Navigating the world of health insurance can feel like deciphering a complex code. Understanding your premium—the monthly cost of your coverage—is crucial for making informed decisions about your healthcare. This guide unravels the mysteries behind health insurance premiums, exploring the various factors that influence their cost and offering strategies to potentially lower your expenses.

From age and health conditions to coverage levels and lifestyle choices, numerous elements contribute to the final premium figure. We’ll delve into the components of your premium, including deductibles, co-pays, and coinsurance, and examine the impact of employer-sponsored plans and government subsidies. Ultimately, our aim is to empower you with the knowledge to choose a health insurance plan that best suits your needs and budget.

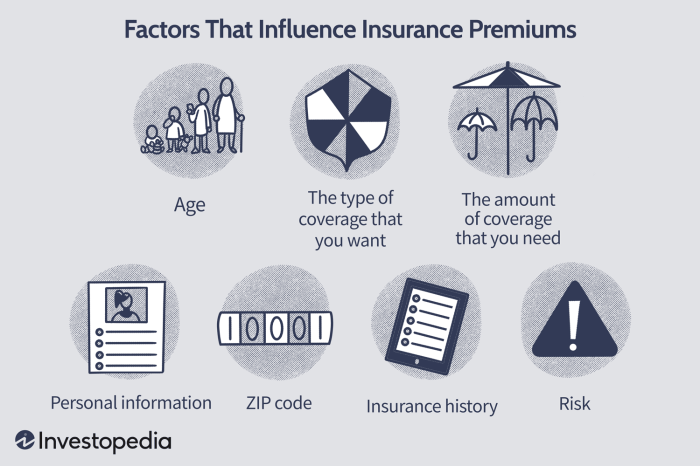

Factors Influencing Health Insurance Premiums

Several key factors contribute to the final cost of your health insurance premium. Understanding these factors can help you make informed decisions about your coverage and budget. These factors interact in complex ways, and the specific impact on your premium will depend on your individual circumstances.

Age and Health Insurance Premiums

Age is a significant factor in determining health insurance premiums. Generally, older individuals tend to have higher premiums than younger individuals. This is because the likelihood of needing more extensive healthcare services increases with age. Insurance companies base their pricing models on actuarial data, which shows a clear correlation between age and healthcare utilization. For example, a 60-year-old individual might pay significantly more than a 25-year-old, even if both are in excellent health. This is not discriminatory; it reflects the higher statistical probability of healthcare needs in older age groups.

Individual Health Conditions and Premium Costs

Pre-existing health conditions significantly impact premium costs. Individuals with conditions requiring ongoing treatment, such as diabetes, heart disease, or cancer, typically face higher premiums. This is because these conditions often involve higher healthcare expenses. The severity and management of the condition also play a role; a well-managed condition might result in a less substantial premium increase compared to a poorly managed one. Insurance companies assess the potential cost of managing these conditions when setting premiums.

Coverage Levels and Premium Costs

Health insurance plans are offered in various coverage levels, commonly categorized as Bronze, Silver, Gold, and Platinum. These levels represent the percentage of healthcare costs covered by the plan. Bronze plans have the lowest monthly premiums but the highest out-of-pocket costs. Platinum plans have the highest monthly premiums but the lowest out-of-pocket costs. Silver and Gold plans fall between these extremes, offering a balance between premium costs and out-of-pocket expenses. The choice of coverage level is a personal decision based on individual risk tolerance and financial capabilities. A healthy individual might opt for a Bronze plan to save on premiums, while someone with pre-existing conditions might prefer a Gold or Platinum plan for greater protection against high medical bills.

Lifestyle Choices and Premium Pricing

Lifestyle choices can influence health insurance premiums. Factors such as smoking, obesity, and lack of physical activity increase the risk of developing health problems. Insurance companies may consider these factors when setting premiums, leading to higher costs for individuals with unhealthy lifestyles. Conversely, maintaining a healthy lifestyle through regular exercise, a balanced diet, and avoiding tobacco can potentially lead to lower premiums or even eligibility for discounts offered by some insurers. Many companies now offer wellness programs and incentives to encourage healthier habits.

Geographic Location and Premium Costs

The cost of healthcare varies geographically, leading to differences in health insurance premiums. Areas with a higher cost of living or a greater concentration of specialists tend to have higher premiums. The following table illustrates average premium variations based on location (these are illustrative examples and actual costs vary considerably based on plan specifics and individual circumstances):

| Location | Bronze (Average Monthly Premium) | Silver (Average Monthly Premium) | Gold (Average Monthly Premium) |

|---|---|---|---|

| New York City, NY | $450 | $600 | $800 |

| Los Angeles, CA | $400 | $550 | $750 |

| Chicago, IL | $350 | $500 | $700 |

| Houston, TX | $300 | $450 | $650 |

Impact of Employer-Sponsored Health Insurance

Employer-sponsored health insurance (ESI) significantly impacts the cost of health coverage for many Americans. Understanding how ESI works, its advantages and disadvantages, and the nuances of premium calculations is crucial for employees making informed decisions about their healthcare. This section will explore these aspects, providing a clearer picture of the role ESI plays in managing healthcare expenses.

Advantages and Disadvantages of Employer-Sponsored Health Insurance Premiums

Employer-sponsored plans often offer lower premiums than purchasing individual plans on the open market. This is largely due to the economies of scale enjoyed by larger employers negotiating group rates with insurance providers. However, this advantage comes with limitations. Employees may have limited plan choices compared to the marketplace, potentially sacrificing flexibility in coverage options. Furthermore, the premium may still represent a significant portion of an employee’s paycheck, particularly for those with families. The employer’s contribution significantly reduces the employee’s out-of-pocket cost, but the remaining cost can be substantial depending on the plan selected and family size. Ultimately, the cost-benefit analysis is highly individual and depends on specific circumstances and the available plans.

Premiums for Individual vs. Family Coverage Under Employer-Sponsored Plans

The cost difference between individual and family coverage under employer-sponsored plans is substantial. Family coverage typically costs significantly more than individual coverage, reflecting the increased risk and potential healthcare needs of multiple individuals. The exact increase varies greatly depending on the plan and the number of dependents covered. For example, a family plan might cost twice as much or even more than an individual plan. This increase is a major factor for employees with families when choosing a plan, often necessitating a careful assessment of coverage needs versus budget constraints.

Employer Contributions and Net Premium Cost

Employer contributions directly reduce the employee’s net premium cost. Employers typically pay a portion of the premium, leaving the employee responsible for the remaining amount. This contribution can vary widely depending on the employer, the plan chosen, and the employee’s compensation. For instance, an employer might contribute 80% of the premium, leaving the employee responsible for only 20%. This significantly reduces the financial burden on the employee, making healthcare coverage more accessible. The employee’s portion is usually deducted directly from their paycheck through payroll deductions.

Situations Where Employees Might Choose a Different Plan Despite Employer Contributions

Even with employer contributions, employees may opt for a different plan than the most cost-effective option offered by their employer. This might be due to various factors, such as: a preference for a specific provider network, a need for more comprehensive coverage (even at a higher premium), or a desire for a higher deductible with a lower premium to better suit their personal financial situation and health habits. For example, a healthy young individual might choose a high-deductible plan with a lower premium, accepting the higher out-of-pocket costs in exchange for lower monthly payments. Conversely, an employee with pre-existing conditions might choose a plan with a higher premium but lower out-of-pocket maximums to protect themselves against significant medical expenses.

Comparison of Premium Costs for Different Employer-Sponsored Plans

The following illustrates a hypothetical comparison of premium costs for different employer-sponsored plans. Remember, these figures are illustrative and actual costs vary significantly based on location, employer, and specific plan details.

- Plan A (High Deductible Health Plan – HDHP): Employee Contribution: $200/month; Employer Contribution: $400/month; Total Monthly Premium: $600

- Plan B (Preferred Provider Organization – PPO): Employee Contribution: $350/month; Employer Contribution: $650/month; Total Monthly Premium: $1000

- Plan C (Health Maintenance Organization – HMO): Employee Contribution: $250/month; Employer Contribution: $500/month; Total Monthly Premium: $750

This comparison shows how different plan types impact employee costs, even with employer contributions. The employee must weigh the lower monthly premiums of an HDHP against the higher potential out-of-pocket expenses.

Government Subsidies and Affordable Care Act (ACA)

The Affordable Care Act (ACA), also known as Obamacare, significantly altered the landscape of health insurance in the United States. A key component of the ACA is its provision of government subsidies and tax credits to help individuals and families afford health insurance coverage. These subsidies play a crucial role in making health insurance accessible to a wider population, particularly those with lower incomes.

The ACA impacts health insurance premiums for individuals primarily through the establishment of health insurance marketplaces (exchanges) and the availability of subsidies. Before the ACA, many individuals lacked access to affordable health insurance, resulting in higher uninsured rates and poorer health outcomes. The ACA aimed to address this by creating a system where individuals could purchase insurance through competitive marketplaces, with financial assistance available to those who qualify.

Subsidy Eligibility and Premium Tax Credits

Eligibility for ACA subsidies and premium tax credits is determined by several factors, most importantly income. Applicants must have income between 100% and 400% of the federal poverty level (FPL). Family size also plays a significant role, as the FPL varies depending on the number of people in a household. Citizenship status and immigration status also affect eligibility. For example, U.S. citizens and legal residents are generally eligible, while undocumented immigrants are typically not. Finally, individuals must not be eligible for other affordable coverage, such as employer-sponsored insurance or Medicare.

Subsidy Amounts and Income Variation

The amount of the subsidy varies directly with income and family size. Lower-income individuals receive larger subsidies, while higher-income individuals receive smaller subsidies, or none at all. For instance, a family of four with an income of 200% of the FPL would receive a significantly larger subsidy than a single individual with the same percentage of FPL income. The subsidy amount is calculated to ensure that the individual’s share of the premium cost does not exceed a certain percentage of their income.

Visual Representation of Income and Subsidy Amounts

Imagine a graph with income level on the horizontal axis and subsidy amount on the vertical axis. The graph would show an inverse relationship: as income increases, the subsidy amount decreases. The line representing this relationship would be a downward-sloping curve, starting at a high subsidy amount for low incomes and gradually approaching zero as income reaches 400% of the FPL. The curve would be steeper at lower income levels, reflecting the greater impact of subsidies for those with limited financial resources. The curve would then flatten out as income approaches the 400% threshold, indicating a smaller change in subsidy amount for higher-income individuals within the eligible range. Different curves could be displayed to represent different family sizes, illustrating how a larger family would receive larger subsidies at each income level.

Strategies for Reducing Health Insurance Premiums

Reducing your health insurance premiums requires a proactive approach encompassing various strategies. Understanding the factors influencing your premium allows for informed decisions that can significantly impact your out-of-pocket costs. By carefully considering plan options and adopting healthy lifestyle choices, you can potentially lower your premiums and improve your overall health.

Choosing a Higher Deductible Plan

Opting for a higher deductible plan often translates to lower monthly premiums. A higher deductible means you pay more out-of-pocket before your insurance coverage kicks in. However, if you are generally healthy and rarely require medical services, the savings on your monthly premium may outweigh the increased deductible. For example, a family might choose a plan with a $10,000 deductible instead of a $5,000 deductible, resulting in a substantial reduction in their monthly premium, provided they can comfortably handle the higher initial out-of-pocket expense. This strategy is particularly effective for individuals with stable health and a strong emergency fund.

Preventive Care and Long-Term Premium Costs

Preventive care significantly impacts long-term premium costs. Regular check-ups, screenings, and vaccinations can detect and address health issues early, preventing them from escalating into more expensive treatments. Insurance companies often reward proactive health management by offering lower premiums or incentives. For instance, a person who consistently attends annual check-ups and receives recommended vaccinations might qualify for a discount on their premium, reflecting the reduced risk they pose to the insurer. This underscores the financial benefit of prioritizing preventive care.

Improving Health and Reducing Future Premium Increases

Lifestyle changes play a crucial role in reducing future premium increases. Adopting a healthy lifestyle—including regular exercise, a balanced diet, and avoiding smoking and excessive alcohol consumption—can significantly improve your overall health and reduce your risk of developing chronic conditions. This translates to lower healthcare utilization and, consequently, lower premiums. For example, someone who manages their weight, quits smoking, and exercises regularly may see their premium reduced over time, as insurers recognize the reduced risk associated with healthier lifestyles.

Negotiating Lower Premiums with Insurance Providers

While less common, negotiating lower premiums directly with insurance providers is a possibility. This often requires demonstrating a strong history of low healthcare utilization and a commitment to maintaining good health. Individuals with exceptional health records might find success in negotiating a lower premium, particularly if they are considering switching providers or have multiple offers. This approach requires research and confidence in presenting a compelling case for a reduced premium.

Strategies for Reducing Health Insurance Premiums

- Select a higher deductible plan to lower monthly premiums (weighing the trade-off with higher out-of-pocket costs).

- Prioritize preventive care, including regular check-ups and screenings, to mitigate long-term health issues and potential premium increases.

- Adopt a healthy lifestyle through regular exercise, balanced diet, and avoidance of harmful habits to reduce health risks and potential premium increases.

- Explore opportunities to negotiate lower premiums with insurance providers, showcasing a strong health history and low healthcare utilization.

- Compare plans and providers annually to ensure you’re getting the best value for your needs and budget.

Summary

Securing affordable and adequate health insurance is a cornerstone of financial well-being. By understanding the multifaceted factors that influence premiums, from individual health circumstances to government assistance programs, you can make informed choices that align with your financial situation and healthcare requirements. Remember to regularly review your plan and explore strategies to potentially minimize your premium costs. Proactive engagement ensures you receive the optimal value for your healthcare investment.

Helpful Answers

What happens if I miss a health insurance premium payment?

Missing a payment can lead to your coverage being cancelled or suspended. Contact your insurance provider immediately if you anticipate difficulties making a payment to explore options like payment plans.

Can I change my health insurance plan during the year?

Typically, you can only change plans during open enrollment periods, unless you experience a qualifying life event (like marriage, job loss, or having a baby). Check with your insurer or marketplace for specific details.

How do I compare different health insurance plans?

Use online comparison tools provided by your state’s insurance marketplace or your employer. Pay close attention to the deductible, co-pays, coinsurance, and out-of-pocket maximums to understand the total cost of care under each plan.

What is a health savings account (HSA)?

An HSA is a tax-advantaged savings account used to pay for qualified medical expenses. It’s often paired with high-deductible health plans to help manage healthcare costs.