and Dependents

If you are self-employed and cover your spouse and/or dependents under your health insurance plan, the premiums paid for them are also generally deductible. The deduction works similarly to premiums for the self-employed individual. For instance, a self-employed individual paying $10,000 annually for family coverage (including themselves, spouse, and one child) and having a net profit of $12,000 can deduct the full $10,000. The deductibility extends to qualified dependents, but not necessarily to adult children who are not considered dependents according to IRS guidelines.

Premiums Paid Through a Health Savings Account (HSA)

Contributions to a Health Savings Account (HSA) are tax-deductible, and while the money in the HSA is not taxed, the distributions for qualified medical expenses, including health insurance premiums, are also tax-free. This creates a triple tax advantage. For example, if you contribute $3,650 to your HSA (the maximum contribution for 2023 for those under 55), you can deduct this amount from your taxable income, and when you use the funds from your HSA to pay your health insurance premiums, you won’t pay taxes on that money either. However, using HSA funds for non-qualified medical expenses will result in taxation of the withdrawn amount.

Examples of Deductible and Non-Deductible Premiums

Here are a few scenarios illustrating the deductibility of premiums:

- Scenario 1: A self-employed carpenter pays $6,000 in premiums for individual coverage and has a net profit of $8,000. The full $6,000 is deductible.

- Scenario 2: A freelance writer pays $12,000 in premiums for family coverage (spouse and two children) and has a net profit of $15,000. The full $12,000 is deductible.

- Scenario 3: A W-2 employee pays premiums through their employer’s plan. These premiums are generally not deductible, as they are often paid pre-tax through payroll deductions.

- Scenario 4: An individual pays premiums for COBRA coverage after losing their job. These premiums are generally not deductible, unless they are self-employed and meet the other criteria for deduction.

Tax Implications and Benefits

Deducting health insurance premiums can significantly reduce your overall tax liability, resulting in substantial tax savings. The amount of savings depends on several factors, including your income, filing status, and the amount of your premiums. Understanding these implications is crucial for maximizing your tax benefits.

The deduction impacts your taxable income by lowering the amount of income subject to tax. This, in turn, reduces your overall tax bill. The exact impact will vary based on your individual tax bracket. For instance, someone in a higher tax bracket will see a larger reduction in their tax liability compared to someone in a lower tax bracket, even if both have the same premium deduction amount.

Tax Benefits Across Income Levels and Filing Statuses

The tax benefits of deducting health insurance premiums are not uniform across all income levels and filing statuses. Higher-income individuals generally benefit more because they are subject to higher tax rates. Similarly, individuals filing jointly may experience greater tax savings than those filing as single individuals, assuming comparable premium amounts and incomes. Consider two taxpayers: Alice, a single filer with an adjusted gross income (AGI) of $60,000, and Bob, a married filer with an AGI of $120,000. Both pay $5,000 in health insurance premiums. Bob, being in a higher tax bracket, will see a larger absolute dollar reduction in his tax liability than Alice, although the percentage reduction might be similar. Precise calculations require using current tax brackets and rates.

Interaction with Other Tax Credits or Deductions

The deductibility of health insurance premiums can interact with other tax credits or deductions, potentially impacting the overall tax savings. For example, the premium tax credit (PTC) offered through the Affordable Care Act (ACA) may affect the amount you can deduct. In some cases, claiming the PTC might be more advantageous than deducting premiums, depending on individual circumstances. Careful consideration of both options is necessary to determine the optimal strategy for minimizing tax liability. A taxpayer should consult a tax professional to determine the most advantageous approach in their specific situation.

Calculation of Tax Savings

Let’s illustrate tax savings calculation with two examples.

Example 1: Sarah, a single filer with an AGI of $70,000, pays $6,000 in health insurance premiums. Assuming a simplified tax rate of 22% for her income bracket (this is for illustrative purposes only and does not reflect actual tax rates), her tax savings would be approximately $6,000 * 0.22 = $1,320.

Example 2: John and Mary, filing jointly with an AGI of $150,000, pay $10,000 in health insurance premiums. Again, using a simplified 28% tax rate (for illustrative purposes), their tax savings would be approximately $10,000 * 0.28 = $2,800. These are simplified examples; actual tax savings would be calculated using the applicable tax brackets and rates for the specific tax year. Professional tax software or a tax advisor can accurately determine the tax savings.

Note: These examples use simplified tax rates for illustrative purposes. Actual tax savings will depend on the individual’s specific tax bracket, filing status, and other relevant factors. Consult a tax professional for personalized advice.

Illustrative Scenarios

Understanding the deductibility of health insurance premiums often involves navigating specific situations. The following scenarios illustrate how the rules apply in different contexts, highlighting both deductible and non-deductible situations. Note that tax laws are subject to change, so it’s always advisable to consult a tax professional for personalized guidance.

Self-Employed Individual Deducts Health Insurance Premiums

Maria is a freelance graphic designer. In 2023, her net self-employment income was $60,000. She paid $7,200 in health insurance premiums for herself and her spouse throughout the year. Because she is self-employed, she can deduct the amount of health insurance premiums she paid, reducing her taxable income. This deduction helps offset the cost of her health coverage and lowers her overall tax liability. She will itemize her deductions on her tax return, claiming the $7,200 premium expense against her self-employment income. This results in a lower taxable income and a smaller tax bill.

Employee Deducts Health Insurance Premiums

John is an employee of a large corporation. His employer offers a group health insurance plan, and John contributes $200 per month ($2400 annually) towards the premium. However, his employer also contributes a significant portion of the premium. In John’s case, he cannot deduct the premiums he pays. This is because he is covered under an employer-sponsored plan, and the premiums paid are not considered a deductible expense under the current tax code for employees. The employer’s contribution is considered a form of compensation and is not directly deductible by the employee.

Premiums are NOT Deductible

Sarah is a stay-at-home mother who is not employed and does not have self-employment income. She purchased a private health insurance plan for herself and her children at a cost of $10,000 annually. Because Sarah does not have any earned income, she cannot deduct her health insurance premiums. The deductibility of health insurance premiums is generally tied to having income from employment or self-employment against which the deduction can be applied. She might explore other tax credits or deductions that could potentially offset some of the cost, but the premiums themselves are not directly deductible in this situation.

Final Thoughts

Successfully navigating the complexities of deducting health insurance premiums requires a thorough understanding of eligibility criteria, documentation requirements, and potential tax implications. This guide has provided a comprehensive overview of these key aspects, empowering you to confidently claim your deductions and maximize your tax savings. Remember to always consult with a qualified tax professional for personalized advice tailored to your specific circumstances, ensuring compliance with all applicable federal and state regulations. Proper planning and understanding can significantly impact your financial well-being.

General Inquiries

Can I deduct premiums for my spouse and children?

Generally, yes, if they are claimed as dependents and meet other eligibility requirements. Specific rules apply depending on your filing status and the type of plan.

What if I paid my premiums through a Health Savings Account (HSA)?

Premiums paid from an HSA are not directly deductible, as contributions to an HSA itself may be tax-deductible depending on your income and health insurance coverage.

What forms do I need to claim this deduction?

You’ll typically need Form 1040, Schedule 1 (Additional Income and Adjustments to Income), and supporting documentation like your insurance premium statements.

Are there penalties for incorrectly reporting this deduction?

Yes, inaccurate reporting can lead to penalties, including interest and potential audits. Accurate record-keeping is crucial.

Where can I find more information on state-specific regulations?

Consult your state’s tax department website or a qualified tax professional for details on state-specific rules and regulations.