The timely payment of insurance premiums is the cornerstone of a valid insurance policy. This process, seemingly straightforward, involves a complex interplay between the insured and the insurer, encompassing various payment methods, acceptance policies, legal considerations, and internal procedures. Understanding this intricate relationship is crucial for both parties to ensure smooth coverage and avoid potential disputes. This exploration delves into the multifaceted world of premium acceptance, examining the mechanics of payment, the reasons for rejection, and the legal ramifications involved.

From the diverse methods available for premium payment – ranging from online transfers to traditional mail – to the insurer’s internal processes for tracking and reconciling these payments, we will examine every stage of this crucial transaction. We’ll also consider the consequences of late or non-payment, including potential policy lapses and the communication strategies employed by insurers to ensure timely payments and maintain clear communication with their policyholders.

Premium Acceptance Policies

Our company maintains a clear and consistent policy regarding premium payments to ensure smooth and efficient processing for all our valued clients. We strive to make the payment process as straightforward as possible, while also maintaining the financial stability of the insurance contracts. This section details our policy on accepting premiums, including partial payments, payment rejections, and the handling of returned or rejected payments.

Partial Premium Payments

We understand that unforeseen circumstances can sometimes impact an insured’s ability to make a full premium payment on time. While we encourage full and timely payments, we do allow for partial premium payments under specific conditions. These conditions typically involve prior arrangement with our customer service department, demonstration of financial hardship, and a documented payment plan outlining the remaining balance and schedule of payments. Failure to adhere to the agreed-upon payment plan may result in policy lapse or cancellation. It’s crucial to contact us promptly if you anticipate difficulty making a full payment to discuss options and avoid potential disruptions to your coverage.

Reasons for Premium Payment Rejection

Several reasons may lead to the rejection of a premium payment. These primarily revolve around insufficient funds, payment made via invalid methods (such as a check drawn on a closed account), or payments that are incomplete or improperly submitted. Payments submitted after the grace period has elapsed may also be rejected, depending on the policy terms. In such cases, coverage may be interrupted until the payment is successfully processed and any outstanding fees are settled. Furthermore, payments made with altered or counterfeit instruments will be immediately rejected and may be subject to legal action.

Examples of Invalid Premium Payments

Invalid premium payments frequently involve issues with the payment instrument itself. For instance, a check that bounces due to insufficient funds is considered invalid. Similarly, a credit card payment that is declined due to insufficient credit or an expired card will also be deemed invalid. Payments made with a stolen or fraudulent credit card are immediately flagged and reported to the appropriate authorities. A money order that is forged or altered would also be classified as an invalid payment. In all such instances, the insured will be notified of the rejection and will be required to submit a valid payment to reinstate coverage.

Procedures for Handling Returned or Rejected Payments

When a premium payment is returned or rejected, we promptly notify the insured via registered mail and email, outlining the reason for the rejection. The insured then has a specified timeframe to rectify the issue and resubmit the payment. Failure to resubmit a valid payment within this timeframe may result in policy cancellation or suspension of coverage. Depending on the reason for the rejection, additional fees or penalties may apply. Our customer service team is available to assist policyholders with resubmitting payments and addressing any questions or concerns they may have throughout this process. We encourage proactive communication to ensure timely resolution of any payment-related issues.

Legal and Regulatory Aspects

Premium acceptance is not simply a transactional process; it’s governed by a complex web of legal and regulatory requirements designed to protect both insurers and policyholders. Understanding these regulations is crucial for ensuring compliance and mitigating potential disputes. Failure to adhere to these laws can result in significant financial penalties and reputational damage.

Legal Requirements Concerning Premium Acceptance

Insurers are legally obligated to adhere to specific procedures when accepting premiums. These procedures often vary depending on the jurisdiction and the type of insurance policy. Common requirements include maintaining accurate records of premium payments, providing clear and concise receipts, and adhering to specific timeframes for processing payments. Furthermore, insurers must ensure that premium payments are properly allocated to the appropriate policies and accounts. Failure to maintain accurate records can lead to difficulties in resolving disputes and demonstrating compliance during audits. Specific regulations may also dictate acceptable payment methods, such as whether cash, checks, or electronic transfers are allowed.

Potential Legal Ramifications of Premium Payment Disputes

Premium payment disputes can have serious consequences for both insurers and insureds. For insurers, unresolved disputes can lead to regulatory fines, legal action by policyholders, and damage to their reputation. They might face claims for breach of contract if they fail to provide coverage due to a disputed payment. For insureds, failure to pay premiums can result in policy cancellation, leaving them without coverage during a critical time. This can have significant financial repercussions, particularly in the event of a claim. Legal action may be initiated by the insurer to recover unpaid premiums, potentially involving court costs and legal fees for the insured. The specifics of these ramifications vary widely based on the jurisdiction, the terms of the insurance contract, and the nature of the dispute.

Examples of Relevant Laws and Regulations Governing Premium Payments

Specific laws and regulations governing premium payments vary considerably by jurisdiction. For instance, in the United States, state insurance departments have significant regulatory authority over insurance practices, including premium collection. These departments often have specific rules concerning the timely processing of payments, the handling of late payments, and the methods of premium payment acceptance. The Insurance Fraud Prevention Act is a significant piece of legislation that aims to protect insurers and policyholders from fraudulent activity related to premium payments. Similarly, in the European Union, the Solvency II directive impacts how insurers manage their finances, including the handling of premiums and reserves. These directives aim to ensure the financial stability of insurance companies and protect policyholders’ interests. Specific regulations regarding consumer protection in insurance transactions may also apply, ensuring transparency and fair treatment for all parties involved.

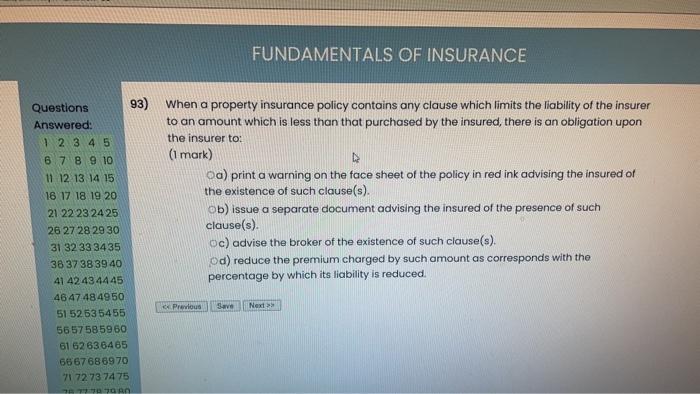

Insurer Premium Payment Processing Flowchart

The following describes a flowchart illustrating the steps an insurer takes when processing a premium payment, highlighting compliance points. This is a simplified representation and specific steps may vary based on the insurer and the type of payment.

[Diagram Description: The flowchart begins with “Premium Payment Received”. This branches into two paths: “Payment Validated” and “Payment Invalidated”. “Payment Validated” leads to “Premium Applied to Policy” which then leads to “Confirmation Sent to Insured”. “Payment Invalidated” leads to “Notification Sent to Insured” and “Investigation of Payment Issue”. The “Investigation of Payment Issue” branch then leads back to “Payment Validated” or “Payment Rejected”. Throughout the flowchart, key compliance points are highlighted, such as “Verify Payment Information”, “Maintain Accurate Records”, “Adhere to Regulatory Requirements”, and “Ensure Secure Data Handling”. Each step includes potential actions and checks for compliance with relevant regulations and internal policies. This structured approach ensures that all payments are processed accurately and efficiently, minimizing the risk of errors and disputes.]

Impact on Insurance Coverage

Prompt and accurate premium payments are fundamental to maintaining active insurance coverage. The timely payment of premiums ensures the policy remains in force, protecting the insured against the risks covered under the policy terms. Failure to meet payment deadlines can lead to significant consequences, potentially leaving the insured vulnerable and without the promised protection.

Understanding the relationship between premium payments and insurance coverage is crucial for policyholders. This section will clarify how timely payments affect coverage, detail the ramifications of non-payment, and compare grace periods offered by different insurers.

Consequences of Non-Payment

Non-payment of premiums can result in a range of negative consequences, ultimately leading to the termination of insurance coverage. The severity of the consequences varies depending on the insurer’s policies and the length of the delay. In most cases, the insurer will provide a grace period, but failure to pay within that period will result in the policy lapsing or being cancelled. This means the insured will no longer be covered for the specified risks. Claims submitted after the lapse date will likely be denied. Furthermore, reinstatement of the policy may be difficult or impossible, particularly if the insured has developed new risks since the lapse. The insurer may also require a new application, including a new medical examination (in the case of health insurance), and may impose higher premiums reflecting the increased risk. In some cases, the insured may face difficulties obtaining future insurance coverage due to a history of non-payment.

Grace Periods Offered by Insurers

Grace periods are the timeframe insurers provide after the due date for premium payment before taking action to lapse the policy. The length of the grace period varies considerably between insurance providers and the type of insurance policy. For example, some auto insurers may offer a 30-day grace period, while a health insurer might offer only 15 days. Life insurance policies often have more lenient grace periods, sometimes extending to several months. It’s essential to review the specific terms and conditions of the insurance policy to understand the grace period offered. Failure to pay within the grace period generally results in the policy lapsing, though some insurers may allow for reinstatement upon payment with additional fees. Policyholders should carefully note the exact duration of their grace period to avoid unintended lapses in coverage.

Stages of Policy Lapse Due to Non-Payment

The process of policy lapse due to non-payment typically involves several distinct stages. Understanding these stages can help policyholders take proactive steps to avoid losing their coverage.

- Premium Due Date Missed: The initial stage begins when the premium payment is not received by the due date specified in the policy.

- Grace Period Begins: Following the missed due date, the grace period commences, providing a timeframe for payment without immediate policy cancellation. The length of this period varies depending on the insurer and policy type.

- Grace Period Ends: Once the grace period expires, and payment remains outstanding, the policy officially lapses. This means coverage is terminated.

- Reinstatement Attempt (if applicable): Depending on the insurer’s policy, the insured may have a limited time to reinstate the policy by paying the overdue premium, plus any applicable penalties or fees.

- Policy Cancellation (Final Stage): If reinstatement is not completed within the specified timeframe, the policy is permanently cancelled, and coverage is lost. The insured will no longer be protected under the terms of the policy.

Ultimate Conclusion

Successfully navigating the process of premium payment requires a clear understanding of the insurer’s policies, the available payment options, and the potential consequences of non-compliance. By understanding the legal framework, internal procedures, and communication strategies involved, both insurers and insureds can ensure a smooth and efficient transaction, protecting the validity of the insurance coverage and fostering a positive relationship built on transparency and mutual understanding. Ultimately, the timely and accurate payment of premiums is vital to maintaining continuous and effective insurance protection.

Essential FAQs

What happens if I pay my premium late?

Late payments may result in penalties, interest charges, or even policy cancellation depending on the insurer’s policy and the extent of the delay. A grace period is often offered, but this varies between insurers.

Can I pay my premium in installments?

Some insurers offer installment payment plans, but this is not always the case. It’s best to contact your insurer directly to inquire about this possibility.

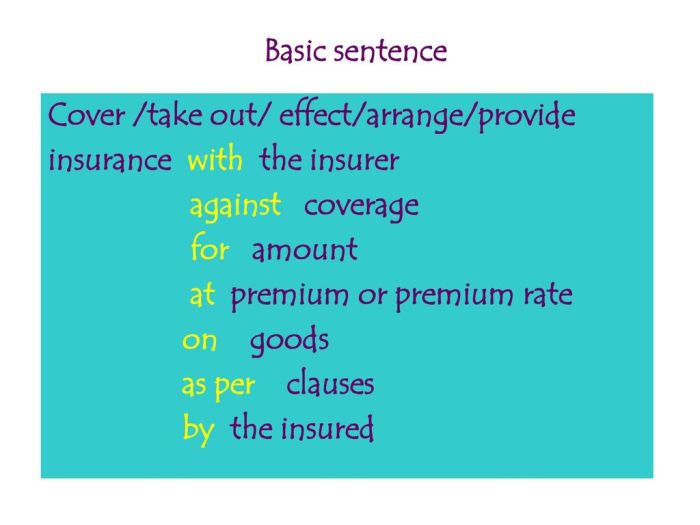

What forms of payment does my insurer accept?

Accepted payment methods vary by insurer but often include checks, money orders, credit cards, debit cards, and online bank transfers. Check your policy documents or contact your insurer for specifics.

What if my premium payment is rejected?

If your payment is rejected, you should immediately contact your insurer to determine the reason for the rejection and to rectify the situation. Reasons may include insufficient funds or incorrect payment information.